TOP 10 Currency Pairs for Carry Trade in 2026

In this article, we will talk about the best-suited currency pairs for the carry trade strategy.

Update. In 2023 there is practically no carry trade opportunities on major currency pairs. Why? Read our new article – The FX Carry Trade in 2023.

If you are familiar with carry trade, you can skip the next paragraph and go directly to:

- Rating of currency pairs for carry trade strategy.

- How to choose a currency pair for carry trade on your own.

Carry trade is a conditionally win-win strategy, which basic principle is not a technical analysis of currency pairs, but using the difference between the interest rates of central banks to make money. In other words, carry trade is focused on profiting from a swap (carrying a position to the next trading day), which size, as you know, depends on the difference between bank interest rates.

The currency pair chosen for this strategy must meet two conditions:

- have a positive swap;

- be trending in the “right direction” (it refers to the trend having the same direction as a trade opened with the carry trade strategy).

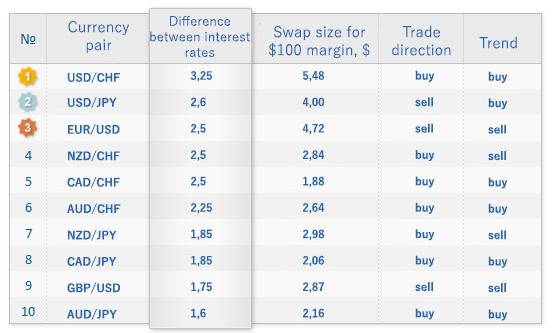

Rating of Currency Pairs for Carry Trade in 2023

The following table shows our analysis of the maximum difference between interest rates (potential swap size) and a trend for each currency pair. Here you can see the list of currency pairs with positive swap. This will help us to identify the best pairs for carry trade in 2023:

Comments:

- USD/CHF has the largest swap size that makes it the most attractive pair for carry traders. Speaking about a trend, the negative interest rate on Swiss franc will further boost this currency pair.

- Margin is important for carry trade, because we just have to take into account the maximum movement against our position. This is why the table presents the swap size for every $100 margin. We consider it one of the basic parameters for the given strategy. By the way, brokers usually indicate the swap size based on the lot size, but it may merely confuse us in this case.

- Please note that AUD/JPY, which has always been widely regarded as the best pair for carry trade, now ranks last. If you google the word “AUD/JPY”, you’ll see that most sources still recommend it as the best pair for this strategy. That’s why it makes sense to figure out how to choose the best pair for carry trade.

How to Choose the Best Currency Pair for Carry Trade

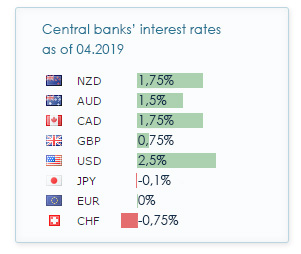

Let's look at the current bank interest rates:

Choosing the best currency pair for carry trade is a three-step process:

- Find the maximum difference between interest rates. In this case, it’s calculated as follows: USD(2.50%) – CHF(-0.75%) = 3.25%. Accordingly, the best potential pair (we don’t necessarily have to choose it) is USD/CHF.

- Determine a trade direction by the following principle: we should buy a currency with a higher interest rate for other currency with a lower interest rate. Accordingly, we need to buy USD/CHF. Note that it’s the other way around for GBP/USD.

- Next, we need to look at the chart, read the news and the forecasts for this pair, and identify the trend. If the trend doesn’t coincide with a trade direction, we consider the next potential pair.

The list of currencies for a successful Carry Trade is constantly decreasing.

In conclusion, we want to ask our readers a question: Have you ever applied this strategy in practice? What were the results?