How to Trade Bull Traps and Bear Traps in Forex

Have you ever seen the market bounce hard off a key level, but the trend is still overwhelmingly against the bounce?

Known as bull or bear traps, depending on the direction of the prevailing trend, trading these patterns is certainly no easy task.

These false reversal patterns are obvious in hindsight, but in the heat of the moment, sucker rallies and dead cat bounces can catch even the best traders off guard.

On the flip side, traders who do manage to trade these patterns effectively snag high probability entries with impressive reward profiles.

Note this article is aimed at teaching you how to trade bull and bear traps.

If you’re still not sure what a bull or bear trap is, you should check-out our what are bull and bear traps in trading article, before continuing.

How to trade bull traps and bear traps in forex: the trend is your friend

Like most things in forex, trading bull and bear traps effectively is actually frustratingly simple.

Essentially it boils down to two cliches:

- “Picking bottoms/tops is not a good idea”.

- “The trend is your friend.”

In other words, if you assume every countertrend bounce or decline is a corrective trap, you will never get caught on the wrong side of one and may even catch some really nice trend trades while you’re at it.

Fighting FOMO, or fear of missing out, is of course one of your toughest jobs as a trader.

But the reality is, the market generally moves a lot slower than we expect it to and aggressive V shaped reversals are the exception in forex rather than the rule.

Although legitimate reversals are usually aggressive in their initial stages, more often than not, momentum cools off and price comes back to a key level, providing the perfect entry opportunity for a patient trader.

Once you accept this reality and start trading trends and reversals accordingly, both your trend and counter-trend trading will improve.

How to trade bull traps in forex

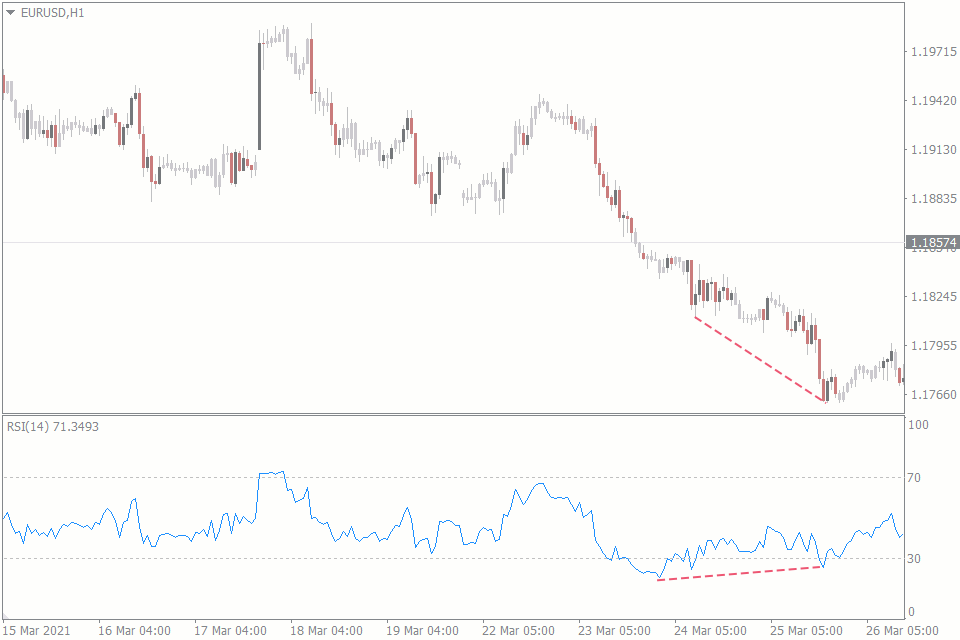

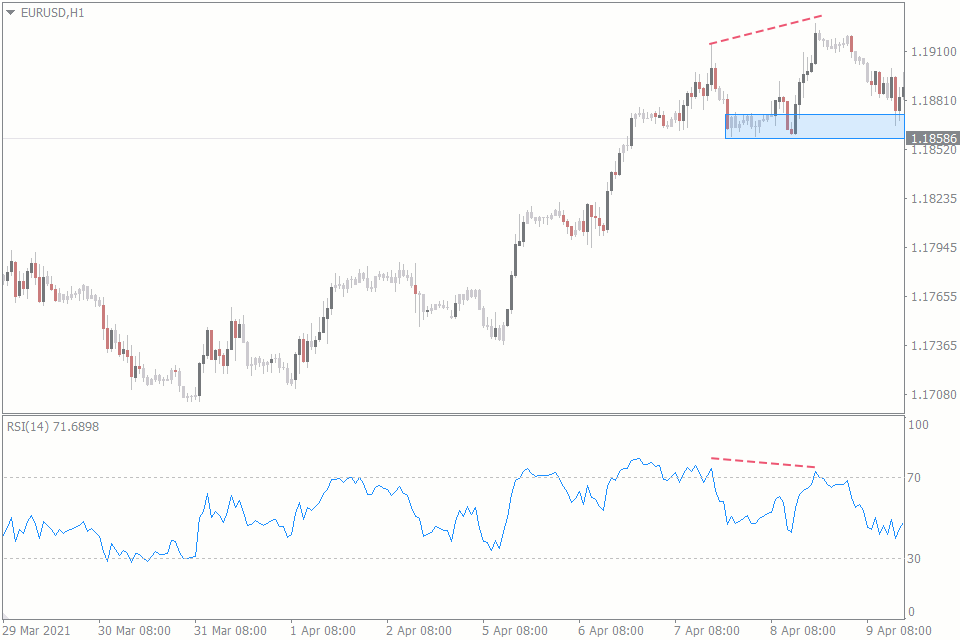

Let’s put the above into practice and take a look at a bull trap on EURUSD:

This is an interesting example as we have two reasons to buy here:

- RSI divergence.

- A bullish piercing line reversal candle marked by the blue X.

We have used an X as we will be ignoring these two bullish signals, we will not be taking this entry – the trend is our friend and the trend is down.

We can assume some profit taking and counter-trend trading will take place based on these buy signals, but absent some fundamental driver which forces a change in market structure, this activity is likely to fizzle out with the trend continuing lower.

As such, we will be treating any apparent strength as a bull trap and selling opportunity.

We chart the former support zone where any sucker’s rally is likely to fail and wait patiently to see how price reacts.

If this zone is breached and the market then carves a higher low above it, the market structure has changed and we are likely looking at a legitimate reversal.

If however, the market becomes exhausted here, our suspicions have been confirmed and we are likely looking at a bull trap and a great chance to sell.

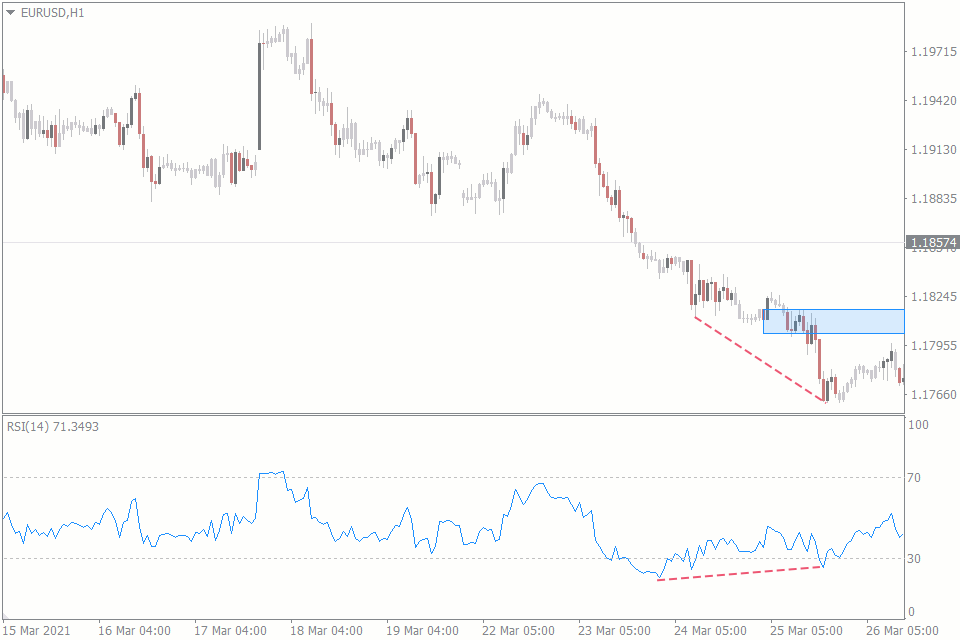

Dip buying and profit taking push the Euro higher over the coming sessions as expected, but there is not enough buying pressure to force a change in market structure.

Price and RSI begin to turn lower from our former support zone and we enter short in the direction of the prevailing trend, capturing a 100 pip down continuation move over the coming sessions.

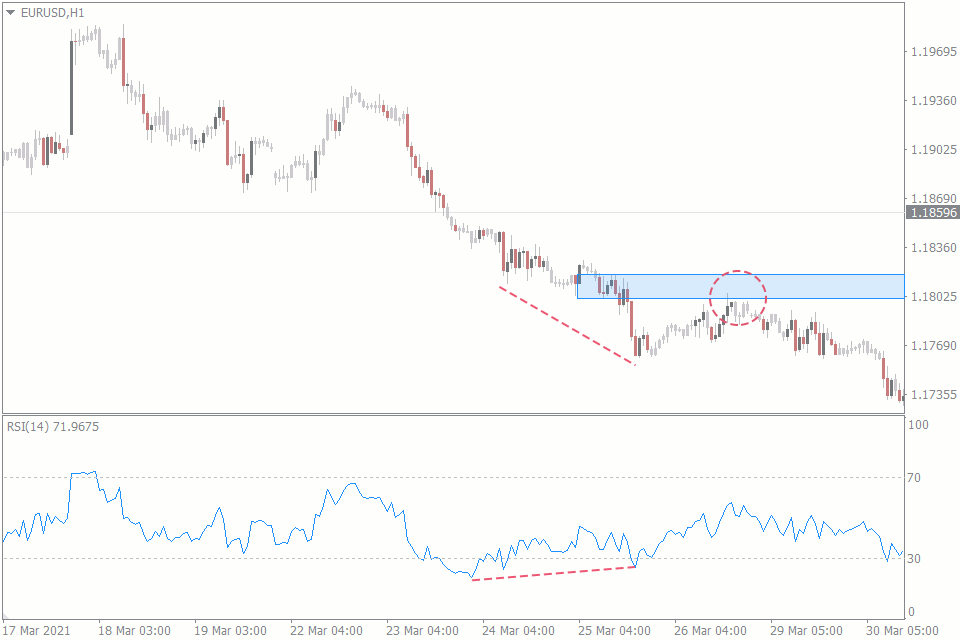

Strategy: how to trade bear traps in forex

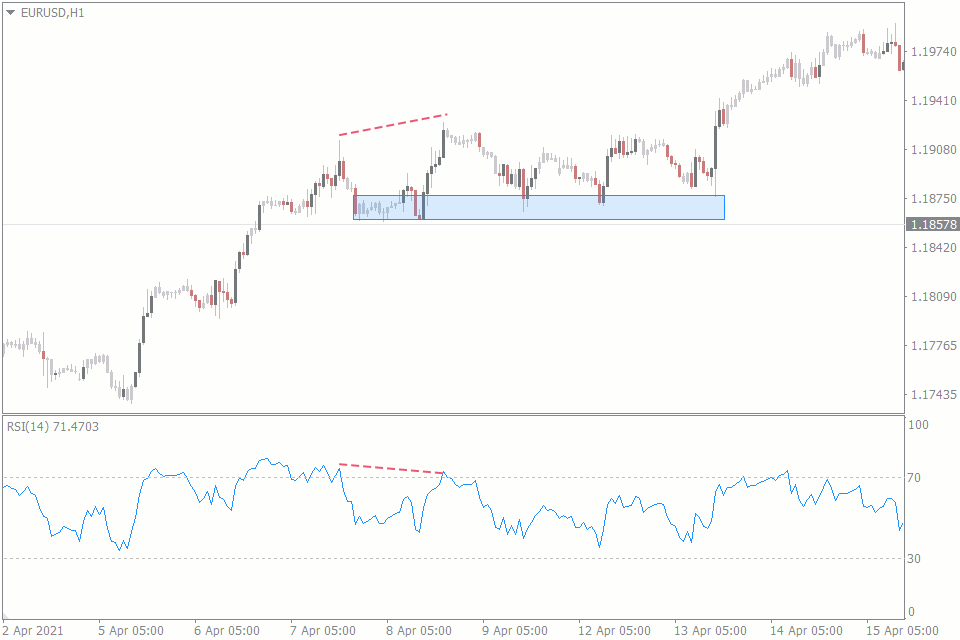

The market has changed structure and is now trending higher.

Let’s take a look at a bear trap that occurred which no doubt suckered in a lot of sellers:

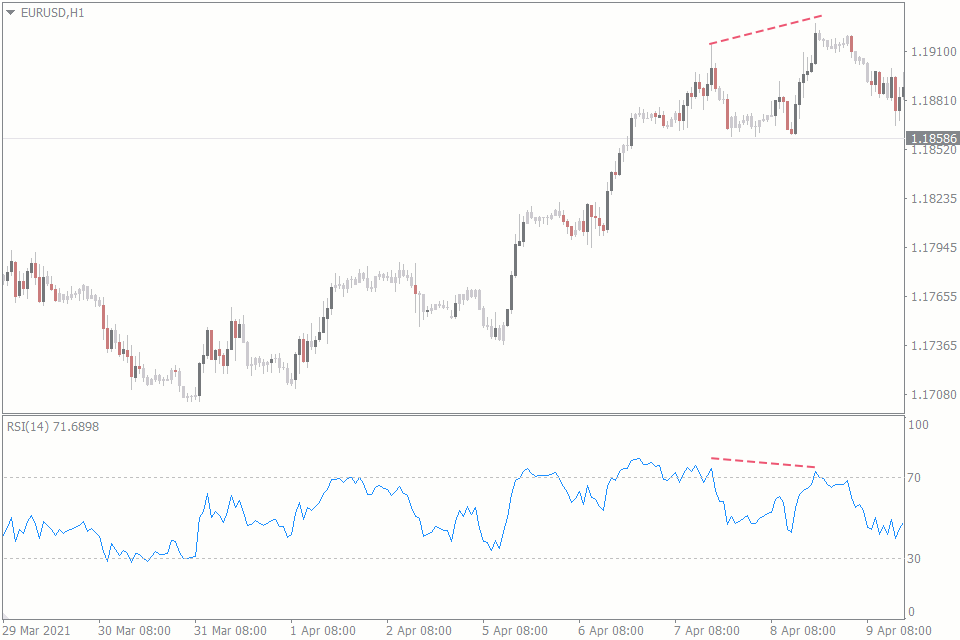

Once again we have a strong trend with RSI telling a very different story of exhaustion.

Although we don’t have a clear topping candle this time, the lower high marked by the X is a clear sign of at least a temporary top and this is undoubtedly a tempting sell.

We have to repeat our friendly trend mantra a couple of times here, but overcome our worst instincts and decide any sell off is likely to be temporary and a great buying opportunity in line with the trend.

Once again we identify a key zone which defines the market structure and watch to see how the market reacts – if price breaches our zone and puts in a lower high below it we know we have underestimated selling pressure and will need to adapt accordingly.

Not to worry – price respects and reacts out of our zone and we enter a long position in line with the trend, capturing a 150 pip continuation move.

Back to our earlier point of the market usually moving slower than we expect it to and generally providing plenty of opportunities for entry – note that if we’d missed that first reaction, the market is kind enough to offer two more opportunities from our zone before the trend eventually continues.

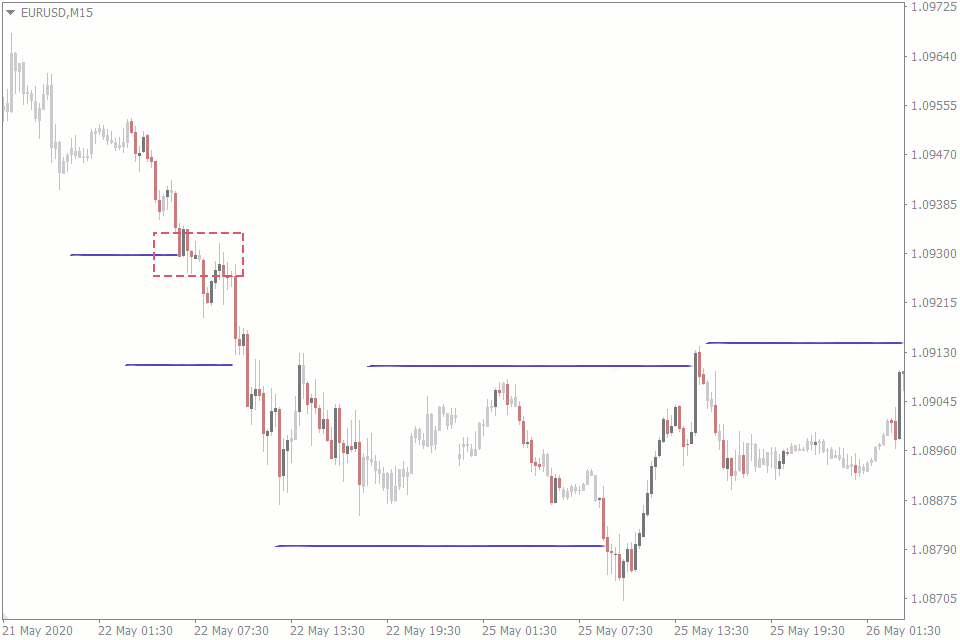

Trading bull traps and bear traps with the Stop Loss Clusters indicator

FXSSI’s proprietary Stop Loss Clusters indicator can be very useful when trading bull and bear traps.

This indicator shows you exactly where in the market other traders have placed their stops and these levels tend to act like a magnet, dragging or pulling price towards them with amazing consistency.

If you spot a counter-trend bounce with a stop loss cluster sitting just below, there’s a good chance you’re looking at a bull trap and you should consider getting short.

Conversely, if the market is an uptrend, but turns lower leaving a stop loss cluster up above, you’re likely looking at a bear trap and should be looking to get long.

Final thoughts on trading bull and bear traps

While trading bull and bear traps is never easy, they can be frustratingly obvious in hindsight.

With the knowledge gained from this guide, you can avoid being caught out by bull and bear traps and hopefully even make money from these setups.

Often with some of the best risk:reward ratios on offer anywhere in the market.