Regularities in Forex Trading - Part 1

Probably, all newbies who step into Forex trading for the first time dream of making good money. But the problem is that they start their journey searching not for profitable regularities, but for a guru who will teach them how to trade.

In the end, it all comes down to this: all beginners are trying to make money using someone else's brains without putting in their effort.

Usually, they dream of an expert advisor who will earn a lot of money for them while planning how to go somewhere and spend this money quickly. However, many of us have been on the same path. Of course, some have managed to get away from this "stereotype," but the rest are still in search of the "Holy Grail."

So, what's this all about? It's like the old sayings – "no pain, no gain." If you don't put enough effort into finding statistical Forex regularities, you're hardly going to become a profitable trader.

Trading Regularities

We all know that a trader should have a trading strategy, but no one says what it should consist of. Usually, everyone picks out several different signals, gathers them into a single strategy and starts testing those in practice. However, a mistake has already been made at this stage, and it, as a rule, nullifies the effectiveness of the strategy.

The problem is that none of the signals used in the strategy have been tested for effectiveness. That is, the effectiveness of each signal separately is unknown, and it’s impossible to say whether they follow any mathematical regularity. For example, two out of 4 signals, can be 50/50, one has a 55% regularity, and the other has a 45% one. Pursuing such a strategy will produce zero result, and if the commissions are taken into account on top of that, there’s a guaranteed loss of deposit. Although one of the signals had potential. This is why it’s so important to test all your groundwork and use only profitable Forex regularities.

If you knew about a profitable regularity, would you just share this knowledge with everyone? Of course not, you’d want to make money out of it. Forex trading is not as complicated as it sounds. A year is enough to learn the basics, but only your work and your own achievements can bring you profit.

So, what to do?

If you find a signal that you plan to put into practice, you have two options to justify its use: you can use theory to prove your idea of why this particular signal should work, or you can test it in practice. And it’s even better, when theory is confirmed in practice.

Not everyone has the opportunity to test their ideas and not every idea can be tested, but there is no other way. Using untested ideas in practice is like "buying a pig in a poke". Of course, manual strategies are difficult to test, since they require a lot of patience, but separate components can always be tested.

For example, "simple candidates" can be tested on their own by creating a simple trading robot that performs this test. More complex research requires hiring people, who can create more structured trading robots. Bear in mind that the main goal is not to make a robot that will trade for you, the idea is to find market movement patterns that you can use in your manual trading.

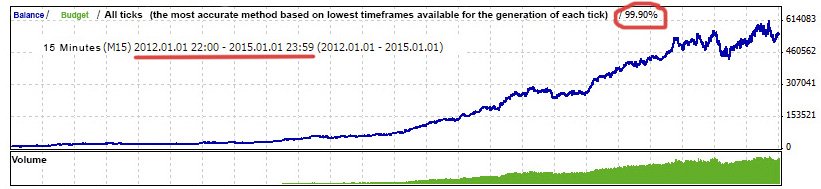

Another aspect that can hide an effective regularity includes spread, swap and commissions. It is better to turn them off when you’re carrying out your tests, since these factors easily cut off 2-3% of profitability. This means that even a 52-53% regularity is important. It might seem like not enough at first, but it can also be put to a good use. For example, here is the test result of a 53% regularity without commissions:

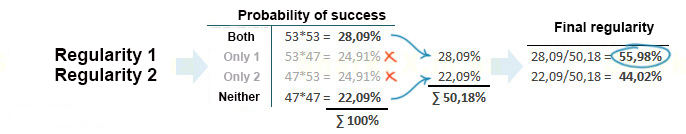

By turning on commissions, such an advisor would become unprofitable. But if you have 2-3 regularities of this kind and you use them as a filter, that is, you enter a trade only when the two conditions are met, you’ll get more than 53% of profitable trades. Specifically, two 53% regularities combined achieve 55.98% efficiency. Here are the calculations:

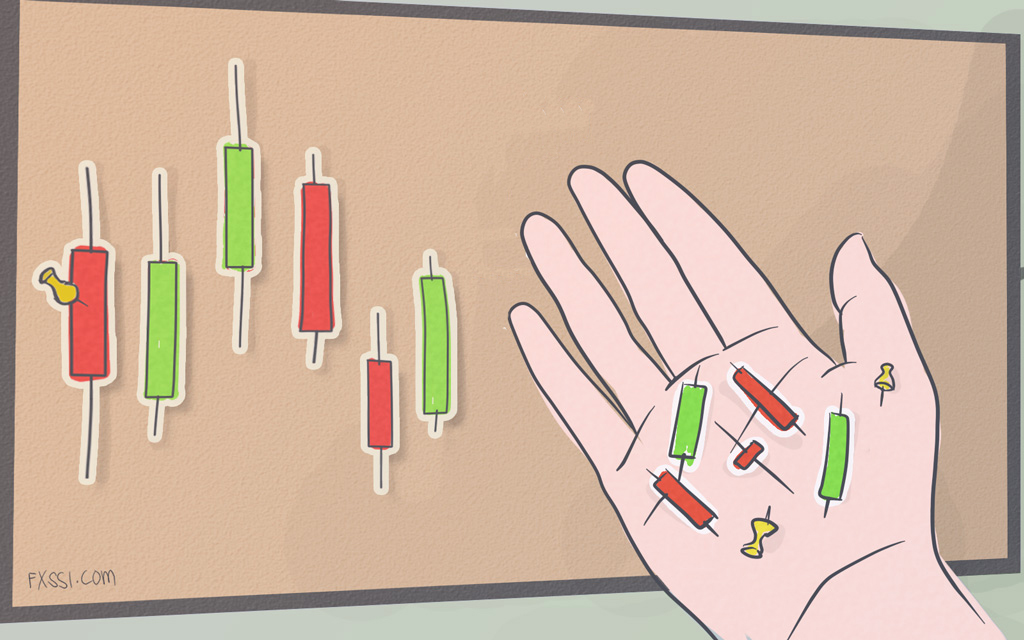

Ideally, these regularities should have weak correlation with each other. For example, the first one takes into account the sequence of candlesticks, and the other one focuses on the ratio of traders' positions. These values barely depend on each other, but they play a crucial role when used as filters. On the other hand, if these regularities have a common source, a described above effect might be lost.

Many people use indicators believing that they are getting some advantage. But is it really so? We did a research and you can read about it here.

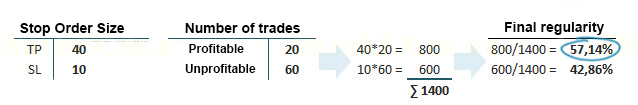

One more thing. A 53% regularity implies that SL and TP trades are equal, that is, the initial probability of a successful trade is 50%, and it increases to 53% with this regularity. Of course, you can generate profit by varying SL and TP even with a 20% rate of successful trades. But even in this case you can calculate the efficiency. Here’s the formula:

Please mind that all calculations in this article are made in a simplified form; actual results may differ significantly from theoretical ones.

What percentage of successful trades is enough?

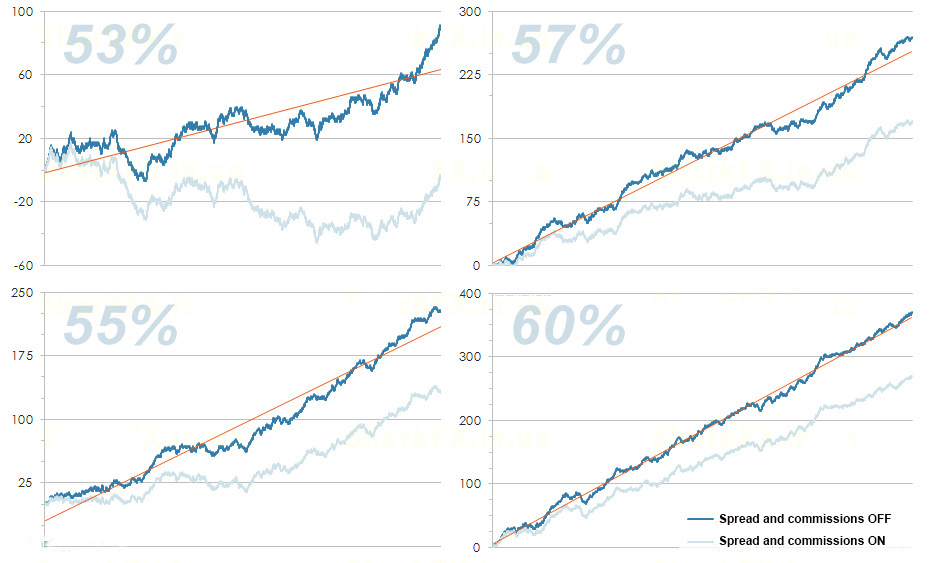

To be honest, even 60% of successful trades are enough to make money. This also applies to manual trading, the only problem is to make sure you’re ready for a series of unprofitable trades. We’ve compared the effectiveness of different regularities with 2 thousand of orders:

Pay attention to the orange line – this is a mathematical trend line. The smaller the deviation of the equity curve from this line, the greater efficiency and stability of the regularity.

It is quite obvious that a 60% regularity is enough reason to start counting profit. The only thing left to do is to find such a regularity, and this is easier said than done.