Supply and Demand in Forex - How to Master Zone Trading

Are you trying to master the concept of trading supply and demand in Forex?

While Forex supply and demand is certainly an advanced trading strategy, it allows you to truly understand the building blocks that make up a market.

The reason price fluctuates over time is because there’s an ever changing imbalance between supply and demand.

If there are more buyers than sellers, then the market has no place to go but up. On the other hand, if there are more sellers than buyers, the market can only fall.

It’s simple economics.

Before we get started, let’s go over the basics of what supply and demand means.

- Supply: Increased selling pressure.

- Demand: Increased buying pressure.

When the concepts of supply and demand are applied to Forex markets, this can be viewed as prices on a chart where there are likely to be buyers or sellers looking to fill orders.

We explore the idea of applying supply and demand to Forex markets a little deeper below.

What is Supply and Demand in Forex?

When talking about supply and demand in Forex, we always refer to zones rather than specific prices.

This is because while the market consensus may be that a particular area is where buyers or sellers want to execute their trades, not everyone is going to have the exact same price point.

If supply sees an increase in selling pressure, then that means we have sellers who are looking to execute trades in this price zone.

On the other hand, if demand sees an increase in buying pressure, then that means we have buyers who are looking to execute trades in this price zone.

Supply and demand in Forex is also characterized by large clumps of orders, often from banks or institutions found within the interbank market.

They’re not your 0.01 lot orders that you’re placing with your retail Forex broker. These are insignificant when it comes to the true supply/demand order flow found in Forex markets.

A Real World Example of Supply and Demand in Forex

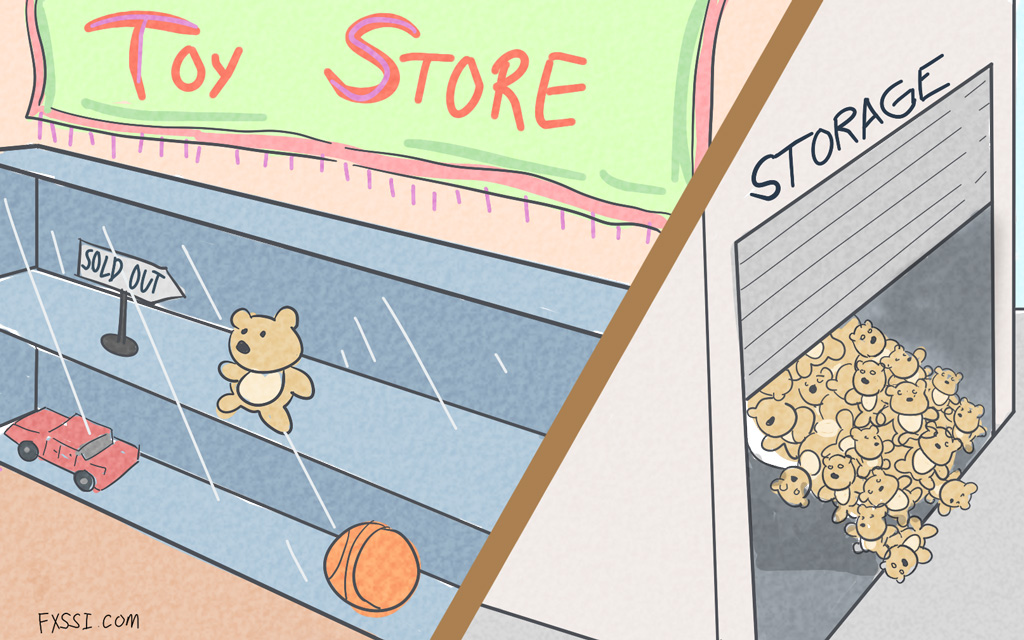

Supply and demand zones are often formed by large clusters of orders that are all executed at once, causing price to move sharply away.

This means that the price preceding a large move must be a zone where there’s a mismatch of supply or demand.

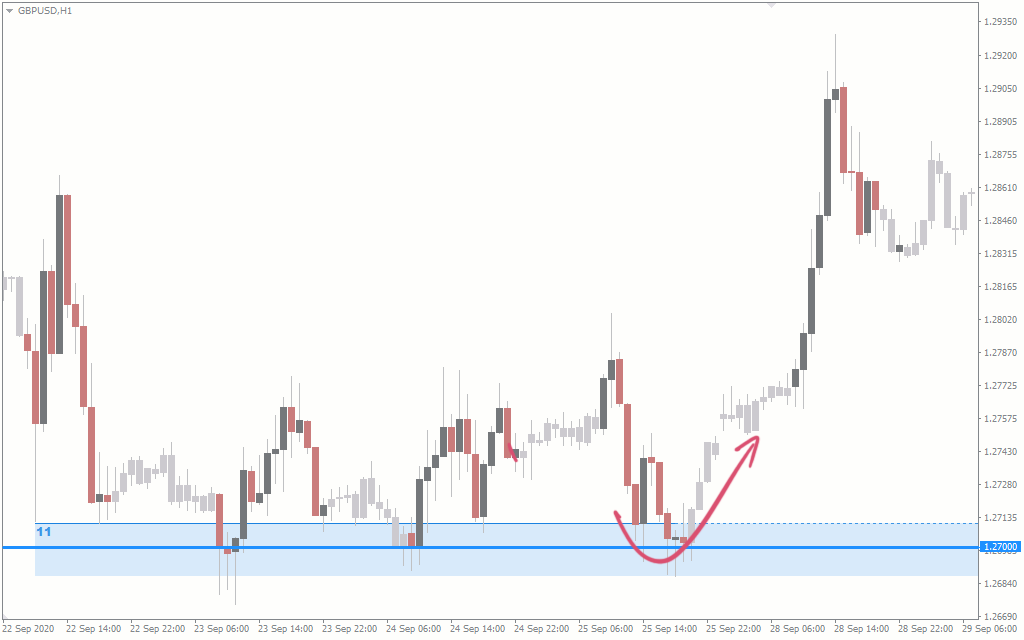

Applying this theory to the GBP/USD chart below, you can see that price ripped higher from the zone around 1.27.

This is a clear real world example of a demand zone.

Confirmed when GBP/USD continued to be bought whenever price returned to the zone.

Demand far outweighed supply at this price point and when the limited sell orders ran out, price could only go higher.

How do you Determine Forex Supply and Demand Zones?

If you’re able to identify areas of supply and demand like this on your charts, then you can build a trading strategy that gives you a statistical advantage.

But before you develop a trading strategy, lets go over how to determine Forex supply and demand zones and draw them on your charts.

Forex Supply Zones

Forex supply zones are areas where banks and institutions are placing a large number of sell positions at a particular price zone.

If a portion of these sell orders remain unfilled when price moves lower, then they’re likely to be left there, just sitting untouched.

When price approaches or returns to this supply zone, these orders are just waiting to be filled and send price back lower again.

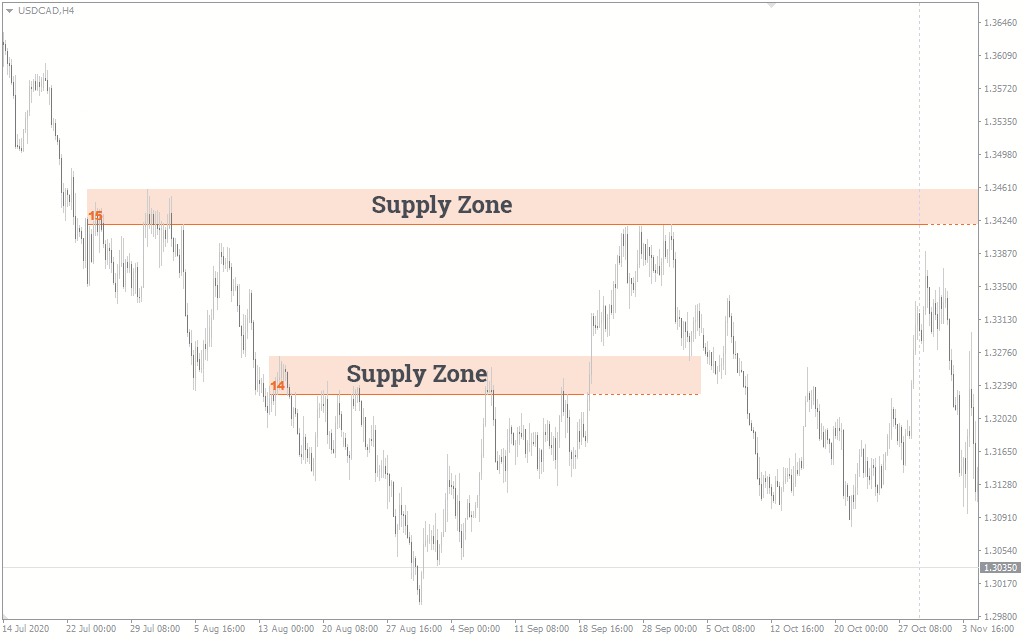

Here is an example of supply zones marked on the USD/CAD H4 chart:

As mentioned above, if we use the price preceding a major move lower as our supply zone, they’re mostly made up of swing highs.

You can see on this chart that there are numerous examples of price returning to a supply zone, before selling again.

All of these areas could have been shorted as part of a Forex supply and demand trading strategy.

Forex Demand Zones

On the other side of the market, we have Forex demand zones.

These are areas where banks and institutions are placing their clusters of buy orders at a particular price zone on the chart.

If price moves higher and leaves a chunk of these buy orders unfilled, then they too are likely to just be left untouched, waiting for price to eventually return and trade through them once more.

When this happens, the huge demand overload is likely to push price higher again.

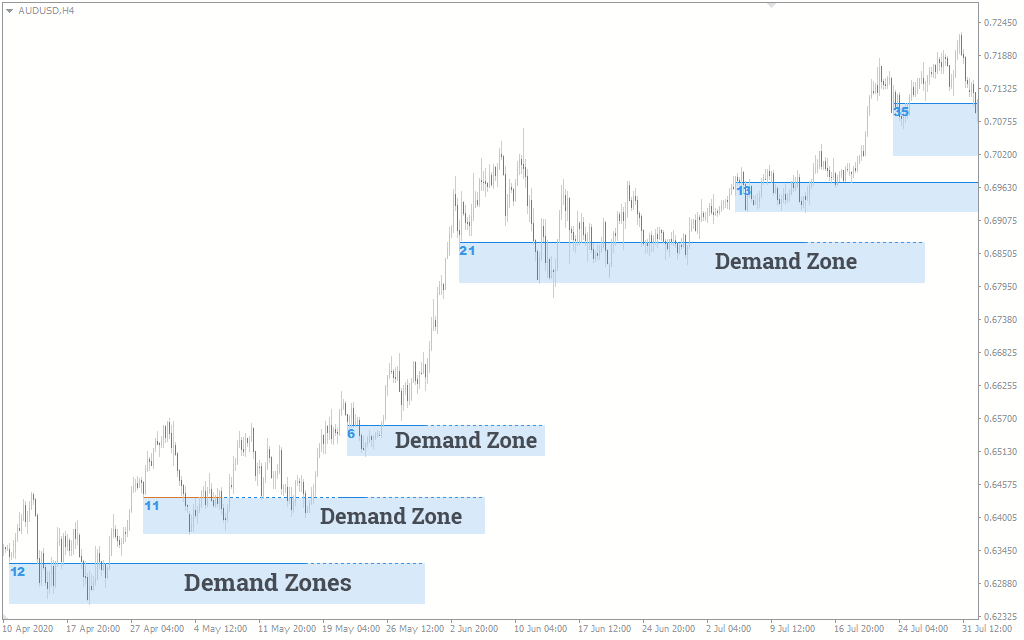

Here is an example of demand zones marked on a AUD/USD H4 chart:

Once again you can see that if we used the price preceding a major move, as our definition above said to do, then we get mostly swing lows.

Zones that once again where returned to, were often areas where buyers were once again found and price was ripping higher as a result.

These are areas on the other side of the market that could have been longed if you were a supply and demand Forex trader.

How do you Trade Supply and Demand in Forex?

As you can see on the charts found within the section above, you can immediately see how a retest of nearly all supply and demand zones saw another rejection.

Maybe the rejection wasn’t as hard as the first move, reflecting more of a supply/demand balance than before, but there was almost always a move nonetheless.

With this in mind, the best Forex supply and demand strategy focuses on trading reversals when price returns to retest zones for a second time.

Trading reversals at supply or demand zones will give you the highest probability of success using a strategy of this type.

Depending on your appetite for risk, there are two ways you can go about trading a supply and demand strategy.

Aggressive Supply/Demand Trading

The first is for aggressive traders who want to milk every last pip they can out of a move by getting in early.

Aggressive traders don’t worry about the risk of price blowing through the supply/demand zone and prioritize the benefit of bigger winners over the risk of a lower winning percentage.

Aggressive traders would enter trades using pending orders as soon as price returns to a strong supply or demand zone.

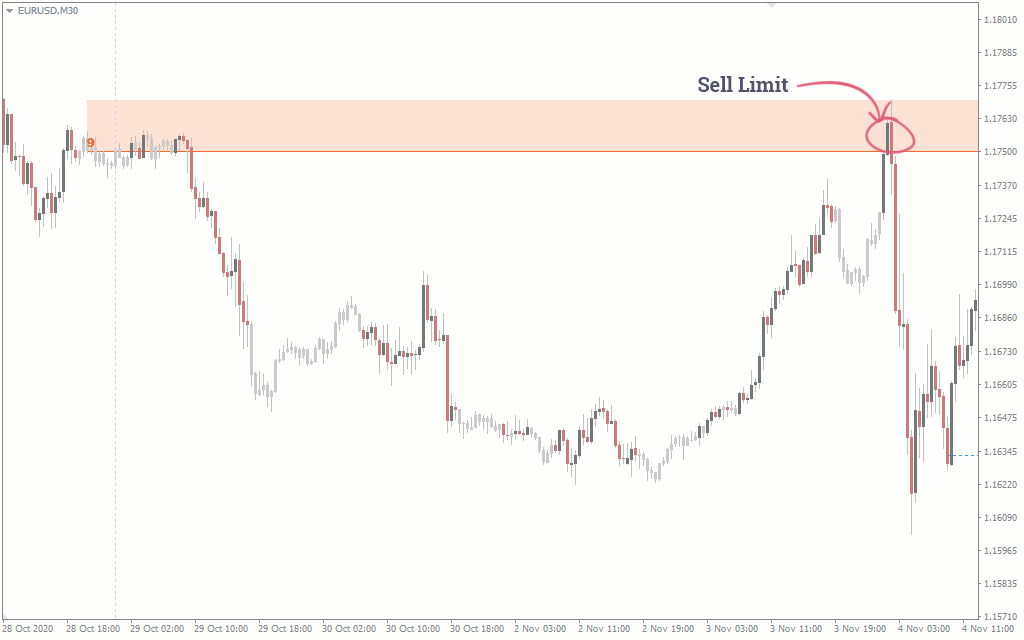

Here is an example of an aggressive short entry taken at supply, on the EUR/USD M30 chart:

You can see that price immediately reversed when it returned to the supply zone and with a stop placed just above the zone, it was never troubled.

Conservative Supply/Demand Trading

The second is for more conservative traders who like to keep their winning percentage high and don’t mind missing a trade if price instantly moves hard and fast away from them.

Conservative traders wait for confirmation of a supply/demand zone remaining significant, though watching price action or waiting for a retest of the zone before they enter.

This strategy requires you to be more active, using market orders to enter trades when the conditions presented are just right.

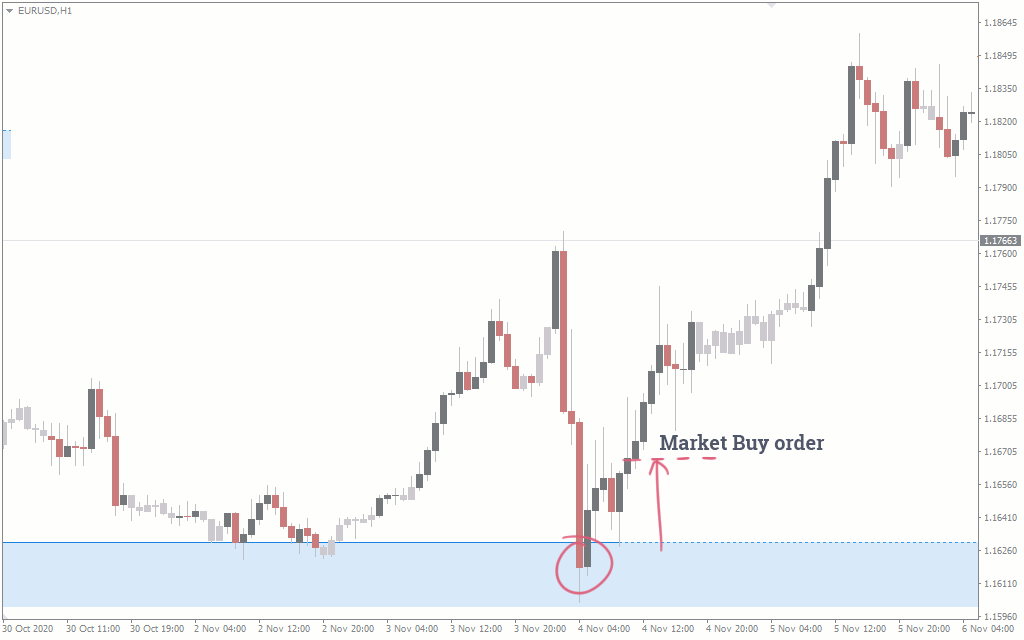

Here is an example of a more conservative short entry taken at supply, this time on the EUR/USD hourly chart:

In this case, price stuttered at the supply zone before retesting short term support as resistance and confirming that sellers were once again in charge of the market.

What is the Difference Between Forex Supply/Demand and Support/Resistance?

The concepts of Forex supply/demand and support/resistance are closely related to each other and therefore quite similar.

Both point out price zones where you’re likely to see a reaction in the market and are essentially the same areas, just interpreted in different ways.

Here are the different interpretations between the two.

- Supply/Demand: A zone where excess buy or sell orders remain untouched.

- Support/Resistance: A level that price has had trouble breaking.

If you’d like to read more on interpreting supply/demand zones differently, then our blog on how to define support and resistance levels is an excellent resource.

Similarly, we’ve also discussed a number of support and resistance trading strategies which you can also add to your trading toolbox.

Final Thoughts on Supply and Demand in Forex

What you need to understand is that trading Forex using supply and demand requires a discretionary approach to the markets.

Learning to trade supply and demand in Forex, is certainly more of an art than an exact science. A mechanical strategy with clearly defined entries and exits just isn’t going to work here.

The decentralized nature of Forex markets means that you’re never going to be able to tell exactly how many orders remain untouched in the market, let alone exactly where they are.

But human beings are predictable creatures and by following the concepts we’ve discussed here, you can certainly put yourself in a position to take advantage of the prices.