Correlation in Forex

Correlation is a statistical relationship between two and more random variables. The Forex correlation coefficient usually varies from -1 to 1 or sometimes from -100 to 100.

The correlation coefficient value of -1 means that there is an inverse 100 percent relationship between two random variables. The value of “1” indicates their direct relationship.

Why do Forex traders need this information? The answer is simple.

The correlation coefficient can tell a trader what the nature of the relationship between two financial instruments, whether they are currency pairs, company shares or commodities, is.

Let’s consider a simple example. You may have noticed that movements of some currency pairs are very similar to each other.

Thus, when positive news from the Eurozone are released, currency pairs including the euro (EURUSD, EURJPY, EURCAD, etc.) soar.

But if you look closely, the pound sterling and the Swiss franc also often respond to this news by their own rally. From the perspective of a fundamental analysis, this can be easily explained: the UK and the Swiss economies are closely linked to the Eurozone economy, so positive news from the Eurozone usually contributes to the growth of the economies of the countries, which are major trading partners, and their currencies.

Forex pair Correlation Calculator

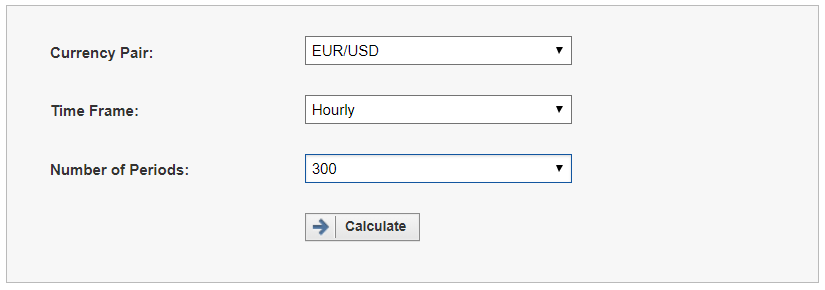

To automatically calculate currency correlation in Forex, you can use a special calculator.

You only need to select the currency pair, the time interval and their number, which you want to calculate the correlation for. Note that the larger the calculation period is selected, the more adequate data will be received by a trader.

Let's try to determine the correlation of currencies using the calculator mentioned above.

To do this, select EURUSD as a currency pair, 1 hour as a time interval, 300 periods (the maximum possible value) and click the “Calculate” button.

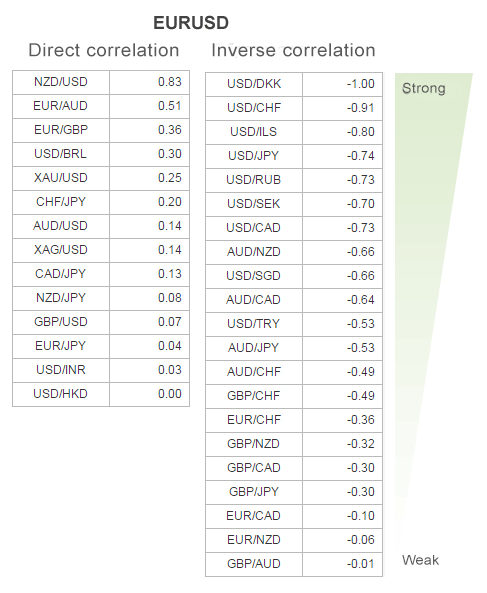

The result will be a Forex correlation table with chart like this (we slightly modified it for convenience):

Based on the data from the table, it may be concluded that EUR/USD correlates most strongly with the USD/DKK. Their movement is a 100% match. However, the relationship between these currency pairs is reversed, as evidenced by the “-“ sign before the value of the correlation coefficient.

USDCHF also displays a strong inverse correlation with EUR/USD (correlation coefficients are -0.91).

NZD/USD and EUR/AUD have the highest coefficient of direct relationship with Euro/dollar (0.83 and 0.51, respectively). This tells us that movements of EUR/USD and the above-mentioned currency pairs match each other in 83% and 51% of cases. In this case, the relationship is direct.

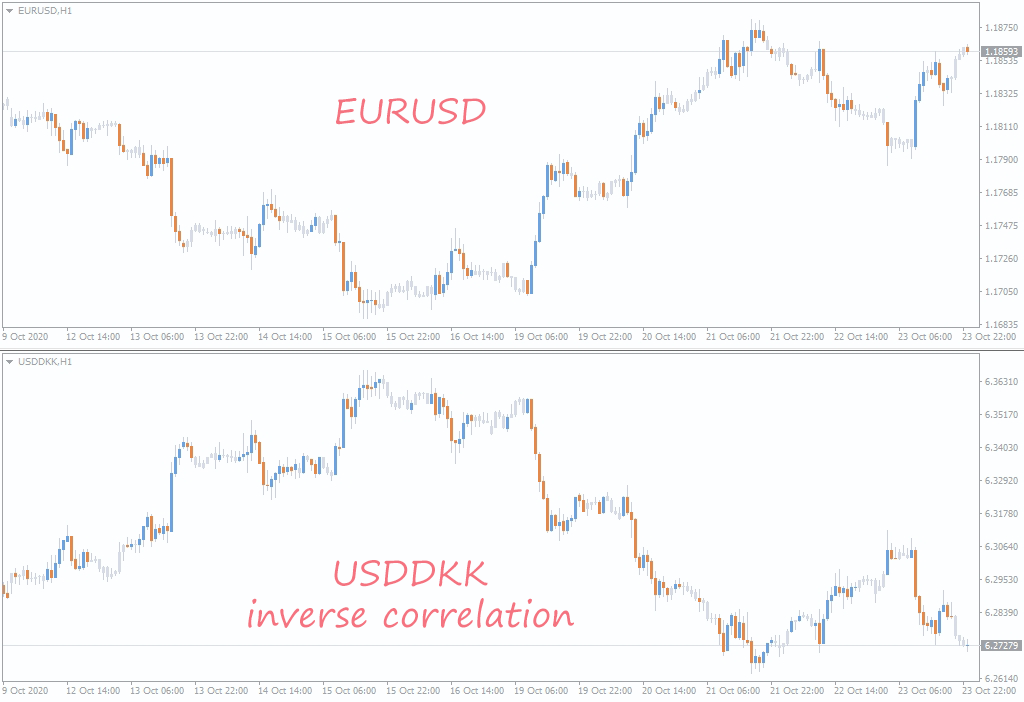

In order to determine how much interrelated two currency pairs are, correlation calculation may often be omitted. You need only to place the charts of two currency pairs side by side (as shown in the picture above), following which the fact of correlation between them becomes obvious.

The picture above shows an example of the inverse (mirror) correlation of EURUSD and USDDKK.

How to Use Correlation

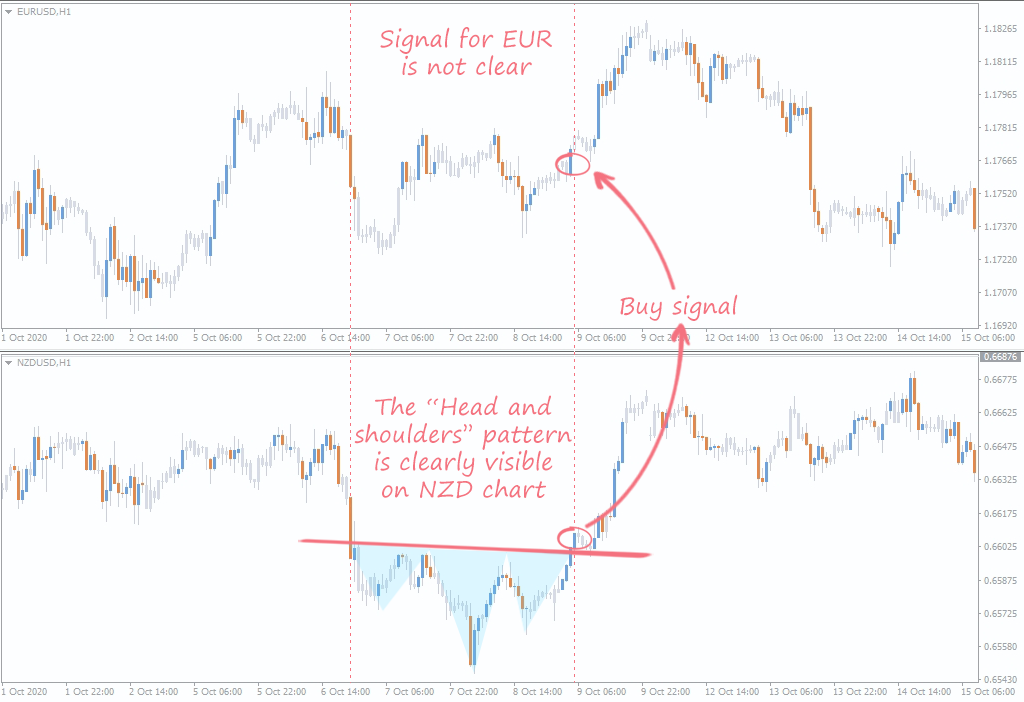

There are various strategies based on the currency correlation such as making patterns clearer:

In this article we will highlight only the principal applications of correlation. You can read about the strategies themselves here.

Traders can use currency correlation for several purposes:

1. Hedging. Suppose that a trader has sold EURUSD in the medium term and decides to wait for the position to close by Take Profit. However, it suddenly comes to know that the European Central Bank (ECB) President Mario Draghi’s speech is scheduled this afternoon.

Such speeches of officials often lead to unexpected and sharp movements in the Forex market. After reviewing the correlation of Forex currency pairs, a trader concludes that there is a strong inverse relationship between EUR/USD and USD/CHF pairs. In this situation, it’s quite logical for a trader to sell USD/CHF in order to hedge an open position on EUR/USD in case of an unexpected upward rebound of the latter currency pair.

2. Diversification of risks. Suppose that a trader decides to buy AUD/USD. Seeing that he/she still has enough funds to open other positions, the trader decides to look for the opportunity to make two more trades. After reviewing the currency correlation coefficients, he/she finds out that AUD/USD shows the strongest correlation with EUR/AUD and NZD/USD and the weakest one with USD/RUB and GBP/JPY. In this situation, the most reasonable solution will be using USD/RUB and GBP/JPY for trading, because if AUD/USD falls unexpectedly, this event shouldn’t affect the above-mentioned currency pairs from the perspective of probability theory.

Using correlation as a trading indicator, you must keep in mind that the currency market is constantly moving, so the currency correlation may also change over time. Therefore, we advise experienced traders not to forget to update their correlation table from time to time.