Mistakes of a Novice Trader: Tips on How to Avoid the Same Errors

The number of winning traders is only 5% of the total. They made their mistakes, gained invaluable experience, and learned how to achieve results.

Beginners are most prone to making mistakes.

But you don’t need to be afraid of them. It is much better to draw conclusions and not repeat those mistakes.

All common mistakes of novice traders can be divided into several groups:

- Psychological;

- Money management errors;

- Technical.

Psychological Mistakes

The first type of trader’s mistakes is psychological.

A novice trader who has just mastered the trading basics seeks to make money as quickly as possible. That is why they often make trades risking their entire capital and thereby quickly losing it.

Overconfidence

Novice traders often make spontaneous trades. One of the reasons for this is excessive self-confidence that makes people forget that currency risks are always very high.

On the contrary, some traders hold dear every cent overmuch and are afraid to open a position even when they really should.

Greed and fear

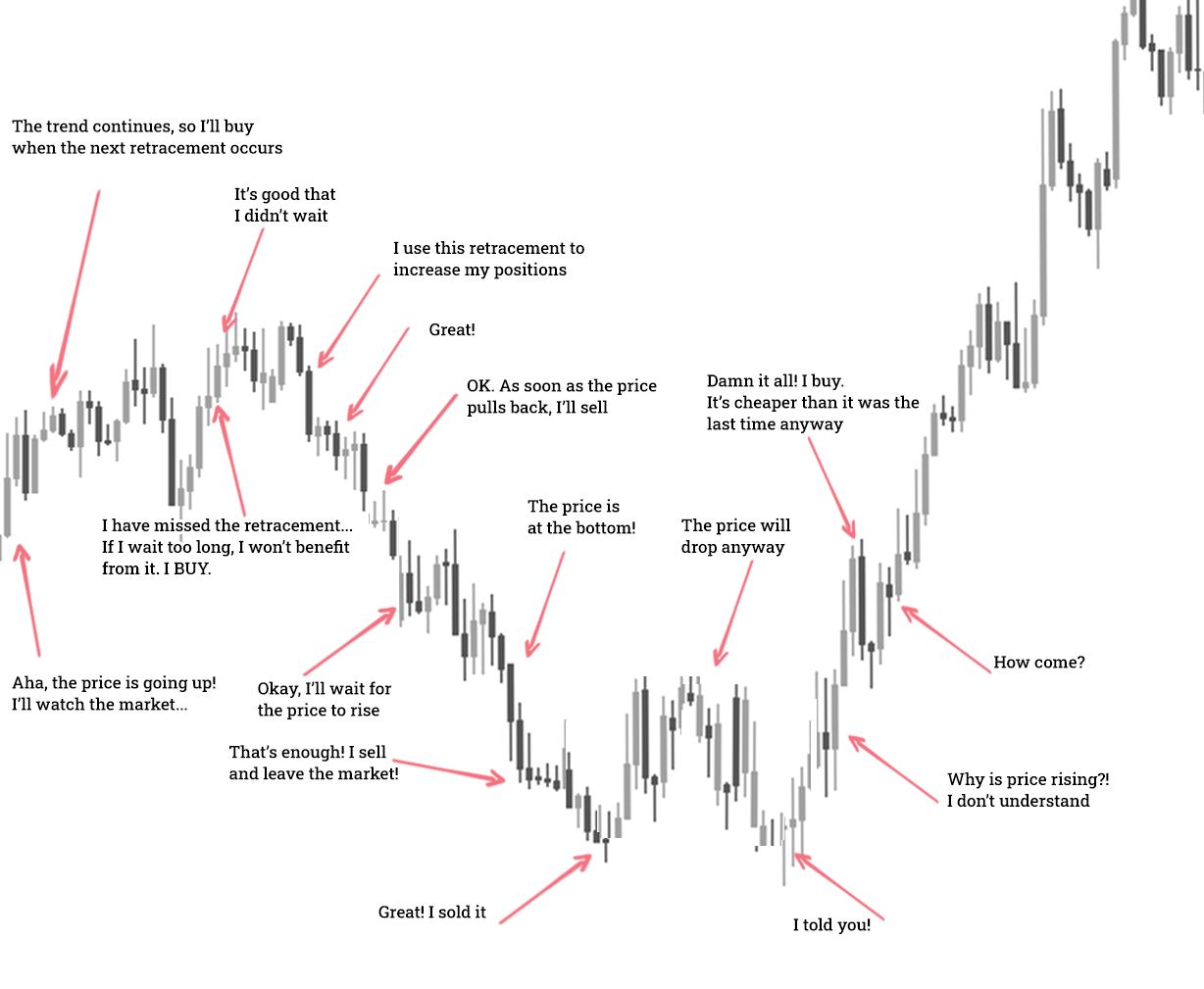

Greed usually shows up when the price begins to move in the direction that's profitable for the trader. Trying to make as much money as possible, they don't manage to close their position on time and leave, albeit with a small, but profit.

Fear comes when the price goes against an open position. When it happens, traders rush to close their orders at an unfavorable price in panic. But after a minute, they see that the market starts to move in their direction again.

Desire to win back money

After making a losing trade, traders are often guided not by cold reason, but the desire to win back their money quicker.

Striving to take revenge can force them to make several losing trades in a row.

It also happens that traders refuse to continue trading even in case of a favorable market situation due to the fear of failure repetition.

Money Management Mistakes

Remember one statement that corresponds to the situation very well: “Don’t put all your eggs in one basket”.

In other words, don’t make trades for more than 10-15% of your deposit. It allows you to minimize the risk of losing a significant part of your capital as a result of a single losing trade.

Even if the price moves in the right direction, you shouldn't strive to increase the volume of your trade, as there is always a risk of a trend change.

Our tips:

- The profit-to-risk ratio must be no less than 3:1. It means that the profit potential of each trade must be at least three times greater than the prospect of losses. It’s better for novice traders if this ratio is 5:1. Thus, if only one of six open trades proves to be winning, you’ll be able to offset your losses.

- Don’t trade with borrowed funds. Use only your free capital.

- Don’t invest money you’re not ready to lose.

- You need to diversify risks and make trades in different assets.

- High leverage leads to additional risks. Therefore, beginners shouldn’t trade with leverage higher than 1:25-1:50.

Technical Mistakes

A common trading mistake made by novices is counter-trend trading.

When trading against a trend, traders significantly reduce their chances of success.

Of course, there are specific strategies for counter-trend trading, but you shouldn’t open a position against the trend until you have come to realize how to make money on trading with it. In this aspect, it’s important to learn how to identify a trend direction correctly. To do this, you need to analyze and thereby trade on the same timeframe.

Rolling over a position to the next trading day can be considered as a mistake in intraday trading. The changing situation overnight involves additional risks – position might be closed at a loss the next day.

Choosing a broker can also be classified as a mistake. If you have opened accounts with several brokers, you can compare statistics for each of them and select the best option. You should avoid intermediaries with a poor reputation, even if they offer attractive trading conditions.

Why Everyone Makes the Same Mistakes

Novices’ mistakes have been described many times, but still, the traders continue making them. It’s all about human psychology. Almost all people are prone to greed and fear, get easily excited, and seek to recover their losses even in the most hopeless situations.

You can easily avoid most of the mistakes, as they are the result of an absent trading strategy.

The strategy is a clear plan to enter and exit a trade that must be thought out in advance.

A high-quality trading strategy involves keeping statistics for every open trade. Having no such statistics is a typical mistake of many novice traders.

Statistics help you separate winning trades from losing ones and identify their causes.

How to Minimize the Percentage of Mistakes

A considerable proportion of trades in the market are made by robots, which are automated programs performing actions according to a defined algorithm.

Robots are subjects neither to psychological nor trading mistakes. They strictly follow the rules of money management, as well as enter and exit a trade according to a previously agreed plan.

Of course, nobody can trade like a robot, but we can learn some useful habits from it.

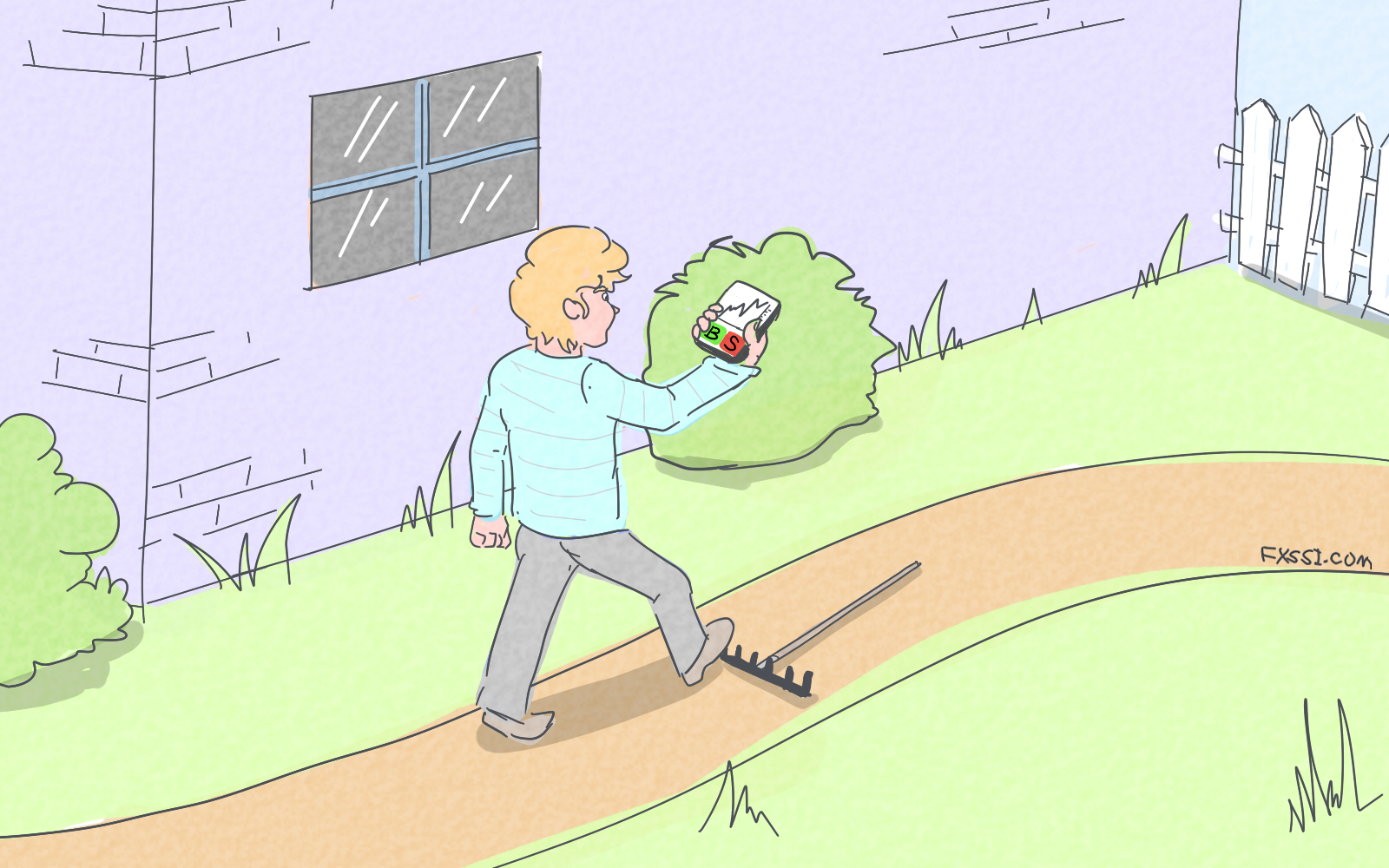

Trade With a Cold Mind

Before you start trading, plan your day, and put minor matters aside. Realize that you can control your emotions. While trading, don’t distract on unnecessary actions so as not to miss the price movement.

If you find yourself in a risky situation and realize that you are losing control over your emotions, stop trading.

Follow Your Plan

To do this, analyze the market situation at the beginning of the day. In a calm atmosphere, look over the charts of assets that you're going to use in trading.

It is necessary to identify those moving next to strong support/resistance levels or having another potential trading setup.

Having selected a few of the most suitable assets, you need to determine the entry point, as well as Stop Loss and Take Profit sizes. Make sure to use Stop Loss and Take Profit in every trade.

A high-quality trading strategy involves keeping statistics for every open trade. You should write down the asset name, entry and exit points, date and result of the trade, and comment it.

After you have written down a fair number of trades, it is necessary to carefully analyze your statistics. So you not only can understand which assets yielded profits and which ones led to losses but also look into the reasons for this.

| Date | Time | Direction | Volume | Currency pair | Profit |

|---|---|---|---|---|---|

| 08.09.2019 | 06:10 | Call | 40 | GBP/USD | 44 |

| 08.09.2019 | 08:51 | Call | 40 | GBP/JPY | 102,74 |

| 08.09.2019 | 10:33 | Call | 40 | GBP/USD | 47 |

| 08.09.2019 | 10:45 | Put | 40 | USD/CAD | 40,08 |

| 08.09.2019 | 11:15 | Call | 40 | AUD/NZD | -17,08 |

| 08.09.2019 | 13:14 | Put | 40 | EUR/USD | -11 |

| 08.09.2019 | 15:18 | Put | 40 | EUR/USD | -14 |

| 09.09.2019 | 03:20 | Put | 40 | AUD/NZD | -25,5 |

| 09.09.2019 | 03:23 | Call | 40 | GBP/JPY | 80,14 |

| 09.09.2019 | 04:50 | Call | 40 | AUD/USD | -26 |

Don’t be afraid of making mistakes. Remember that even major players once started small. Study the material, develop your own system, and follow it.