What Truth Binary Options Brokers Don’t Tell Us?

One day I came across a link to a binary options broker’s website. Well, I thought it was time to figure out what binary options were and understand why the industry was growing so fast.

In principle, I knew before what binary options were and how they worked. However, as usual, I wondered how effective they were as compared to other financial instruments and whether they were the right tool for making money.

Read a brief background on their origin before going further.

What are Binary Options, and Where Did They Come From?

Sarcastic note: please read the Wikipedia’s definition of binary options just in case.

As I understand it, binary options lie somewhere between the financial markets and slot machines: while you interact with other players in the financial markets, you play exclusively against a broker in case of binary options. This makes binary options a rather difficult type of making money, and brokers themselves are unwilling to talk about the mathematical component underlying their activity. We’ll talk about it a little bit further.

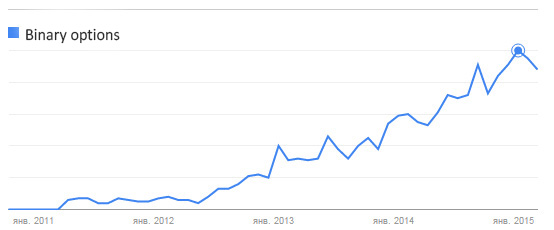

Binary options first appeared in the United States back in 2006. They reached their height of popularity in early 2011, mainly due to the abundant advertising.

Speaking of search queries related to binary options, their total number exceeded several millions per month according to Google. This public interest deserves attention.

Let’s Get Back To the Link

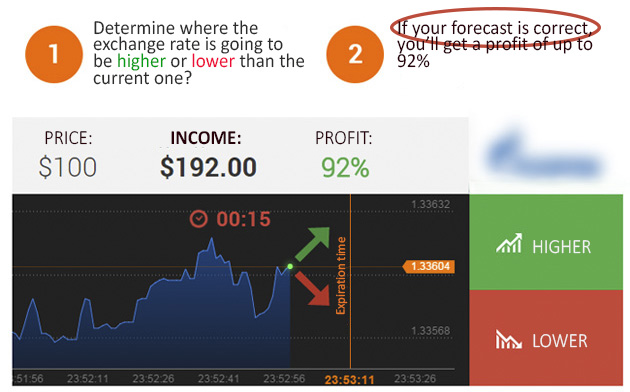

So, when I clicked the link, I was redirected to a broker’s website, where I was immediately offered to make a “choice” and find out how much money I could make. Notice the highlighted text:

I chose “Lower” and won. Then I chose it again and won again. And I did it all over again. Every time I made my choice, the price moved at a fast clip in the chosen direction. This is how I did it.

It would put any quick-witted person on the alert and make them think of it as a “some kind of bait-and-switch”. However, we became so accustomed to such marketing gimmicks that we pay no attention to it and believe that everything will be different when we log in to the platform (after registration and opening an account). Yes, it will be, but exactly the opposite.

If you believe that a broker will deceive you and paint fake quotes, you’re wrong. They don’t need to do it at all, because their business model is organized in such a way that they’ll always win. Let’s consider it in a little more detail.

Win Rate of Binary Options

When I flicked quickly though trading conditions of a few top brokers, I came to the conclusion that the average return on binary options ranged from 72 to 82%, while the loss was 100%. The given difference between the return and the loss is a broker’s earnings, which size is however slightly excessive.

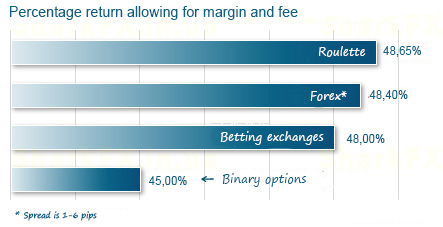

Comparison of return on various financial instruments, taking into account margins, fees, and zero:

In other words, you pay 5% fee for each trade (whether it’s profitable or not) to your broker. Is it too much?

What do brokers do to hide this crazy fee? They put the size of bet itself into the size of expected payout for the bet. Therefore, if you win, you’ll make $182; if you lose, you’ll lose only $100. Visually, it seems that the advantage is on your side, although it’s not true, in fact.

By the way, if you “guess” the exchange rate direction in 55% of cases in Forex, you can make good money, while it allows your binary options account to show neither profit nor loss only. Not to mention the fact that the actual percentage of profitable trades hardly exceeds 45-48%.

One conclusion can be drawn about it: binary options brokers cheat you when they promise you earnings, since your earnings are their losses.

Other Interesting Facts

Deposit bonus – up to 100%. I’d say this: the size of deposit bonus offered in various projects is directly proportional to the rate of blowing up your trading account, and I believe that the notion of “deposit bonus” itself, if it’s more than 2-3%, is nothing more than a sign of bait-and-switching or fraud.

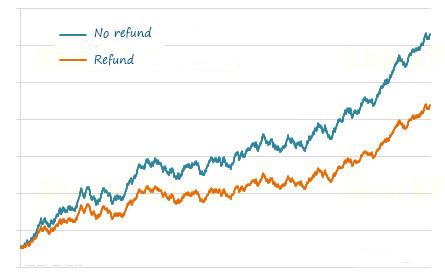

Refund. A feature that brokers like to advertise as their own advantage. Nevertheless, do traders have any use for it? Yes, but only negative one. If you’re still planning to make money on binary options, you don’t need this feature at all. Here is an illustrative example of how to use the feature (provided that 60% of trades are successful):

Return on financial instruments. Return on binary options has to be at least 95-96% to somehow come up with that in Forex. In fact, it rarely exceeds 82%. Here is a brief dialogue with support service on this subject:

Martingale and averaging. In case of binary options and their large fees, these popular (not to be confused with effective) money management methods are very hard to apply. The fact is that a large fee makes you to increase a trade volume too fast, following which your deposit will run out of money as a result of 6th-7th averaging.

Thinking out Loud

I wonder what may happen if someone makes more money than a broker will pay out? After all, trades aren’t submitted to the market (it’s the principle of “bucket shop”). Truly speaking, that’s not possible, because the trading conditions simply leave no room to make money, and those who really know how to trade properly would more likely go for trading in the Forex or other exchange markets.

The verdict is as follows: binary options are nothing but slot machines with a very low expected payoff, so I cannot recommend them as the tool for making money.

Stay alert!