The FX Carry Trade in 2023 - Dead or Alive?

Forex traders are now asking whether carry trading in 2023 remains a viable trading strategy, or if we should consign it to history.

In an FX carry trade, you’re seeking to profit from a difference in interest rates between the two currencies within a Forex pair.

This difference is what's known as an interest rate differential and, under the right conditions, can be highly profitable.

After holding a position overnight, currency carry trading allows you to capture the difference between rates via swaps paid into your account by your Forex broker.

But with central banks from the US, Europe and even the Asia Pacific committed to keeping interest rates at or near zero for the foreseeable future, finding variations in rates has become a lot harder.

The list of currencies for a successful Carry Trade is constantly decreasing.

Optimal Conditions for FX Carry Trading

The optimal conditions for FX carry trading, features a central bank in the midst of an aggressive rate hiking cycle.

Ideally at the very least, they’d be providing forward guidance on policy that suggests rates will likely be rising in the near to medium term.

In the midst of a global pandemic with no end in sight to the global recession we currently find ourselves in, these conditions certainly aren’t present in 2023.

Alongside a rate hiking cycle, currency carry trades are most effective during times of low volatility.

As long as the currency pair you’re trading doesn’t wildly move against you, the FX carry trade will remain profitable.

During the early 2000s, we saw a perfect combination of these conditions across numerous Forex currency pairs, exploited most popularly in AUD/JPY.

The Aussie dollar has historically yielded higher interest rates than other global currencies. Demand for yen on the other hand, has always been boosted by low interest rates, firmly etching its place as a safe-haven asset.

This particular FX carry trade involved going long AUD/JPY. You were essentially borrowing the yen at rock bottom interest rates, to fund your long in the high-yielding Aussie dollar.

But now we’ve reached 2023, you no longer can simply identify the best Forex pairs to carry trade such as AUD/JPY and take a position.

It just doesn’t work like that anymore.

The 2023 Central Bank Scoreboard

With central banks racing to the bottom throughout the 2010s, this global COVID-19 pandemic could not have hit at a worse time for central banks.

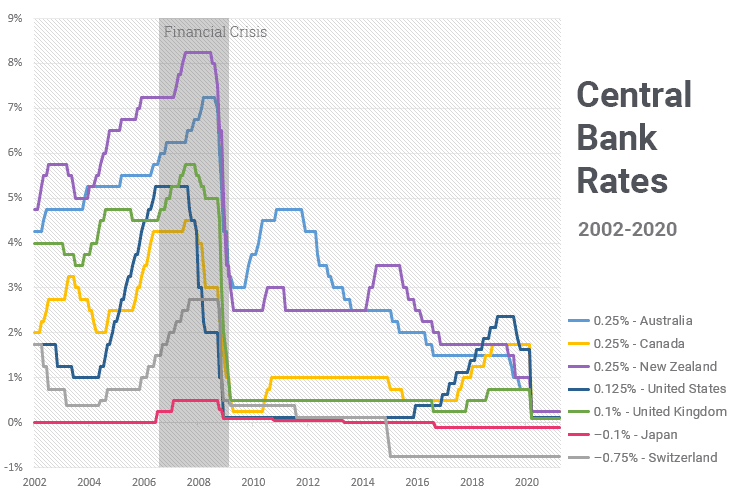

The global economy never fully recovered from the GFC and as you can see on the chart below, central banks in 2023 are no longer racing to the bottom…

| Country | Central Bank | Current Rate |

|---|---|---|

|

Swiss National Bank | -0.75% |

|

Bank of Japan | -0.10% |

|

Federal Reserve | 0.00%-0.25% |

|

European Central Bank | 0.00% |

|

Bank of England | 0.10% |

|

Reserve Bank of Australia | 0.10% |

|

Bank of Canada | 0.25% |

|

Reserve Bank of New Zealand | 0.25% |

|

Central Bank of Brazil | 2.00% |

|

Reserve Bank of India | 4.00% |

|

Reserve Bank of Russian Federation | 4.25% |

|

People's Bank of China | 4.35% |

…They’ve well and truly bottomed out.

Even the traditionally conservative central banks such as the Reserve Bank of Australia or the Reserve Bank of New Zealand, have bottomed out at, or near zero.

Take a look at how this is displayed on a comparison chart, featuring some of the most popular Forex currency pairs’ bank rates.

This is the perfect visual representation of why an FX carry trade in 2021 is harder to exploit than ever.

Just compare the difference in rates between the UK and Japan from the year 2000 and then to where we are 2 decades later in 2020.

The difference is chalk and cheese.

But did you notice that we said that FX carry trading isn’t dead? Just that it’s harder than ever.

There are certainly currency carry trade opportunities present within the Forex market, they just require you to think outside the square of the traditional Forex majors.

Currency Carry Trading Strategies in 2023 – Enter the Exotics

With central banks behind the Forex majors having slashed overnight bank rates and rollovers to all but zero, they’ve been taken out of currency carry trade consideration.

What this has done however, is opened opportunities for certain exotic currency pairs who’s issuing central banks have not been as aggressively dovish.

If you’re looking for pairs to implement into your FX carry trading strategy, then the exotics offered by your forex broker are worth a look.

Exotics such as the South African rand, the Mexican peso and Brazilian real are all options that most reputable Forex brokers offer, with currency pairs featuring USD, EUR and even JPY variations.

These currencies are all supported by some of the highest rates among developing countries and are worth a look.

However, there is a catch that makes implementing these pairs into your 2023 carry trading strategy, extremely difficult.

Exotic currency pairs are notoriously volatile.

Remember above when we spoke about the optimal conditions for FX carry trading and highlighted low volatility being optimal?

By their very nature, the exotics are much more volatile than their major counterparts. This means that even by trading a low risk strategy in the direction of the daily trend, you can easily be whipsawed into taking losses due to volatility.

Most Forex brokers will also charge their clients more to trade exotic currency pairs. From a broker’s point of view, their volatility and unpredictability puts pressure on their own risk management practices and they place a larger premium on spreads as a result.

We can’t stress enough that you need to trade with extreme caution if you’re implementing the exotics into your own carry trading strategy.

Final Thoughts on the FX Carry Trade in 2023

While this is going to vary from broker to broker, finding currency pairs with positive swap is going to be your biggest roadblock.

If you’re an FX carry trader, then choosing an ECN forex broker with a large selection of tradable pairs that you’re able to take advantage of is key.

A simple trick for sourcing suitable MT4 Forex brokers is to download their demo platform and follow these simple steps:

- Select view from the top menu.

- Right click on Market Watch and select Symbols.

- Pick an exotic currency pair and select Properties.

If you see a positive swap on that particular currency pair, then it could potentially still be used in your carry trading 2023 strategy.