5 Questions About Forex That Will Never be Answered

Forex trading is probably the most ambiguous type of trading. There's no “Good”, “Bad”, “Right” or “Wrong” here; there's only a trader's subjective opinion of the market and the things happening there!

So, it's not surprising that there are plenty of questions that don't have a straight answer, for example:

- Why did a trade close at a profit? Is it because the market analysis worked well, or was it just sheer luck since the price could have moved in the right direction due to its own reasons?

- Did a news release push the prices up just because the announced data were good, or did it benefit a large market player?

- Does a trading strategy work or just has a period of winning streak that is soon to be followed by a losing one?

- Did the price bounce off a resistance level, or has an impulse been simply exhausted?

The list of such questions goes on and on.

Obviously, not a single question from this list has a straight answer.

Although, this is nothing compared to the 5 questions that can easily spark a heated discussion, fierce disputes, and even violent argument.

1. Does Anybody Make Money on Forex?

Meeting a profitable trader is like finding a needle in a haystack.

At the same time, there is no guarantee that a yesterday’s profitable trader will not become a losing one today. It is very hard to find a trader who makes money precisely because past success doesn't guarantee future profit. In addition, temporary luck is often behind the income.

A well-known phrase, which people find necessary to mention quite often, states that 95% of traders lose their money. However, we’ll never know for sure the exact percentage: is it 95%, 99% or even 99,9%? We prefer the last option, since one profitable trader per thousand makes more sense than five profitable traders per hundred.

Plausible answer: for the most part, Forex market allows only temporary profit. For example, if we look at the traders’ profitability statistics on various brokers, we'll see that a fairly large number of traders (~33%) manage to make money during a quarter. However, if we increase this period up to one year, the percentage would switch closer to 5% and then to 1%, etc.

You can ride the wave and make a certain amount of money; if you keep on going you’ll be “chewed up by a shark” , you’ll lose everything you’ve earned. So, if you hit the jackpot by, for example, opening a PAMM account and making a significant amount of money, it’s best to stop and not continue.

As for regular Forex earnings, it's possible only if you've already learned how the Forex market works and thereby possess the information that most other traders simply don’t have.

Here is a simple example: imagine an organization willing to sell a very large amount of euro. Of course, it's interested in selling it at the best price and saving a few hundred thousand dollars. To do that, it will play out a scenario (price movement) to reach its goal with the existing market liquidity – including our trades – and thereby not crash the market itself. And now ask yourself: “which indicator or strategy can predict what this organization is about to do and when it plans to move forward?“

Of course, the strategy of "trading against the crowd" is worth mentioning at this point, since it's one of the few that takes these scenarios into account.

Conspiracy answer. The probability of any given individual to make money in the Forex market is close to zero, and those single instances where it seems as if someone has earned something are just to prevent people's “faith in the money making” from dying. The Forex market itself is a better version of a Ponzi scheme where you don’t need to pay interest and there's no need to return deposits.

The impossibility to make money is due to the fact that the price movement is almost chaotic and doesn’t have any regularities, and therefore, doesn’t make it possible to earn anything.

2. Who’s a “Market Maker”?

Traders have long been haunted by the idea that there is someone else on the market, apart from them – a much larger and a more powerful player, who knows what they don’t. How can they safely trade knowing this? Perhaps, they can do this if only they learn to look at the market as a market maker.

Can one give a more precise answer to the question: “who’s a market maker, and what’s it like? Is there just one or are there many market makers?”

Unfortunately, ordinary traders like you and us will never be able to answer these questions, since they are simply beyond the reach of the organisations that can hypothetically be the market makers. It’s like when humankind allows a possibility of the existence of other civilisations, but cannot tell exactly how many of them there really are and what they’re like – and it might never even find out.

Plausible answer. All the market participants that have sufficient capital to somehow influence the price movement in their favour fall into the category of “market makers”. It could be various corporations, funds, banks or even individuals from, for example, the Forbes rating. The national government can also act as a market maker on behalf of a central bank.

All the above mentioned participants create an image of a “market maker”, but their actions are not coordinated, i.e. they are motivated by personal interests and rarely cooperate, either by agreement or by a sheer chance. The only thing they have in common is the need for a financial or political benefit from the market.

Conspiracy answer. There is also an idea of a single market maker or an organisation that has such a powerful influence that even central banks are only small fish to it.

There's a lot of talk about a secret society which consists of the most powerful people, and there are also mentions of the Masons. In addition, the role of such a market maker is not only to take money from citizens, there's also a higher purpose that we cannot understand.

3. What is it That Drives The Price?

There are ongoing debates in a trading community on what is the primary source of the price: EUR futures, interbank market, Forex market or a spot market? Which of these instruments is a leading one, and which ones are following?

Disputes become very fierce when it comes to the source: which data can be trusted, and which should be ignored.

Here is a simple example: trading volumes. Can one give a precise answer which volumes are more informative: futures or Forex, from exchange №1 or №2? Taking into account that the term “correctness” is not accurately defined in the Forex market, there is no answer to this question either.

Plausible answer. Every single source of the price has its own asset price determined by trading results inside the source. At the same time, the prices from all sources are synchronised by trades, also known as arbitrage.

Imagine walking down the street and seeing two exchangers – and the buying rate of the first one is higher than selling rate of the second one. Without hesitation, you'll start carrying money over from one exchanger to another and benefit from the difference in the exchange rates. It will continue until the prices become equal in both exchangers due to the dramatically increased demand in the second exchanger and the excess supply in the first one.

This is how the sources of Forex prices are interconnected, but in a little more technological manner. However, it's quite likely that there might be a great demand among population in the spot market itself, which would result in the prices moving up/down.

Conspiracy answer. Asset price is established in one market (stock exchange), and other prices just follow it. It’s interesting that Forex traders often believe that the Forex market itself is the driven market, but not the leading one. That's probably how they try to justify their inability to make money particularly in the Forex market; if they've traded in CME (Chicago Mercantile Exchange), things would have been different.

Centralized stock markets – but not the Forex market (due to its decentralization) – are most often considered to be the leading markets.

4. Are Your Trades Submitted to the Interbank Market?

Lots of blood has been spilled in the battles over the subject, and all of this has been for nothing since there is no answer to this question either.

Why do traders care about this issue so much even though it doesn’t actually affect anything in reality? The point is that people, by their nature, don’t really like when somebody makes money on them, especially when that someone directly cooperates with them.

If a broker had openly told you about making money on your loss, you would have never opened an account with this brokerage company. It’s a different matter when brokers declare that they charge only their modest fees; if you have incurred loss, a trader just like you, but on the other side of a trade, will make that money.

That's why regardless of the fact that a trader hasn’t yet learned to make money, it’s already important for them that trades – even the smallest ones – are submitted to the interbank market.

Is there any way to confirm a submission of a trade to the interbank market? Even if we've established contacts at the brokerage level and learned whether a particular broker submits trades to the interbank market, or rather, whether it submits all trades to its liquidity provider, it doesn’t mean that the liquidity provider itself passes them further. This provider often uses “bucket shop”-style methods, but on a much larger scale.

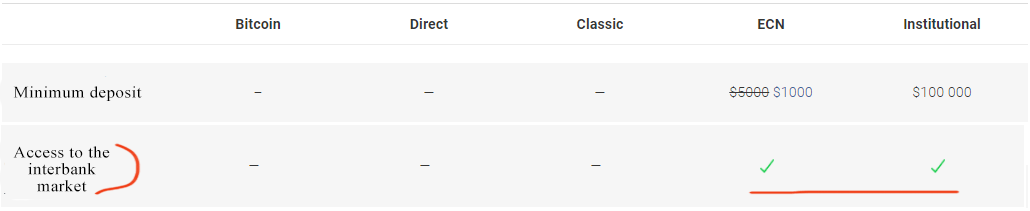

Plausible answer. Nowadays access to the interbank market is by no means something unique, and many brokers actually provide this service. So, it’s nice when a broker specifies which of its accounts have access to the interbank market and which don't.

For example, if we look at the specifications of various brokers' accounts, we can see a selected number of accounts that have access to the interbank market, and it does seem plausible.

Therefore, brokers might submit trades to the interbank market, but they don’t necessarily submit each and every one of them. From a business perspective, it makes much more sense to introduce a series of filters, so that the trades of potentially losing customers remain inside a brokerage company, and potentially winning ones are submitted to the interbank market. This is a hybrid model – you can read more about this and other models in article A-book and B-book.

At the same time, there are also limitations on the order lot size. For example, it would be naive to think that 0.01 lot order will be submitted to the interbank market, since it is cheaper for a broker to pay for it out of their own pocket.

Taking into account the facts mentioned above, the dilemma of choosing a broker submitting trades to the interbank market is absolutely unclear. When making your choice, it's wiser to pay attention to the broker's reputation, their lifetime and overall reviews.

For example, choosing a brokerage company with 10 years of experience, your risk is significantly lower compared to opening an account with a young broker that supposedly “submits” trades to the interbank market.

Conspiracy answer. The interbank market was established so that only banks could trade there. Forex trades are passed to as far as a liquidity provider and more likely meet their counter orders there or the provider acts as a counterparty.

The only connection between Forex and the interbank market is the fact that in order to hedge its risks, a liquidity provider can open an aggregate position on every financial instrument in the interbank market.

5. Does the Market Plays Against You?

When traders face a series of losing trades, they begin to suspect that their trades are the market's target. There are many pictures proving that the price gets back to its initial level after triggering a Stop order.

Of course, it all sounds ridiculous until the trade size exceeds, for example, 50 lots. With a greater lot size, it’s hard to say which order the price really “stopped out” of the market.

This is why this question, just like the previous ones, will never get a straight answer.

Plausible answer. In 99% of cases, the price DOESN’T hunt your trades in particular. However, It’s a different story if you've placed your trade at the same level as all the other market participants have done. If this is the case, you will see an entire cluster of, for example, Stop Loss, and the price is very likely to trigger. By the way, we have an indicator of such clusters.

There are also cases when a certain broker sees volatility happening in an absolutely calm market and the price immediately triggers your particular Stop Loss and comes back. However, this looks rather like a foul play of your broker against you, and it's not the market's fault.

Conspiracy answer. Even assuming that the market is governed by one authority, it’s hard to imagine the latter is playing against anyone in particular. Indeed, when someone buys, someone else sells at the same time, so the only possible thing that can happen is that the market is playing against the majority. The last phrase makes sense, but there's no conspiracy, since the market nature is that the majority loses and the minority wins.

What to Do?

The questions above are very important to every trader, especially if they've chosen trading as a profession.

Although the fact that these questions have no answers can create a sense of incompleteness and psychological discomfort, that can affect trading.

Imagine a trader coming to the market to make money and not knowing for sure if someone has earned anything in the market before and whether it's possible at all. At the same time, the trader has been doing trading for a while, but without any result. Where do you find the strength and motivation to go on?

First of all, you need to decide what trading is for you: a profession, a game of chance or a hobby.

- If trading is a profession for you, are you ready to devote as much time to it as necessary, like with any other profession?

- If trading is a game of chance for you, how much money are you ready to lose before this game starts giving you headaches?

- If trading is a hobby for you, do you still enjoy it when you incur a loss?

Of course, the last two options don’t require such a deep immersion in the subject as the first one, but we believe that the next recommendation is going to be fair to everyone.

You should find a comfortable answer to every one of these 5 questions or, at least, a point of view that you agree with in particular. And don’t pay attention to the discussions on this subject from now on. This will be enough to avoid being distracted from the primary objective of trading – making money.

Although we've attempted to give answers to the questions above, they still represent only our subjective opinion, which is not necessarily true.

And how would you answer these questions?