A-book and B-book. Some New Facts on The Old Things

Forex industry has a small and dirty secret … It’s unpleasant for traders themselves, and brokers prefer keeping silence about it.

The issue is a conflict of interests…

Forex is the only market where a broker can trade against you by using a bookmaker-like model. It’s simply impossible to do this in other markets due to a regulator.

It's not just that a Forex broker doesn't want to operate on a fair business model. The fact is that there are circumstances that made it select such a model. That is what we’re going to tell you in this article.

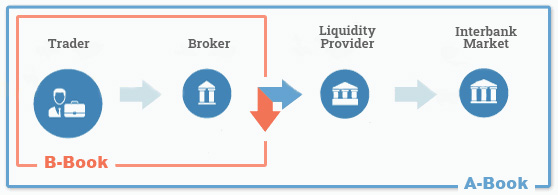

A-Book and B-Book Models

A-Book model is the business model of a broker, according to which all customers’ transactions are directly sent to the interbank market. The scheme is often called a Straight Through Processing.

At that, the broker earns on fees for every transaction or spread markups.

The given model doesn’t have a conflict of interests since the broker receives its money irrespective of whether traders earn or lose their money. It is to their advantage to some extent that a trader will profit from trading because their long-term cooperation will bring more money to the broker.

Besides, it’s interesting that many A-Book brokers raise the limit of minimum deposit up to $5,000-$10,000. The reason for it is the regularity that the larger is an initial deposit, the more adequate is a trader.

If we look at the trading conditions provided by A Book broker, we can see that there is a relatively high minimum deposit limit for opening accounts.

Look at the fees related to these accounts as well – it makes their trading conditions a little worse than that of other accounts.

It all shows that these particular accounts work based on the A-Book broker model.

B-Book model is a business scheme where a broker itself acts as a liquidity provider for your transaction. It means that your transaction will not be sent to the interbank market at all. Traders call it a "bucket shop".

In this case, the broker profits from its customers’ losses and vice versa: when its customers earn profits, the broker incurs losses.

It is evident that a conflict of interests arises here. At that, nobody knows how aggressively the B-Book broker will bleed its customers dry. It might just wait when its customers lose own money by themselves or contribute to that by transmitting non-market quotes to them.

Why are brokers enforced to apply B-Book models?

The issue is about competition here…

One needs to have a solid startup capital, obtain many licenses and conclude a plenty of agreements with liquidity providers in order to enter the Forex market as an A-Book broker. For all of that, the broker will not receive large income enough to finance its operation. This is why the A-Book brokers have to charge large fees and add spread markups.

And here come B-Book brokers with their "unlimited liquidity" and low maintenance costs – they’re able to offer their customers more competitive conditions.

Of course, the customers select the best conditions.

Therefore, we encourage brokers to B-Booking by ourselves.

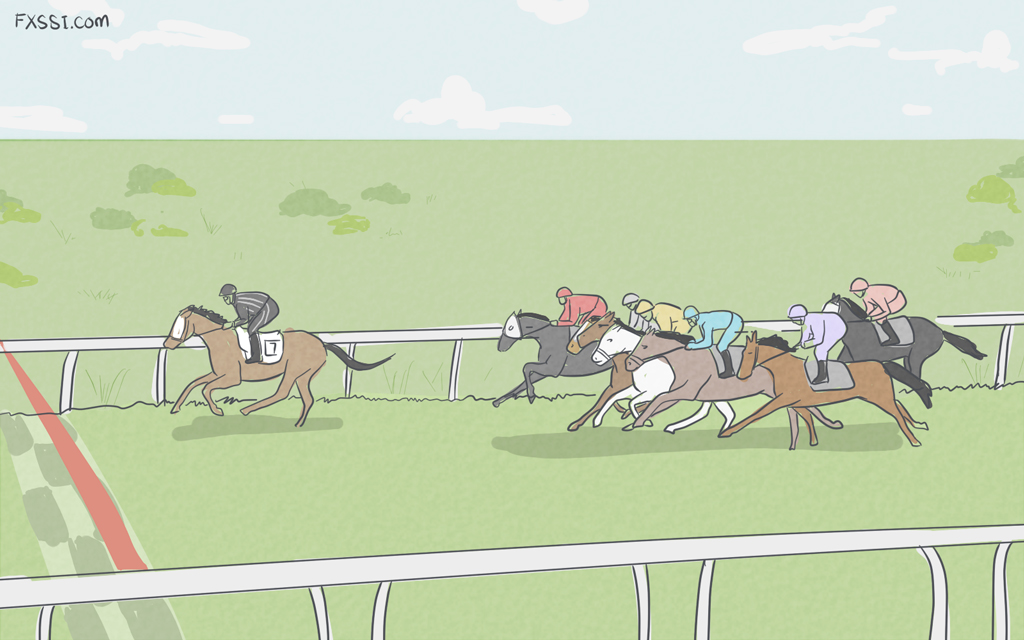

Besides, it’s commonly known that 90-95% of traders lose their deposits over 6 months – it’s good for a B-Broker as well.

Let’s compare a broker’s income from these two models under equal conditions.

I think it is evident that many brokers prefer the "bucket shop’s" model.

However, there is an option to make even more money…

Hybrid Model

Many brokerage companies apply for a hybrid model by using A-Booking and B-Booking simultaneously.

This is another way to increase their income.

It is as simple as ABC: 10% of all traders (i.e. winning traders) are provided access to the real market, and the rest 90% traders (i.e. losing traders) continue trading inside a broker’s pool of customers.

Below you can see some characteristics of losing traders:

- Maximum leverage;

- More than 10% risk per one transaction;

- No stop-losses;

- Small deposit.

In view of the aforementioned, I suppose that creation of some algorithm to determine potential winning traders wouldn’t be a hard work.

Everything would be fine, if not for a single problem.

Winning traders are someone else's losses anyway.

Hybrid brokers send only the orders opened by winning traders to liquidity providers and thereby create a so-called "toxic flow".

When the liquidity providers get this "toxic flow", they will degrade the quality of execution of orders sent by the hybrid brokers. Traders will feel it in the form of frequent slippages.

What is better for us, ordinary traders?

Of course, we all want to trade in the interbank market, but you must understand that nobody will send your trade of 0.01 lot into the real market – it is easier to handle it according to the B-Book model since it doesn’t pose a serious risk to broker itself.

In other words, trading through the B Book broker is not worrisome, if the broker doesn’t interfere in trading and let traders withdraw their profits.

Besides, competition among brokers is so strong that most of them merely ceased to "help traders lose their deposits" and allow them to trade normally.

Of course, when your deposit exceeds $10,000, you’ll be either automatically redirected to the A-Book model, if your broker is hybrid, or change your broker to A-Book one by yourself.

The conclusion is as follows: professional Forex traders should look to A Book brokers in the long view and B-Book brokers will do very well for newbie traders.