The Difference Between Trading Forex and Currency Futures

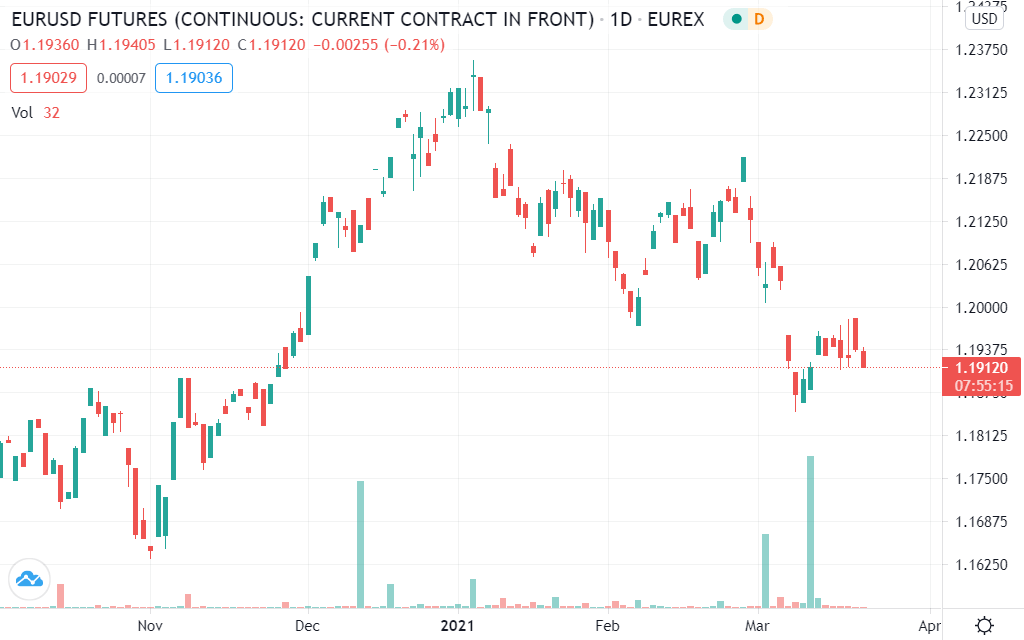

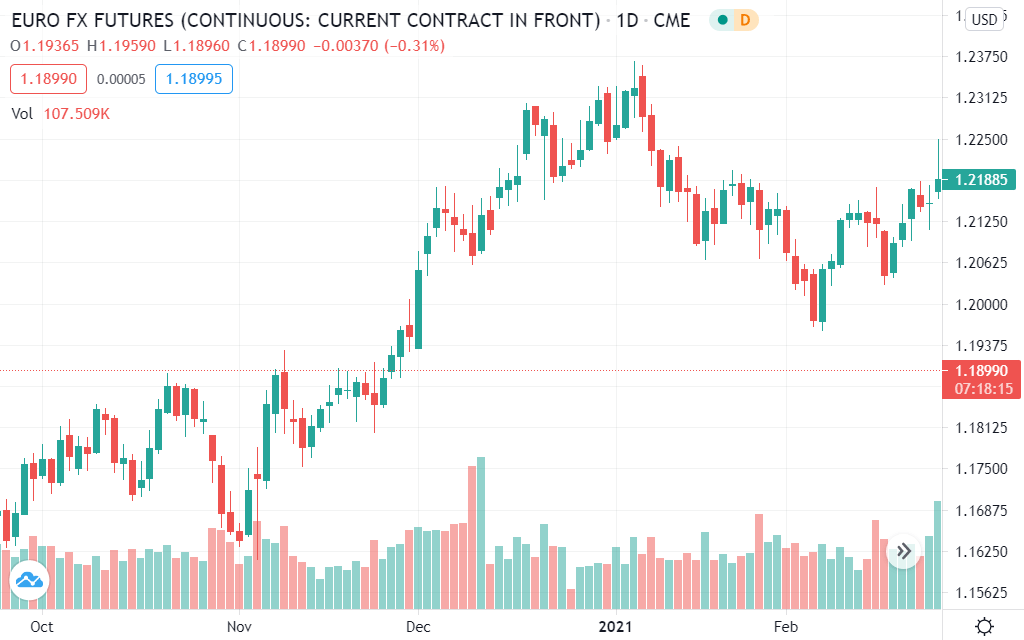

Currency futures and spot forex are both used to speculate and hedge risk on foreign exchange rates.

So what is the difference between forex and futures?

We’ll go over the key differences between the spot forex and futures markets, helping you make an educated selection and achieve your trading goals.

If you’ve been looking to speculate or hedge in the foreign exchange markets and wondering whether to trade spot forex or currency futures then this guide is for you.

Currency Futures are Highly Regulated and Exchange Traded

Just like the stock market, currency futures are traded on centralized exchanges and are heavily regulated.

This makes for a more transparent market than spot forex with data like daily volume and open interest readily available.

On the other hand, there are generally higher barriers to entry for exchange traded products.

The Forex Spot Market is Less Regulated and Offered Over the Counter

Though there has been a distinct shift towards regulation of the spot forex market globally, these markets are still less regulated than currency futures.

Unlike currency futures and stocks, spot forex is offered OTC or over the counter by broker dealers all over the world. That is, spot forex is traded off exchange in a decentralized fashion.

This means there is a lot more competition in the forex market, barriers to entry are miniscule and regulatory arbitrage opportunities are abundant for traders with tough local restrictions.

On the other hand, a lack of valuable internal market data is a major drawback for this market.

The Spot Forex Market is the Largest in the World

The spot forex market is the most liquid and actively traded market in the world, dwarfing the combined volume of all the world’s stock exchanges.

Currency futures on the other hand have just a fraction of the daily volume with a lot of this feeding back into the spot market in one way or another. As currency futures are a forex derivative, the currency futures market will always be smaller than the underlying market by its very nature.

Having said that, popular currency futures contracts will always be relatively liquid and likely more so than a lot of local stocks.

The Forex Spot Market Enables Massive Leverage

Although currency futures contracts are also traded on margin, the amount of leverage available is generally a lot lower than what’s available in the spot forex market.

Spot forex brokers often offer up to 500:1 leverage and some less scrupulous brokers have been known to offer leverage in the thousands. Leverage is a double edged sword in trading, magnifying both gains and losses, but some strategies such as scalping do require large amounts of leverage in order to place trades with desired risk:reward parameters.

If you are scalping forex with 5 pip stops then the highly leveraged spot market is definitely the way to go.

Commissions and Fee Structures Vary Between Spot Forex and Currency Futures

Currency futures contracts will always have a commission charge associated with them as well as a spread.

The forex spot market on the other hand offers a wide selection of brokerage models ranging from commission free with wider spreads to super tight spreads somewhat offset by commission charges. Forex spot markets also have daily swap or interest charges based on interbank lending rates.

Minimising trading fees is a simple way of improving your cumulative trading performance at the end of the year, but whether currency futures or spot forex is the cheaper option will largely depend on your trading strategy and the associated fee implications.

Some savvy forex traders will trade both markets for different kinds of trades.

Spot Forex Trading is Always Done in Pairs

Though there are currency futures contracts for all the popular currency pairs, one distinct advantage the futures market holds over spot is the ability to speculate on a single currency.

This is possible in the spot forex market, but it requires opening a basket of trades in multiple currency pairs, so it is inherently much more complex to enter a trade and much more difficult to manage.

Trading single currencies in the futures market can be very attractive as the risk of picking the wrong quote currency to trade against is entirely eliminated. In the forex market you may be correct that the Australian Dollar is going to depreciate over the coming months, but select a trade against a currency that depreciates even faster, ending up with a losing trade.

This same trade in a single currency futures trade would have been profitable so if you’re finding yourself right but wrong all the time, simplifying your trading decisions through single currency contracts could be a great option.

Tax Treatment can Vary Wildly Between Different Forex Markets and Jurisdictions

In the United Kingdom, spot forex trading is known as spread betting and considered a form of gambling that can be tax free depending on your circumstances.

How your trading profits are taxed can vary wildly between markets and even more so between jurisdictions. The ins and outs of this are well beyond the scope of this article, but if you are a profitable trader deriving substantial income from your trading activities, it’s likely worth having a chat with your accountant to see if there’s any way you can reduce your tax liabilities by trading forex vs futures.

It could also be worth looking at trading via a special purpose structure in another jurisdiction.

Which Market is Right for You?

When it comes to speculating on fluctuations in foreign exchange rates or hedging foreign currency risk you have a wide array of options.

Only after considering the difference between forex and futures, can you make a final decision on which is right for you.

After comparing forex vs futures, the right product for you will come down to the availability, your trading strategy and a host of other factors.

If you are just getting started trading forex, the spot market is much more accessible and is likely the ideal place to start.

On the other hand, if you are a serious trader and access isn’t an issue, currency futures markets may be worth exploring to see if there are any cost or other advantages.