What is the Best Leverage in Forex

Selecting the most appropriate amount of leverage for your Forex trading account is an important consideration that needs your full attention.

When you are transitioning from demo trading to real trading, leverage is something you may have overlooked so far. While practicing on your demo account, most traders are purely focused on trading, improving their skills, enhancing their understanding and developing a strategy. Forex leverage plays an important role in your trading strategy.

If you have read other articles about the role leverage plays in Forex, then you’ll already know that leverage is commonly referred to as a double-edged sword. If you’re still uncertain about this topic, we strongly recommend checking out our article How Does Leverage Work in Forex.

In this article, we would like to offer an experienced point of view to help you make informed decisions and choose the best leverage for Forex trading.

What to Consider when Choosing Leverage for your Forex Account

Many non-European Forex brokers offer leverage up to 1:500, which is relatively normal. Some brokers go higher and sometimes as far as 1:3000, Forex leverage as high as that is not common nor recommended.

Brokers that offer leverage up to 1:500 generally allow you to choose your own setting, which raises the question: what is the best leverage ratio for your Forex trading account?

Some things you need to consider are:

- How much balance will you deposit.

- What is your risk to reward ratio, i.e. how much drawdown will you be tolerating.

- How many positions will you allow yourself to open at a time.

Best Forex Leverage for Beginners

Leverage is, without a doubt, one of the main attractions of the Forex market. Traders with a modest amount of margin can get meaningful exposure to a number of financial markets. The problem is, many new traders are drawn to selecting the highest amount of leverage possible. The highest isn’t necessarily the best Forex leverage for beginners.

High leverage can be useful, but only if it’s used correctly. New traders often take the opportunity that leverage offers to open larger positions to get bigger and faster results from their trades. The drawback of this is that each time a position doesn’t play out the way it was expected, a larger loss results in less margin for the next trade and so on.

Best Leverage for $10 and up to $500

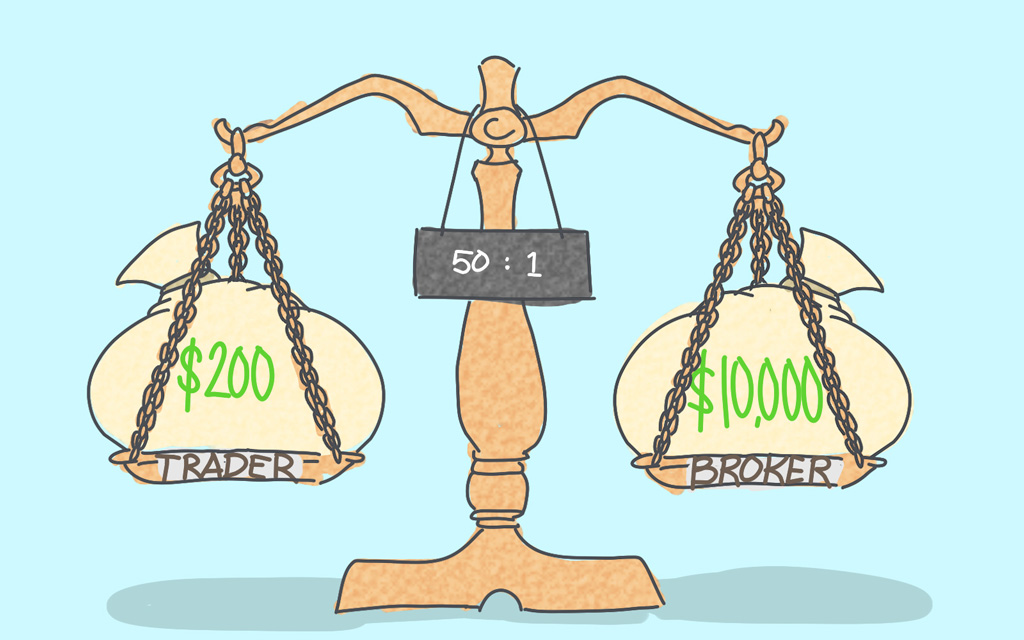

With a trading account balance as little as $10, you will need a fair amount of leverage just to be able to place a trade and have enough free margin left in your account to sustain a small amount of drawdown.

For example, with 1:500 leverage, you can open a position for 2,000 GBP/USD with just $5.00 of margin. That sounds great, but if you have an account balance of $10, that’s 50% of your margin and leaves you with just $5.00 free margin to place other trades (which you really shouldn’t do).

Most brokers will have a Stop Out level set at 50%. With a Pip value of $0.20, that means if your position loses 45 Pips, your margin level will be close to 100% and puts you dangerously close to Stop Out.

With a $500 deposit to your trading account, that scenario would look very different. There would be plenty of free margin to deal with any temporary drawdown. However, inexperienced traders usually end up using this extra wiggle room to open more positions or increase the size of their positions.

Best Leverage for $500 and up to $2000

Depositing $500 or more to your trading account, even if you are a beginner, is more realistic. A small account relies on high leverage and risking a high percentage of the account balance.

The best leverage for $2000 also depends on how many positions you intend to hold simultaneously. With 1:100 leverage you would only utilize approximately 1% of your trading accounts available margin to open a 0.02 Lot position. Compare that to the earlier example where 50% was required to maintain a similar size position.

Increase your trading results by following the Smart money with MT4 Sentiment Indicators.

The Risks of Forex Leverage

Regulators in Europe have made excessively high Forex leverage the centre of attention in recently introduced changes to what Forex brokers can offer their clients. High Forex leverage for beginners has become a massively controversial subject. Regulators took a tough stance on this topic which has affected traders who use it responsibly and depend on it for their trading strategy to work as intended. Brokers have also been hurt due to a loss in business.

Many traders treat Forex leverage like a credit card. It’s easier to spend more when you know there is more than you can spend. Someone on a spending spree can rationalize their actions by convincing themselves they’ll pay it back with their next salary. It doesn’t always happen. Much is the same with Forex traders. Opening a higher position can be easily justified by convincing themselves that they’ll close the position in profit. This doesn't always happen either.

Conclusion on How to Choose the Best Forex Leverage

Determining the best Forex leverage for beginners is not a one size fits all circumstance. It depends on how much capital you have and are willing to risk. It also depends on how much you want to trade and how often. The best advice anyone can give is to exercise extreme caution while dealing with leverage. Besides trying to figure out the best leverage for Forex trading, you might want to review our list of 9 Things I Wish I Knew When I Started Trading Forex, which is packed with many great suggestions