How to Trade the 1-2-3 Reversal and the Ross Hook Patterns

Trend reversal traders often need two main tools in their trading. The first one is the ability to recognize potential trend reversals. Without doing this, they would miss out on reversals a lot.

Another crucial ingredient trend reversals can't do without is strategies to trade the trend reversals.

As a result, forex patterns have been derived to simplify the processes of reversal spotting and reversal trading. Two of such patterns are the 1-2-3 reversal pattern and the Ross Hook pattern.

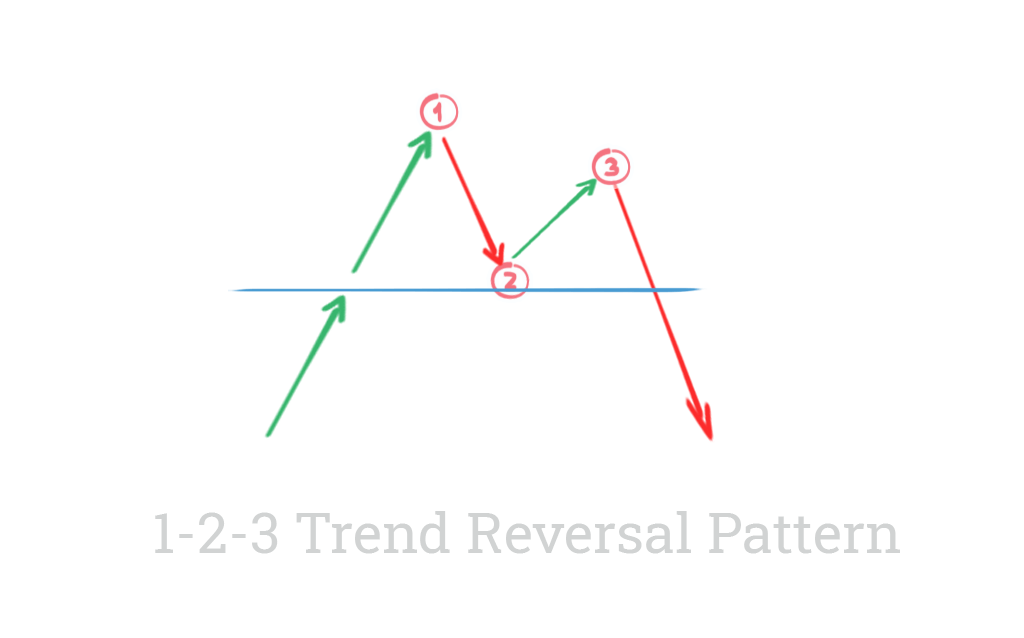

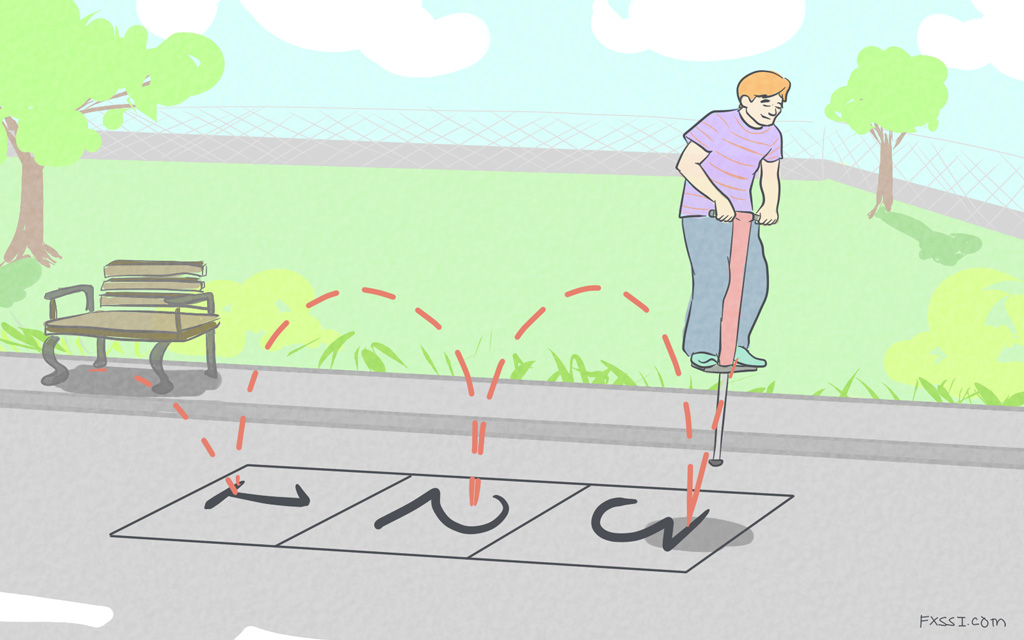

The 1-2-3 Reversal Pattern

The 1-2-3 pattern can be used to trade reversals on the forex charts. The pattern signals the end of a major trend and looks to catch trades on the reversal into a new trend.

Just as it is with any other pattern, you would first need to know how to identify it before you can make any trades using it.

The 1-2-3 reversal pattern forms in three steps. Before we take a deep dive into the steps, recall that the 1-2-3 pattern is used to trade trend reversals.

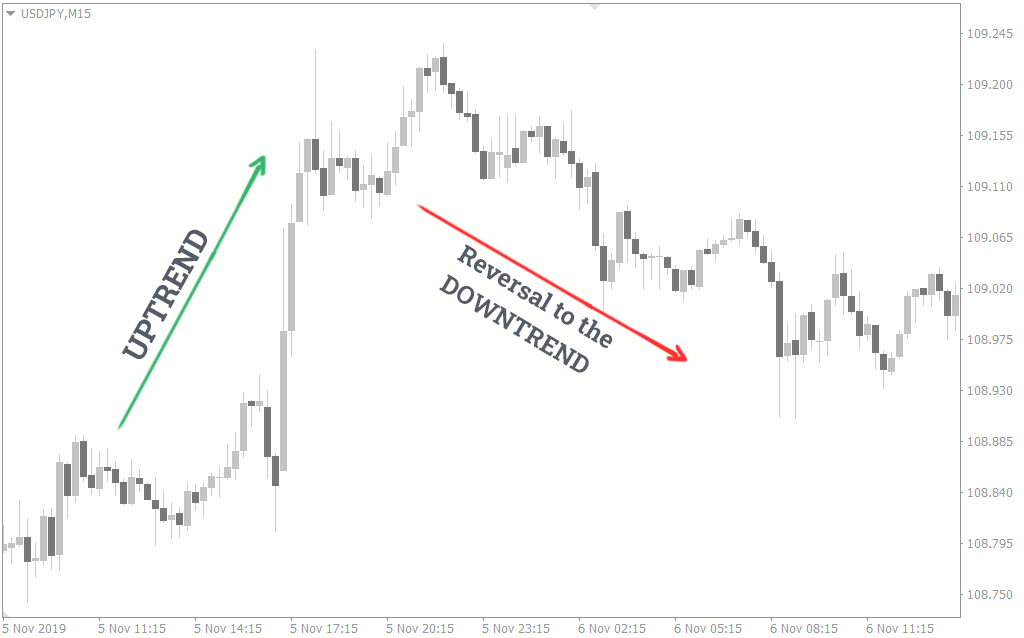

So, if the market is currently in a downtrend, you would look to trade a reversal to the uptrend with the 1-2-3 pattern. Conversely, if the market is in an uptrend, you would be on the lookout for a trend reversal to the downtrend.

How to recognize the 1-2-3 reversal pattern on forex chart

The first thing is to look for major trends. Typically, the stronger the trend, the bigger the reversal would be.

Although you can still use the 1-2-3 pattern on smaller trends, there are more fakeouts on these smaller trends and the reversals are usually not big enough to make a lot of profit.

We will use the 1-2-3 High (a reversal to the downtrend from an uptrend) to explain the basics of the 1-2-3 pattern. Is that anything that works for an uptrend will work for a downtrend in forex if you flip it on its head. But we’ll still mention some 1-2-3 Low scenarios (a reversal to the uptrend from the downtrend).

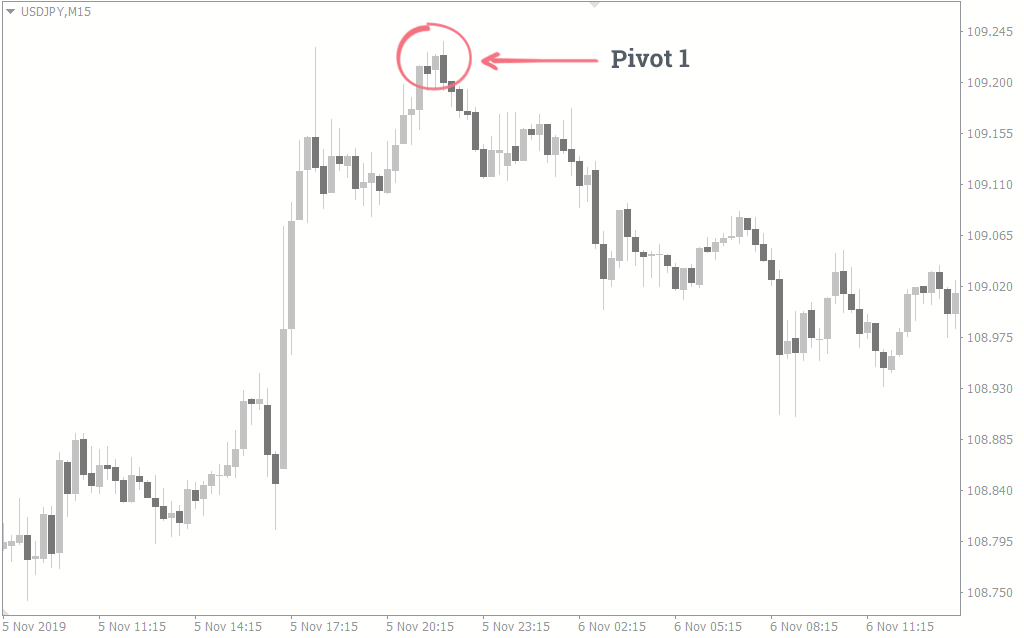

The first pivot

You need to identify the highest point of the strong trend. The retracement from this point is your Pivot 1.

A way to recognize the highest point is by drawing a support trend line beneath the trend. The highest point before the market breaks the support trend line is your first pivot.

Make sure the trend line is following prices reasonably close enough, but not too closely. If the trend line is too close to the price, you may get faked out often. And if your trend line is not drawn tight enough, you may miss out of the several opportunities. A rule of thumb is to use the recent two or three support levels to draw your trend line.

Of course, this doesn’t work all the time. But it would help many beginners recognize many trend peaks.

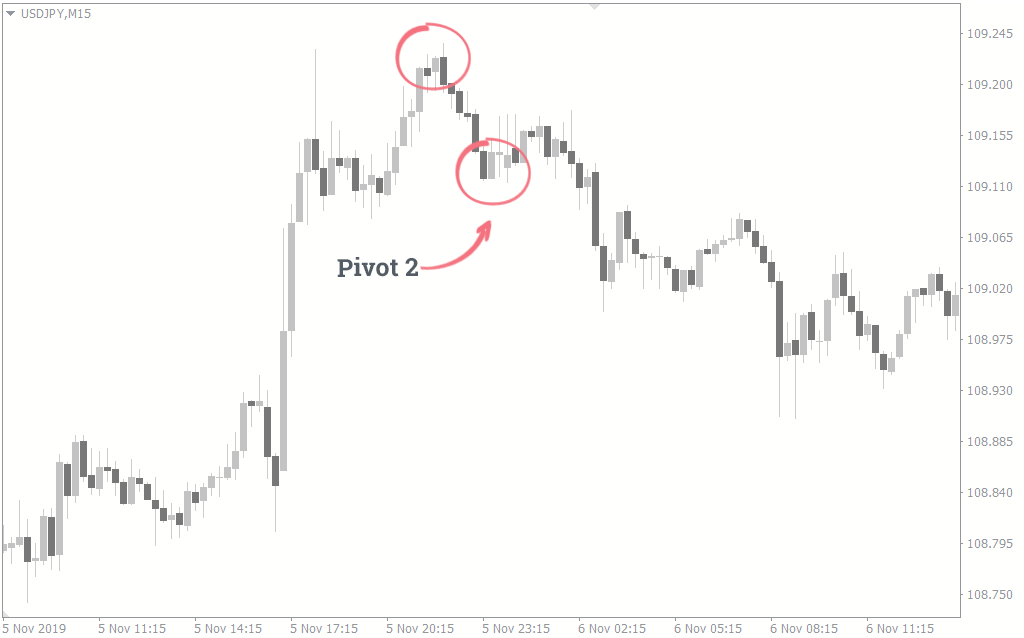

The second pivot

The second pivot in an uptrending market is the lowest point after the retracement from Pivot 1. It is the point where the market hits a support level and goes back uptrend.

Sometimes, Pivot 2 occurs on the same level as the previous low. Other times, it forms beneath the low. And in some cases, the retracement occurs even before the price reaches the level so the previous low. Whichever way, this second retracement is your Pivot 2.

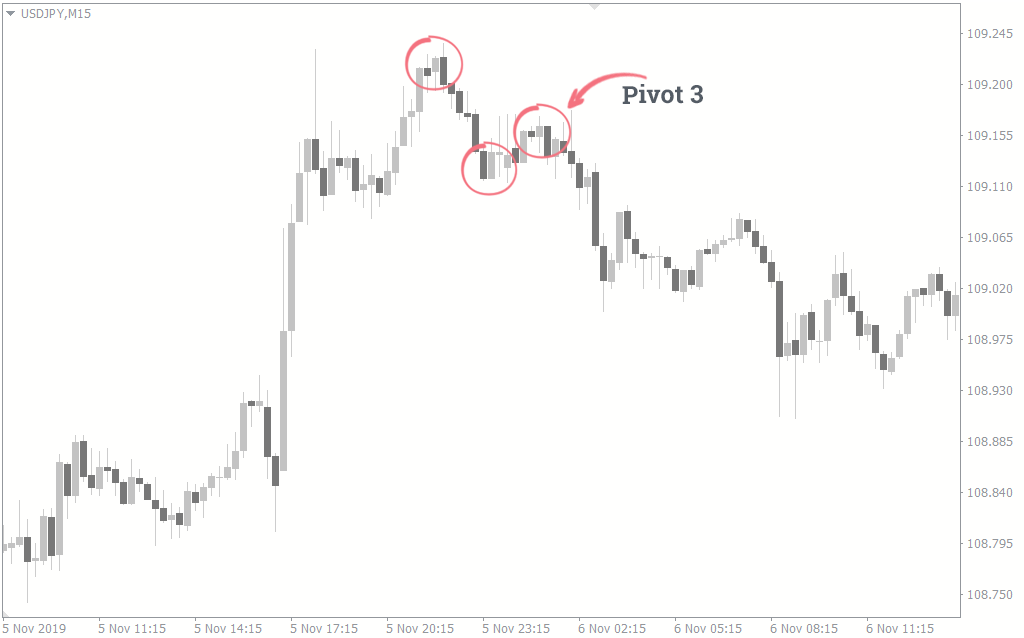

The third pivot

The third pivot is the final retracement in the downtrend direction. After the price goes through Pivot 2 and behaves like it's going back uptrend for a while, it makes a U-turn somewhere in between Pivot 1 and Pivot 2 back to the downtrend.

This pivot must be in between your first and second pivot. Otherwise, it is no longer a 1-2-3 pattern.

Those three pivots make up the 1-2-3 high reversal pattern. For 1-2-3 low, it's all about flipping the pivots on their heads. For instance, you look for a strong downtrend and wait to see a retracement from the lowest point of the trend. The retracement from that point gives you your Pivot 1.

The retracement from the short uptrend is your Pivot 2. Your Pivot 3 forms in between Pivot 1 and Pivot 2, when the market temporarily returns to the downtrend before making a final U-turn to the uptrend.

You will find this pattern forming on your chart on any forex timeframe you use. However, it is best to stick with the 15 minutes chart and higher if you are a beginner or an intermediate user of the 1-2-3 reversal pattern. Lower time frames tend to spiral out of control.

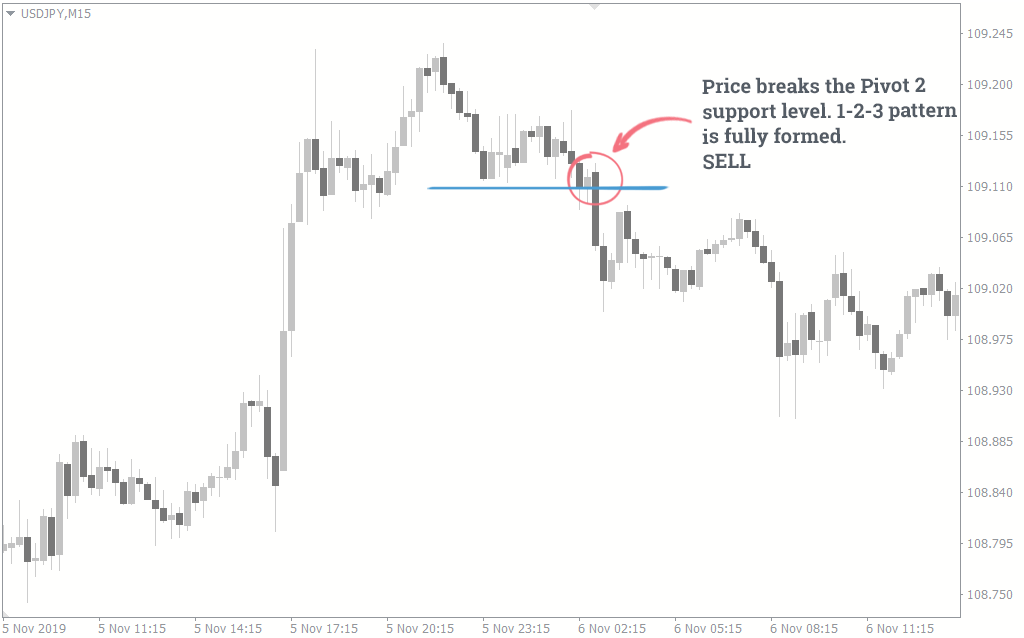

Trade Entry

After the 1-2-3 reversal pattern has formed, your entry point is where the price breaks the level of your Pivot 2. In a 1-2-3 High, the price breaks the support level of the second pivot and makes a dash for the downtrend.

It is important to wait for the 1-2-3 pattern to form completely, and that price breaks the support of the second pivot before you make any entry. If you only wait for the pattern to form but not the support break before making an entry, the market may hit the support and go back up.

There is often a second entry point in case you missed the first. Sometimes, price makes a retracement after breaking the second pivot. This retracement is your second entry. Although the retracement doesn’t happen every time, it happens frequently enough that it is worth waiting for. There is a name for this retracement, and you’ll soon find out what it is.

Stop loss

Typically, your stop loss should be anywhere within the third pivot to the first. Often, this stop loss level is enough to give the market some breathing space. However, one thing to consider is the risk to reward ratio the stop loss level is offering. If you think the risk is bigger than you are willing to take, ignore the trade. Another opportunity will come.

You can also use the StopLossClusters indicator to set your stop loss.

Take Profit

There are many ways to choose a take profit level. One of them is to use your risk to reward ratio. Another way is to wait for price to reach notable support or resistance levels and take profit from there. The StopLossClusters indicator are also great for choosing take profit levels. And of course, you could always ride the reversal to the end if you know how to.

Last note on the 1-2-3 Reversal pattern

There are some things you should be mindful of when using the reversal pattern.

You don’t always have to wait for the pattern to form out cleanly on the charts before you trade it. Many times, the pattern would not form as cleanly as they are in the examples above. It then comes down to your level of experience and how good you are at spotting the pattern before you can trade its subtle formations.

Finally, if you find yourself missing out of trades from the 1-2-3 reversal pattern, there is yet hope for you. There is a strategy that can help you secure some pips after you miss your entry on the 1-2-3 reversal pattern. It’s the Ross Hook pattern.

The Ross Hook Forex Trading pattern

The Ross Hook pattern is very similar to the 1-2-3 reversal pattern, and it only shows up after the reversal pattern. It does not matter if the 1-2-3 reversal is bullish or bearish, the Ross Hook pattern often follows it.

On the 1-2-3 High, the Ross Hook pattern appears after the 1-2-3 pattern on the new reversal downtrend that forms. And on the 1-2-3 Low, the Ross Hook pattern forms after the 1-2-3 pattern on the new reversal uptrend that forms.

Recognizing The Ross Hook Pattern Formation

As you will soon see the Ross Hook pattern derives its name from looking like a hook. Here is how it forms.

Ross Hook pattern to buy

The Ross Hook pattern to buy comes after a 1-2-3 Low, that is, when the market is making a reversal from the downtrend to an uptrend.

After the price breaks the Pivot 2 level of the 1-2-3 pattern, it forms a new high. And after a new high is formed, price makes a retracement back down. For a valid Ross Hook pattern, this retracement is usually above the Pivot 3 of the 1-2-3 pattern.

From this temporary retracement, price makes a U-turn to continue its uptrend movement to form the shape of a hook.

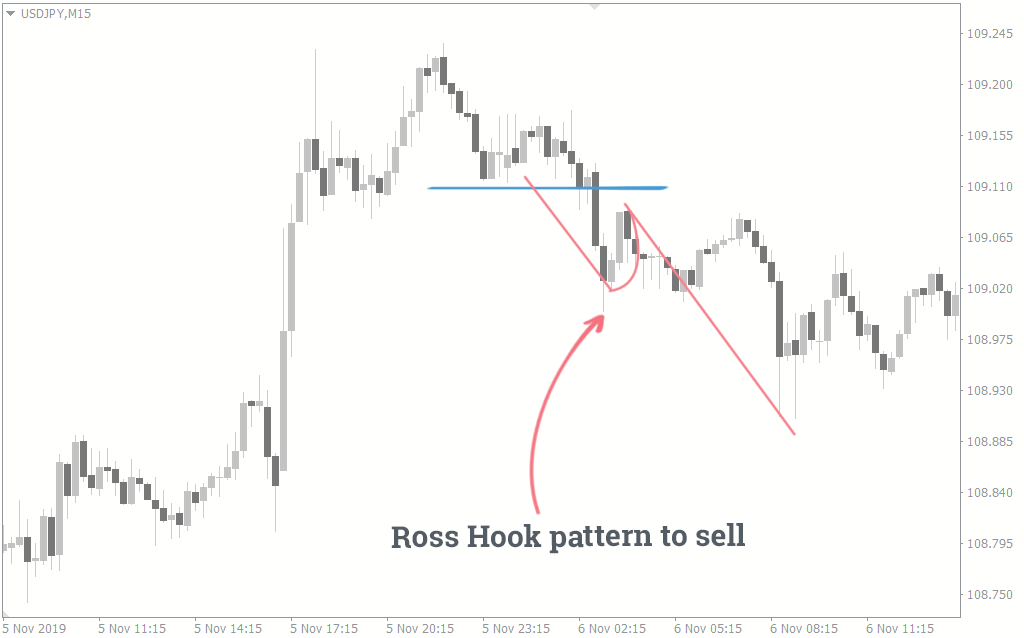

Ross Hook pattern to sell

The Ross Hook pattern to sell comes after the 1-2-3 high. In other words, it comes after the market makes a reversal from the uptrend to the downtrend. Don't forget that the reversal must be confirmed by the 1-2-3 pattern before it can be called a Ross Hook pattern.

Price forms a new low after it breaks the Pivot 2 support level of the 1-2-3 pattern. Soon after forming the new low, it makes a temporary retracement to the uptrend. In an ideal Ross Hook pattern, this retracement must not go past the pivot 3 of the 1-2-3 pattern.

From anywhere between the Pivot 3 of the 1-2-3 pattern and the recent low, price makes a U-turn to continue its downtrend movement. It then forms the shape of a hook. This is how the Ross Hook pattern to sell forms.

Trading With The Ross Hook Pattern

Just as it is with any forex pattern, it is not enough to be able to recognize the patterns. You also need to know how to make entries and manage the trade. Here's the Ross Hook trading strategy.

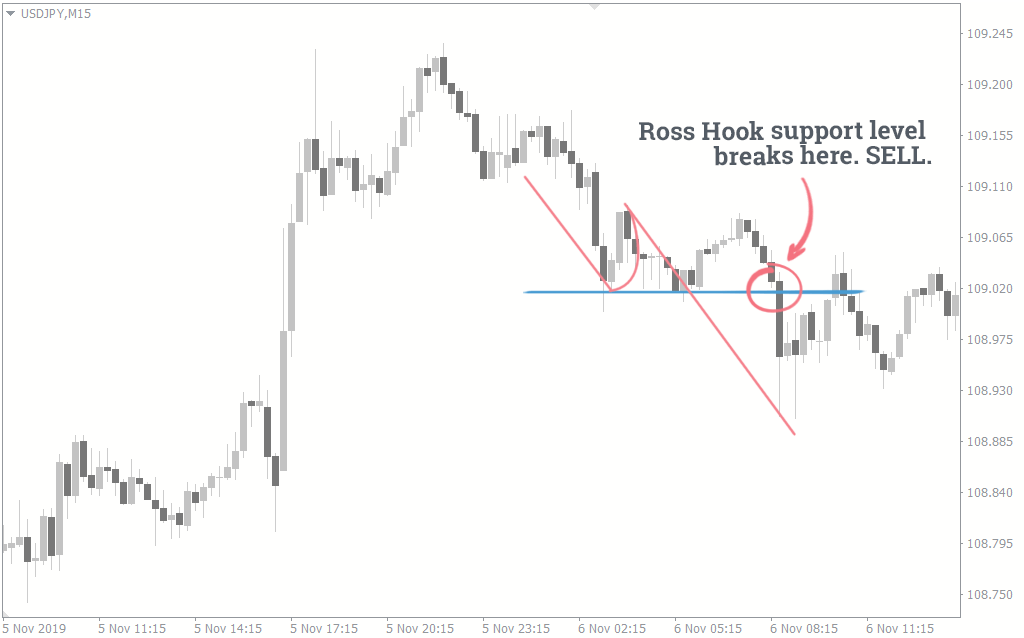

Trade entries with the Ross Hook pattern

Entries come on the Ross Hook pattern when price breaks the latest high of the Hook in an uptrend or the most recent low in the Hook in a downtrend.

In many cases, the Ross Hook pattern keeps duplicating itself through the new trend. As a result, you can also use it to trade trend continuations after a reversal. And at each point, the entry is always when the price breaks the recent low (in a downtrend) or the recent high (in an uptrend).

To make things easier for you, you can automate the trade entry by placing a pending order to buy or sell when the price breaks your hook.

Setting stop losses with the Ross Hook pattern

There are many ways to set your stop loss when you are looking to make a trade entry with this pattern. The most common way is to set your stop loss above the recent high in the case of a downtrend. And for an uptrend, the stop loss should always be underneath the most recent low.

Setting take profits with the Ross Hook pattern

The first and most conservative way to set your take profit is to measure the price distance from Pivot 3 of the 1-2-3 pattern and the Hook of the Ross Hook pattern. The number of pips from the measurement should be your take profit.

Another reliable take profit method is to look for previous support or resistance levels that price has respected in the past and take your profits at these levels.

And if you want to ride the trend till it's over, you can set trailing stops to follow the price. However, you have to be careful when setting a trailing stop. Don't set your trailing stop too tight or too loose.

A StopLossClusters indicator can also be used to set the take profit level if you are trading the Ross Hook pattern.

Also, if the first Ross Hook after the 1-2-3 pattern is far away, do not take that trade. The Ross Hook pattern works best when it is close to the 1-2-3 pattern.

The 1-2-3 reversal and Ross Hook patterns may not be very easy to spot on the forex chart. However, you can get better at identifying them by constant practice.