Best Forex Indicator Combinations

If you ask any trader what data they take into account before taking a trade, chances are the word "confluence" is going to come up.

Whether this is a fundamental trader looking to play a strong currency against a weaker one, or a price action trader waiting to see how price reacts at a certain level, the best trades happen when there are multiple reasons to be in the trade.

Although indicator confluence is much less subjective than either of these examples, finding the best forex indicator combinations is no easy task and many new traders go about it the wrong way.

Combining two forex indicators of the same type

One pitfall new traders unwittingly walk into is combining two indicators of the same type eg two reversal oscillators.

As the vast majority of forex indicators are derived from the same Open, High, Low and Close data, two indicators of the same type may always or usually confirm each other.

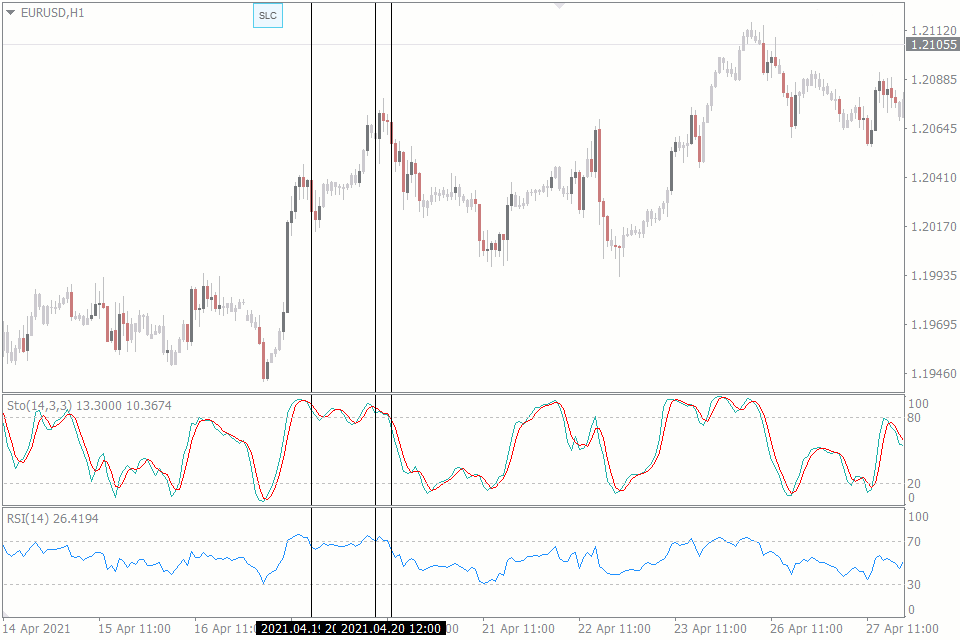

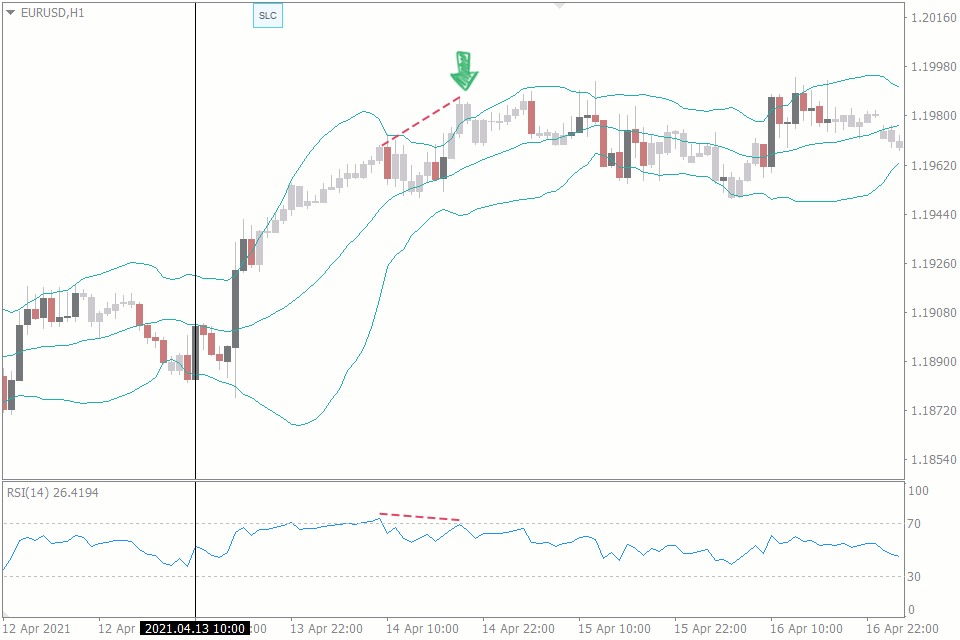

Let’s take a look at two popular reversal indicators to demonstrate – the Relative Strength Index (RSI) and Stochastics, both with the default settings:

Here we have three RSI sell signals. The first one is a poor signal, occurring right at the corrective low before the final push higher. The next two are good signals, occurring very close to the ultimate high and leading to modest declines.

If we take a look down at the stochastics indicator, it confirms each and every RSI sell signal, both the loser and the two good signals, so it doesn’t appear to be a very useful tool for filtering out bad RSI sell signals.

Although RSI does filter out 1 bad Stochastics signal, you would have also avoided that if you had just used RSI instead of Stochastics in the first place.

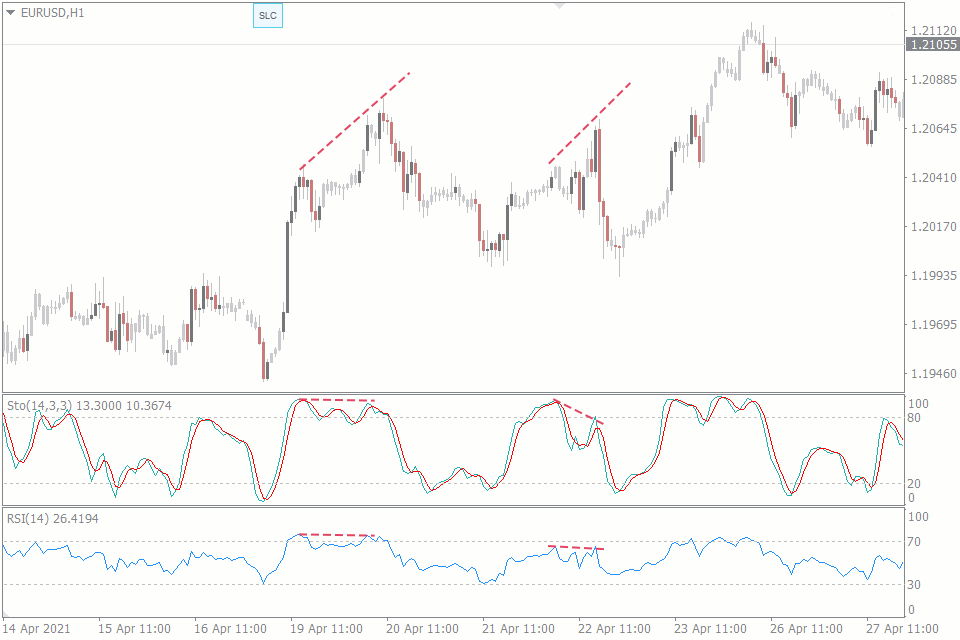

It’s a similar story when we look at the two divergence signals, both are good trades, but you would have caught each of them using either indicator in isolation:

Now we’re not ruling out combining indicators of the same type all together, we’re not even ruling out this particular indicator combination all together, but you do have to look closely and see whether combinations of this type are actually giving you any advantage.

You may also need to get a little creative: if we continue with RSI and Stochastics, as Stochastics is generally more responsive, issuing more signals than RSI, it may be useful for taking profits:

Even though the final RSI signal is a great entry signal leading to a modest decline, if you look closely, RSI never tells you to exit the position and your profits are then all given back in the next wave higher.

On the other hand, stochastics issues multiple buy signals, so if you’d used RSI to enter and stochastics to exit, this would have been a profitable trade.

Furthermore, if you’d waited for stochastics to become divergent, you would have taken profits very close to the low – RSI did not show any divergence in this example.

Combining two forex indicators of different types

Bollinger Bands are another popular indicator and quite versatile in that they can be used for both trend following and reversals or mean reversion.

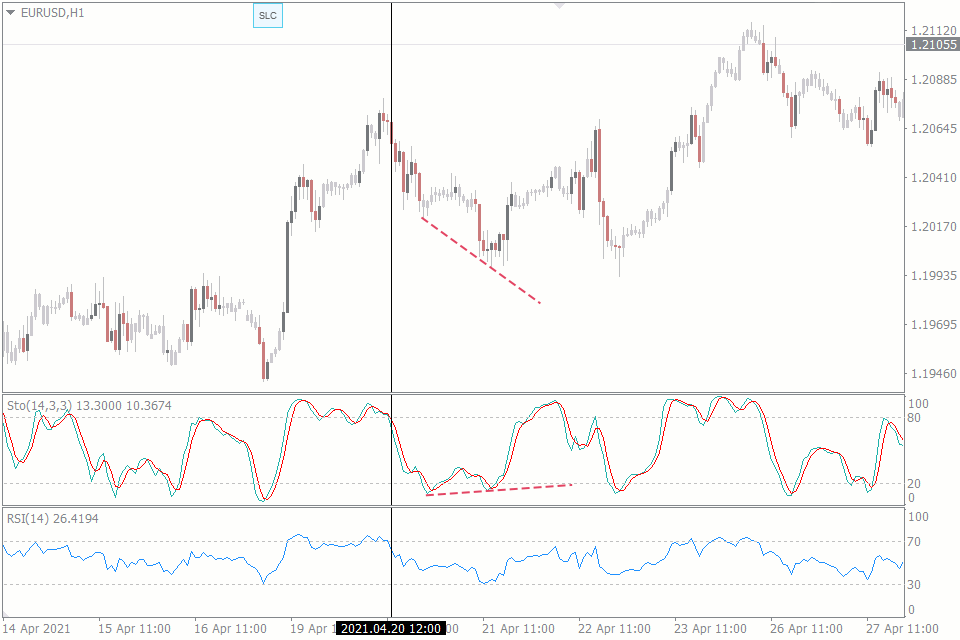

One issue with this indicator is price regularly breaches the upper band only to continue higher, or breaches the lower band only to continue lower:

Though buying here when price reverses into the median line and exiting on the breach of the upper band is a good little trade, the pair clearly continues much higher after the breach and the bands don’t show any re-entry opportunity.

Let’s take a look at filtering the breach signals using RSI divergence, as the next breach signal is obviously quite good:

Voila: by waiting for the combination of a breach of the upper band and RSI divergence, we ignore the first breach signal and take the second, taking profits very close to the top and netting an extra 50 pips.

Combining proprietary indicators and forex disciplines to get the best results

New traders will often ask which is better, fundamental or technical analysis? But even the best technical traders consider fundamentals to some degree and fundamental traders obviously have to look at a chart before taking an entry.

Ignorance may be bliss, but it is likely not the path to successful forex trading.

The best traders consider all the information available to them and use this information to execute trades with confidence.

Proprietary indicators are of interest here as they are not always based on OHLC data, so can be much more useful in confirming a signal from a standard indicator.

Another reason proprietary indicators are useful is they can eliminate subjective elements of price action analysis. For example our Auto Trendlines indicator which draws trendlines for you based on a consistent criteria.

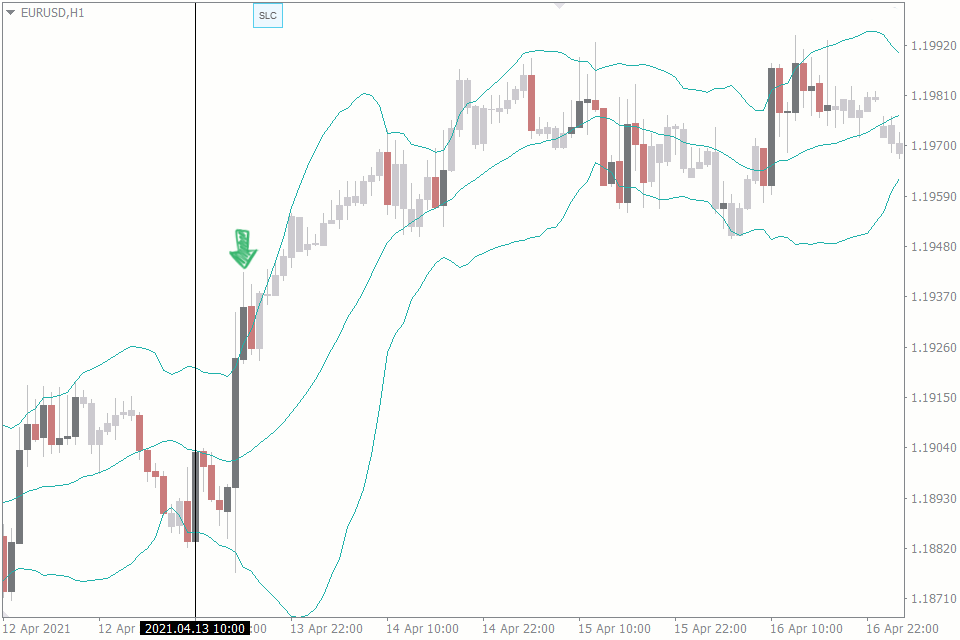

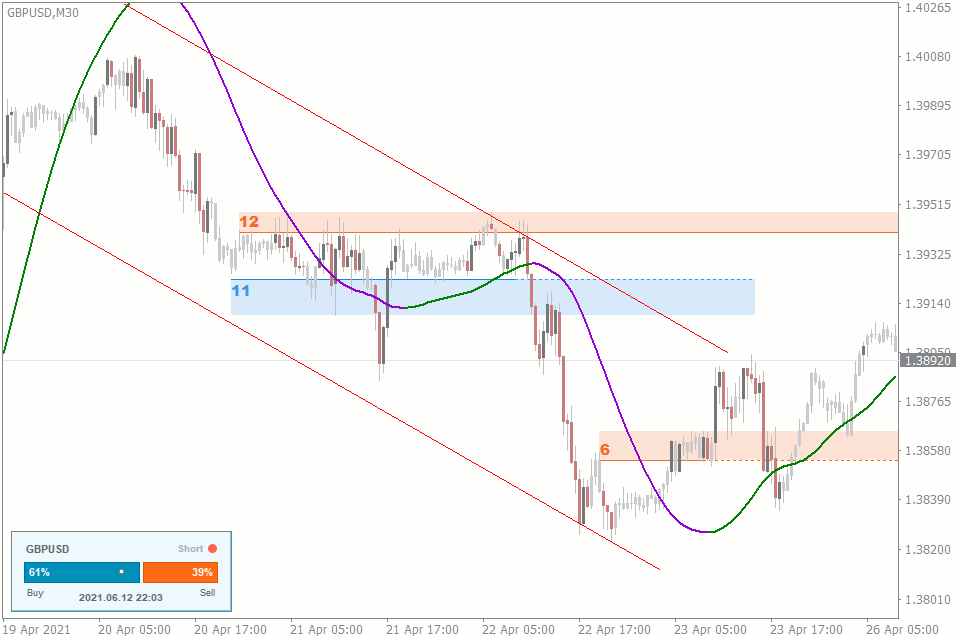

Let’s take a look at combining some of our proprietary indicators for MT4 with a more traditional indicator, the Hull Moving Average:

In the above example we have a 100 period Hull moving average, combined with three of our proprietary indicators for MT4 – Auto Trend Channels, Support and Resistance and Sentiment Lite.

Although the final Hull sell signal is quite good in isolation, similar to our original example with RSI, it has not issued a take profit signal yet, despite a significant decline and modest bounce.

Sentiment is also neutral on this particular occasion, giving us no clues as to whether or not we should take profits.

Our price action indicators on the other hand really do the job – they suggested two prime selling opportunities before the Hull even started falling and the decline into the channel floor is the perfect time to take profit.

Note that the Hull is not redundant here either: after we short the reaction from the channel top and resistance zone, it confirms the trend has indeed turned lower, and then acts as a backup exit plan if we fail to take profits at the lows.

Combining proprietary indicators with more traditional ones in this manner opens up a whole world of possibilities for improving your trading strategies and getting the best results from your forex trading.