How to Effectively Use Fibonacci Retracement in Your Forex Trading

Did you know that the ratio of the length of your forearm to the length of your hand is 1.618? That's the golden ratio. And it's found in the Fibonacci sequence and exists in almost everything if you know where to look, even in Forex.

Here's another example of the golden ratio: the ratio of the temperature of an average human (37 degrees) to the perfect room temperature is 1.618.

An Italian mathematician, Leonardo Fibonacci, discovered the Fibonacci sequence. The relationships among the numbers in the sequence are not only consistent in mathematical theory, but also in nature, architecture, and others.

In this piece, you'll learn how to calculate the Fibonacci retracement levels and how to set them up on your chart. And since not all levels are equally important, we’ll show you the important Fibonacci retracement levels and how to trade them in forex.

How to Calculate the Fibonacci Retracement Levels

Leonardo Fibonacci made the sequence up by adding the last two numbers to get the next number, starting from 0 and 1.

0 1 1 2 3 5 8 13 21 34 55 89 144…

The sequence looks like you are merely playing with additions until you calculate the ratios these numbers form with one another.

Pick any two consecutive numbers from 5 upwards in the series, for instance, and divide the smaller one by the bigger one. The ratio is 0.618 or anything close. And if it’s the golden ratio you want, divide the bigger number by the smaller one.

Go ahead, try it.

When you do the same with a number and the number two spaces ahead of it, you have 0.382 or anything close. The ratio of 21 and 55, for example, is 0.382 approximately. Do the same for a number and another number three spaces ahead and the ratio falls to a consistent 0.236.

These ratios are the Fibonacci retracement levels on your forex charts.

How to Set Up Fibonacci Retracement Tool on the MT4 charts

You’ll find the Fibonacci retracement tool when you click on the “insert” tab at the top-left area of your MT4. Hover above the “Fibonacci” drop-down option and click on “retracement” among the other options that appear to the right.

There are two ways to set up the Fibonacci retracement tool on your MT4. One is for when the market is in an uptrend, and the other is for when the market is in a downtrend.

Follow these steps to set up the Fibonacci retracement tool on your chart.

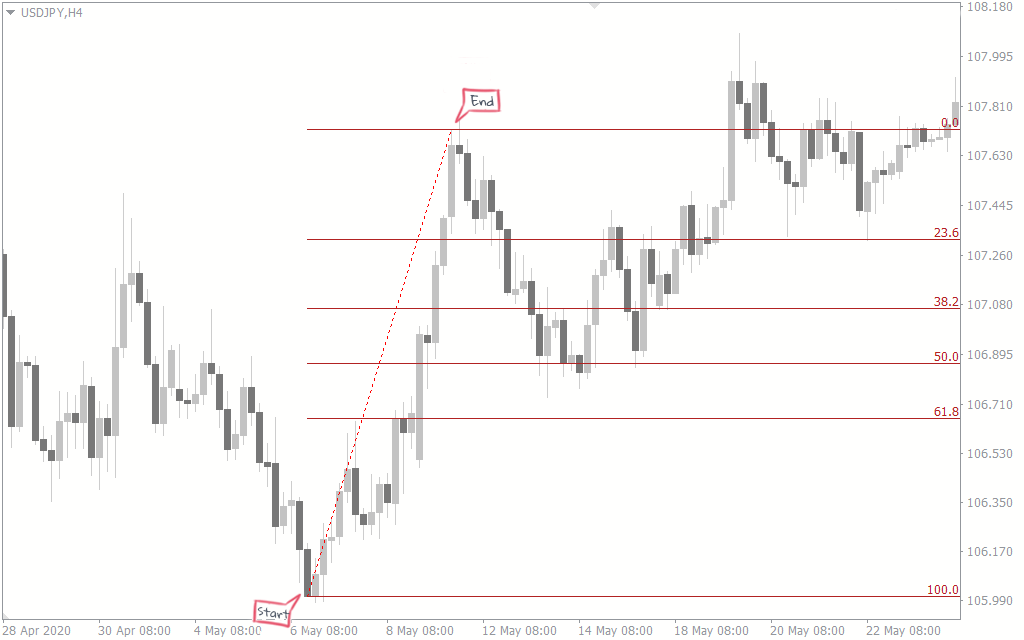

How to Set Up the Fibonacci Retracement Tool in an Uptrend

- In an uptrend, click and hold the Fibonacci cursor at the bottom of the trend and drag it to the top of the trend.

- If you drew it correctly, the bottom of the trend would be your 100 level and the top of the trend would be your 0 level.

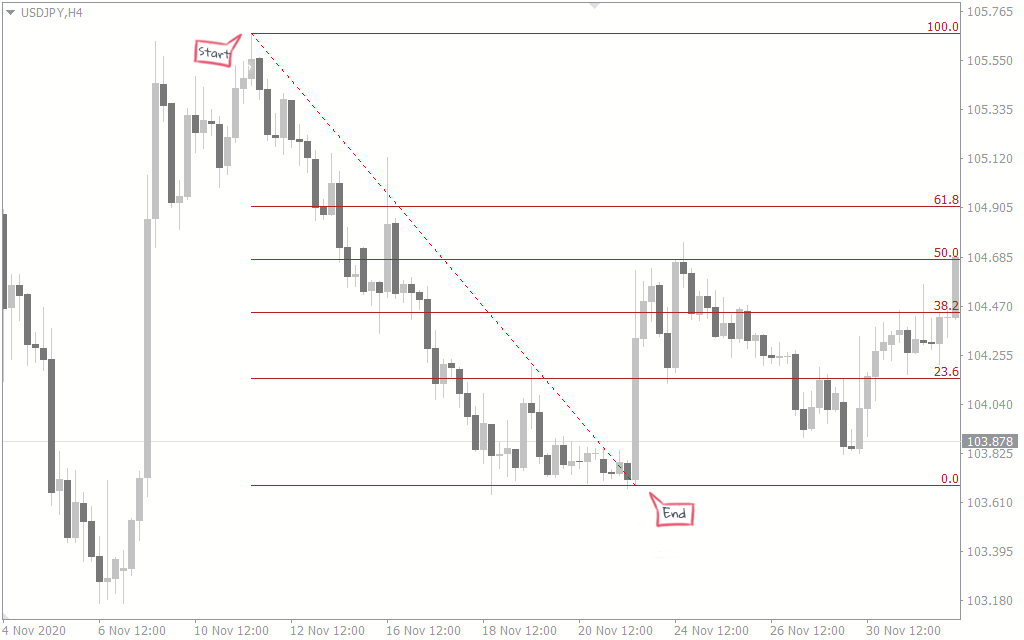

How to draw the Fibonacci Retracement Tool in a Downtrend

- In a downtrend, click and hold the Fibonacci cursor on the top of the trend and drag it to the bottom of the trend.

- If you drew it correctly, the bottom of the trend would be your 0 level and the top of the trend would be your 100 level.

Important Fibonacci retracement levels

When you draw Fibonacci levels on your chart, you expect that price retraces when it gets to these levels. That’s why they are called Fibonacci retracement levels. However, you may notice that price retraces from some levels more often than it does at others.

These levels that accommodate more retracements are the most important Fibonacci retracement levels.

When you study the market closely enough, you’ll notice that all levels from the 38.2 up to 61.8 are very important. You rarely see price retracing at the 23.6 level in a trend.

Trading Strategies with Fibonacci retracement levels

Now that you are familiar with the important Fibonacci retracement levels, of what use are they to you and your forex trading?

These are some of the most commonly used Fibonacci retracement levels trading strategies.

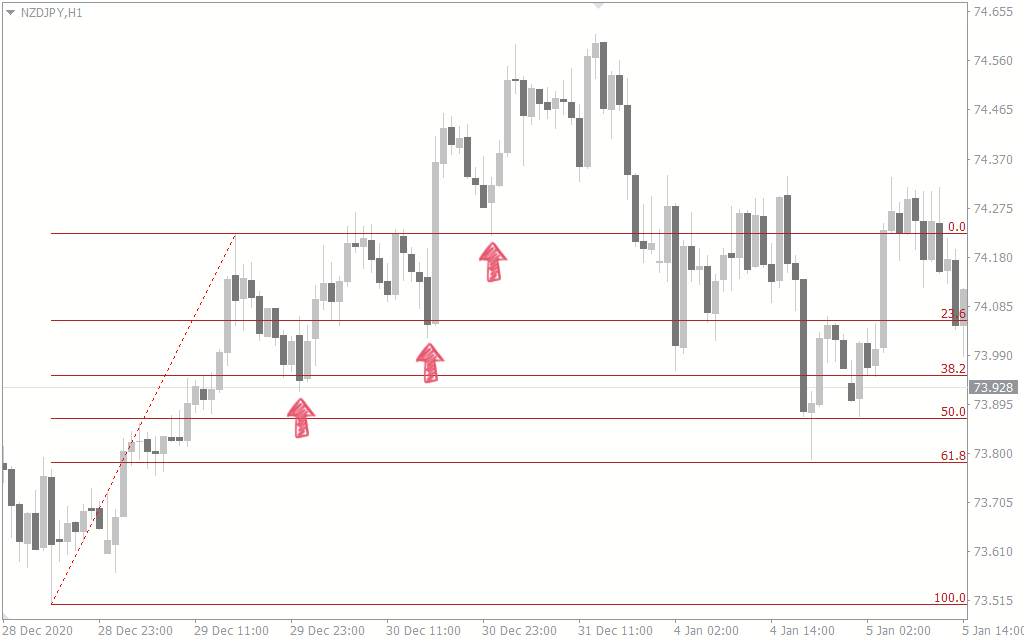

Pullback Levels

You can use Fibonacci retracement levels to predict where price is likely to pull back during a trend. In the chart below, price keeps pulling back to higher Fibonacci levels on its way up.

You may enter trades at these pullbacks to get the best risk-reward ratio on your trades. You could also use various pullback trading strategies with the Fib retracement tool as your pullback indicator.

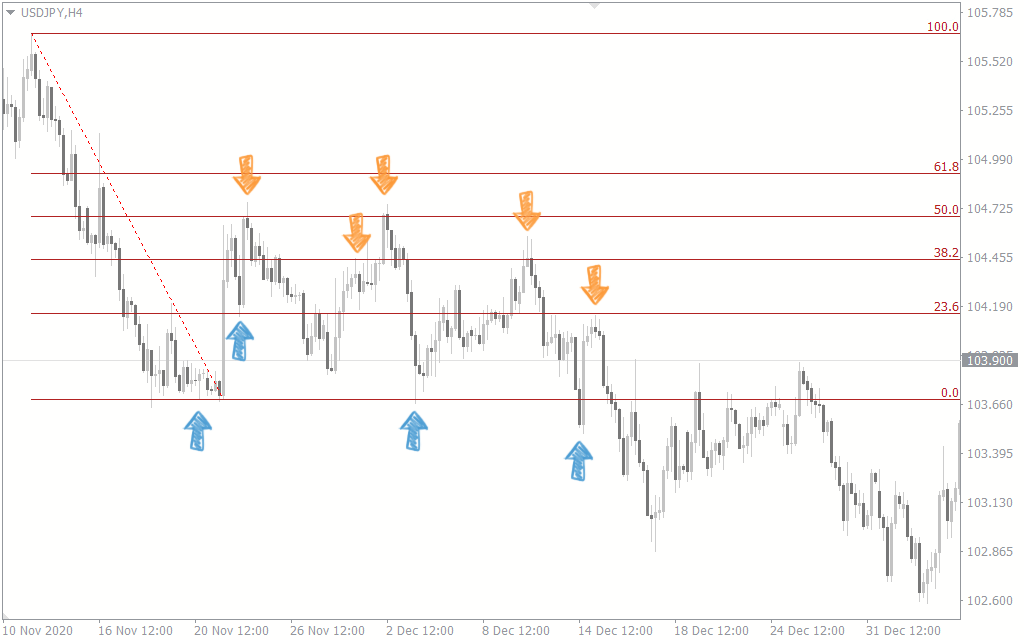

Dynamic Support and Resistance Levels

You’ll usually find that your Fibonacci retracement levels serve as temporary support and resistance levels, as long as price is within the 0 and 100 levels. The chart below is a perfect example of where the Fib retracement is acting as support and resistance levels.

You may trade these levels as you would trade your normal support and resistance levels: Buy at support, Sell at resistance. You may also use the fib retracement tool with the FXSSI support and resistance indicator.

For Potential Price Targets

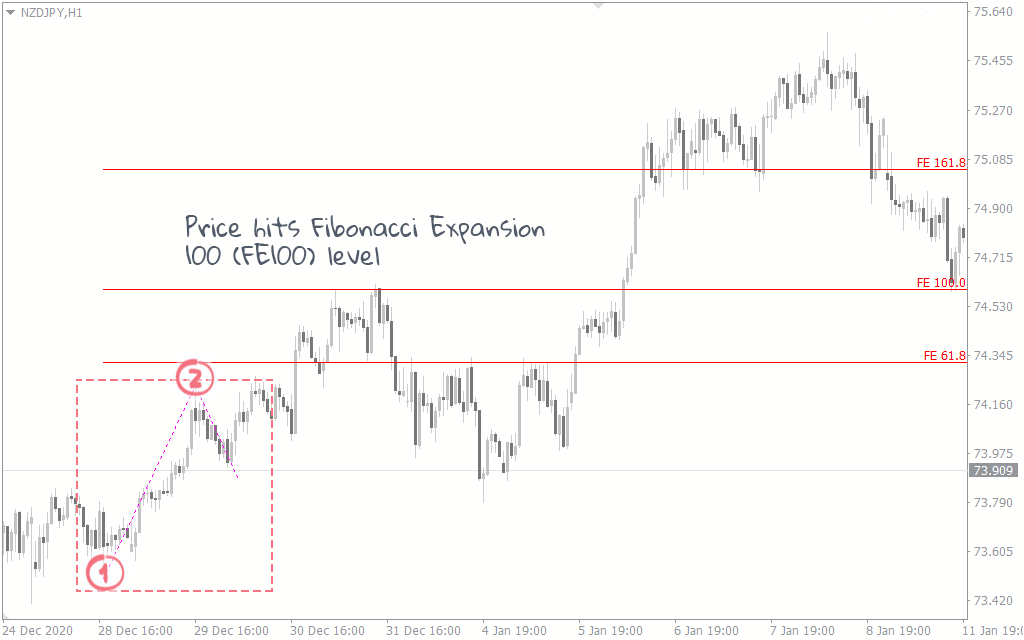

You may also use Fibonacci extension levels to project future price levels. You’ll find the Fibonacci extensions on the MT4 with the name “expansions” where you found the retracement.

You can see Fibonacci extensions at work on the chart above. After price makes a retracement and shoots out of the 0 level, it heads straight for the 100 level.

Conclusion

The Fibonacci retracement tool is very effective for all forex traders of all skill levels, but it doesn’t work all the time. That is why we always tell you to never make trades with just one tool. Try to use different tools in confluence with one another. Even then, you wouldn’t be right all the time, but you would have reduced your risks substantially.