Synthetic Currency Pairs

A synthetic currency pair is a pair artificially created by opening two opposite positions for other currency pairs in Forex.

As a rule, traders resort to the creation of a synthetic currency pair when a broker or a liquidity provider itself doesn’t have this currency pair in their set of symbols.

Though, even if one or another currency pair is not presented in the list of financial instruments, it doesn’t mean that you cannot create your own currency pair! To do this, you need to take two different currency pairs and create a third one, which is not listed.

Brokers don’t include very rare pairs in their lists due to low trading activity for them. However, traders sometimes want to experiment with pairs, so a loophole was created, enabling you to create rare currency pairs based on the more popular ones.

How to Create a Synthetic Currency Pair?

Traders can create almost any synthetic currency pairs based on two different currency pairs including US dollar or other most traded currency pairs in Forex.

Suppose that you want to trade EUR/MXN. Since it is not actively quoted, you can recreate it by trading EUR/USD and USD/MXN currency pairs.

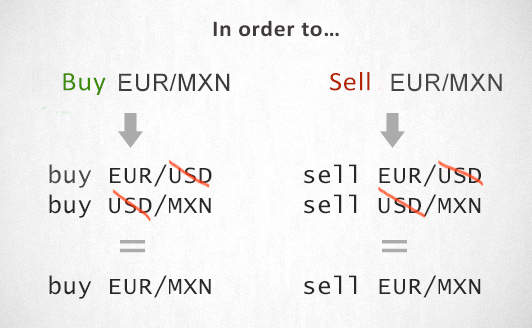

In this case, if you want to BUY EUR/MXN, first you need to buy EUR/USD (buying Euro and selling US dollar) and then USD/MXN (buying US dollar selling Mexican peso).

After this trade is made, positions for US dollar will mutually cancel each other, and you’ll have only two positions – to buy Euro and to sell Mexican dollar.

As you can see in the picture above, you can create a synthetic position to sell EUR/MXN in the same way.

Costs

You can both save on trading costs and double their amount using the above-mentioned technique.

Since you open two individual positions to create a third synthetic one, spread associated with each of these trades will be charged.

It may be that your broker has the currency pair you need, but the spread on it is much larger than the total spread on the two pairs constituting it. Accordingly, it will be more profitable for you to trade just a synthetic pair, but not a real one.

Speaking of spread, here at FXSSI we use Spread Warner indicator to monitor spread size in real time.

You should also bear in mind the difference in the interest rates of those countries, whose currencies are involved in these trades. Since there may be only three such countries, you need to monitor the interest rates of these countries, because they can have a positive or negative impact on your trading performance.