Recognizing a “Smart” Trade in Order Book

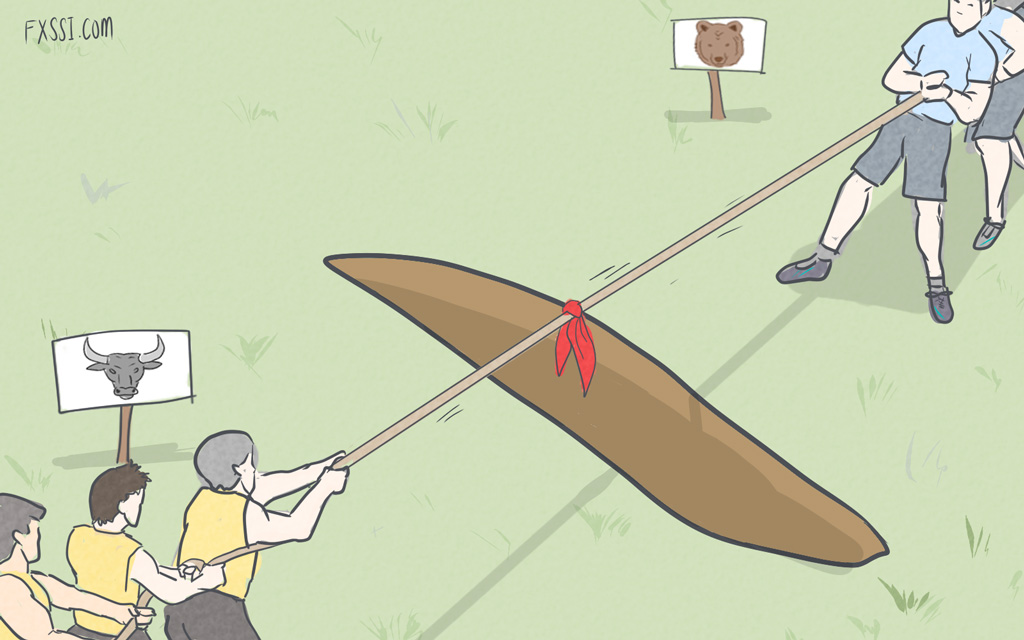

As you know, market makers (or “smart money”) play an important role in the market. They are major players who have significant resources and are able to influence the price movement direction by their actions.

Since their trades are opened by the decision of entire groups of analysts, managers with enormous experience or sophisticated computer algorithms, such trades can be called “smart”.

As a rule, “smart money” doesn’t simultaneously inject huge amounts of liquidity into the market in everyday trading, but gradually build their positions, in order not to disclose their presence.

If they somehow come to light, other traders will immediately begin to open their trades in the same direction. “Smart money” really doesn’t need it. This is why they learned to sneak up on traders and attack them underhand like a predatory fish, because their primary goal is to buy out positions of the market crowd and misdirect it, following which to move the price in the right direction, when the crowd’s strength to stand up runs out.

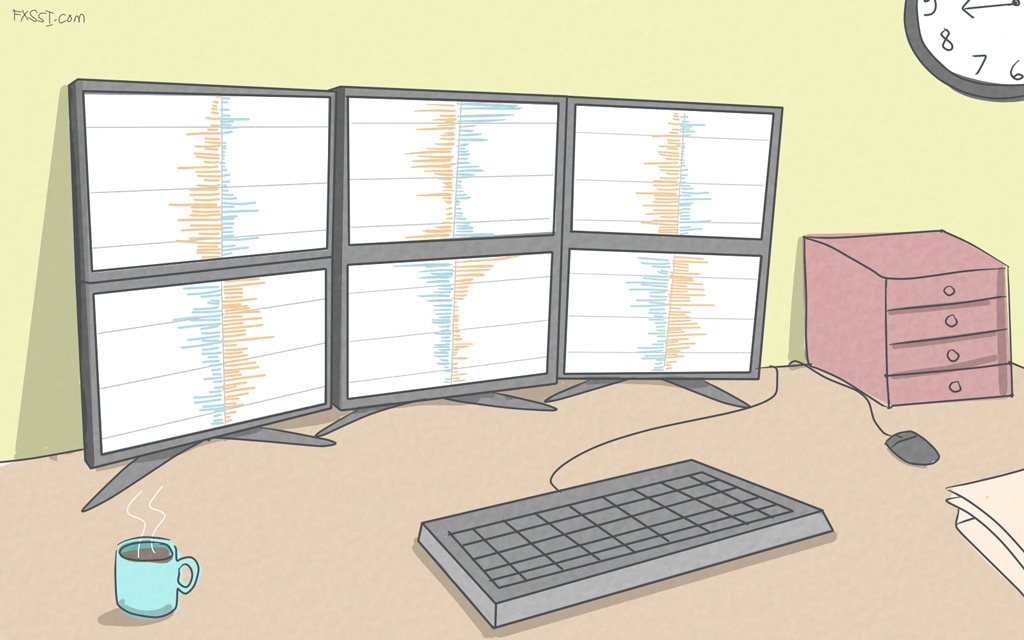

Now let’s get back to such a phenomenon like a “smart” trade in the Oanda’s order book. There are situations where we can clearly see a major player in the order book – its trades stand out due to their large volume among all others.

Unfortunately, we cannot claim that exactly these trades move the price, but that’s a fact that they work well.

Besides, not all large volume trades can be considered “smart” and useful for us.

Below is the list of three main features of a “smart” trade that can be useful for us.

Unexpected Appearance

In most cases, large “barriers” gradually increasing in number are not “smart” trades, particularly at the round-number price levels – this is how the crowd usually sets its Stop Losses. However, a sudden appearance of the “ray” in the order book for 1-2 hours might be a major player entering the market. To check such a trade, it may be enough to hover the mouse cursor over the chart and analyze how this “ray” was forming throughout the series of the order book’s casts.

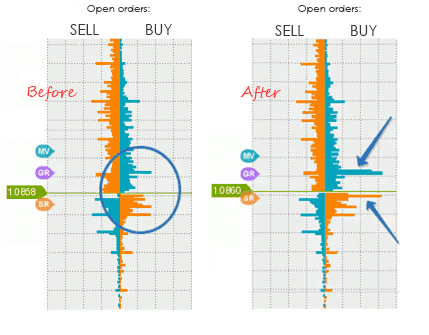

It looks like this:

The picture shows two adjacent casts of the order book with the time difference of 20 minutes. We can see a sudden appearance of large volumes on the second cast: that’s a “smart” trade.

Stop Loss and Take Profit

As you know, one of the major rules of professional trading is the mandatory use of Stop Losses, so Stop Loss is almost always included in a “smart” trade.

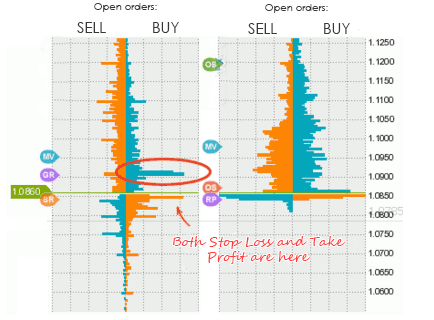

It looks like this:

We can see that a major player has opened a Sell trade and specified Stop Loss and Take Profit levels for it. You may think that we’ve made a mistake, since SL and TP of the “smart” trade are long (=relate to a Buy trade) and we’ve said that the “smart money” has opened the Sell trade. We can assure you that there can’t be any mistake: the point is that you need to buy before you close a Sell trade according to the margin trading rules.

Relatively Short Distance Between Take Profit and Stop Loss

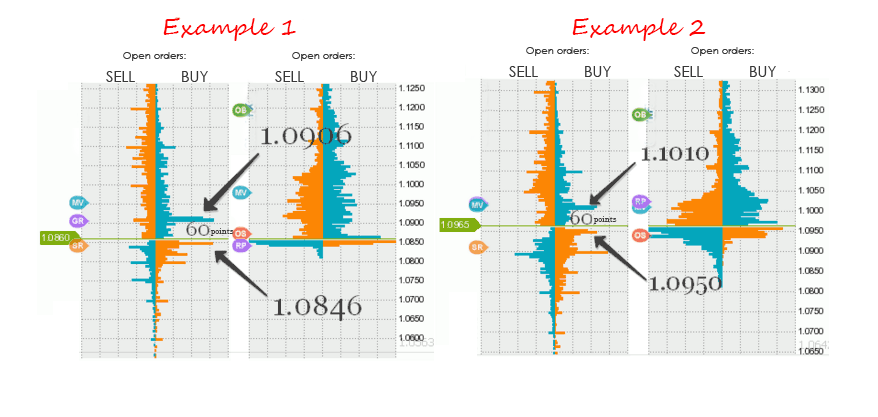

A major player won’t risk the deposit of hundreds of thousands of dollars when opening a trade. This is why Stop Loss of a “smart” trade is set relatively close to Take Profit, namely, within range of about no more than 100 points.

As you can see from these two examples, it can be even assumed that the same participant has entered the market: the distance between Stop Loss and Take Profit is 60 points in both trades.

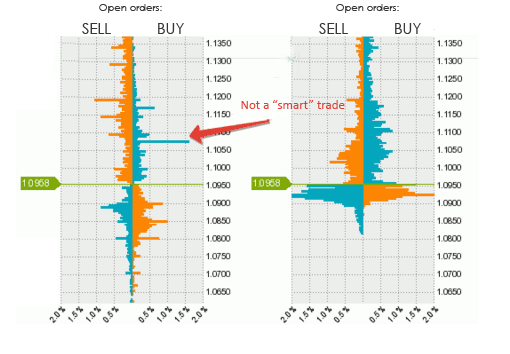

By the way, suddenly appearing Stop Losses of large volume trades cannot be regarded as a “smart” trade.

Example of a “false” target:

No Take Profit. Far from the price.

Therefore, recognizing a “smart” trade requires 3 of the above listed conditions to be met. If at least one condition is not met, you need to be careful: perhaps someone is trying to mislead you.

Important note: we always “aim” at the clusters of Stops Losses under normal conditions when trading with the book of orders and positions. When it comes to a “smart” trade, the opposite is true: you need to “aim” at Take Profit (orange ray).

This statement is based on the fact that when a market maker opens a trade, it knows what ordinary traders don’t know (… Has it got insider information?) or it’s ready to push the price to its targeted Take Profit level by the available trading volumes. Since trading with the book of orders and positions is based on the principle of following the market makers, we should open a trade in the same direction as a major player.

It’s also important not to forget that trading with “smart” trades is not a panacea and cannot give you 100 percent guarantee of pursuing your goal. The fact is that there is more than one market maker on the market, and their plans may not coincide with each other’s. Sometimes it happens that the market movement stops even strong players out, so don't risk your whole deposit “tagging along” larger players.