Forex Trading Without Stop Loss

One area all traders struggle with is determining where to place their stop loss. Fiddling with a Stop Loss can be a sign that you are on a slippery slope to Margin Call or worst, Stop Out.

New traders are repeatedly told to stick to a strict risk-reward ratio and religiously follow their trading plan. Despite all the experts telling you that trading without a Stop Loss is close to being a criminal offense, there is some appeal in the idea that you might be able to afford yourself some leniency. After all, the markets swing up and down day and night.

The level where you originally placed your Stop Loss may be obsolete after a few hours, and a reevaluation makes total sense. Using no Stop Loss Trading methods can undoubtedly be risky.

In this article, we will explore if and when you should be trading without a Stop Loss in your Forex Strategy and how you might be able to overhaul your approach to using Stop Losses.

Why do we use Stop Losses?

Before we can decide whether we should trade Forex without a Stop Loss or not, let’s remember why we use them in the first place.

- Stop losses are an essential component of responsible risk management. They limit the maximum amount of damage your position can cause.

- You determine your trade parameters based on analysis that you made in advance while you were cool-headed and not yet emotionally involved in a trade.

- You can move your Stop Loss once your position in gaining a certain amount in order to secure profits should a trend start to reverse.

A big problem in the Forex education space is that traders are educated on the importance of using Stop Losses. New traders are notoriously prone to blowing their accounts in a very short space of time, so this is not a bad thing. The downside is that many new traders don’t learn how to set a Stop Loss Properly in order to learn the different Stop Loss strategies retrospectively.

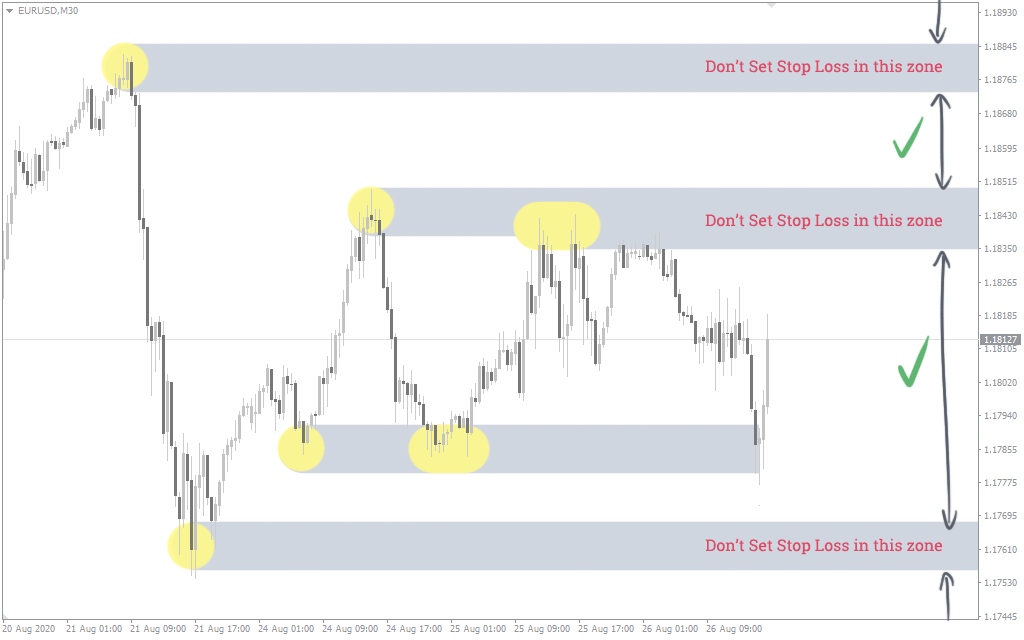

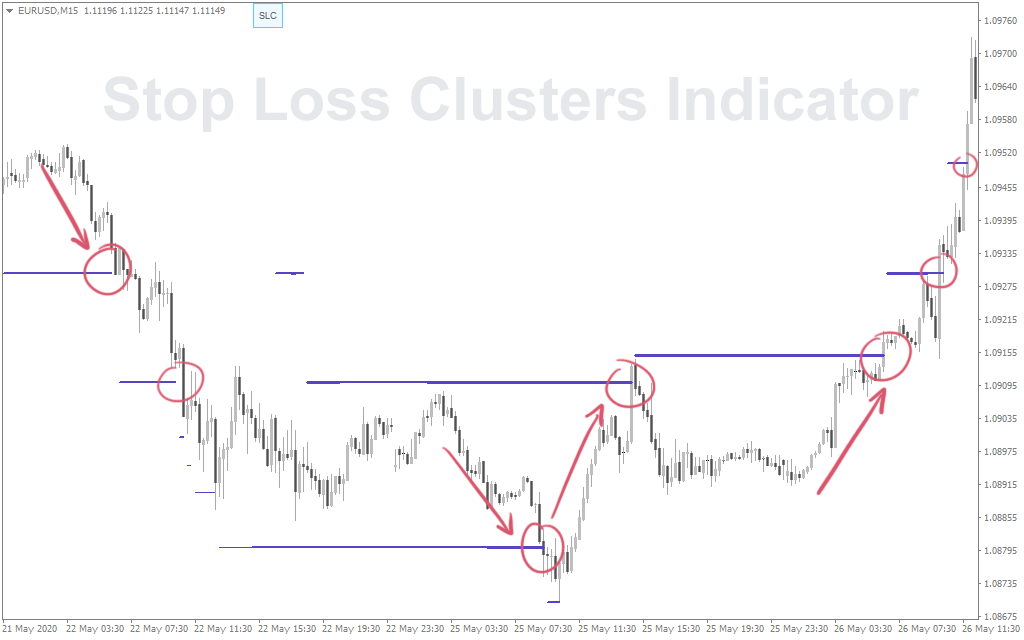

One of the approaches we discuss in the aforementioned article is setting Stop Losses outside of the High and Low ranges and the Round Price Levels. Most traders place their Stop Losses inside of these zones, which are ranges where the market is likely to fluctuate within.

There is a strange phenomenon in the online trading world whereby prices seem to gravitate towards wherever Stop Losses are clustered. Considering the scale of this phenomenon, it’s unlikely to be manipulation, but rather a widespread and common behavior exercised by traders everywhere. By knowing where other traders are setting their Stop Losses, you can place yours further from theirs.

What is the Problem with Stop Losses

The advantages of using a Stop Loss are clear. This is Forex trading 101. Less often discussed is the common issues faced by traders when using a Stop Loss. There are some valid arguments for trading without a Stop Loss.

- Stop Losses are a definitive statement that a specific trade has failed.

- Many traders place their Stop Losses on Resistance Levels which may turn out to be Pivot Points. This results in traders losing money even if their trade was right, but just the entry point was misjudged.

- Traders place their Stop Losses too close to their entry point. This does not give the trade enough breathing room to pull back. This is especially true when traders oversize their positions, they focus on monetary losses in their Risk-to-Reward ratio, and neglect the trading pair’s range of movement.

- You may think that a trade has become invalid, yet you stick to the plan and wait for it to reach the Stop Loss.

- Stop Losses are prone to be triggered by erroneous spikes in the price or short term volatility.

- You can misjudge your entry point and have your Stop Loss hit despite the setup still being valid.

Do Professional Traders Use Stop Losses?

As traders become more experienced, their abilities evolve. Many professional traders reduce their reliance on indicators as their interpretation of the markets becomes instinctive. Take Price Action traders, for example; they are well known for Forex trading without indicators.

Professional traders most likely are using Stop Losses in their strategies, but not in the same way as an average trader would. Professional traders recognize that drawdown is a natural element of trading Forex; it doesn’t spook them and doesn’t make them feel their trade is invalid. Professional traders express that their Stop Loss setting tactics allow for plenty of breathing room.

In many ways, a Stop Loss takes control away from you. A professional trader objective is actually not to allow their Stop Losses to be triggered but to decide for themselves if their trade is invalid and close it themselves. Doing this limits how much they lose.

Professionals do trade Forex profitably without Stop Loss orders. Still, they can only do that if they are constantly monitoring their account or have a significant amount of available margin to be able to sustain this strategy.

Trading Forex Without a Stop Loss – Should you do it?

It would never be responsible for anyone to advise Forex traders not to use a Stop Loss. The best advice you can take away from this article is that you should reevaluate how you are deciding where to place your stop losses.

Suppose you can’t allow enough room to let your downside move through the established trading ranges. In that case, you should consider decreasing the size of your positions or increasing the margin in your trading account (does not necessarily suggest increasing leverage on your account).

Naturally, before you choose to attempt Forex trading without a Stop Loss, you should test this approach on a demo account. When you move to a live account, consider starting on a cent account or by trading Micro-Lots until you can adjust to this bold change and the psychological effects that it may have on you.