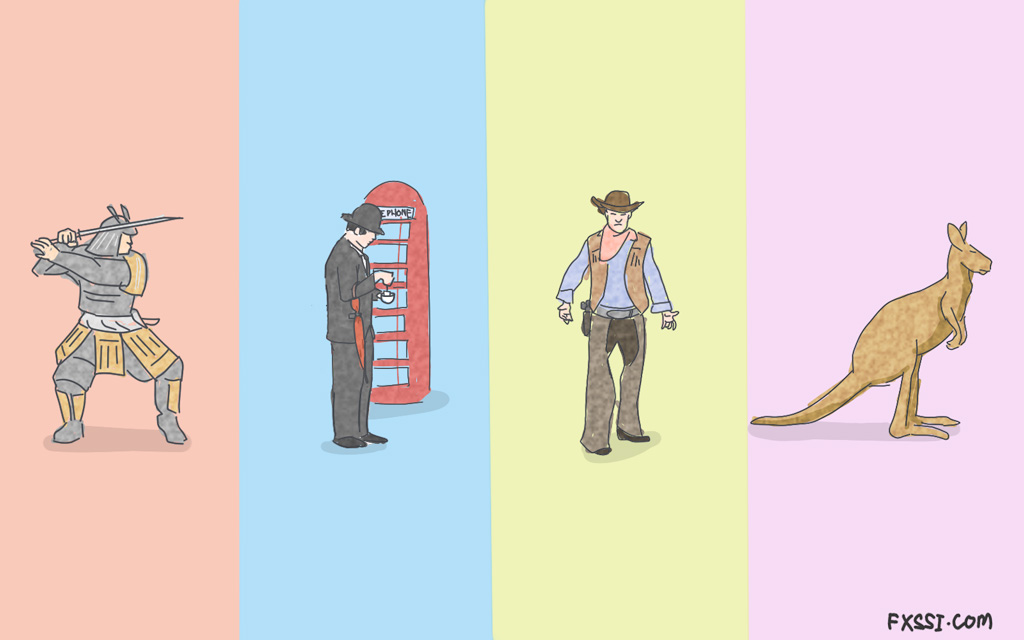

Forex Strategies for Each Session

You know that the Forex market is open 24 hours a day, 5 days a week. But what does a 24-hour day in the Forex market actually look like?

Well, a typical trading day is broken up into 4 sessions, each with their own price action characteristics and market flows.

- The Tokyo Session: 23:00 UTC – 8:00 UTC.

- The London Session: 7:00 UTC – 16:00 UTC.

- The New York Session: 12:00 UTC – 21:00 UTC.

- The Sydney Session: 21:00 UTC – 6:00 UTC.

By using the FXSSI Forex Sessions Indicator for MT4, you’re able to take advantage of these unique characteristics and create trading strategies accordingly.

We’ve highlighted 3 such Forex trading strategies by session below.

The Asian Session

Thanks to their low volatility, the Sydney and Tokyo sessions are often combined under the one banner and referred to as the Asian session.

The Asian session runs from 21:00 UTC to 8:00 UTC and is the first trading session of any new weekly candle.

With its lower volatility compared to the London or New York sessions, many traders choose to ignore the Asian session.

But if you can use this lower volatility to your advantage, then trading in the Asian session can be just as profitable as its more popular counterparts.

Asian Session Scalping Strategy

This is a variation on the classic master candle trading strategy.

A master candle is a candle that has 4 or more bars printed within.

While most master candle trading strategies look to trade breakouts, during the Asian session they often don’t have any momentum.

For this reason, we’ve adapted the strategy to fade Asian session breakouts and renamed it our Asian session scalping strategy.

Currency Pairs:

As the strategy looks for low volatility moves that lack momentum, trade any currency which sees its major financial hub sitting outside of Asia.

The major Forex currency pairs featuring European and North American currencies are perfect examples.

Example currency pairs to be used in our Asian session scalping strategy include EUR/USD, GBP/USD and USD/CAD.

Timeframes:

Our Asian session scalping strategy requires you to use two charting timeframes.

To find master candles, use a H1 chart and use the trend line tool to mark the high and low points of the candles.

After a master candle has been identified, zoom into an M15 chart and wait for price to reach the upper or lower range of the master candle.

Trade Entries:

A long signal will be triggered when price breaks 5 pips below the master candle’s low.

A short signal will be triggered when price breaks 5 pips above the master candle’s high.

Remember, you’re fading here.

Take Profit and Stop Loss:

Take profit would be the size of the master candle back in the other direction.

Your stop loss would also be the size of the master candle, making this a 1:1 risk reward trading strategy that requires you to hit a 50% win-rate to be profitable.

The London Session

The London session is the most volatile trading session.

London is considered the largest global financial hub and as a result, the London session open is marked on every bank and retail Forex trader’s daily calendar as a time of increased volatility.

With this, comes a trading opportunity and if you can time your trades right, you can take advantage of the biggest moves of the day.

The London session stretches from 7:00 UTC to 16:00 UTC and finds itself wedged between the quiet Asian session and the unpredictable New York session.

London Open Forex Strategy

Our London open Forex strategy puts a twist on one of the most popular strategies used by traders.

Otherwise known as a London breakout Forex strategy, it involves taking advantage of a breakout of the current day’s range.

Remember above when we were fading Asian session master candles because the momentum isn't there for the market to break out?

Well when the London session ticks over, breakouts are on the cards and our London open trading strategy aims to ride momentum and lock in a large chunk of this initial move.

Currency Pairs:

This strategy relies on volatility to trade breakouts on currency pairs that have the ability to make hard and fast moves through support/resistance.

This means you want pairs that are going to be the most active during the London session, such as European currencies and their volatile currency cross variants.

Examples of good currency pairs to use in our London open Forex strategy are GBP/USD, EUR/USD and the highly volatile GBP/JPY.

Timeframes:

Our London open Forex strategy is an intraday strategy.

It requires you to mark the Asian session range, so find the best intraday timeframe below the D1 chart that works for you.

You could use the H1 to clearly mark the Asian session range and then an M15 chart for entries and trade management.

Trade Entries:

Any breakout strategy around the London open is prone to fakeouts.

For this reason, we’ve altered the entry rules of our London open Forex strategy in order to wait for directional confirmation before joining any momentum move.

While you may miss the boat on some trades, you’re going to offset that long term, by experiencing a higher winning percentage.

A long signal would be triggered when price breaks above the Asian session range and retest previous resistance as support.

A short signal would be triggered when price breaks below the Asian session range and retests previous support as resistance.

Take Profit and Stop Loss:

Take profit would initially be the size of the Asian session range.

Your stop loss would be the opposite side of the Asian session range.

When the Asian session range is small and the breakouts are large, you’re able to subjectively keep trades with a high risk:reward open, drastically lowering your required win-rate to remain profitable.

The New York Session

Last of all in the trading day, comes the New York session.

Running from 12:00 UTC to 21:00 UTC, this is the final trading session of the day.

As the New York session is positioned this way, end of day/end of week flows make it somewhat unpredictable.

New York Breakout Strategy

While the London open is the most important part of the day, the entire New York session is more of a slow-burn.

As there’s no time-based trigger within this session’s trading strategy, instead use the dynamic support/resistance indicator known as Bollinger Bands.

This is a popular indicator created by John Bollinger, consisting of upper, medium and lower lines which expand and contract according to market volatility.

You can rely on this indicator to signal how much momentum is behind a move and use it to trade New York session breakouts.

Currency Pairs:

At the end of the day the market flows can be highly unpredictable, use some of the more stable currency pairs for our New York breakout strategy.

When it comes to Forex currency pairs, stability comes from liquidity and the most liquid pairs are the majors.

The fact you’re trading USD denominated currency pairs during a time of the day when the financial hub of the United States is open also makes sense.

The more liquid the better, so use pairs such as EUR/USD, GBP/USD and USD/CAD.

Timeframes:

The New York breakout strategy is another intraday strategy.

For the Bollinger Bands to be effective within a single session, they have to be viewed on an M5 timeframe.

Trade Entries:

A long signal will be triggered when you have 2 consecutive candles close outside the upper Bollinger band line.

A short signal will be triggered when you have 2 consecutive candles close outside the lower Bollinger band line.

Take Profit and Stop Loss:

Your stop loss would be placed on the opposite side of the first breakout candle.

Take profit are placed as multiples of your stop loss risk.

This is done to raise the risk:reward of the strategy and protect you against fakeouts which you can miss if you're inexperienced using Bollinger Bands.

Final Thoughts on Forex Strategies by Session

No matter which part of the world you’re in or how your daily schedule looks, there’s a trading strategy that can work around you.

Use the FXSSI MT4 Forex sessions indicator to clearly track where you are within the 24-hour trading day and use it to take advantage of the unique characteristics that price displays throughout each session.