Extended Depth of Market for MT4 – Order Book Indicator

In this article, we give an overview of an interesting and unique proprietary indicator for MT4.

It’s the Depth Of Market (DOM)indicator transmitting data from the Order Book tool to your favorite MT4 terminal.

Some Words About Theory

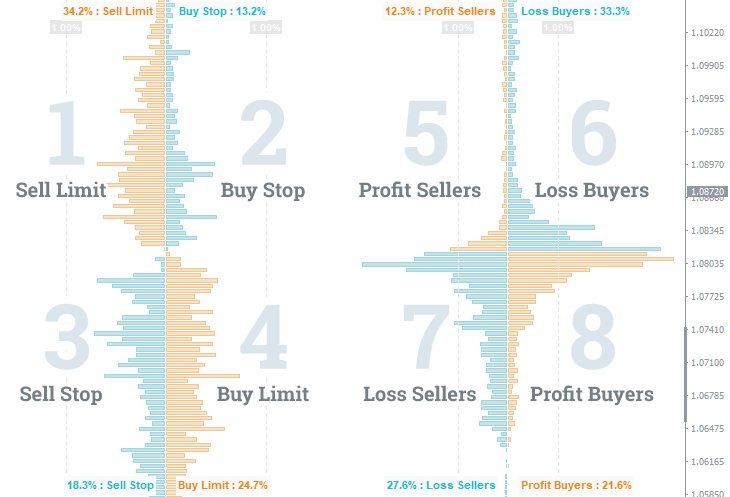

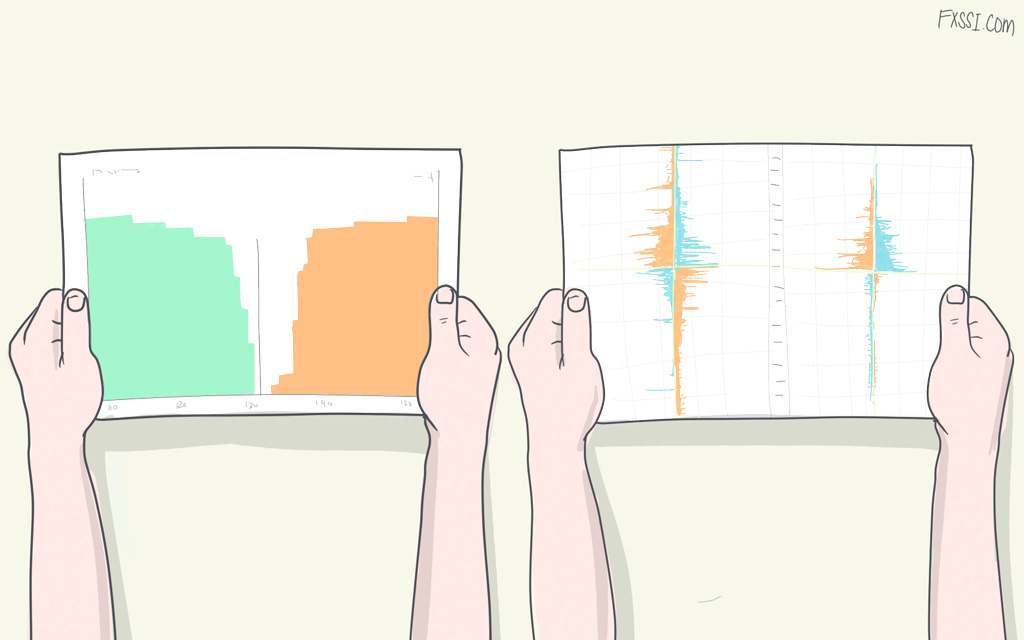

Depth Of Market (order book) is a graphical representation of trading activity, namely, open trades, pending orders, and stop orders. Data on trades are summed up and presented as a histogram at each price level. As a result, we get the picture:

The picture shows the extended order book including all types of orders as well as open trades. Originally, the order book concept implied displaying only 1st and 4th squares, that is, only limit orders. You can read about the principles of formation of just such an order book comprising limit orders in the article on the stock exchange order book.

Adding other types of orders and forming a two-sided order book like that in the Order Book was made possible only on the basis of a specific customer base of an individual broker. Stock exchanges cannot provide a two-sided order book, as they simply don’t have such information.

If you’re not familiar with a concept of the order book and principles of its analysis, we recommend you to read this 5-step guide.

Description and Features of the Indicator

The DepthOfMarket indicator is a light version of the OrderBook Pro web-based tool. Although it has a slightly limited functionality, the indicator provides enough data for comprehensive analysis as compared to the web-based version.

Up-to-date data come to the indicator every 20 minutes.

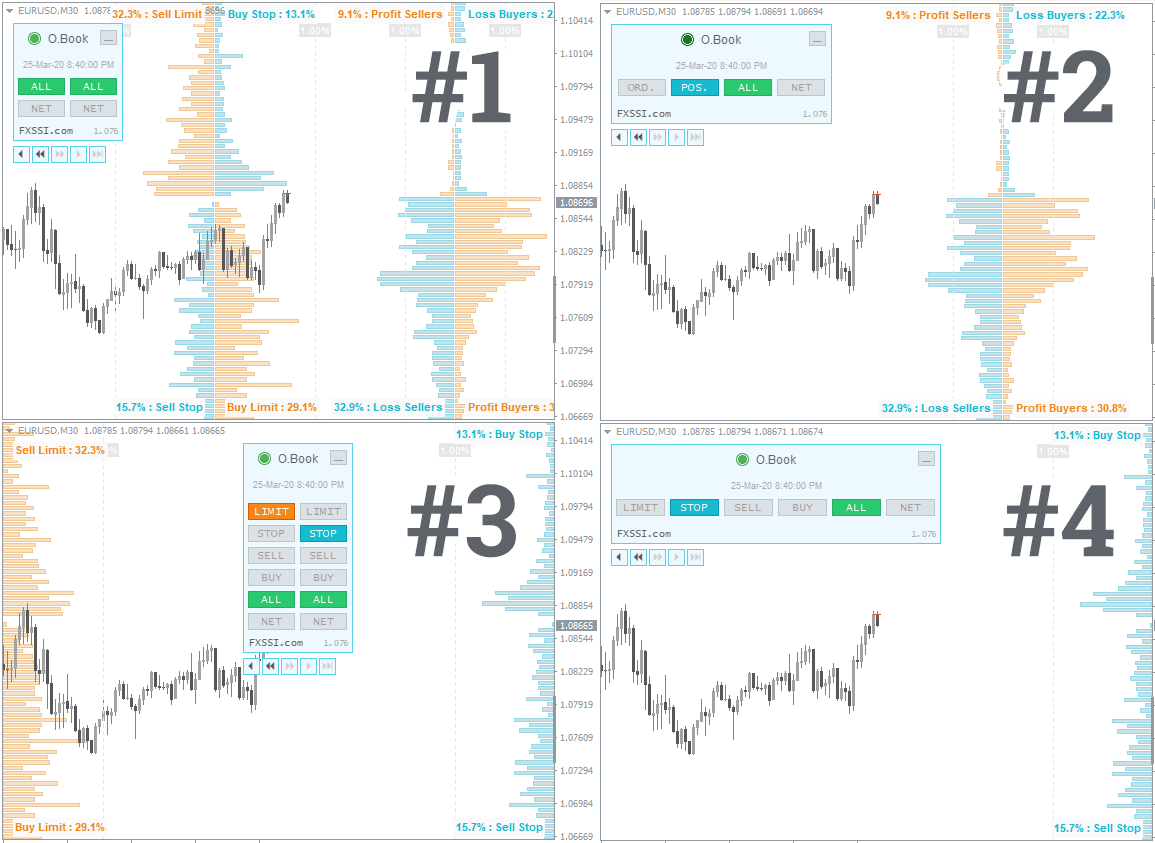

It has a feature that allows rather flexible customization of the displayed data format. For example, here are some of the possible visualization options:

The parameters related to the classical layout of data (like the one in the web-based tool) are set as default.

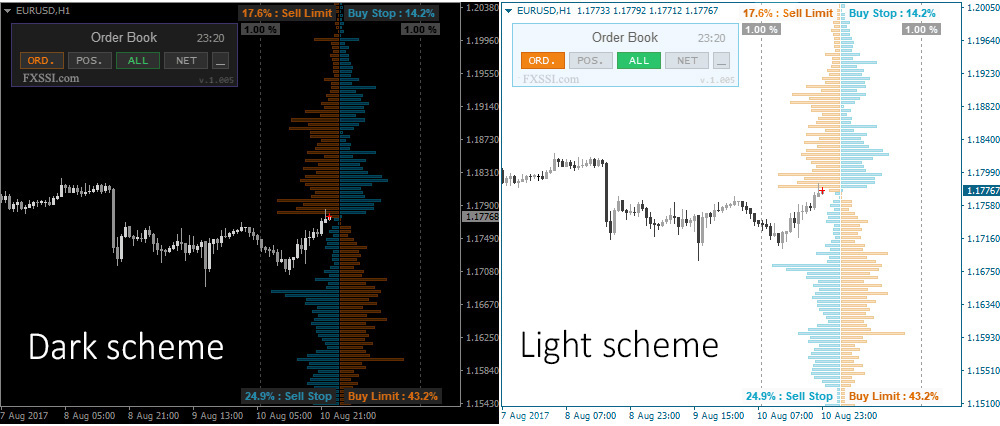

We also made sure that the indicator can be used right out of the box –all you need is to choose a color scheme.

As for the color scheme, there are currently two pallets of colors to choose from: for dark and light backgrounds:

The DOM indicator has a built-in light version (it can be selected in the settings), which allows you to free up space on the chart and display data at the edges of the chart window.

The light version looks like that shown in the image #1 just above. It’s more compact and doesn’t overlap candlesticks. However, users note that you need to get used to this (simplified) format, if you have used a two-sided order book before for long.

Indicator Interface

Btw, if you are looking to upgrade your terminal with pro indicators and different utilities you can browse from variety of resources available at FXSSI Product manager.

Menu. The menu with buttons was placed on the chart to enable switching between the left and right order books, as well as between the “NET” (“net value”) and “ALL” (“all orders”) modes, so that you don’t have to constantly go to the settings.

The Depth of Market indicator’s panel has the button to minimize the panel. You can set the minimized state of the panel as default in the indicator’s settings. It reduces the menu size in such a way as not to prevent you from making a candlestick analysis.

Snapshot time. The panel shows the time of the current cast. Actually, it’s the time the data was last updated.

Red cross mark. Many people may have noticed a red cross mark on top of the candlestick chart. It indicates the time as well as the price at the time of data update.

Additionally, the feature allowing you to view the history of casts is now available. The indicator allows you to navigate the history of casts. The history depth depends on the selected subscription plan.

Description of Settings

OrderBook Depth. It sets the number of horizontal columns of the histogram. The higher the value, the larger the height of the order book.

Layout. Classical layout can be seen in web-based tools, and the simplified one looks like halves of the order books at the edge of the chart.

Offset from the Right Side, Dist. between OrderBooks. Both parameters set the location of the histograms on the chart.

History Navigation. Enables/disables navigation through cast history.

Show Navigation Buttons when Minimized. Determines whether the rewinding panel will be displayed when the main one is minimized.

Fast Rewind Speed (in snapshots). Sets the step for fast rewinding. You can enter the value at your discretion. It is measured in bars.

Show Scale on Chart. Enables/disables the vertical bar-scale of the histogram.

Orders/Positions – value width/value size. They determine how far the vertical scale lines will be drawn from the middle of the order book.

DOM Indicator Panel Settings:

- Indicator Panel Position – selects the chart’s corner to place the indicator panel.

- Vertical, Horizontal Offset – sets the offset (in pixels) from the selected corner.

- Panel Initial Size – by default, it will maximize/minimize the panel when you start your terminal.

Left Side/Right Side – Default Filter. Shows all data or the net default value.

Left Side/Right Side – Default Data. Sets the default data type for the simplified display.

Add All/Net Filters. Enable/Disable the net value mode.

Color Scheme. By default, the indicator automatically detects the color scheme depending on the chart background. If necessary, select the desired color scheme from the list.

Alert on receipt of new data. You can set a sound alert, which is triggered at the time of receiving up-to-date data. Sound file. Enables to select a sound file for alert.

Download and Installation

You can download the indicators by clicking the links provided above. We advise you to read our instruction to avoid the problems with installation.

You can discuss the indicators and ask your questions directly in the Comments section.