Before You Make That Trade! Are You Sure That Breakout is Not A Trap?

Have you ever been in a trade where everything seems to be going according to your analysis? You take your eyes off your charts for a moment and return to find that your trade has closed at an unexpected loss.

A wick probably shot out to take out your stop loss, or the price went the other way, completely ignoring your predictions and taking out your stop loss. If this sounds familiar, then you have experienced bull and bear traps firsthand.

This article will not only show you what the bull/bear traps are, but you’ll also learn to identify them based on their patterns and how to avoid them.

Before we dig too deep though, please mind that this piece isn’t about how to trade the traps. If that’s what you’re interested in, we have an article that focuses on effective bull and bear traps trading strategies in forex.

What are Bull and Bear Traps in Forex?

Bull Trap Definition: A bull trap occurs when it seems that the price is going on an uptrend, only to make a reversal and take out the waiting stop losses of bulls who bought into the false uptrend.

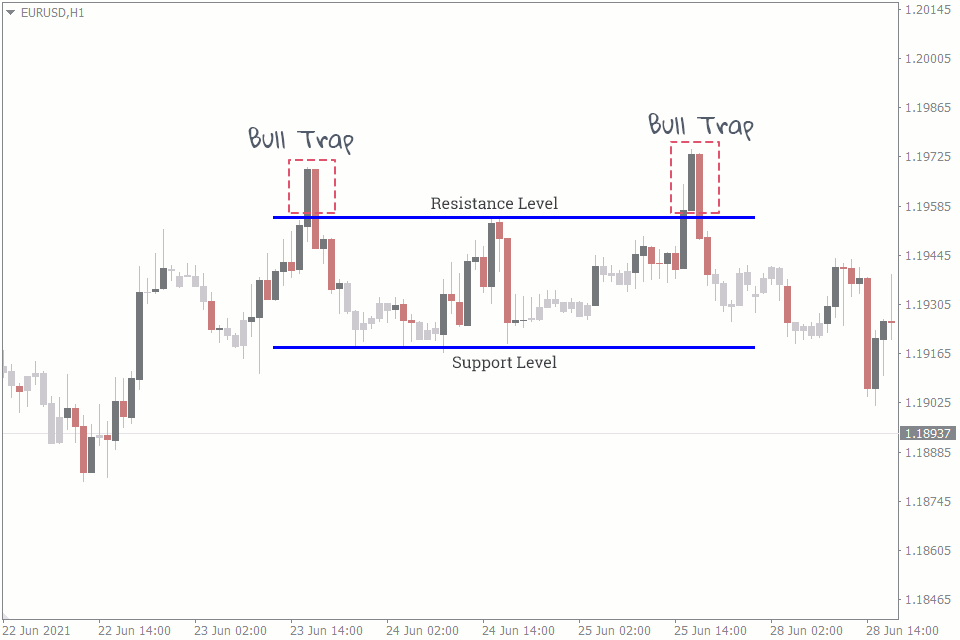

One of the most common places you’ll find bull traps is at the resistance levels breakouts. Usually, resistance breakout heralds a sequence of higher highs. The only thing is that a bull trap forces the price to make a bearish reversal immediately after the breakout.

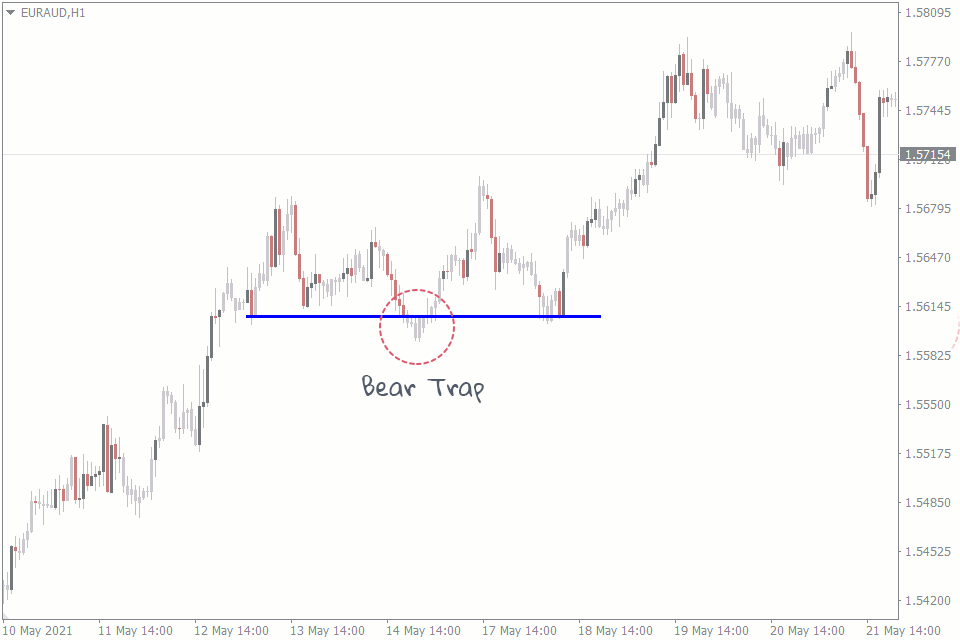

Bear Trap Definition: A bear trap tricks traders into taking short positions on market setups that are seemingly going bearish. In reality, however, the price makes a reversal and takes out the stop losses of bearish traders.

A bear trap is the same as a bull trap, the only difference being that this happens on a downtrend instead of an uptrend. So, it frequently occurs when the price breaks out of a support level. The chart above shows a typical example of a bear trap.

Pinpointing Potential Bull/Bear Traps Using Indicators

Finding potential bull/bear traps in a live forex market is quite tricky. But you are not completely helpless against these traps. There are patterns and tools to help you identify these potential bull or bear traps in forex.

When bull/bear traps appear, they’re out to take out stop-losses and end trades in premature losses. Would knowing where other traders are placing their stop losses help you set a stop loss that doesn’t get you into the trap? It could. And there’s an indicator for that.

The Stop Loss Cluster indicator is an excellent tool to help you identify potential bull/bear traps. The Stop Loss Cluster indicator shows you areas where many other traders trading your currency pair have put their stop losses. These stop losses appear in clusters, hence the name. These clusters are potential bull/bear traps.

Finding Potential Bull/Bear Traps Using Patterns

Bull and bear traps happen so often in forex that they form noticeable patterns on the chart. Recognizing these patterns could help you avoid falling into these traps and it could keep your trade out of premature termination.

The most common bull and bear trap pattern examples in forex are:

1. The Bull/Bear Trap Candlestick Pattern

This pattern begins and ends with a candlestick. A candlestick breaks out of a support or resistance zone and many amateur traders fall for it. They open positions based on just this one candlestick. Sometimes they even commit to the trades before the candlestick is fully formed.

In reality, however, the market makes a complete U-turn after this candlestick, leaving executed stop losses and deflated accounts in its wake. A perfect example of the bull trap candlestick pattern is shown in the chart above.

2. The Failed Retest

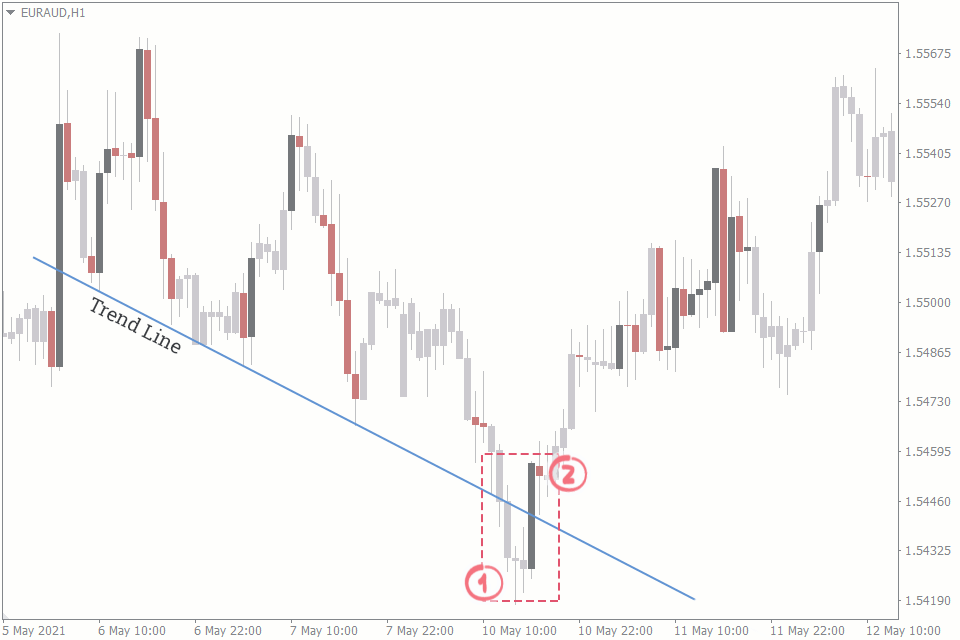

When the price breaks out of support, resistance, or a trendline, it is common to see it retest the level it just broke out from before continuing on its way. Before you jump on the trade and buy the retest, beware: it could be a trap!

What seems like a perfect trade entry opportunity could quickly turn into a trap, especially when the price fails to bounce off the resistance zone (which is now your support zone). Instead, it goes through the zone and takes out stop losses underneath the resistance zone. An example of the failed retest bull trap is in the chart below:

- Price breaks the support trend line to suggest a continuation to the downtrend.

- A failed retest bear trap, however, happens, pushing the candlestick back above the support to make a reversal.

Avoiding Potential Bull or Bear Traps

The mere knowledge of bull and bear traps is not enough until you top it off with understanding how to avoid them. So, here are some tips on avoiding potential bull/bear traps:

1. Don’t Set Your Stop Losses Too Tight

Setting your stop losses too tight is almost like asking the bull/bear traps to take them out. When you use the Stop Loss Cluster indicator to identify your potential bull/bear traps, for instance, it only makes sense that you set your stop losses away from the clusters, since you would want to avoid being taken out when the clusters are taken out.

But when you set loose stop losses, be careful and remember to follow good risk management techniques.

2. Don’t Trade Breakouts on the Breakout Levels

Trading breakouts on the levels the price is breaking out from is very risky. It is always recommended to wait for the price to retest the breakout levels before you open a position. This helps you ascertain to an extent that the price movement is not a trap. But even then, you can’t be completely sure. And this brings us to the next tip.

3. Wait for the Price to Recover From a Retest Before Trading

Even after you observe the retest, don’t place your orders right at the retest level. Wait for a candle or two to confirm that price is going your way before you get into the trade. For instance, let the price form one or two candles that suggest a downtrend after a retest that follows a breakout from a support level.

4. Don’t Chase Late Entries

If you miss an entry position, don’t make the trade again. Wait for the next entry level. Chasing a late entry could get you into a trap.

Conclusion

Bull and bear traps in forex are responsible for a lot of deflated accounts. Don’t let your account end up on such a list. Learn how to identify the traps and avoid them. Trade smartly.