Order Book. Part 3. – Ins and Outs

We continue looking into the Order Book. In this part, we’re going to tell you about the ins and outs of trading with the order book.

The previous part of the article addresses basic signals which can be received with the order book.

The information presented here cannot be found anywhere since we gained it from our personal experience.

We’re also not sure that you can apply this information when using other similar order books, but it may be so.

Let’s get started…

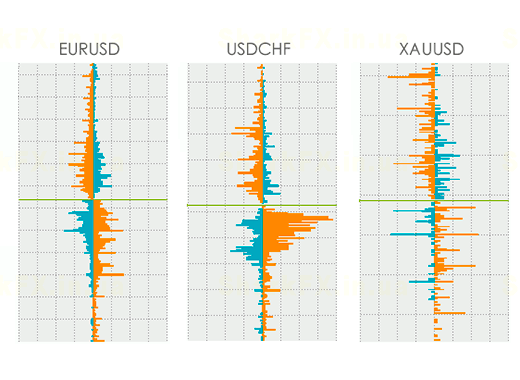

The Order Book for Various Pairs Looks Differently

The order book for every currency pair looks differently and generates different signals. It is more likely related to the liquidity and the popularity of these pairs.

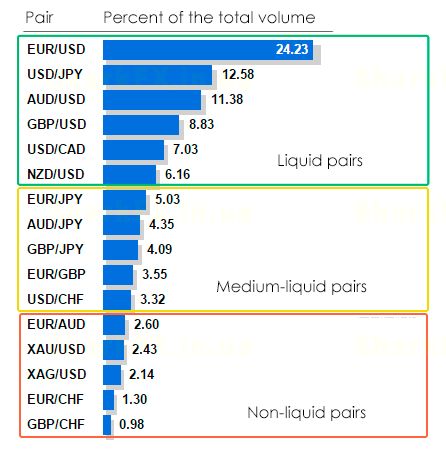

Less liquid pairs as shown in this picture are very hard to analyze due to a representativeness of the sample. Deviations from the total statistics will often happen since volumes of these pairs are too small. Imagine that only 20 trades for GBP/CHF shown in Order Book. It is a very little number so it is highly probable that these trades will not resemble statistically average ones.

Which pairs are liquid and which are not? – By comparing trading volumes of all pairs one can determine liquid, medium-liquid and illiquid pairs. Let’s do it:

If we build a graph of signals’ quality for these pairs, it will look roughly the same as that shown above: i.e. EURUSD generates the most qualitative signals and GBP/CHF generates the most inaccurate ones.

Besides all this, the signals are generated and look differently. The signals got from the British pound differ from those formed by the Euro, etc. We doubt whether we can describe it – it would be easier if you observe these pairs by yourself in order to get an insight into every pair over time.

There is a number of pairs subject to interventions – this is especially the case with USDJPY. The problem of the pair is that the signals generated by the Order Book are often ignored by the currency pair following which it sometimes moves in the opposite direction.

By the way, we try to provide examples exclusively for EURUSD when describing signals: it is easier to learn to trade by this pair and it provides more clear pictures.

You must also bear in mind the strategy based on correlation of currency pairs: it will allow you to make use of the signals generated by EURUSD to trade with GBPUSD easily and vice versa.

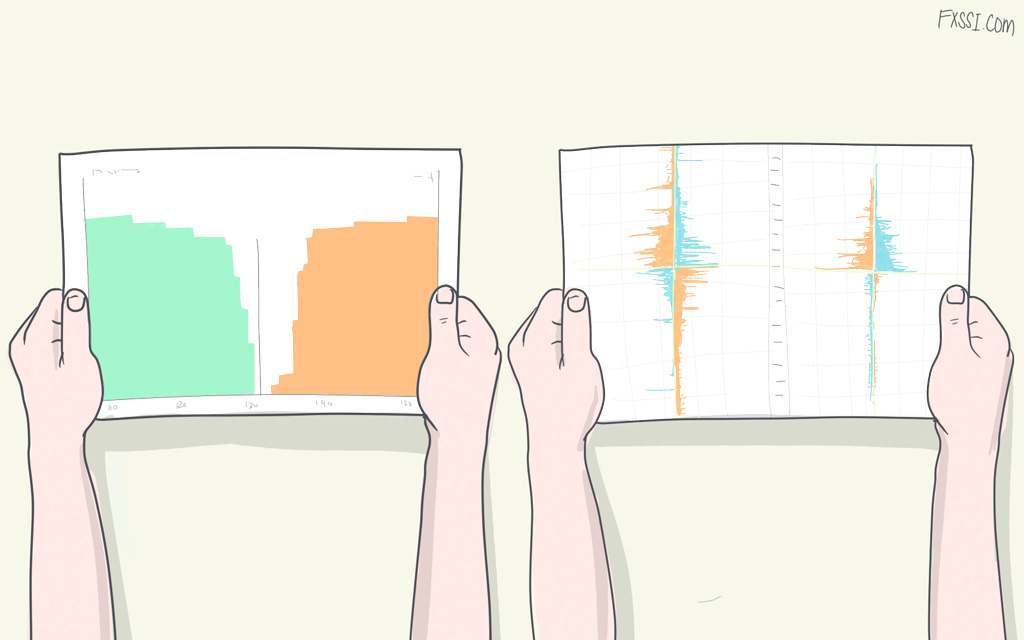

Order Book and News

We have one more significant observation.

Price prefers taking into account the data provided by the Order Book than that published during news release. We don’t say that the order book moves the price. As we mentioned repeatedly, the fact is that the order book displays an adequate sample which is very much like the market in the whole.

We think that each of you has seen the price dipping after the positive news release.

The point is that fundamental news has a long-lasting effect which cannot be always noticed and events happening during news release are short-term speculations intended to increase volatility. We suppose that all of you understand what’s behind these speculations. So, the order book is particularly well suited for news trading.

Examples are plentiful. Here is one of them:

Sometimes seems the order book is preparing for the major news. The fact is not that traders are forced to open trades: we just look at the order book’s snapshot at some point and think: "It's gonna be a nightmare for traders". That’s mostly the way it happens.

Can anyone make money trading the news by the order book? — You would better not try it until you master the order book. Your stop-losses will more likely be triggered or you will hardly notice how you find yourself in a group of losing traders. Besides, high volatility doesn’t allow setting reasonable stop-losses.

We have considered the situation concerning opening trades before the news is published. But what will happen if we open trades 10-15 minutes after the news release?

In this case, your chances are quite good. Just look at the updated snapshot of the order book after the news release and take the field if there is (are) any signal(s).

Analysis in Dynamics

It is essential to analyze the dynamics of the order book formation.

You can do it by moving the mouse cursor over the chart in the DOMs tool that makes it possible to display the previous snapshots of the order book.

The snapshot is a picture as of a certain time and date, i.e. one picture is one snapshot.

You may notice that volumes occur more actively at particular levels than at other ones while analyzing old snapshots. It helps to understand which levels are more interesting for the audience of traders.

Do it like that: if you see that stop-losses have accumulated gradually, it indicates that a signal will be stronger than if the stop-losses would have rapidly occurred in one of the snapshot.

The activity happening in the order book itself signals the current volatility as well. If new trades and orders appear in the order book slowly, it follows that it’s not worth expecting sharp moves (except for news).

When the US session ends, the activity in the order book significantly reduced: most of the traders, shown in Order Book, are EU, US located. So, we can expect that the order book predicts night price moves not so good.

Smart Trade and Injection

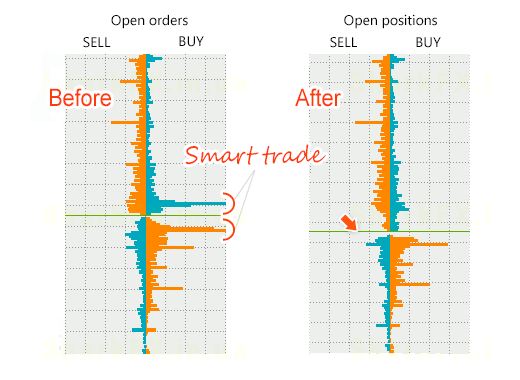

Smart trade is a large-sized (>100 lots) trade made by a broker’s customer with a required deposit of about $200,000. As we have mentioned in this article, the larger is a deposit, the more profits traders earn.

Accordingly, if a trader risks losing such a volume, it means that he knows what he is doing. This is why his trade will bring him rewards.

How to identify a smart trade in the order book?

The smart trade has one special feature – it instantly appears in the order book, i.e. a smart trade can be absent on the previous snapshot and appear in the current one. The volume of the trade is also remarkable: it must be over 1.5% of total Order Book client base.

Here is how it looks like:

In this case, the trade has both stop-loss and take-profit, but there might be a situation where it has either stop-loss or take-profit only.

Identification of trades like this can help in the selection of the right profit target levels or closing a trade if it goes wrong. At the worst, we can try to copy this smart trade if the price hasn’t gone too far.

Note that the signal generated by a smart trade is contrary to the basic signals provided by the order book. So, if you don’t notice the smart trade in time, you may enter the market and set your profit target at the level where stop-loss of the smart trade is set. You have to understand that your trade will come to a bad end.

Such trades appear not often in the whole and you shouldn’t use them as the only basis for your strategy. However, it’s essential that you know that they exist.

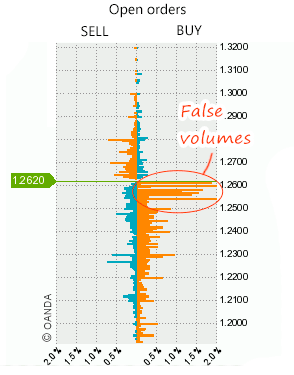

In addition to the smart trades, one can see injections of false volumes. They are similar in their essence: it seems to you that there are many Limit orders at the level but you’re being fooled indeed and the price will not response to them properly.

The injections are identified based on the same principle as a false trade: there are absolutely no volumes at first and then there are large volumes. Besides, the volumes might disappear and appear again later and cannot be found on a particular level only.

Example of the false volumes:

You can see the injections on less liquid pairs more often.

False volumes need to be ignored when analyzing the order book.

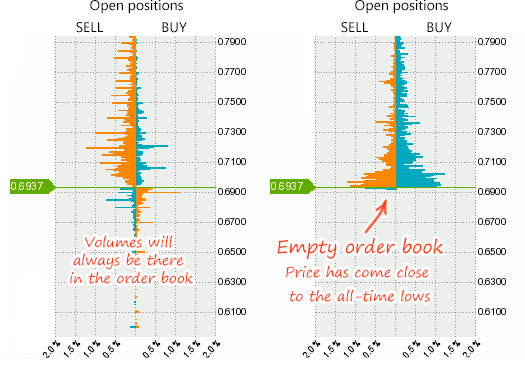

No Volumes (Emptiness) at the End of the Order Book

It so happens that price approaches the order book’s boundaries where there are already no open trades and very little open orders.

It usually indicates either a continued trend or a strong impulse.

Don’t be scared about such situations: price tends to break out all-time lows.

What should you do in these situations? — The answer is not to pick pullbacks but trade with a trend (in the direction of emptiness).

There is nothing unusual about it in the whole. We have mentioned it so that you’ll no longer think like that: "Oh, I can see the end of the order book, so it’s gonna be a reversal now".

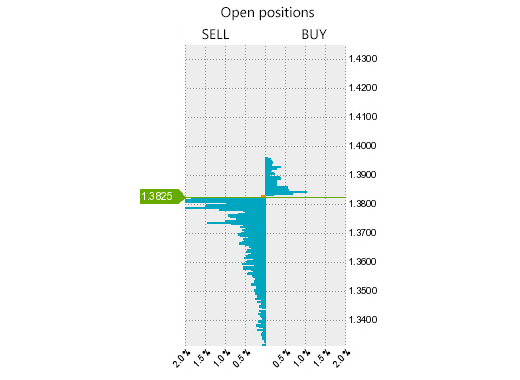

Why the Net Value of the Right-Side Order Book is Always Losing

The right-side order book is always losing indeed if we withdraw the net value.

The explanation lies in a behavioral regularity: traders tend to close profitable trades faster than losing ones. Just try to remember how fast you want to close a profitable trade and how long you hold a losing one.

What good will it do to us?

These accumulations of losing traders serve as a fuel required for future price movement. If the price moves against them, they will have to close their trades thereby pushing the price even more.

Market-maker usually takes advantage of such situations. It buys at the start of the movement and then losing traders help it to extend its profit.

Basic Mistakes in Trading With the Order Book:

Most newbie traders make typical mistakes including those committed while trading by the order book.

Below are the basic mistakes:

- Comprehensive analysis. Many people forget that an order book is a complex tool and begin to make trading decisions according to a single signal only. For example, you have seen that there is a nice accumulation of losing trades and decide to take advantage of it but at that, you haven’t noticed an accumulation (contradictory to the first one) of Stop orders in the left order book. Conclusion: look at both order books and check all signals.

- "Seeing things that aren't there". It will become especially popular after reading this guide. You will begin looking into the order book in search of something described above. The given mistake is usually fixed by the time.

- "Price must do it!" The price owes no one anything. Even if the order book tells you to Sell, it doesn’t mean at all that the price will certainly move downward. If you remember, in this article we set the framework of efficiency for various regularities. Well, it’s not worth expecting more than 55-60% efficiency from the signals sent by the order book. Of course, it might be higher than the figure but you must "hope for the best and have a plan for the worst".

- Emotions and lack of experience. If you proceed to trading by the order book on a real account immediately, you will be overwhelmed by your emotions and not be able to monitor the order book properly. Just wait a little and in the meanwhile make trades on a cent account.

Honestly speaking, we doubt if you manage to avoid these mistakes. However, if you’re aware of them, you already know what mistakes you must punish yourself for. "Forewarned is forearmed".

That’s all we wanted to tell you in this article. Keep money management in mind!

Next part of the guide.