In What Ways Can You Use Indicators In Forex

The ultimate aim of indicators is to present market data in ways that encourage interpretation. But what various uses should you expect to extract from indicators?

Forex traders often rely on indicators. There’s hardly a way to learn forex without learning about some common indicators, such as MACD and Moving Averages. But not all indicators perform the same functions. Some tell the trend while others tell volume.

We have 7 common uses of indicators in this article. Of the thousand, and maybe millions of indicators that we have, some are used…

To Trade Trends

The forex market can either be in an uptrend or a downtrend. Most times, it is easy to tell which one the market is currently in by just looking at the charts. But this is only when the trend has been clearly established.

Sometimes, however, your eyes fail you and the current trend is not immediately obvious to you. A good example is when a new trend is just developing. For this, you would need an indicator to give you an objective view of the trend.

The moving average is a perfect example of a trend indicator, especially when it is set to high periods, such as 50 or 100. If the trend rises above the moving average, the market is regarded as being in an uptrend. And when it falls below the indicator line, the price is in a downtrend.

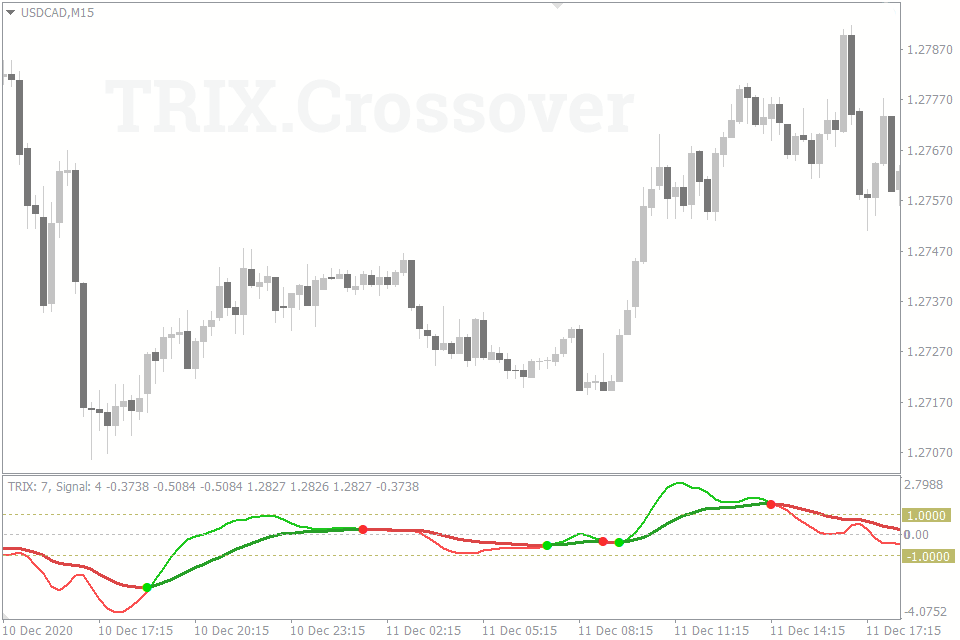

For Trade Entry/Exit Signals

As their name suggests, signal indicators give signals when the price is potentially about to make a move. They tell you when to buy, sell, or get out of a trade.

This category of indicators is probably where we have the most indicators. There are indicators that give you trading signals using overbought and oversold levels of the currency pair. Indicators that give you price reversal signals also exist. You’ll also find those that offer trend signals. Indicators that also use price action to give you signals exist.

Some even use psychological levels to produce their signals. There are so many ways through which signal indicators generate their signals. The burden lies on you to find one which works best for you.

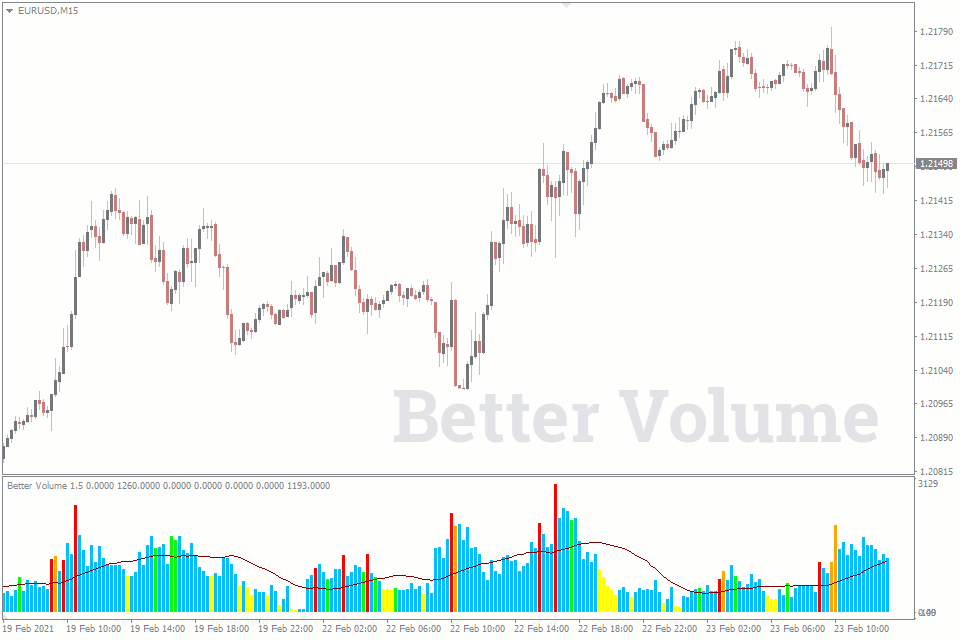

To Measure Volume

Volume indicators give you estimates of how many trades have occurred on a particular currency pair. This knowledge, on the surface, may look unnecessary. But knowing ways to exploit this knowledge may be what makes the difference in your trading. In fact, many forex traders never make a trade without first consulting a volume indicator.

When volume is low on a currency pair, it means not many people are trading the currency pair at the moment. There aren’t many traders pushing the currency pair and the price moves very slowly. But when volume rises, it means many traders are coming onboard the currency pair. This increases the momentum of the currency pair and spurs the price to cover more pips in a period.

To Measure Momentum

This set of indicators tells you how fast or slow the price is moving. With momentum indicators, you have an idea of how much patience you may need to exercise on every currency pair you trade before the price hits your take profit or stop loss.

High momentum currency pairs hit your take profit levels quickly. That is the advantage of such currency pairs. On the flip side, high momentum indicators can hit your stop loss just as quickly. The same goes for low momentum indicators, only in reverse. Low volatility currency pairs take a long time to reach your take profit and stop-loss levels.

To Measure Volatility

Volatility indicators tell you how much ground (pips) a currency pair covers in a given period. Highly volatile currency pairs can provide traders with opportunities of earning more. But high volatility currency pairs can also be your downfall as you risk losing more any trade that doesn't go your way. The Average True Range (ATR) indicator has proven to be one of the best volatility indicators over time.

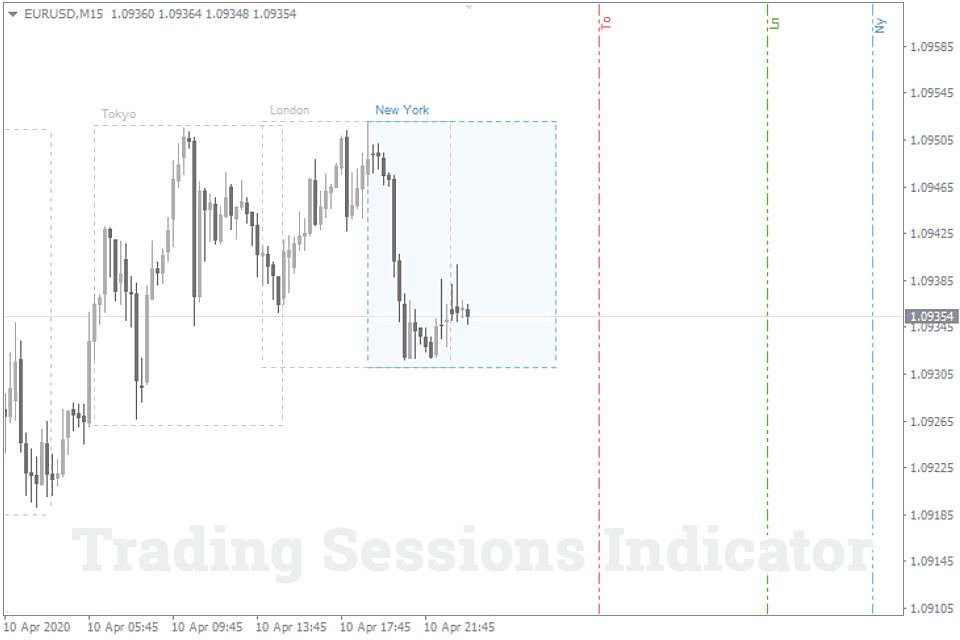

To Show Market Data

This is another indicator category that boasts of thousands of indicators. The forex market is not always about signals, volume, and trends. There are other market data a forex trader may rely on to be able to better interpret the market. Indicators whose jobs are to present you with such important market data in comprehensive ways are called market data indicators.

Common examples of market data indicators are the Current Ratio, Forex Calendar, and Forex Trading Sessions, among many others. The current ratio indicator gives you the market sentiment of other forex traders from 10 brokers. The forex calendar is very useful for telling what important news is coming up and when. This way, major news wouldn’t catch you off guard and ruin your trades.

Forex Trading Sessions indicator shows you what trading sessions are active when you’re trading. This knowledge can come in handy in picking the best currency pairs to trade per time.

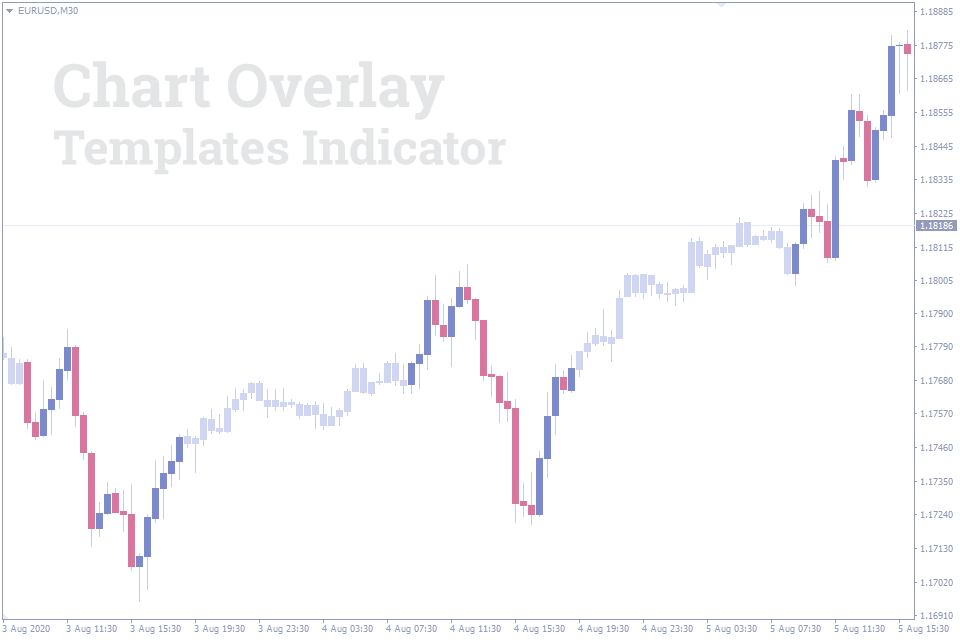

To Beautify Your Chart

You deserve to feel comfortable using your chart, especially if you spend a lot of time on it. And that is a job for this set of indicators. They make your chart more comfortable to use.

The more comfortable you are on your chart, the less clutter there is in your mind, and this sets your mind in the best condition to make the best trading decisions. Novice traders can also benefit from these indicators, as most trading platforms look overly sophisticated and maybe even too scary to work on.

A perfect example of an aesthetic indicator is the Chart Overlay indicator for MT4.

Conclusion

Indicators, in all of their numbers, are mostly used for any of the 7 categories above. And thanks to this diversity in uses, you can get more diverse interpretations of the market to help make better trades.