How Are Market Volume, Liquidity and Volatility Related?

The foreign exchange market is the largest and most liquid financial market in the world, with razor sharp spreads and daily trading volumes in the trillions of dollars.

It is also one of the least volatile markets in the world, with traders being forced to use leverage to magnify natural volatility to tradeable levels.

Coincidence? Not if you understand how these three things relate to and interact with each other – the forex market is liquid enough to absorb all that volume with very little volatility.

If you don’t quite get it just yet, don’t worry, read on as we break down these three elements and how they relate to and interact with each other.

Volume

Volume is simply the size of a trade and and you will often hear these two terms used interchangeably when pro traders are talking shop eg. “trading volume” or “trading size” – both of which refer to traders taking big positions in the market.

Volume in the forex market is opaque because forex is decentralised so there is no central exchange reporting volume figures and very few brokers share their volume data publicly.

Even so, the tick volume you see in MT4 is highly correlated to actual volume and FXSSI has a great free indicator – Better Volume – if you’d like something a bit more advanced.

Liquidity

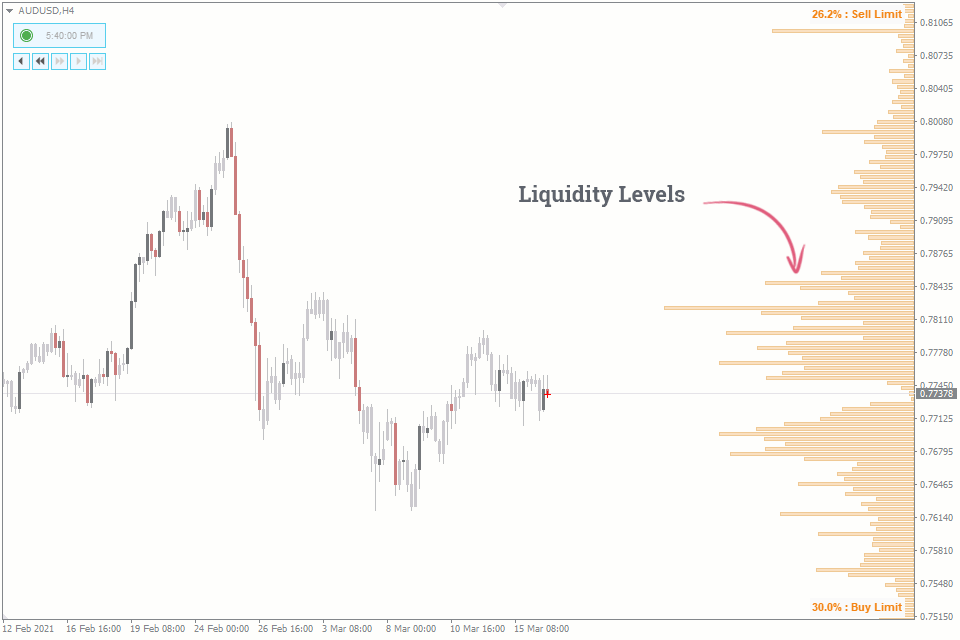

Liquidity refers to the depth of a given market – the ability to buy or sell at the current price without moving the market.

If a market is liquid, you can readily buy or sell large volumes without affecting the price. Conversely, if a market is illiquid, even small volume trades will move the market – you can see this first hand in cryptocurrency markets or low cap stocks where even a $5000 trade will often affect price.

Available liquidity is determined by limit orders from other participants. For example if you want to open a 1.0 lot trade on EURUSD when it is trading at 1.2350, there needs to be a willing seller at that price point with sufficient volume on offer.

If there isn’t sufficient volume available at that price, your market order will be partially filled with the available volume at 1.2350, with the rest filled at a higher price until 100% of your market order has been filled.

The spread is a great proxy for liquidity in the forex market, though spreads can be deceiving too. All the spread tells you is that there is some available volume at the bid and the ask – it does not tell you how much volume is available.

Even so, if you’re seeing a 10 pip spread on EURUSD, it’s a tell tale sign that there’s currently a lack of liquidity in the market.

Liquidity is especially low on a Monday morning if you’re trading in Asia (Sunday night in the US) and to a lesser extent each day at the same time before and after a new daily candle (5pm NY).

Liquidity also tends to dry up around economic news events as market makers are less willing to offer tight spreads when there is impending event risk and uncertainty – this is where volatility really comes into play.

Volatility

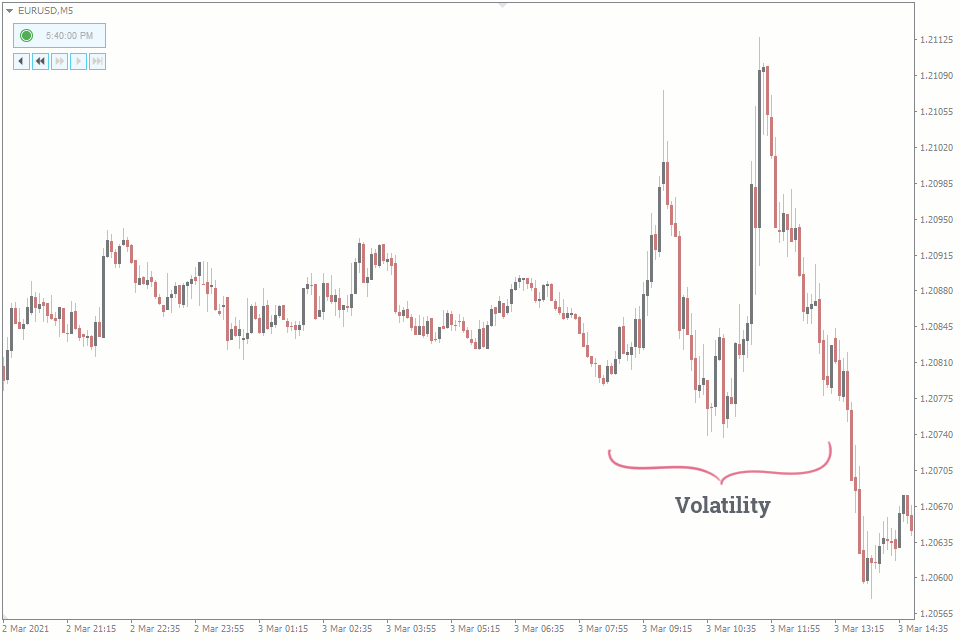

Volatility in forex refers to the magnitude of moves in the market and the time it takes for these moves to occur.

In a low volatility environment the market won’t do much of anything and will take its sweet time to do it – if you’ve ever traded Asia before you are probably all too familiar with low volatility forex trading. Conversely in a high volatility environment, the market will make big moves very quickly.

Although forex is one of the least volatile markets around, once you throw in a bit of leverage, it can become very volatile.

Volatility can be one directional, but usually it cuts both ways – if a market can topple in a matter of seconds, it can just as easily bounce back in a couple of seconds. If you’ve ever traded the US jobs report you have likely witnessed this bi-directional volatility first hand and been hurt by it.

If you were really silly, you may even have been hurt multiple times in both directions in a matter of minutes before finally sitting it out and calling it a week (don’t worry – we’ve all been there).

Tying it all Together – The Relationship Between Volume, Liquidity and Volatility in the Forex Market

So why is the US jobs report so volatile and difficult to trade?

Well as you’ve probably gathered by now, volatility is a direct product of a) the volume traded b) the liquidity available and both of these factors come into play when it’s NFP time.

When event risk comes around, market makers trim their exposure to this risk, widening their spreads or even sitting the risk out entirely. This is the smart money and this is of course a smart play – unless you have the leak on the numbers, no one has any idea what is about to happen.

Simultaneously, we have millions of dumb money traders who think they do know what is about to happen and who are looking to make quick profits off the event risk. In other words, we have the perfect storm of low liquidity and lots of volume and the result is high volatility.

It’s important to note that high volatility often becomes self-reinforcing as stops get hit, traders who stood aside to begin with pile in and market makers remain conservative until they are sure the dust has settled.

Trade Volatility in Forex Like a pro

Volatility isn’t the enemy, in fact most traders hate low volatility periods and tap their feet waiting for the next volatility surge so they can capture those big moves.

Having said that, volatility breaks accounts just as easily as it makes them, so it’s important to understand the phenomena and have a read on it so you can make educated trading decisions.

FXSSI Pro members have access to a wide range of proprietary indicators designed to give you an edge over the market so become a member today and start trading volatility in forex like a pro.