How Does Leverage Work in Forex?

Leverage allows a Forex trader to increase their position size beyond what they’d normally be able to trade, if they were using only their own account size.

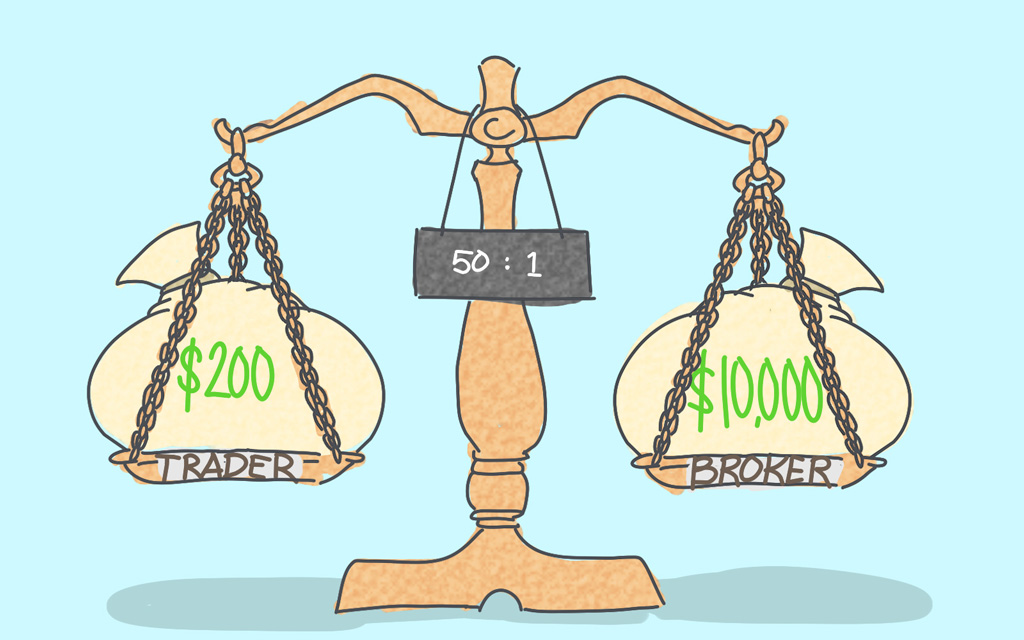

Forex brokers offer leverage to their clients in the form of a margin trading accounts. This is where a Forex broker provides access to borrowed funds.

While the use of leverage in Forex has many benefits for traders, it also comes with extensive risks. Whenever trading Forex on leverage, make sure you first read our guide on setting your stop loss properly.

The Definition of Leverage

The best place to start is by going over the key definitions of leverage and margin.

Leverage: The ability to control a large amount of money using a limited amount of your own. For example, to control a $100,000 position using 100:1 leverage, you need as little as a $1000 account.

Margin: The amount of money needed as a good faith deposit in order to open a new trade with your account. Using the example above, the $1000 in your 100:1 leverage account, is your margin.

The advantages and disadvantages of leverage

As we touched on in the opening section of this blog, there are numerous benefits to using leverage in Forex, but there are also considerable risks.

In order to build a bigger picture of how leverage works in Forex, let's go over a few of these pros and cons below:

- Profit from small price moves: Leverage allows Forex traders to amplify their winning positions as if they were trading on a much larger account.

- Risk management: Trading Forex on leverage requires a strict risk management strategy to vary position sizing in order to keep risk consistent.

- Losses amplified as high as profits: At the same time, Forex traders open themselves up to amplified losses if trades turn and go against them.

- Active management required: Trading Forex on leverage is not a passive investment strategy, but requires active position management.

How to work out what leverage allows you to control?

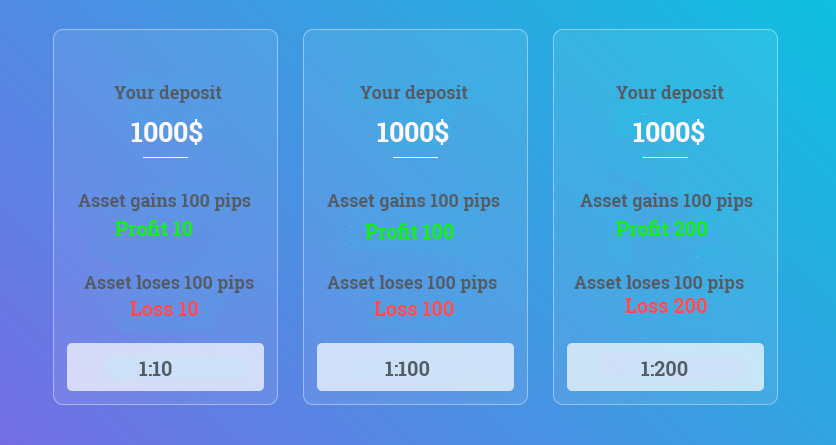

You can already see that leverage allows you to control a much larger account size than your initial deposit, but how large depends on the level of leverage offered by your broker.

We’ve highlighted two of the more popular levels of leverage that traders apply to their accounts, starting with 100:1 leverage.

100:1 Leverage

If we continue to use the 100:1 leverage level as the example ratio, we know that for every $1 in our account, you can trade with $100.

That makes it possible to use just $1000 to enter a trade that controls up to $100,000.

By using 100:1 leverage, you’re able to earn profits on the equivalent of a $100,000 trade with just a $1000 deposit.

On a USD denominated account using 100:1 leverage, if the price of EUR/USD moved by 100 pips, your profit would be $1000.

1:200 Leverage

Let’s now work out what we can control if we were trading on 200:1 leverage.

Your $1000 is now able to control $200,000, meaning you’re able to up your trade size for every position you take.

On a USD denominated account using 200:1 leverage, if the price of EUR/USD moved by just 50 pips, your profit would be $1000 – Double that of the example above.

As you can see, leverage offers a considerable increase in potential profits.

But don’t forget that while profits can be magnified, losses are magnified equally if a position moves against you.

It’s for this reason that you must fully understand how leverage works when it comes to trading in Forex and in order to do this, there are a few more terms we need to go over.

Finally, we must understand what happens when you push your available margin to the edge. When understood, leverage can be a powerful tool. But if you fail to take the time to understand what you’re doing, you’ll soon find you receive a margin call from your broker.

That’s right, there is definitely such a thing as too much leverage in Forex.

Margin Call Level: The level at which your margin has reached its threshold and your broker sends you a notification to take action before they do.

Margin Call: The actual event where your positions are forcibly liquidated by your broker.

How Much Leverage Should You Use?

While you may think that the more experienced a Forex trader gets, the more leverage they should use on their account, this actually couldn’t be any farther from the truth.

There is no correct amount of leverage that any new or experienced trader should use. If there was, then every broker would offer that on the one account type and that would be that.

Instead, every Forex trader is different and must make a decision on how much leverage they should use for themselves. That is, how much leverage makes them comfortable.

Make this decision by taking into account your experience, trading style and overall tolerance to risk. If your trading strategy makes money without having to use high levels of leverage, then don’t think you have to push it simply because you’re not a beginner anymore.

Using High Leverage Effectively

When it comes to how much leverage you should use, the most important thing is that you use your leverage effectively.

It’s imperative you remain within standard risk management guidelines. That is that you never risk more than 2% of your account per trade and that you not take trades with higher risk:reward ratios.

Just because you have access to high leverage such as 1:100 on your trading account, doesn’t mean you have to use all of it. By varying your lot sizes to stay within your 2% risk parameters, you’re able to effectively use your high leverage rather than blindly use it all on every trade you take.

Keep in mind that many brokers who offer high leverage such as 1:1000 often run unregulated b-books, meaning they make money when their clients lose. When a broker is focused on offering high leverage and not ensuring their clients employ intelligent risk management strategies, then you know they’re just taking advantage.

Trading with an ECN Forex broker can help remove this conflict of interest between b-book brokers offering high leverage simply to make money from their client’s poor trading.

Final Thoughts on Using Leverage in Forex

Using leverage while trading in Forex can be an excellent means to scale up your profits, especially if you don’t have the initial capital required to trade a meaningful size.

However, leverage is a double edged sword and as most new traders who don’t educate themselves soon find out, that it can actually do more harm than good.

Using a stop loss is imperative when it comes to managing risk while using leverage in Forex and one way margin traders use them is through the implementation of tight trailing stop losses.

Proper risk management is key to effectively using leverage in Forex.