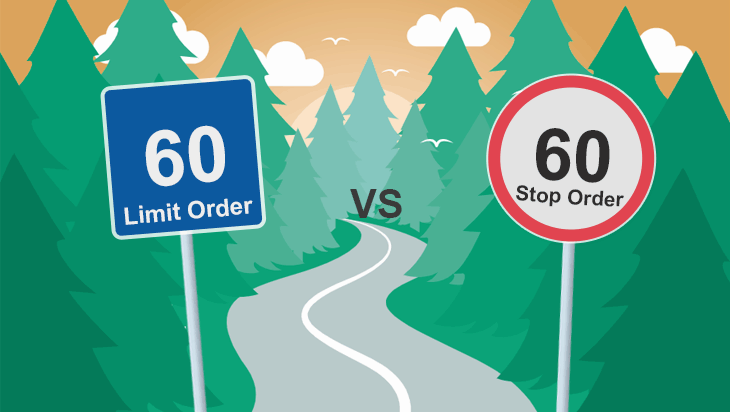

Limit Order vs Stop Order. What is the Difference Between Them

The first time the traders notice the existence of pending orders in the terminal, they often wonder what is the difference between them… Limit Order vs Stop Order, what is their purpose and how to distinguish them?

In this article we will explain what is the difference between these types of orders, what is their purpose and how to stop confusing them.

Before we go into the comparison of Limit Order and Stop Order, let’s figure out what they are separately.

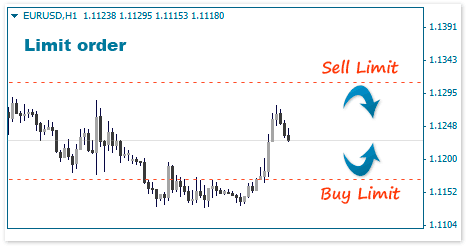

Limit Order

Limit Order is an instruction to execute a trade at the requested price or better.

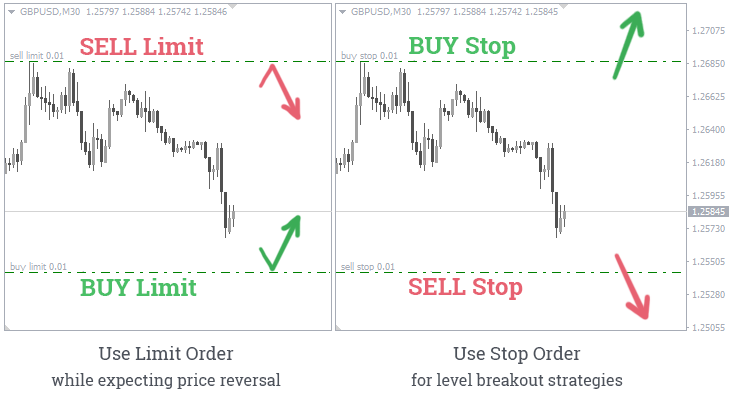

The SELL limit order is set higher the current price, and the BUY limit order is set below than current price. Thus, these orders are applied when the trader is expecting reversal from specific price level.

Order of this type is distinguished by the fact that a trade will be executed at the requested price or better. In other words, you won’t get a slippage.

Alternatively, there can be a situation where the price hits a Limit order but a trade is not opened. This is because there are not enough Market Orders for all Limit Orders which are set at the same level and closed by these Market Orders.

It is interesting that a familiar Take Profit order is an analog of Limit Order. This is the reason why the Take Profit Order never faces a positive slippage (except for a gap).

Stop Order

Stop Order – upon reaching the price, it forms an instruction for the immediate execution at any affordable price.

Buy Stop order is set above the current price, and Sell Stop is set below it. These orders are mostly used as part of level breakout trading strategies.

This type of order is distinguished by the fact that it automatically turns into a Market Order upon hitting the predetermined price level.

Accordingly, Stop Order will be necessarily executed but significant slippages are possible.

As you may have guessed, Stop Order is an analog of Stop Loss order with all the consequences that come with it.

Limit Order vs Stop Order

| Limit Order | Stop Order |

|---|---|

| No slippage | Possible slippage |

| May not execute when price reaches | Necceserialy execute |

| Suitable for Reversal strategies | Suitable for Breakout strategies |

Note that currently we’re talking about the orders and their method of execution in most popular MT4 terminal.

These or other types of orders are available in other trading terminals and may execute in other way. For example, there also exist Buy Stop Limit Order and Sell Stop Limit Order that are not available in MT4.

Now back to the above-mentioned difference between Limit and Stop orders.

If you want to make a buy trade, you may open both Buy Stop and Buy Limit orders. In this case, the first is set above the current price, and the second – below it.

It’s up to your trading strategy to decide what type of order – Limit Order versus Stop Order – should be selected.