Trading With Pivot Points: Which Are the Best for Intraday?

One trading style that relies heavily on pivot points is the intraday or day trading. The reason behind this is that pivot point trading includes strategies that often allow intraday traders to get in and out of trades within a day.

However, there are many calculation methods for forex pivot points. And each method offers different entry points and levels. Naturally, a question arises: which pivot points are best for intraday trading? We'll try to answer that in this article.

Pivot Point Calculation Methods

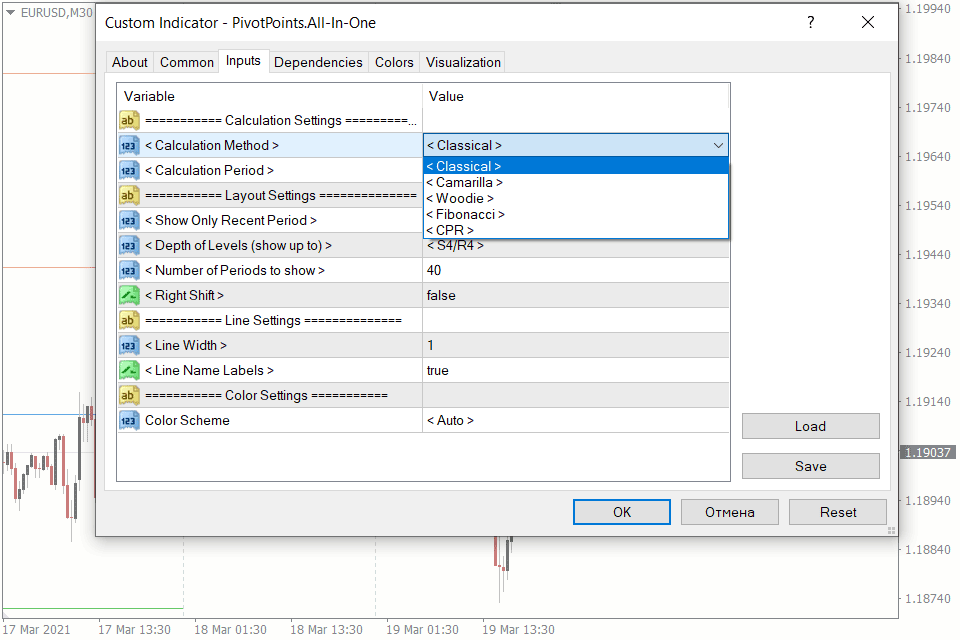

There are five most common pivot point calculation methods. They are the Classic, Woodie, Camarilla, Fibonacci, and Central Pivot Range (CPR).

And they all have something in common: they all use the high, low, and closing prices of the last trading sessions in their calculation of support and resistance levels.

Classic Pivot Point

Take a look at the classic pivot point, for instance.

It starts with the basic pivot point (PP). Every other pivot level is then based on the PP.

Basic Pivot Point (PP) = (High + Low + Close) / 3

Resistance 1 (R1) = (2 x PP) – Low

Support 1 (S1) = (2 x PP) – High

Resistance 2 (R2) = PP + (High – Low)

Support 2 (S2) = PP – (High – Low)

Resistance 3 (R3) = High + 2 (PP – Low)

Support 3 (S3) = Low – 2 (High – PP)

We will not dwell much on other pivot point calculation methods because our All in One Pivot Points Indicator article already deals with this topic.

The Best Pivot Point For Intraday Trading

There isn’t just one pivot point that is absolutely the best one for intraday trading. What we have is a pivot point that suits you more than it does another intraday trader. It’s all about preferences.

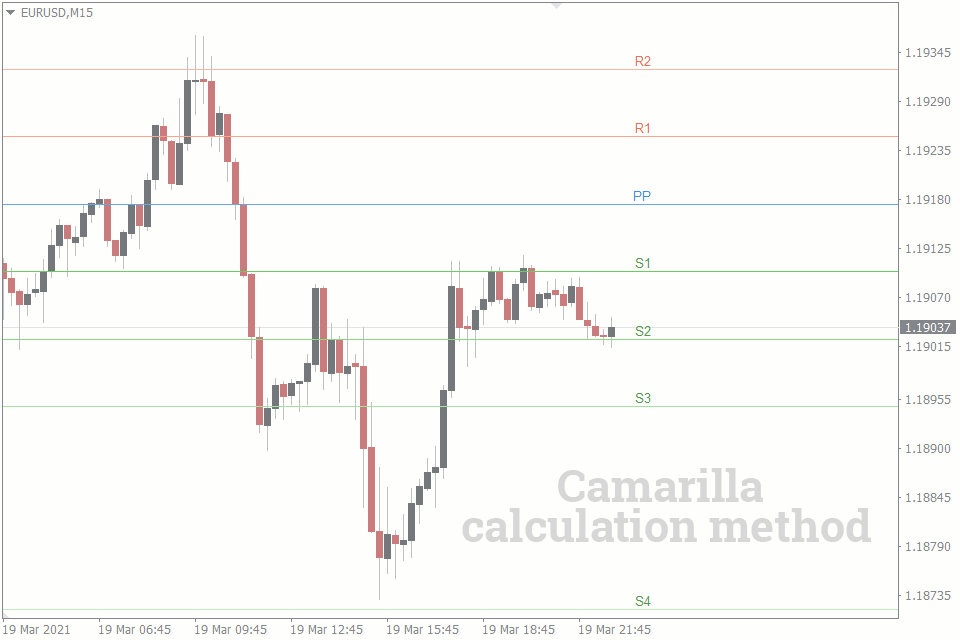

If you prefer making multiple trades daily, for instance, you may prefer Camarilla and CPR pivot points. These calculation methods lead to more pivot lines. And the more pivot lines there are, the more trading opportunities you have. A downside to this kind of aggressive trading is that you have to be comfortable earning little pips at a time.

For instance, the Camarilla calculation method may have its R1 and R2 merely 10 to 15 pips apart.

And depending on how wide the spreads of your borker are, the gains or losses are usually lower than that. But since you make multiple trades daily, you may accumulate profits and losses at the end of the trading day.

And if you are an intraday trader who prefers making only one or two trades per session, you may find the classic, Woodie, and Fibonacci pivot points more suitable for your trading style. These calculation methods rarely end up with as many pivot lines as the other.

There are even times when R3 and S3 are not in sight. This then leads to fewer trading opportunities. However, the pivot lines are usually far away from one another, leaving more pips between pivot points.

Our article on the best pivot point indicator will help you with the process of finding out the best pivot point for your intraday trading.

Best Intraday Trading Strategies Using Pivot Points

The five pivot point calculation methods have varying support and resistance levels. This may serve as your basis for developing a trading strategy using pivot points. For instance, the Fibonacci pivot point may have its R1 in one place, and the R1 of the Classic pivot point might have a different location.

And usually, the difference between these two R1s could just be a matter of pips. So, you may have a pivot line scraping the top of a candlestick using one calculation method, and have a gap between the line and the top of the candlestick using the other one.

So, you're the one to decide how close you want your resistance and support levels to be to your candlesticks.

Irrespective of the calculation method you use, there are common trading strategies you might want to implement. Here are some of the best intraday trading strategies using pivot points.

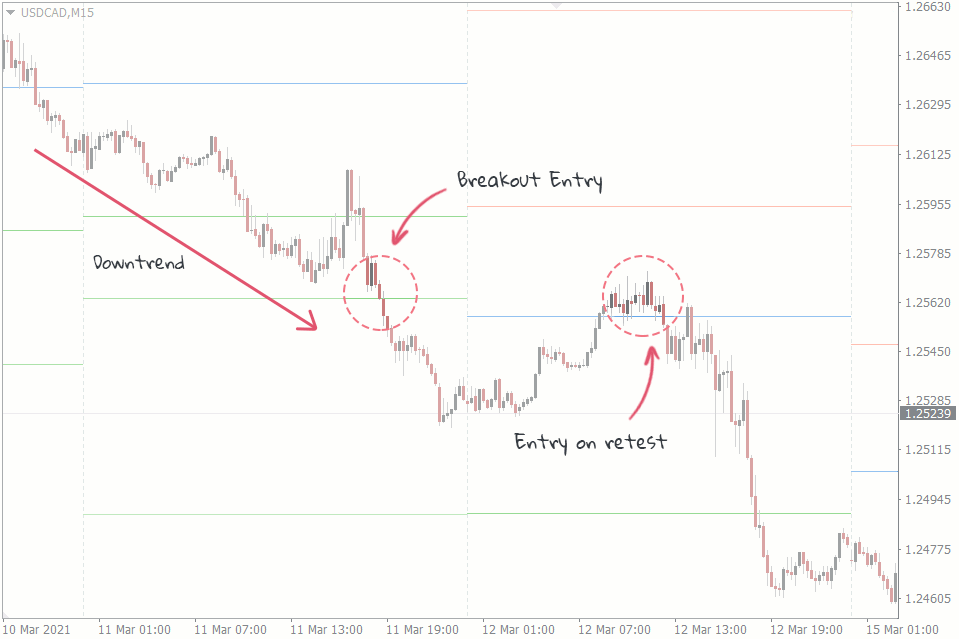

Pivot Point Breakout Intraday Trading Strategy

This trading strategy aims at trading price breakouts from pivot lines. You place a buy order when the price breaks above a resistance pivot line and you sell when the price breaks below the support line.

Usually, the way to predict the bias of the price for a day is to check if the price opens above or below the basic pivot point (PP). A break below the PP is considered to be a bearish bias and a break above is perceived as a bullish bias.

So, in a bullish bias, look for trade breakouts above your resistance pivot lines. And on the other hand, you might want to look for trade breakouts below the support lines, if you're looking into a bearish bias.

However, you don’t always have to adhere to this rule, since the price may have a bullish bias at the start of a trading day and end the day below its starting point. To make up for it, you might want to trade breakouts of support and resistance lines, irrespective of the bias. However, this might increase the risks significantly, since you would be trading against the bias.

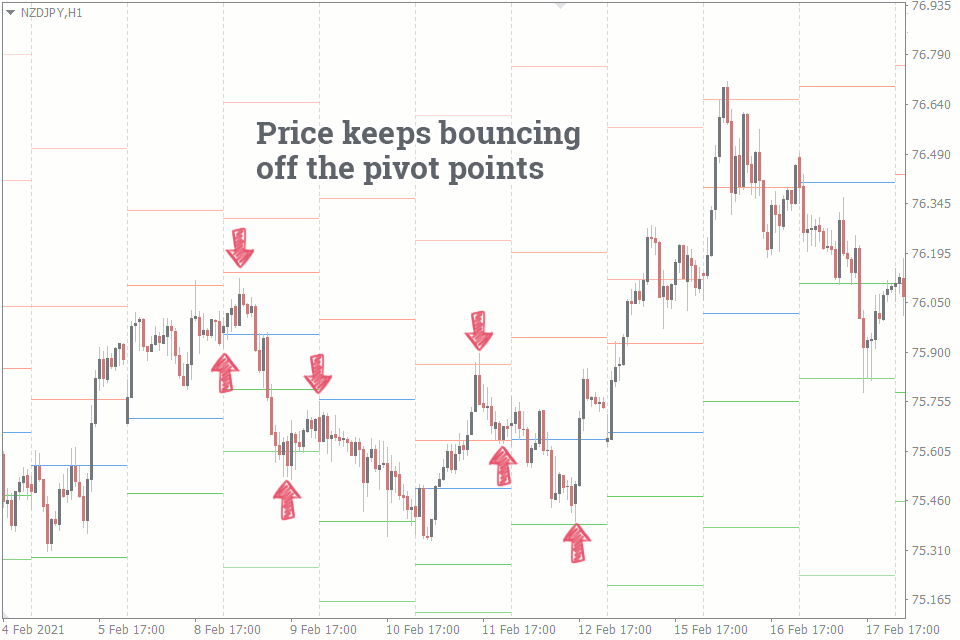

Pivot Point Bounce Intraday Trading Strategy

The pivot point bounce trading strategy hinges on the ability of the pivot lines to serve as turning points for the price. When the price approaches the line and bounces back in the previous direction, that is your cue to enter a trade in that same direction.

For example, if the EURUSD tests the line from above and bounces back up, it's time to open a buy position. Conversely, it's wise to sell the currency pair if the price bounces back to the downside after testing the pivot line from below.

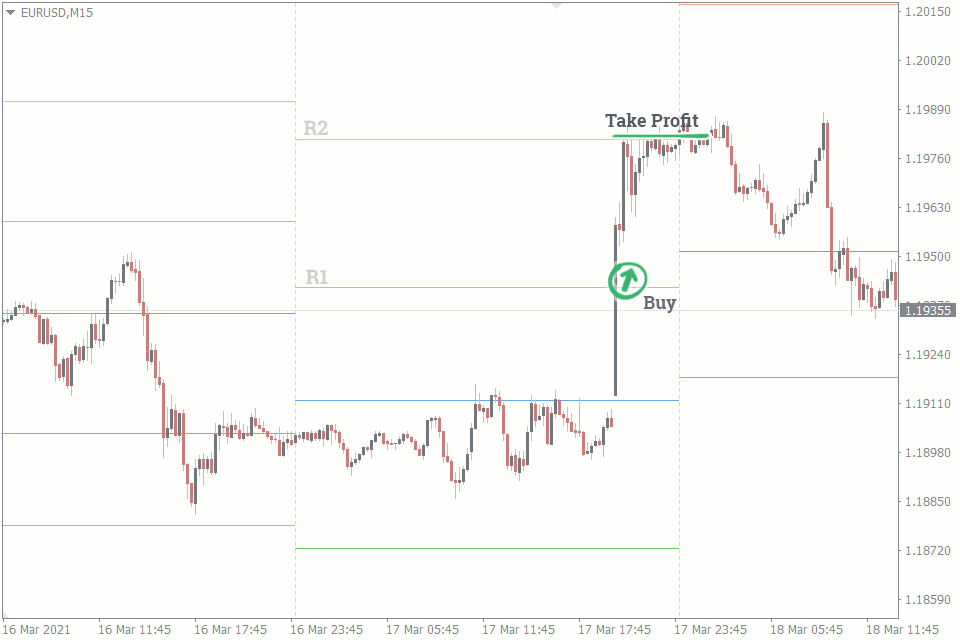

Where to Take Profit and Place Stop Loss

The ideal level to take your profits when using any of the above mentioned trading strategies is at the next pivot point from your entry point. If you enter a sell trade at S1, for instance, your take profit level will be at S2. Similarly, if you enter a buy trade at R1, your take profit level will be at R2.

This take profit method will usually help you protect the pips you’ve already gained, but it’s not ideal for earning all the pips you can from a price movement. The reason for this is that the price sometimes keeps breaking pivot points to gain new heights or lows.

For instance, the price might break R2, which would have been your ideal take profit level if you had bought at R1, and then continue its movement towards R3. Similarly, the price may not stop at S2 if you sold at S1, but continue to move towards S3.

Placing stop losses is not as complicated as taking profits. The ideal stop loss level is just below or above the pivot point, depending on your trading bias. Set the stop loss several pips below a pivot line if you're buying, and place it above if you are selling.

Check out our in-depth guide on how to trade pivot points to help you understand pivot point trading better.

Conclusion

As it is with many other forex trading tools, there isn’t one particular pivot point that is better than the other. It’s all about your preferences.