Rollover in Forex and How It Affects Your Trading

When you trade a currency pair in forex, you are not buying or selling the individual currencies. You are only speculating on their future exchange rates and hope to make profits when they move in the direction of your speculation.

Although you are not buying or selling the actual currencies, you still can’t separate them from the interest rates of the country where the currencies are used.

For instance, the USD has an annual interest rate from the US Federal Reserve, just as the EUR and every other currency has from their respective central banks. And since forex is a market of two currency pairs, forex traders deal with two interest rates on an open position.

| Country | Central Banks | Current Interest Rate |

|---|---|---|

|

Swiss National Bank | -0.750% |

|

Bank of Japan | -0.100% |

|

Federal Reserve | 0.250% |

|

European Central Bank | 0.000% |

|

Bank of England | 0.100% |

|

Reserve Bank of Australia | 0.100% |

|

Bank of Canada | 0.250% |

|

Reserve Bank of New Zealand | 0.250% |

These interest rates have several implications in forex, and one of them is the forex rollover.

What is rollover in forex?

When forex traders hold positions from one trading day to another, they are charged or paid an interest.

This interest is called rollover in forex, and it is calculated using the interest rates of the two currencies involved in the trade.

Your broker credits rollover to your trading account when you hold a long position overnight on a currency pair where the base currency has a higher interest rate than that of the quote currency.

This does not only happen in long trades. Rollover rates also apply to short positions.

For instance, assume that the EUR and USD have interest rates of 2.5% and 1.5% respectively.

Holding a long position overnight would lead to a rollover rate being added to your account because the base currency has a higher interest rate than the quote currency. Leaving a short position overnight would lead to a deduction from your trading account.

When is the Rollover Rate Applied in Forex?

The rollover rate is applied at 5 PM ET. This time is 5 PM New York time, 10 PM in London, 7 AM in Sydney, and 6 AM in Tokyo.

Every trade that crosses this time is subject to rollover. Open a position at 16:59 ET and close it at 17:00 ET, the rollover rate would still apply to you.

Many forex brokers close all trades at the end of a trading day and reopen them almost immediately but with the rollover rates calculated and applied.

Weekends and Holidays

The forex market never stops charging or paying rollover fees during weekends and holidays, even though the market is inactive during these days.

To account for the break from trading days on weekends, three times the rollover rates are charged and paid every Wednesday. And for holidays, the rollover is calculated for the length of the break and applied two days before the holiday.

How to Calculate Rollover Rate

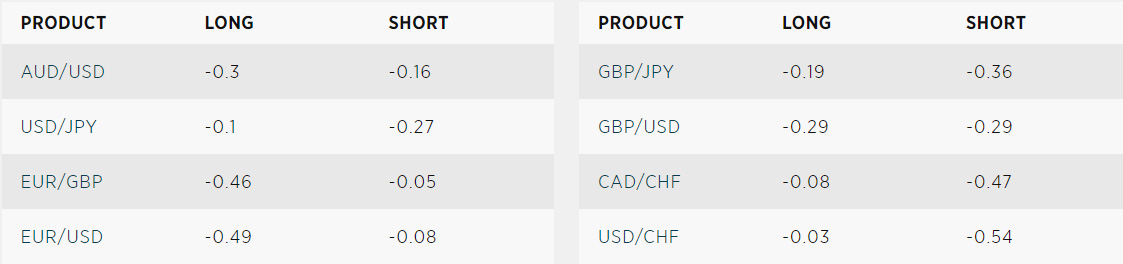

The rollover interest changes as the interest rates of the individual currencies in the pair change. So, many brokers automatically calculate and upload the rollover rates on their website. But it doesn't do any harm to know how the rate is calculated.

But before we proceed, your calculated rollover interest might differ from what your broker has on its website. This difference may be due to several reasons, including some charges imposed by the broker.

The formula to calculate the forex rollover rate is:

Rollover rate = (Base Currency – Quote Currency)/(365 * Exchange Rate)* Position size

For instance, assume the interest rates of EUR and USD are 0.5% and 0.1% respectively. Going long on EURUSD with 1 lot and at an exchange rate of EURUSD being 1.2. Percentages need to be converted to regular numbers, this can be done by dividing them by 100.

Rollover = (((0.5 – 0.1)/100)/(365 * 1.2)) * 100,000

You have a rollover rate of €0.91. What this means is that you are paid €0.91 for every night you hold the trade, assuming the interest rates don't change throughout the trade duration.

Can You Benefit from Forex Rollover

Taking forex rollover into consideration when you trade may increase your profitability. There is even a forex trading strategy aimed at exploiting forex rollover to make profits. It is called the forex carry trade.

Carry Trade

The fundamental idea behind this trading strategy is that you make a profit when you trade a currency pair where rollover is credited to you. When you enter the position and hold it for long, the rollover accumulates and you earn without doing any actual trading.

Traders who practice this form of trading don’t just pick a currency pair at random. They have ways of deciding the best currency pairs for carry trade.

And to increase their chances of success, carry traders only go long when they believe the base currency would rise in value against the quote currency at the end of their trade duration.

This is just the fundamental idea, remember. You should read some interesting information about carry trade in 2021.

The Disadvantage of Forex Rollover

When the rollover favors you, it is an advantage. Otherwise, it is a disadvantage. So, forex rollover becomes a disadvantage when it is deducted from your account.

However, there is a way to avoid forex rollover rates completely in your trading. Some brokers offer Islamic swap-free accounts where rollovers are not paid or earned.

Conclusion

The daily gain or loss from rollover might seem very small, but they could accumulate over time. As a result, you may want to add rollover to the list of things you check before you enter a position, especially if you are holding it for a long time.