A Little Trick Protecting You Against Tilt at the First Losses

A brief psychological note on how to protect yourself against tilt (distress) as a result of a series of losing trades.

First, let’s agree on the concepts.

The word “Tilt” has another meaning which is ”slope”. Previously, pinball machines had a sensor determining the slope of the device itself; if a player cheated, tried to incline or shake the device being on edge, a large inscription “TILT” appeared on the scoreboard, following which he/she lost one of the attempts. Afterwards, gambling and then the Forex market took the concept over.

Nowadays, the concept of ”tilt” slightly transformed: heedless actions of a trader, violation of money management rules, and subsequent losing of a significant amount of money as a result of a series of losing trades are currently referred to as the “tilt”.

Let’s consider a situation, following which the tilt usually occurs, as an example.

Example of Tilt

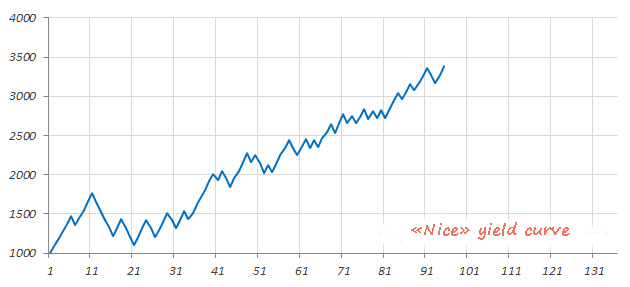

Imagine some traders trading profitably for a few months, so much so that they have almost no drawdowns. Their equity curves look something like this:

They often begin watching their statements, so to say, “admire” their “nice” equity curves and subconsciously wish the curve to remain the same – “nice”, smooth, and ascending.

However, that never happens in trading, and there will be a losing trade sooner or later.

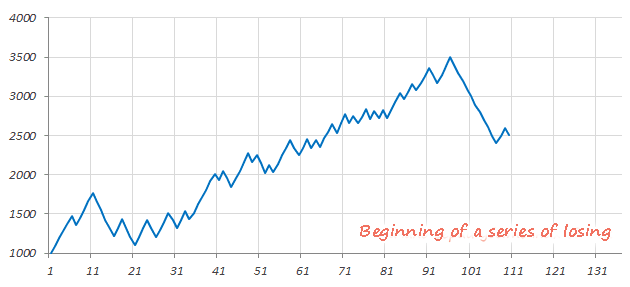

At this moment, traders are still in control of the situation. They understand that trading losses are acceptable, and the losses incurred should be just won back. But, as it often happens, a losing trade is followed by the second losing one, then by the third losing one, etc.

As a result, their equity curves begin to take the descending form:

When their equity curves cease to be “nice” as they used to be, they begin to feel some discomfort and the desire to make things right as quickly as possible. It is at that moment that all problems begin. The time comes into play, because they have to quickly get “nice” equity curves back on the chart.

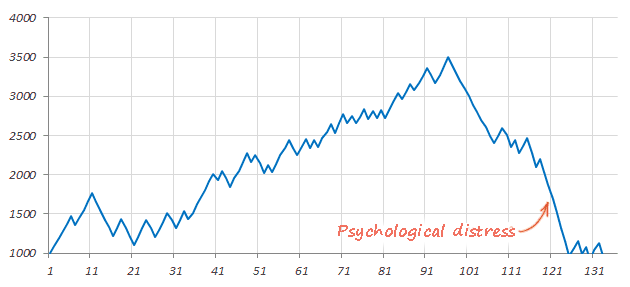

Next comes a quite predictable scenario: a trade opened without a signal leads to a loss; another trade opened with too large lot size incurs a loss; opening a trade for another currency pair causes a loss; going back to the main pair results in a loss. “I’m fed up with it! Now or never” – they open a trade for the entire volume and incur a loss again.

And only then traders realize that they have given in to emotions, made a mistake, but it’s too late.

What is the main reason for such a distress? The answer is a series of losing trades. It is due precisely to the fact that traders cannot wait for a winning trade, which cools their eagerness, they begin doing foolish things. When 6-7 losing trades have been made, they cease to believe in their strategy and begin to break its rules.

How to Reduce a Series of Losing Trades?

If the main reason for the distress lies in a series of losing trades, why not try to reduce its size mathematically?

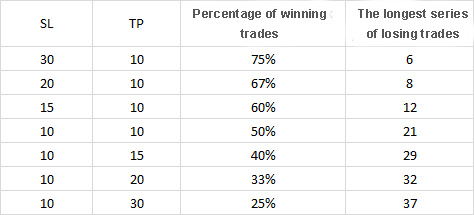

How to do that? Reduce Take Profit (TP) size while increasing that of Stop Loss (SL).

Assuming that if the ratio of SL to TP is 3 to 2, the number of winning trades will be one-and-a-half times more than that of losing ones in plain mathematical terms and not allowing for the quality of trading signals.

At the same time, the series of losing trades will be reduced. Let’s count roughly and obtain the following data: the longest series of losing trades includes 21 trades, if SL equals TP, and only 12 trades, if the ratio of SL to TP is 3 to 2.

In this case, everything seems so easy, but there is one more thing you should pay attention to. It turns out that the shorter a series of losing trades, the greater the load on your deposit you can use in each trade.

From words to deeds – How to stop Tilt in Forex trading

Previously, we published an article on the ratio of SL to TP stating that, in principle, it didn’t matter what kind of the ratio you’d have – the main thing was to set them in the right places. If you’re exposed to distresses, or something like this already happened to you, the above-described technique can help you to avoid a distress.

By the way, when considering the concept of a “smart trade” in terms of the order book, we can see that large players often trade particularly with a small Take Profit and a much larger Stop Loss.

The given technique has its drawbacks. Setting Stop orders in such a way will partially coincide with the second pattern of the crowd behavior, so you’ll have to choose what is more important to you in this case: to be not like everyone else or protect yourself against a distress.

How to achieve the ratio of SL > TP, while setting them in the right places?

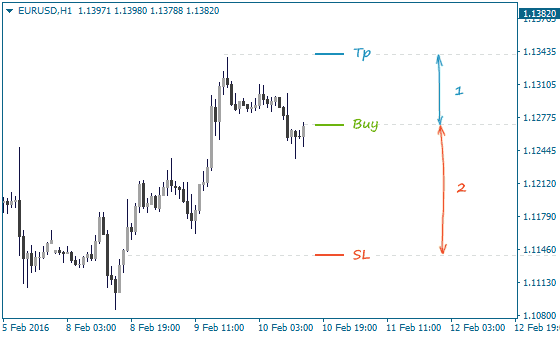

It’s simple, and we already wrote about that. Take a look at the picture:

Set TP exactly at the extreme level and SL a few dozen points below the level. By doing so, you’ll get the ratio of 1 to 2 or 2 to 3 in most cases. Learn more about these techniques: for SL and for TP.

Let’s simulate this situation to conclude this article and confirm what has been said above.

Let’s assume that you’ve decided to trade “with a small Stop Loss” with the ratio of 1 to 10. This means that your Take Profit size will be 10 times larger than that of the Stop Loss. And now imagine what kind of feelings you’ll have when the next trade will be 10th-19th in a series of losing trades. Will you be able to still believe in your strategy or be under doubts after all?