What’s Better: Bars or Japanese Candlesticks?

There are three types of charts in MT4 terminal: candlestick, bar, and line charts.

The latter is all wrong for analysis, because it overlooks a lot of valuable information.

This is why most traders choose between Japanese candlesticks and bars. But what’s better?

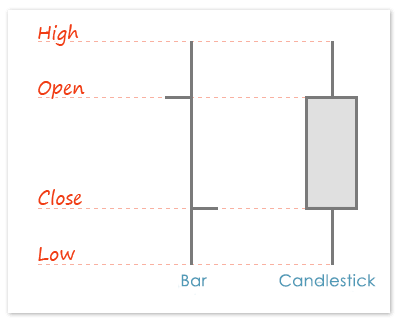

In principle, both these charts show the same information:

The only difference between candlesticks and bars is the method of indicating a direction:

- Bar will be bearish if the left tick (Open) is at the top, and the right one (Close) is at the bottom, and vice versa: bar will be bullish if the left tick (Open) is at the bottom, and the right one (Close) is at the top.

- Direction of candlesticks is determined by their color. For example, a green candlestick indicates an upward direction, and a red candlestick indicates a downward direction.

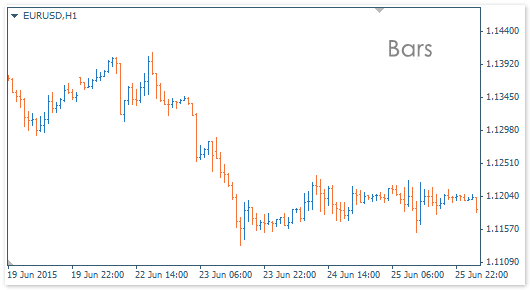

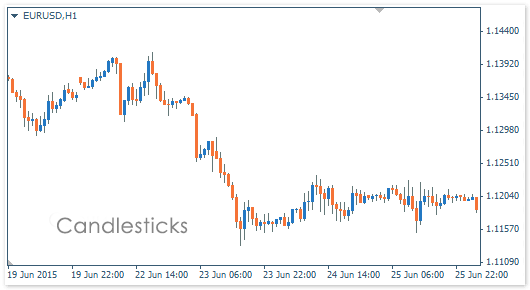

On the other hand, you can also specify a color scheme for bars depending on their direction, but there is one more nuance, which does make candlesticks more convenient: when the scale is small, bars are less clearly visible – eyesight might deteriorate until you find where Open and Close prices are.

Compare by yourself:

Generally speaking, candlesticks are easier to analyze and more popular among traders.

Besides, most charts available online are also candlestick ones. If you get used to bars, it’ll be harder for you to analyze charts on the Internet.

Btw, if you are looking to upgrade your terminal with pro indicators and different utilities you can browse from variety of resources available at FXSSI Product manager.