What Currency Pairs Should You Be Trading Right Now?

With an enormous amount of currency pairs and commodities that the forex market has to offer you, it might be tough to choose the best pairs to trade. But we’re here to help!

The vast number of trading instruments forex provides is a huge advantage as it helps you diversify your trading portfolio. But it can as easily turn into a disadvantage, when you get overwhelmed by the sheer number of currency pairs to choose from.

So, let’s cut straight to the chase and take a look at the 4 best currency pairs to trade today. We’ll also show you how to choose other currency pairs should you want to broaden your trading options.

The Best Currency Pairs to Trade in 2021

These are the top currency pairs you should be looking into now:

EURUSD

The number one reason that makes the EURUSD stand out is its friendliness to both technical and fundamental traders.

From a fundamental viewpoint, this currency pair is very reactive to the news, especially to the reports from the United States Federal Reserve and the European Central Bank. And from a technical viewpoint, the EURUSD can be successfully traded using technical analysis. In other words, it is predictable.

What this means is that you can place a support or a resistance line on the chart, build a trading system or develop a strategy around the line, and expect the price to react as you have predicted.

Another reason the EURUSD makes a good currency pair to trade in forex is its high liquidity. And this makes it a suitable pair to trade for those who want to reduce their risks.

USDJPY

If you took the EURUSD out of the equation, the USDJPY would be the most traded currency pair with a trading volume of 13.34%. And what makes this currency pair so popular? Volatility.

The volatility of the USDJPY is driven on the part of the Japanese yen by the economic and natural factors peculiar to the country. Unfortunately, Japan is prone to natural disasters, making its currency frequently fluctuate.

Some negative political factors tend to affect the value of the Yen as well. But the Japanese economy is very robust, causing the currency to always bounce back.

Apart from the fundamental triggers that move the currency pair, its sensitivity to technical analysis makes it suitable for technical traders.

Despite the volatility, the USDJPY is stable and less prone to slippage. This means that the price does not jump from one position to a ridiculously high or low in a blink of an eye. In other words, your risk exposure is kept at a reasonably low-level.

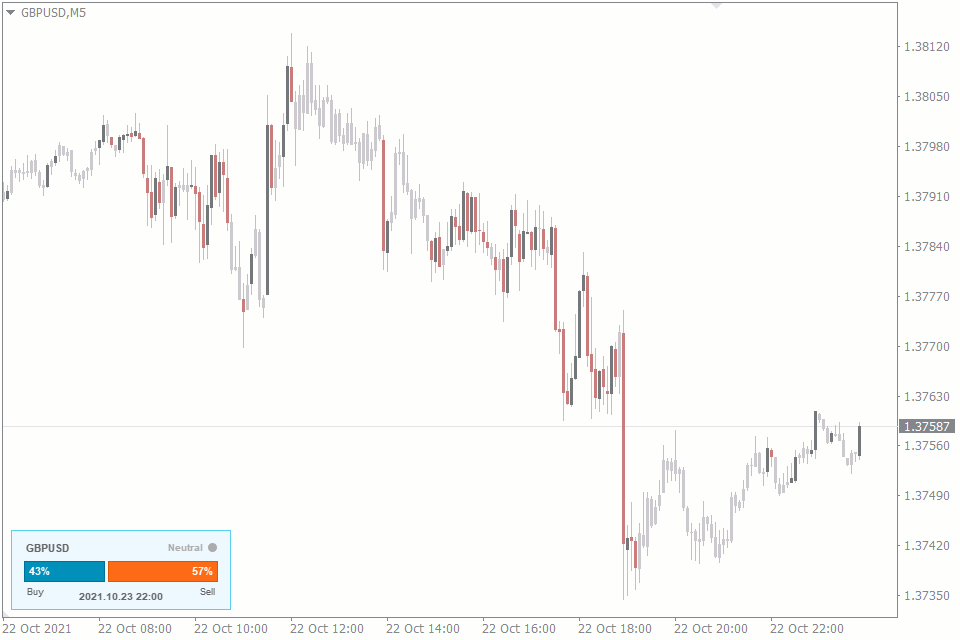

GBPUSD

Also known as the Cable, GBPUSD is a very volatile pair that has moved by an average of a little over 100 pips daily in the past year (data gathered from September 2020 until September 2021). This high price movement makes the GBPUSD a hotspot for traders who are looking to make high gains from short-term trades.

Take caution when trading this pair, however, as its volatility is a double-edged sword. You could make as much as 100 pips in a day or lose just as much in the same period of time.

The susceptibility of the GBPUSD to news and reports from the Federal Reserve and the Bank of England also fuels its volatility.

AUDUSD

This list would be incomplete without the Aussie. The AUDUSD pairs the USD with the Australian Dollar to make one of the most traded currency pairs in forex. The Australian economy is tightly knit with its commodity exports. And with commodities such as gold and iron amounting to billions of trading volume in the world, the AUD rides on their back.

In addition, the Aussie has enough volatility, liquidity, and stability to sustain its position as one of the most traded currency pairs in the world. As a result, the chances of successfully trading the AUDUSD using fundamental and technical analyses are quite fair.

How to Choose the Best Currency Pair for Yourself

The currency pairs in this article are the best currency pairs to trade across the board. But if none of them suit your trading style, here’s how to choose the best currency pair for yourself.

Your active time

Currency pairs have times when they are most active. And for each currency pair you’re trading, it’s best you trade it in its active time. You can use our article on the best currency pairs to trade at what sessions to help you decide what forex pairs to trade.

For instance, if you don’t want to spend your night trading, it’s better to choose currency pairs that are active in the morning or afternoon of your time zone.

This tip may not be useful to swing and positional traders, since they’re more into long-term trades. But day traders and scalpers should keep this tip in mind, as their chances of success rely on how much profit they can make within a currency pair’s active session.

Your risk appetite

Currency pairs have varying volatility levels. For instance, the GBPUSD is more volatile than the EURUSD when you take a look at their Average True Range values.

This means you’re likely to make more profit within a day on the GBPUSD than on the EURUSD. However, this also means your losses on the GBPUSD would be bigger than on the EURUSD. Therefore, match the currency pairs you’re trading with your risk appetite.

Spreads

The currency pair spread is another factor to put into consideration when you trade it. And since the spread on each forex pair is dependent on the broker, it also means you have to take your time finding the right broker.

Commonly traded currency pairs, like the ones we’ve mentioned in this article, often have very low spreads across all brokers. So, you might get away with not considering spreads when trading those pairs. But traders choosing exotic pairs and some cross pairs would have to calculate their spreads to know if the trade is worth it.

Conclusion

The four currency pairs we’ve mentioned at the beginning of this article are the top currency pairs to trade for most traders. But in case you decide to choose your own path and pick other forex pairs to trade, just follow our short guide with helpful tips.