Gap in FOREX: Definition, Features, and Strategy

Successful Forex trading requires not only a good trading system, but also understanding of all the market processes, their correct interpretation, and application.

In technical analysis, you can often come across a phrase “gap in Forex”, which is a quite interesting consequence of the market situations, and most importantly, an effective method of making money in the financial market.

As you know, charts presented as Japanese candlesticks or bars show the sequence of the price movement over a certain unit of time, for example, 5, 10 or 15 minutes.

Accordingly, candlesticks sequentially follow one another on the charts. Given the heightened liquidity of financial instruments, the current candlestick closing and forming a new one typically occurs at the same price levels.

However, there are exceptions to every rule.

Forex Gap: What Is It?

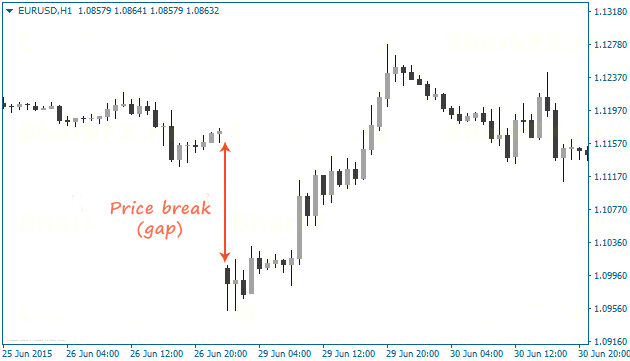

So, what is gapping in Forex? Gap is a break in price on the chart of a financial asset, namely, the situation where an unusually large space appears between two adjacent bars. See the picture above for more details.

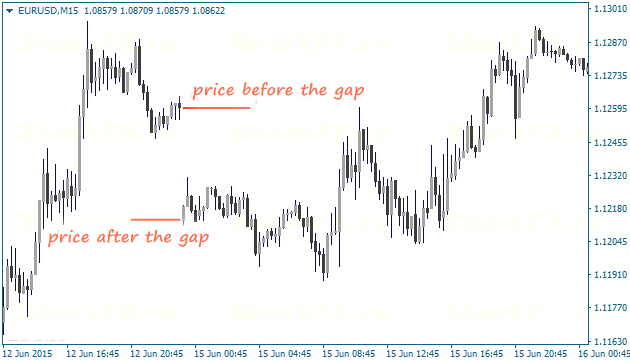

From a technical analysis’ perspective, gap in Forex is explained by an essential difference between the closing price of the previous candlestick and the opening price of the next one.

From a fundamental analysis’ perspective, gap in Forex can be explained by a strong shift in trader sentiment regarding an asset price. At some point, traders stop paying attention to the closing price of the last candlestick before a gap, and no trading occurs at the nearest price levels; the opening price of a new candlestick after the gap is regarded as the most actual one (in the opinion of the majority).

Reasons Behind the Occurrence of Gaps in Forex and Their Types

“Weekly gap” – break in prices between the end of one trading week and the beginning of the next one – is the most common.

Main currency trading ends on Friday and begins only on Sunday night with the opening of the Pacific trading session. During the weekend, significant macroeconomic changes or various disasters, terrorist acts, technological accidents, natural disasters, and other events leading to a rapid revision of the optimal value of currencies by global investors might happen in the world.

Therefore, a huge number of Buy or Sell orders, which have no matching counter-orders, accumulate before the market opens. Due to the lack of supply/demand, market participants already have to open their positions at actual prices, which are much higher or lower than that as of Friday’s evening.

Weekly gap on the Forex charts can be easily seen on almost any timeframe (M1-H4).

Gap can be also formed within a day, which is extremely rare in contrast to weekly gap. Intraday price break usually occurs after the most important economic news release or the announcement of extraordinary events in the world. For example, a significant intraday gap was seen on the charts of the currency pairs including the Swiss franc, when the Bank of Switzerland announced removing the cap on the Swiss franc's euro exchange rate.

When the disasters at the Fukushima nuclear power plant in Japan or in New York on 11 September, 2001, had happened, intraday gaps also occurred on many charts. Taking into account such events, investors immediately change their attitude to the estimation of currency value and begin to actively send their orders at new prices, which are much higher or lower than the current ones, that results in price breaks on the price chart.

Features of Gaps

In traditional technical analysis, gap is used as a quite reliable and popular pattern used to enter the market or exit an already open position. Many traders apply gaps in their trading, because this pattern often presents a good opportunity to make money with a fixed Stop Loss, a predictable Take Profit level and a good probability of the pattern materialization.

Before we move on to the analysis of the popular strategy of trading gaps, let’s consider its key features enabling traders to make winning trades.

Gap Levels

As noted above, price break on the charts is explained by a strong shift in investor sentiment regarding the actual value of currency pairs. Accordingly, the level at which a gap originated and the price level where trading continued are considered to be important price levels that can further act as support and resistance.

Gap Filling

Traders noticed the following regularity: when a gap is being formed, the price often tends to fill this price break. According to statistics, more than 70% of all formed gaps in Forex were immediately filled.

Gap filling means the price has moved back to the original pre-gap level.

The given statistics applies particularly to weekly gaps, since intraday gaps occur much less frequently and are formed as a result of high-impact news releases. Filling such gaps can happen for several days or even weeks, because the news can be so important that investors will not soon be able to believe that the price can actually return to the previous levels.

Gap Trading Forex Strategy

Gap trading strategy is based on the above-described regularity of filling weekly gaps in the first hours after the market opens. This strategy is one of the most popular and stable.

Speaking of Strategies, here at FXSSI we use CurrentRatio indicator in order to trade like smart money do. In other words, to trade contrary to retail traders.

According to statistics, more than 70% of trades are closed on the plus side.

- Assets: highly volatile currency pairs – EURUSD, USDJPY, GBPUSD, and USDCHF.

- Signal: gap is formed at the Monday open.

- Condition: gap size in points must be at least 5 times larger than that of spread on a currency pair (or more than 20 points).

- Timeframe: 30 minutes (M30).

If a currency pair gaps up at the Monday open, a trade should be opened in the downward direction (Sell); if a currency pair gaps down at the Friday close, a trade should be opened in the upward direction (Buy).

You should enter a trade 30 minutes after the market opens, because, statistically, the market still moves towards a gap direction for the first 30 minutes.

When the first candlestick closes on M30 timeframe, enter a position towards a gap filling. The primary trading target will be the Friday’s closing level.

Before filling a gap, the price may still go against your position for a while, so you need to determine an acceptable level of Stop Loss to stay in the market. To do this, you need to multiply the size of Take Profit (the target of a trade) by 1.5, which will be the size of Stop order.

Additionally, you should always take into account the fact that gap may not be filled and it will bring you losses, so use an acceptable risk per trade, for example, 1-2% of your deposit.