Simple Moving Average vs Exponential Moving Average?

Among the many Forex technical indicators, moving averages continue to be one of the most popular trading tools out there. Due to the effectiveness, beginner traders through to seasoned professionals include them in their trading arsenal.

However, many new traders quickly learn that there are different types of moving average indicators. The two most common are simple moving averages (SMA’s from now on) and exponential moving averages (EMA’s from now on).

So, one of the most important questions for any new trader is which is better the simple moving average or exponential moving average?

Let’s take a look at some of the difference between of each.

SMA’s

SMA’s tend to be the first moving average that most new traders will deal with. The beauty of SMAs are that they are automatically plotted onto the chart for you by your MT4 platform, so you don’t have to do any of the hard work plotting them.

Using Simple Moving Averages to Identify Trend & Place a Trade

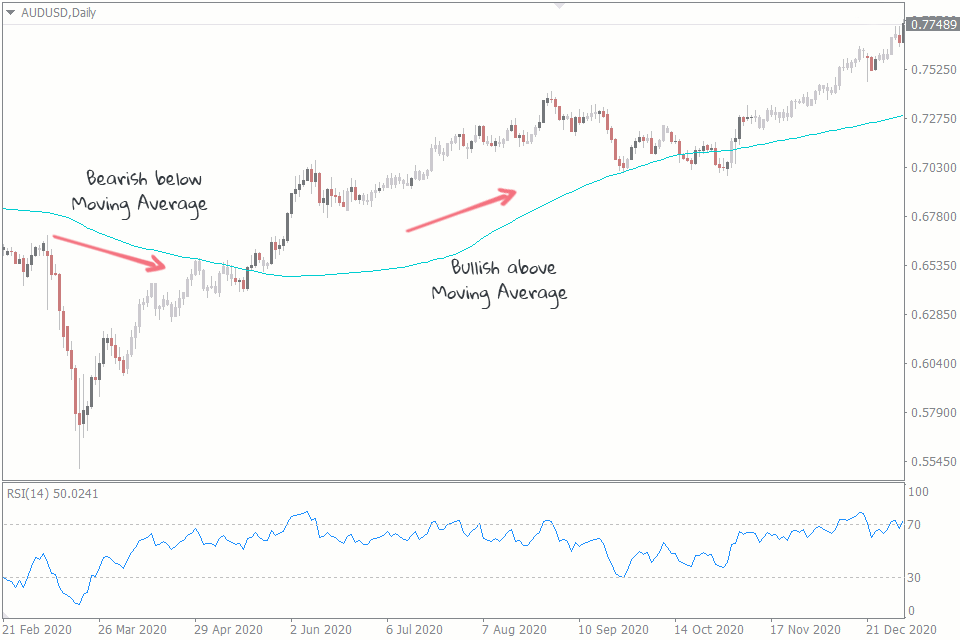

Most traders will use SMA’s to help identify the trend in the market. A basic rule of thumb is that if price is below the moving average, the trend is bearish meaning that traders should look for selling opportunities. Similarly, if price is above the moving average, the trend is bearish meaning that traders should look for buying opportunities.

Different MA Lengths

The length of moving average a trader will use will depend on the timeframe they are on. For example, if you have a 21-period moving average on a 1-hour chart, this gives you the average over the last 21 hours of trading. On a daily chart, however, this would give you the average over 21 days. One of the most common moving average lengths on a daily chart is the 100-period, shown below in blue.

In the image above you can see price is moving lower (bearish) while below the moving average. Price then reverses and breaks above the moving average and starts to move higher still (bullish).

EMA’s

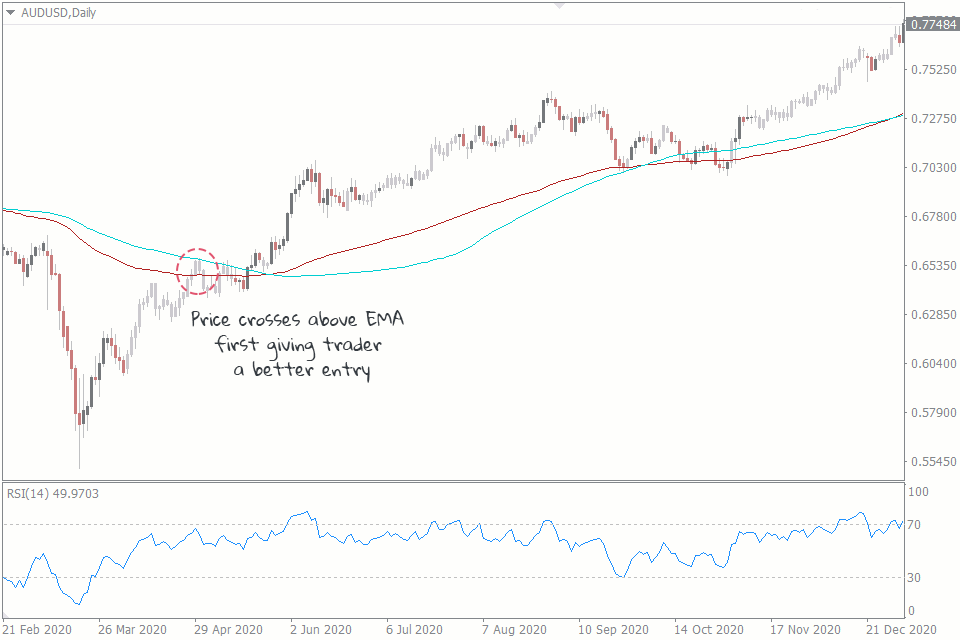

Now, if we take the same chart and add a 100-period EMA to it (shown in red) you can see something interesting. Because of how EMA’s are calculated, they are much more sensitive to price.

You can notice on the image above that the exponential moving average follows price much more closely and that at the point where price breaks above the moving averages to turn the market bullish, price crosses above the EMA much earlier than the SMA.

So, the great thing about EMA’s is that they can help you get into a trade much earlier than the SMA. Because they are more sensitive to price, EMA’s can be a great tool for catching a market reversal earlier and getting a better price for your entry.

Using Exponential Moving Averages to Manage Trades

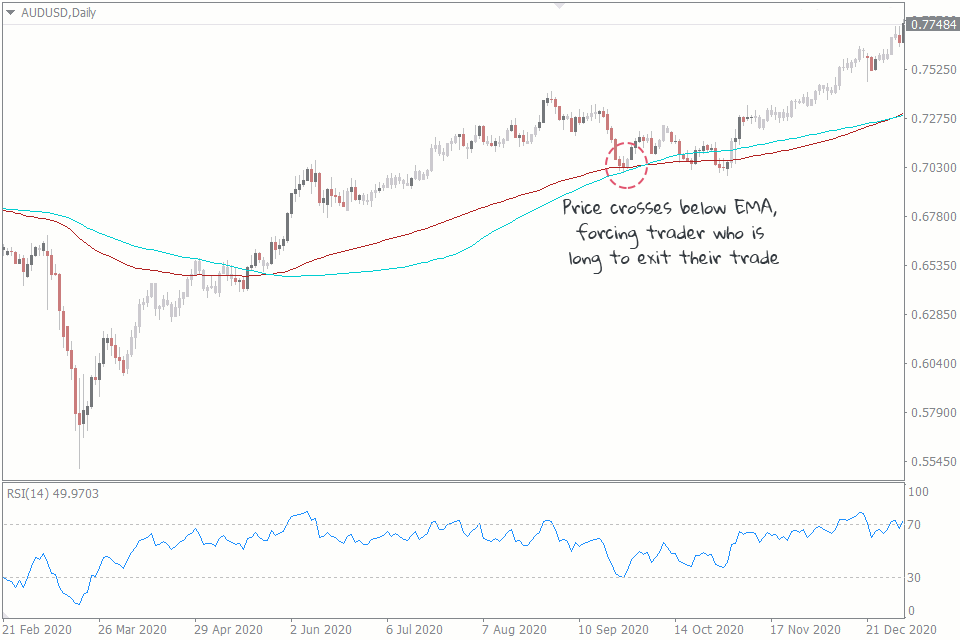

Now, although the sensitivity of the EMA means that it can help you get a better trade entry than using an simple moving average there are some disadvantages. This same sensitivity can mean that if you are using your exponential moving average to manage your trade, you might end up exiting the trade prematurely.

In the image above you can see that after price crosses above the moving averages and trades higher, there comes a point where price dips below the EMA but not the SMA.

Many traders who use moving averages to enter trades will also use them to manage their trades. So, if a trader is long once price crosses above the moving average, they will then stay in the trade until price crosses back below the moving average.

Now, you can see that if the trader had been using the EMA, they would have exited their trade as price dipped below. However, if the trader had been using the SMA, they would have stayed in the trade. This is certainly something to consider between the simple moving average vs exponential moving average.

Pros & Cons of EMA and SMA

So, the question is, which is better between using a ema vs sma? Take a look at the pros and cons chart below.

| Moving Average Type | Pros | Cons |

|---|---|---|

| Simple Moving Average | Plotted on chart automatically. Helps identify trend direction. Good for managing trades |

Less sensitive = poorer trade entries |

| Exponential Moving Average | Plotted on chart automatically. Helps identify trend direction. Good for entering trades |

More sensitive = not as good for managing trade |

Conclusion

As you can see, looking at the EMA vs SMA, both have pros and cons meaning that neither one is strictly better nor worse. The main thing is how useful you find them and how they fit into your own trading style.

Based on what we have learned a good strategy might be to use a mix of the SMA and EMA to improve your entries and manage your trades best.