What Is Stock Order Book. Is There One for the Forex Market?

Have you ever asked yourself why price goes up or down, and what makes it do so?

A stock exchange order book can help us answer this question because it is based on the core principle of pricing.

Understanding Stock Exchange Order Book

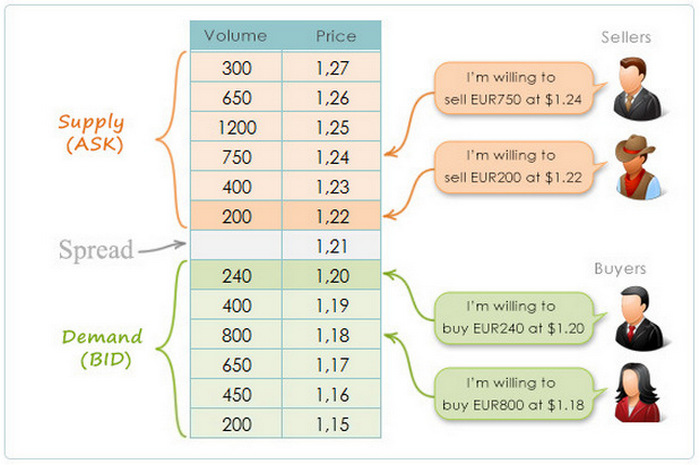

Any exchange is anything like a traditional market where buyers meet sellers. The former wants to buy cheaper, and the latter wants to sell dearer. If we gather together the wishes of all the market players in a single table, we’ll get the following picture:

These sellers and buyers might be called passive ones since they’ll be waiting until someone fills their orders. This kind of players boosts the liquidity of a financial instrument, and their orders are referred to as Limit orders.

When the market is full of Limit orders, the second group, now including active market players, comes into play. They don’t wish to wait and want to buy at the price currently available in the market.

These active players buy Limit orders of the passive players at the best market price – this is why their orders are called Market orders.

Market orders are not displayed in the order book since they are immediately executed. Let’s consider an example of a Market order execution:

As the picture shows, the ASK price has moved up at 1 point when a trade is made. This is what they call the price formation process. Thereafter, if the buying activity exceeds the selling one in the market, price will go up, and vice versa.

So, what’s the order book? The stock exchange order book is a table of data on Limit orders to Buy and Sell for a particular financial instrument. Every line of the table provides information on price and volume of the assets offered for purchase/sale.

The stock order book has other names: Depth of Market and Level II.

The stock exchange order book enables traders to estimate the liquidity of an instrument at any given time. It is generally used to identify actual support and resistance levels. However, there are numerous methods to analyze the order book – for example, scalping using the order book is an extremely popular method.

What Order Books are Like, and Where to Find Them?

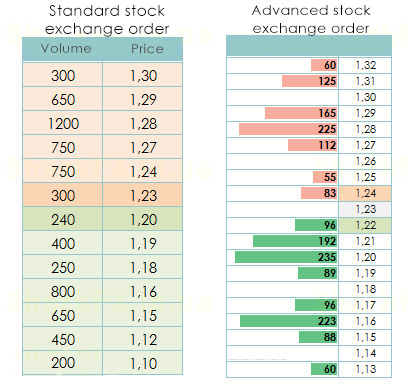

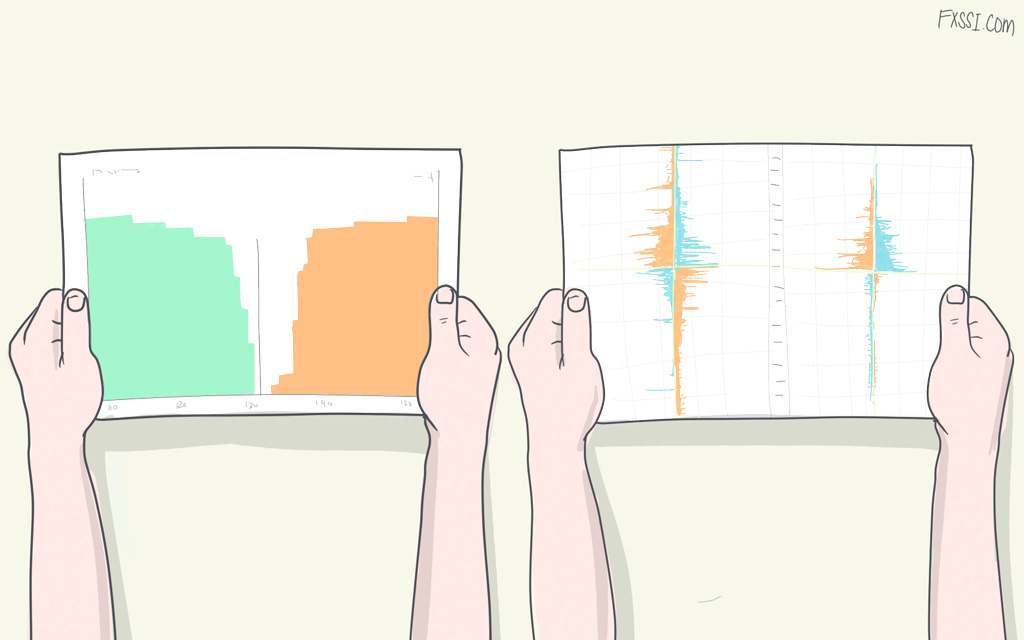

Visually, the stock order books are different, and how they appear depends on the trading terminal that you use. However, they can be classified into two types:

Notice that there are "empty" prices in the advanced stock exchange order book. It better suits for estimating instrument liquidity, and the histogram makes it easier to perceive volumes.

"Depth of Market" is available on almost all US and Russian stock exchanges.

So, we have concluded that the order book is a purely stock exchange tool, but most readers of this article are more likely interested in the Forex market.

Therefore, this raises the question of whether the order book exists in the Forex stock market.

The true order book doesn’t exist in both the stock exchanges and the Forex market, but there is something similar.

Is There an Order Book in the Forex Market?

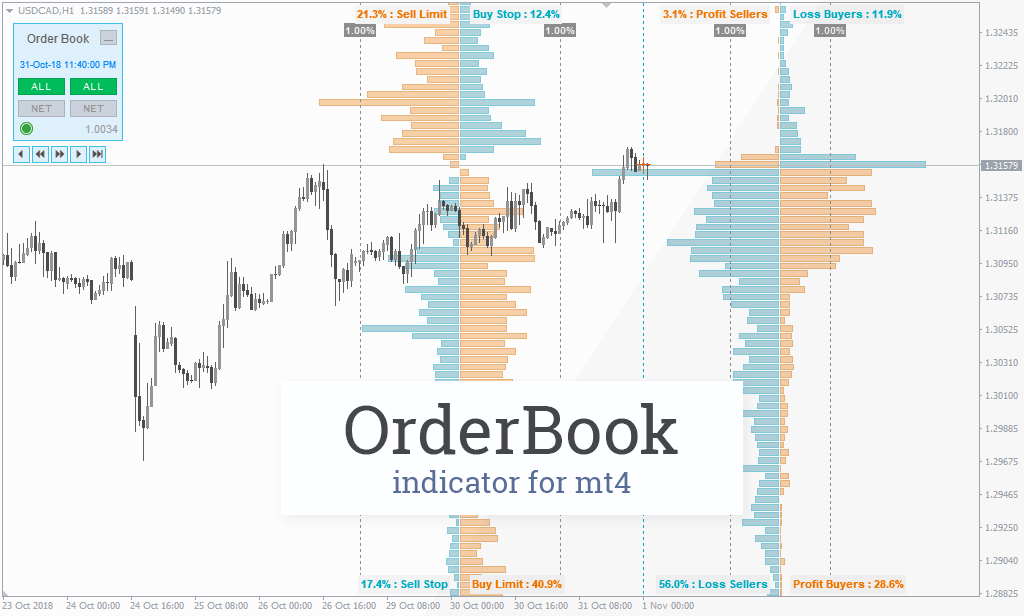

The indicator enabling to display the order book in your MT4 terminal appeared. Click this link to learn more and download OrderBook indicator.

Currently, none of the existing liquidity providers offer the Forex market order book online.

Maybe, some financial regulator will force them to do so in the future, but these data are not available to the public as of today.

On the other side, the Forex market is ten or even hundred times faster and more liquid than other markets. Just imagine the volume of the information that needs to be processed and delivered to customers’ terminals.

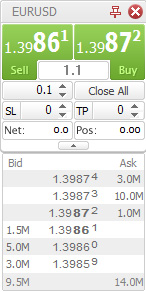

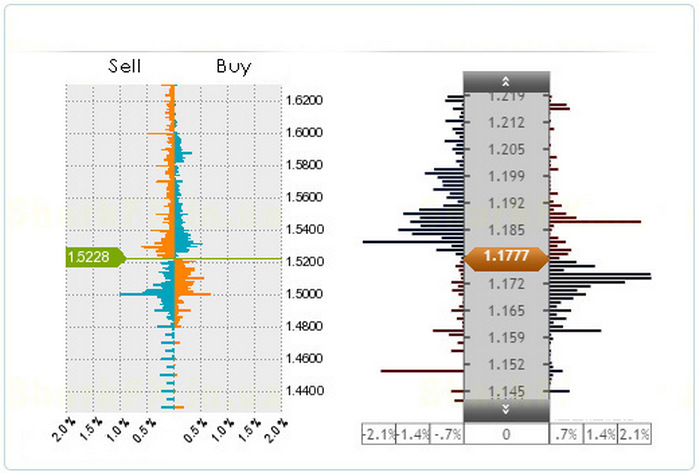

MT4 and MT5 terminals have some sort of order book that looks something like this:

But they don’t have any actual or close to actual data.

The only thing Forex traders can hope for is order books from big brokers. The thing is that they have such a large customer base that aggregate data on positions can provide us with quite interesting information.

There are two types of the Forex market order books available nowadays. You can see their screenshots below:

They have a number of shortcomings and benefits in relation to the stock exchange order book:

Data on Stop Losses and Take Profits are displayed (stock exchange traders would envy Forex traders).

Data are updated at intervals of 20 minutes but not on a real-time basis.

Data are shown as a percentage only but not as real figures.

Let’s sum it up. Why the order book is so important for a trader? The answer is that it is the only truly leading indicator. All the other technical analysis tools represent merely a mathematical formula based on the price and, thereby, they cannot predict the future price behavior in any way.