Psychology of Breakeven: Don’t Let Your Profits Run Away

We all want to be on the plus side in Forex. But how do we assess our profitability? In most cases, we compare the amount of incurred losses with that of profit. However, this indicator alone cannot be sufficient motivation.

We risk falling into one of the psychological traps in case of a series of losing trades. After a series of failures, our desire to make a profit (recover our losses) becomes so strong that it causes more and more losses. Often, it results in an increased emotional charge, and trading based on emotions and going for broke leads to great losses.

One way of releasing emotional charge in trading may be moving Stop Loss to breakeven.

What is Breakeven in Trading?

Breakeven is such a price level relative to an open trade where there is neither profit nor loss. In other words, breakeven is a situation when the price has come back to the point of opening a trade.

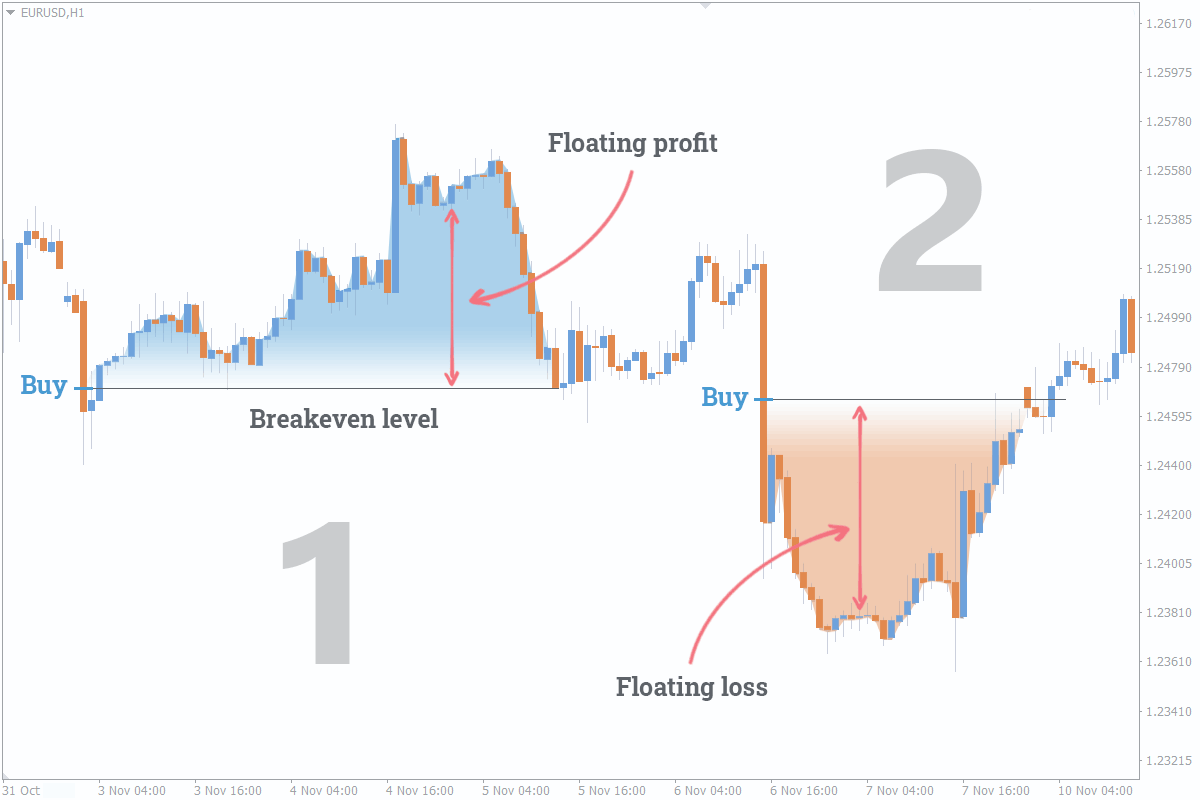

Coming back to breakeven point can be of two types:

- when a trade had a floating profit;

- when a trade had a floating loss.

Learn more about breakeven level in the picture:

Note that a newly opened trade doesn’t open at the breakeven price, since there are spread and commissions that need to be paid for.

Psychology of Breakeven in Forex

Success of traders depends for 10% on their trading strategies and 20% on money management. The remaining 70% of the success is psychology and emotional balance, so trading is a work at yourself. In this situation, breakeven can play the role of a stabilizer or a sedative, and everyone will make own decision whether it helps him/her or not.

Traders who ignore moving Stop Loss to breakeven often want to “win” the market specifically in this situation forgetting about risk management. They forget that every single trade is just an opportunity to make money, and success of a trader depends not on one trade, but on the aggregate of all own trades. Therefore, when moving Stop Loss to the breakeven level, you don’t put your trading account at stake, but you reserve the right to return tomorrow and continue trading.

It is really important to move Stop Loss to the breakeven level when a trade has a good floating profit. This will help you to keep your capital safe and avoid a troubling situation when a winning trade turns into a losing one.

Breakeven is just a tool, which needs to be properly used. Too emotional traders abuse moving Stop Loss to breakeven that leads to a large number of “zero-profit” trades. This is why you need to carefully consider this tool and the possibility of its integration into your trading strategy.

In general, if your next trade is neither winning nor losing, take a break and get some rest, because the near-zero result or closing a trade at breakeven is a positive result in the long run in Forex.

When Should Stop Loss be Moved to Breakeven?

Honestly speaking, moving a trade to breakeven doesn’t give any mathematical advantage, i.e. the mindless use of breakeven won’t boost the potential of a trade, but only limit your loss. It is also important to take into account the peculiarities of your trading system when moving Stop Loss to breakeven.

In the midst of all of this, several situations where you should move Stop Loss to the breakeven level may be distinguished:

- Your trade has a large floating profit, and it’s extremely unlikely that the trade will return to breakeven. It’s how we will protect ourselves from force majeure, where the price moves at a fast clip against your trade for no apparent reason.

- Your trade has a floating profit, but the signal quality has deteriorated, or you’ve got the opposite signal. By doing so, we’ll rule out the possibility of any loss from the trade that lost its potential.

- Your trade has a floating loss, and the option of “moving to breakeven” will significantly reduce your psychological stress. If a trade has exhausted you, and you don’t realize what’s happening in the market, breakeven is your best option in such a situation.

We don’t recommend moving Stop Loss to breakeven during news releases. This can play a low-down trick with you when a winning trade closes with enormous loss due to slippage or spread widening. To limit the losses incurred during news announcements, it’s better to use locking.