Understanding Forex Market Sentiment

When used with effective technical and fundamental tools, Forex market sentiment can help improve your trades. But first, you need to understand the meaning of market sentiments.

To help you understand what market sentiments are in forex, let’s do a little exercise.

Pull up any forex currency pair chart on another tab of your browser and take a cursory look at it. What do you think about it? Do you think the pair is bullish? Do you think it’s going bearish? Don’t worry. Are you more likely to buy the currency pair or sell it? There’s no right or wrong answer.

What you thought about the pair, whether bullish or bearish, is your sentiment for that currency pair. Your sentiment differs from the one we’re talking about because the market sentiment here is the cumulative sentiments of millions of other traders and investors like you.

Market Sentiment Definition

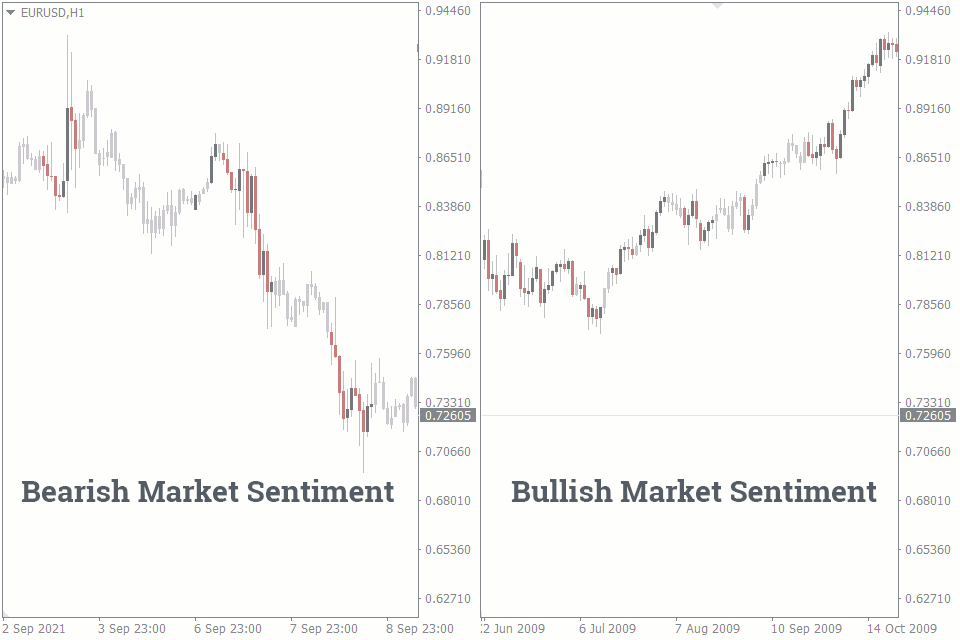

Market sentiment is the cumulative bias of the forex traders towards any currency pair as represented by their positions on the currency pair. When the currency pair is rising, the market sentiment, or Speculative Sentiment Index (SSI), is bullish. And when the currency pair is dropping, the market sentiment is bearish.

Trading With/Against the Market Sentiments

The importance of market sentiments comes to the forefront when you need it to understand the general bias of the market on a pair. This understanding can improve your trading, mainly when you use it with fundamental and technical analyses tools.

Say, for instance, you pulled up an indicator that shows the market sentiments in the form of “buy” and “sell” ratios. Although this information is not enough to give you precise trading signals, it is more than enough to help you determine what direction you want to trade.

Traders trading with the market sentiment would look to enter trades that correlate with the bias of the dominant bias of the market sentiment.

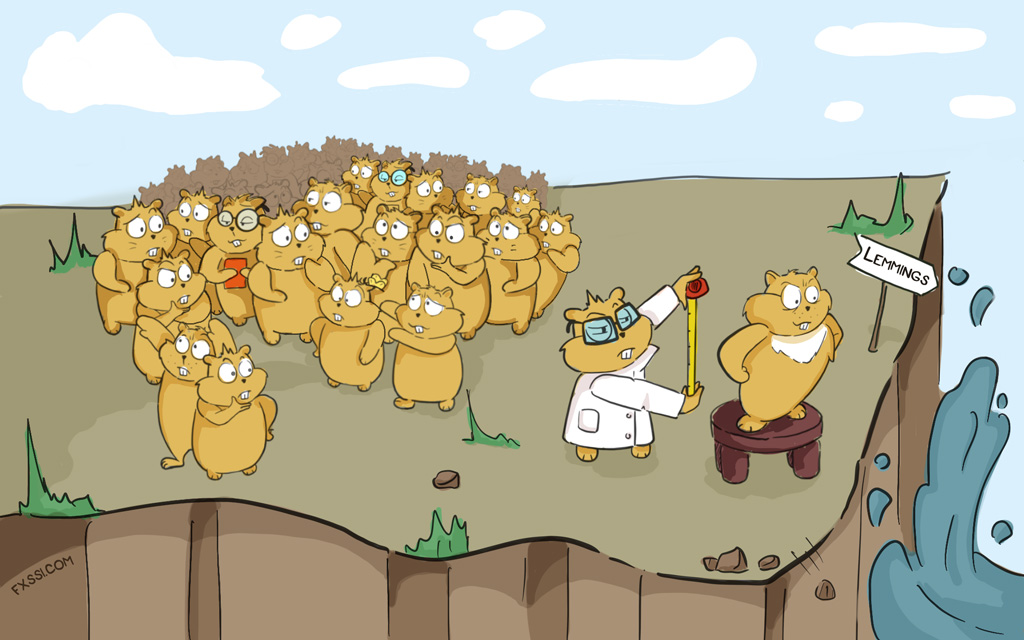

Contrarian traders, however, go against the dominant market sentiment. This is our preferred trading method here at FXSSI because big money uses the same method. When the market sentiment indicates more buyers than sellers, we look for opportunities to sell. For instance, in the chart above, the sentiment is mostly bullish, but the chart is trending downwards. It means that although most retail traders are bullish, big money are majorly bearish on the pair.

Getting Reliable Market Sentiments Data

Using the market sentiments in your trading is relatively easy to do. The only tricky part is where to get reliable market sentiment data.

It's challenging to obtain reliable market sentiments data because forex is traded over the counter (OTC). In other words, it is decentralized, and no single entity controls it. You can trade forex through establishments called brokers, and there are thousands of those. So, there’s no way to get accurate total market sentiment data from all the brokers.

“But most brokers post the market sentiments of their traders on their websites. Why don’t we just accumulate the data and form one ‘almighty market sentiment data’?” This may be your thought. But this isn’t still going to guarantee accurate market sentiment data because some brokers are dubious. They manipulate the values of the market sentiments on their platforms for their selfish benefit.

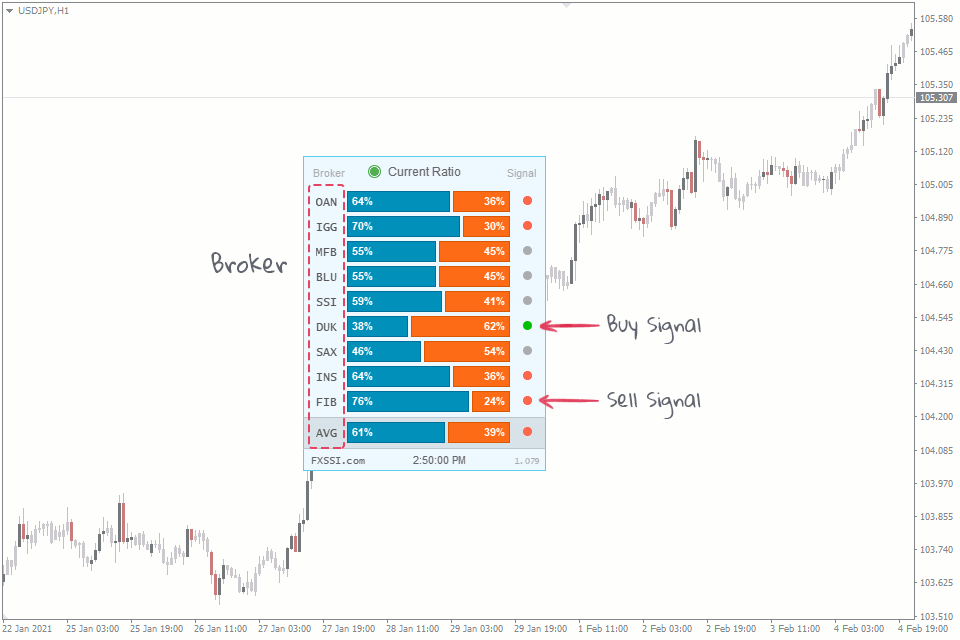

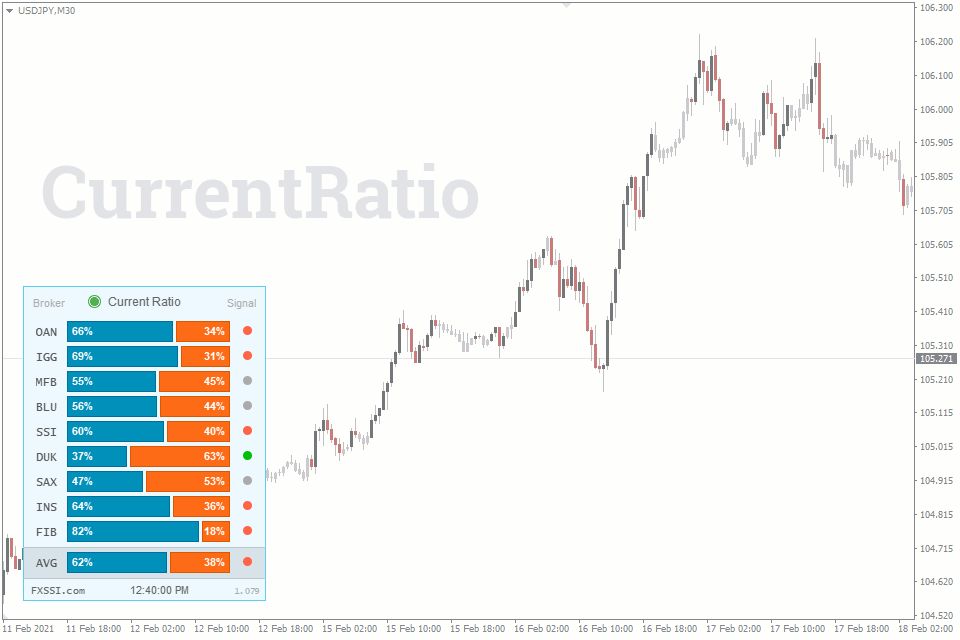

Fortunately, not all brokers are untrustworthy. Our FXSSI Current Ratio indicator collates the sentiment ratios from 10 brokers we have vetted, tested, and trusted, and it places their ratios on your chart.

Other tools that have reasonably high credibility are some other market sentiment indicators (more on that below) and the COT reports.

Market Sentiment Indicators

Market sentiment indicators show the bias of traders on a currency pair. For instance, in the chart below, the FXSSI Current Ratio indicator shows the percentages of traders who have taken the “buy and “sell” positions on the AUDUSD. According to this chart, 64% of traders are long on the currency pair, according to Oanda (OAN), while the remaining 36% are short.

One of the ways forex traders use market sentiment indicators is by watching for when significantly more traders are taking a particular position to go against that position.

For instance, when most traders across various brokers are going long, you go short instead, expecting price reversals. Be careful when you’re trading this method, however. Do not base any position you take on just one indicator, but multiple indicators or tools.

Apart from the Current Ratio Indicator, you’ll find other impressive market sentiment tools on the FXSSI sentiments products page. The tools there tell you market sentiments from various insightful perspectives. This beginner’s guide can give you an insight into using the sentiment indicators.

Conclusion

Now that you understand the market sentiment, the knowledge gained from spending a little time doing a market sentiments analysis can help you trade forex with more assurance.