CFD: Definition and Advantages

Probably every trader came across the abbreviation of CFD, at least once.

However, if you ask traders what this means, the answer in most cases will be something like this: “It’s a kind of Forex, but only for stocks.”

In principle, it’s close to the truth, but there are some nuances. We’re going to talk about them in this article. First, let's look at the CFD meaning.

What exactly is CFD?

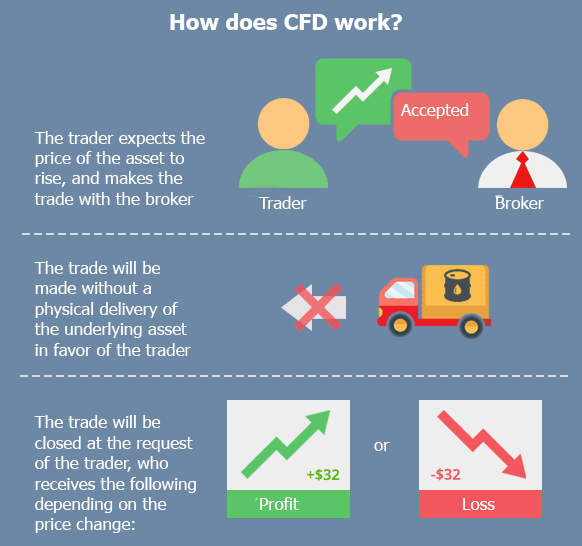

CFD (short for Contract For Difference) is a kind of a contract between a buyer (usually a trader) and a seller (broker) that stipulates that one party will pay the difference between the current value of an asset and its value at contract time to another party. The party obliged to pay is determined by comparing the direction of the actual price movement with that agreed in the contract.

According to the definition, it can be assumed that the contract for difference (CFD) is used mainly for making a speculative profit, as well as for hedging.

CFD refers to derivative financial instruments. This means that its main purpose is not to receive a physical underlying asset, but, as mentioned above, to make a speculative profit. For example, if you buy CFD on coffee, nobody will deliver coffee in your warehouse, as it would happen with a future contract upon its expiration.

Let's try to figure out the exact meaning of CFD contracts on the real-world example.

Illustrative Example of CFD: Betting at Pub

Imagine that you and your friend are sitting in a pub and getting some rest after a working day. TV is broadcasting news showing a regular report on Brexit and possible implications for the British pound. You switch to this topic and start the following dialogue with your friend:

You: Somehow I doubt that Brexit will take place… They’ll fail to get their work done on schedule. I’m sure the pound will drop even lower.

Friend: They’ll make every effort to bring the pound back to its starting point.

You: Let’s bet I’ll be right eventually!?

Friend: Well, agreed!

You: If the pound continues to drop by the New Year, you will pay me a tenfold difference between the current exchange rate and the one at the New Year’s time. If the pound strengthens, I will pay you the tenfold difference. Deal?

Friend: Deal!

Now imagine that you’re a trader and your friend is a broker. That is, he acts as counterparty to your trade. As a result, one of you will make a profit, and the other will incur losses: it depends on the exchange rate movements of the underlying asset, which is the pound in this case.

Moreover, the trade may be closed not necessarily by the New Year, as it was said in the dialogue, but whenever the trader wants.

It should be noted that all the cash settlements related to this bet will be carried out when the bet is over. In other words, you only drew a contract without any delivery of the underlying asset at the time of the bet itself.

Now some words about what kind of financial instruments you can sign a contract for difference for.

Btw, if you are looking to upgrade your terminal with pro indicators and different utilities you can browse from variety of resources available at FXSSI Product manager.

What Kind of CFD Instruments Are There?

Given that CFD is a “bet” between a trader and a broker, you can bet almost anything:

- CFD on Forex (currency);

- CFD on commodities (oil, gas, and cookies);

- CFD on stocks;

- CFD on metals etc.

At that, the most popular are CFDs on stocks.

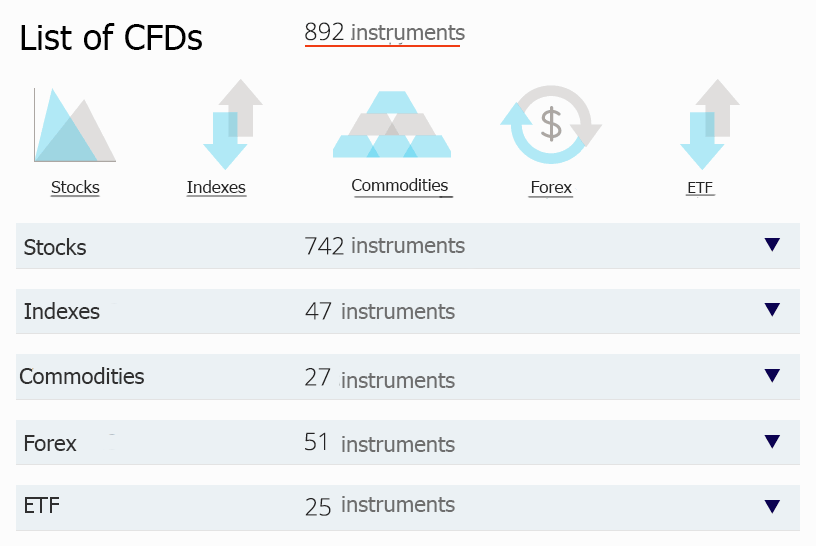

By the way, we recently did a review on the Xtrade trading platform, which specializes in CFDs. So, the total number of financial instruments available for trading with it was almost 900 units: ranging from the stocks of US companies to those of unknown Polish firms.

The popularity of CFDs is explained by the fact that you don’t need to buy stocks themselves to speculate on them. In addition, the margin requirements (starting from 2%) are much lower than that in the stock market. But one shouldn’t forget that contracts for difference can be bought with a fractional number of standard lots, for example, 0.1 lot.

Another notable feature of this type of derivatives is that the total number of obligations under it is not linked to the total volume of the underlying asset traded in the market. In other words, the total number of CFD contracts on stocks of a company can be several times larger than the number of the stocks issued.

The next stage of this bet is its completion, namely, the moment when the trader decided to close his trade. And then the question of “What exchange rate should you close a trade at?” immediately comes to your mind.

Where Do Quotes for CFDs Come From?

The contract value changes following the value of the underlying asset without any deviation.

Thus, CFDs are traded using indicative quotes, which are taken from the corresponding exchanges. Quotes for currencies come from the Forex market, and those for stocks come from the stock exchange, etc.

Other trading options:

- Spread is usually fixed, so the difference between Bid and Ask quotes is always the same.

- There is usually no commission, or it’s included in a spread.

- Execution of trades is instant and, in theory, should have no slippage. Given that the underlying asset is not delivered, there is no need to draw liquidity, the lack of which causes slippage to occur, from the market.

- Requotes are possible.

In general, CFD trading has a number of certain advantages, which have greatly boosted the popularity of this type of financial instrument over the past few years. However, it has its disadvantages.

Advantages and Disadvantages

Advantages:

Huge selection of instruments. CFDs are available for almost all possible financial instruments and are the best option for fans of diversification.

High leverage. CFDs enable trading with a much higher leverage (up to 1:500) as compared to the stock market. This ensures low margin requirements starting from 2%. Depending on the underlying asset (for example, stocks), the margin requirements can be as high as 20%, but no higher. This allows traders who have a little capital to enter the previously inaccessible markets.

Access to all the markets from one platform. Most CFD brokers offer instruments for all global markets. This means that traders can easily trade in any global market through a single trading platform.

No restrictions on short positions. Some markets have rules, which prohibit making short trades at particular moments in time or require a trader to borrow an asset before opening a short position. The CFD market usually has no restrictions on short positions, so you may open short positions at any time and without additional costs.

Execution without commissions. As mentioned above, trades are executed instantly and often without any commissions.

No restrictions on day trading. Again, some markets have capital restrictions on day trading, but CFD markets don’t have these restrictions.

Disadvantages:

Bad for scalpers. All costs are included in spread, which, in principle, doesn’t allow you to make trades quickly and make money on the smallest price fluctuations. For example, spread for EUR/USD can amount to 30 pips against that of 5-16 pips in the Forex market.

Poor regulation. CFDs are not as strictly regulated as the stock market, so you should trust only reliable brokers with positive reviews. Although, if you compare it with the Forex market, the differences are minor.

Where to Trade CFDs?

Seller of contracts for difference don’t have to own a certain amount of the underlying asset. This means that any Forex broker can add CFD instruments to their terminal if desired.

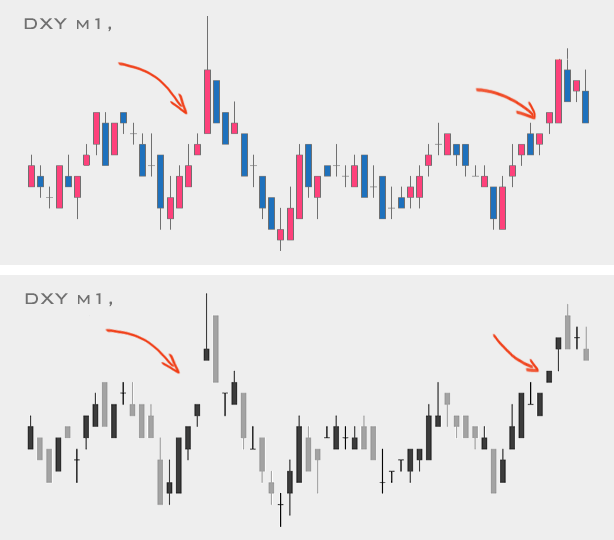

In principle, most brokers do so, but the business is hardly of interest to them, so they don’t pay special attention to its details. You’ll more likely be able to see it if you look at the chart below.

Let’s consider an example of it:

If we compare two charts from various brokers, we’ll see that the chart from the trading platform provided by 1 broker, which specializes in CFDs, has a smoother price line and smaller gaps. As for the chart from 2 broker, whose core business is currencies (Forex), there are certain problems like “holes” on the price chart.

Perhaps, in the first case a more expensive provider of quotes for this type of derivative instruments was more preferable.

If you’re serious about trading CFDs on stocks, you should opt for a specialized broker, whose core business is CFDs.

P.S. Should you have something to add on this subject, or some nuance wasn’t completely covered, feel free to share your thoughts in the Comments section.