Stop Loss vs Stop Limit Orders - The Difference Explained

As a trader, it’s imperative that you understand the difference between stop loss and stop limit orders.

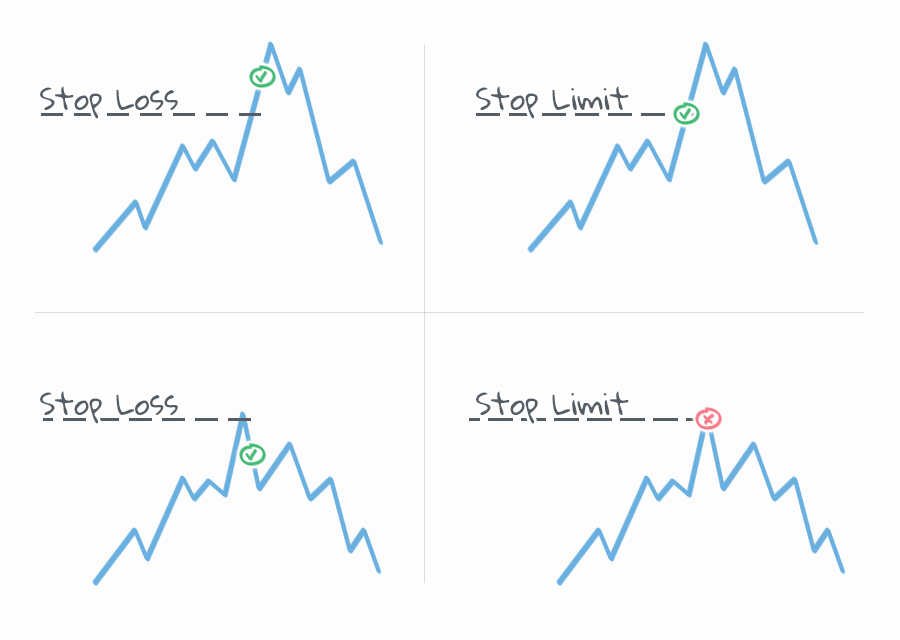

Stop loss orders ensure your trade is executed at the current market price, meaning slippage may occur. Use stop loss orders if you want to ensure your trade is executed, no matter the price.

Stop limit orders ensure there’s no slippage from your set price, but your trade won't be executed if the price is unavailable due to low liquidity. Use stop limit orders to execute your trade at the set price, or not at all.

If you’re looking for the difference between limit and stop orders, we've also got you covered.

Now, let’s go over stop loss and stop limit orders in more detail.

Stop Loss Orders

Stop loss orders are the simplest pending orders available and will only trigger once a certain price has been hit.

They can be used to trade in both directions, open or close orders and most importantly, limit your loss on a position that goes against you.

Buy Stop Loss

A buy stop loss order is designed to protect short positions.

They do this by triggering a market buy order if the price rises above your set price level.

When you place a buy stop loss order, you’re essentially saying that this price is the maximum you’re willing to let the market move against you, before closing your position.

Instead of letting price continue to rise, you’re executing a buy stop loss order to close to your short position automatically.

If the market continues rising and goes through your buy stop loss level, then the order will be executed at the current market price.

As it’s executing a market order at this price, there’s a chance you may experience slippage and may be a worse price than expected.

Sell Stop Loss

A sell stop loss order on the other hand, is there to protect long positions. They achieve this by triggering a market sell order if the price falls below your set price level.

When you place a sell stop loss order, you’re now saying that this price is the maximum that you’re going to let the market move against you, before you want to close your position.

Instead of letting price keep falling, you’re executing a sell stop loss order to close your long position automatically.

If the market continues to go against you to the upside and goes through your sell stop loss level, then the order will be executed at the current market price.

Just like we explained in the buy stop loss example above, this is a market order and therefore there’s a chance you may experience slippage.

Stop Limit Orders

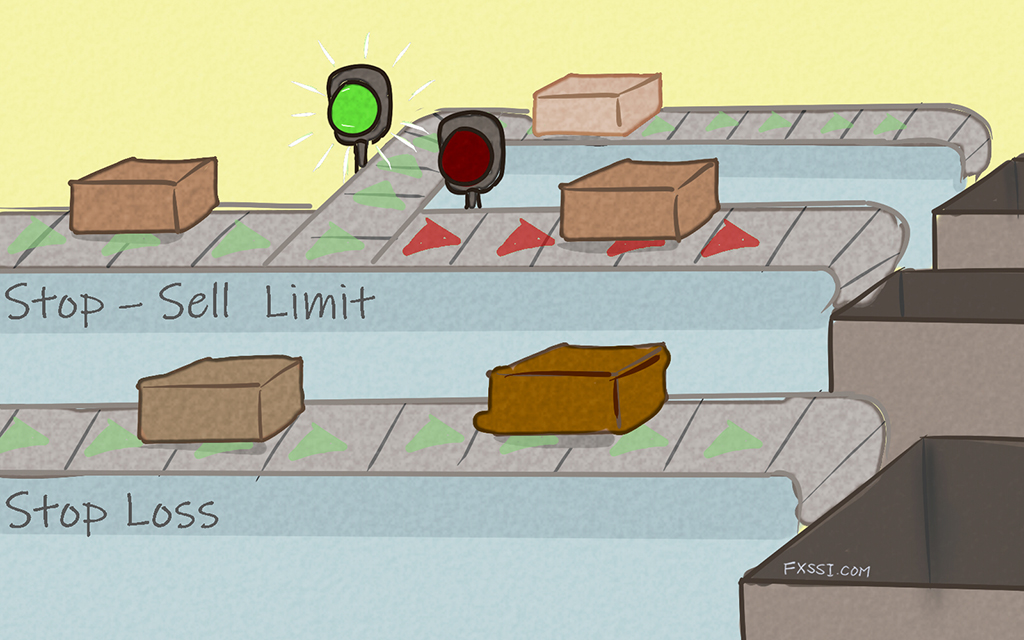

By setting a second price, stop limit orders try to solve the problem of having your stop loss order triggered at the sometimes undesirable, market price.

When price hits the stop price, the order becomes a limit order rather than executing at market.

This means that you can specify that you’d only want the stop limit order to be executed at an exact price or better.

Buy Stop Limit

A buy stop limit order will only execute at or below the price you’ve set.By using a stop limit order rather than a regular stop loss order, you can specify that you’d like to close your short trade by buying if price rises above a certain level.

But if price goes through that level because of slippage, it's okay for the buy stop loss order to not be executed and you’ll remain in your original trade.

That is, you don’t want to buy it for any more than the second limit order price that you’ve set.

Sell Stop Limit

A sell stop limit order on the other hand, will only execute at or above the set price.

Once again, this means that you can specify that you’d like to close your long trade by selling, if price rises above a certain level.

If price goes through that level because of slippage, you’ll still remain in your original trade because you don’t want to sell for any less that the second limit order price you’ve set.

Stop Loss vs Stop Limit Quick Comparison

Here’s a quick comparison table, showing the key differences between stop loss and stop limit orders.

| Stop Loss Orders | Stop Limit Orders |

|---|---|

| Guaranteed execution, but not price | Guaranteed price, but not execution |

| Price slippage frequently occurs | No price slippage |

| Price executed may be considerably worse | Could leave you with a totally exposed position |

As a trader, one of the most important things you must understand, is how to manage your risk.

In order to do that, you have to first know how to set stop loss orders properly and where others are placing theirs.

The FXSSI stop loss clusters indicator for MT4 displays the levels where the maximum number of stop orders are sitting and can help you make decisions based on this knowledge.

But the most important thing here, is that you’re using stops in your trading. Use either of these stop order types, just make sure you’re using them.

Trading Platform Compatibility

Not all trading platforms allow traders to use stop limit orders.

We’ve compared each of the major stock and Forex trading platforms, to determine which of them allow the use of both order types.

| Trading Platform | Stop Loss Order | Stop Limit Orders |

|---|---|---|

| Robinhood | Yes | Yes |

| Ameritrade | Yes | Yes |

| eTrade | Yes | Yes |

| Thinkorswim | Yes | Yes |

| MetaTrader 5 (MT5) | Yes | Yes |

| MetaTrader 4 (MT4) | Yes | No |

If you're a Forex trader using the MT4 platform, unfortunately you’re unable to use stop limit orders.

If this is an order type your trading strategy requires, you should consider upgrading to MetaQuotes’ next generation trading platform, MT5.

Final thoughts on Stop Loss vs Stop Limit Orders

You should now have a better understanding of the difference between stop loss and stop limit orders.

Summarizing, both order types can provide different types of risk management protection for traders, no matter your strategy.

Stop loss orders guarantee execution, while stop limit orders guarantee price.