Market Order vs Limit Order

Whether you are trading Forex or any other asset class, you are using one of two orders types; a Market Order or a Limit Order. Any other order types you may be familiar with are just variations of Limit Orders and Market Orders.

In this article, we’ll look at the difference between Market and Limit Orders, how traders use them in different circumstances or trading strategies, and finally, how each order type powers many other orders that are available in your trading platform.

What is a Market Order?

A Market Order in its standard form is the simplest way to place a trade in all trading platforms. It’s a request to buy or sell at the best available price on the market at the moment you submit the order. Market Orders usually get filled instantly, or at least very quickly depending on liquidity in the market, as there isn’t a condition related to time or price that is likely to prohibit the execution of your order.

As we said in the previous point, a Market Order is usually executed instantly and successfully, but that’s not always the case. A Market Order is not always guaranteed to be filled, especially if your order is a large one. If your broker does not have access to enough liquidity to fill the order volume, then your order will be cancelled. This phenomenon is an order execution policy known as Fill or Kill or FOK.

Types of Market Orders

The Market Order is at the core of many other order types, which may or may not be in the Forex trading platform you use.

Stop Order: A Stop Order is a pending Market Order that rests at a specific price. Once that price is reached, the Market Order is submitted. Use a Stop Order to Buy above the market if you think the market will go up to a certain level and then keep trending up. Likewise, you can Sell below that market if the price is going to drop to a certain level and then continue to trend downwards. Suppose you want to directly compare the difference between a Limit Order and a Stop Order, we have you covered with another detailed article on the subject.

Stop Loss Order: Stop Orders are also used as Stop Loss Orders which, as mentioned above, is a variation of a Market Order. A Stop Loss Order is simply a Stop Order which instead of opening a new position is instructed to close an existing one. If you are in a Long position, you will need to Sell to close it. Your Stop Loss will be set at the level that is below the market. In this case, you are selling below the market and protecting your account from a continuing down-trend.

Time-Based Market Orders: There is a variety of time-specific Market Orders where orders are sent without considering the price.

- Market On Open Order (MOO) – A pending Market Order that is triggered as soon as the market opens and quotes start streaming.

- Market On Close Order (MOC) – A pending Market Order that is triggered shortly before the market is scheduled to close, usually five minutes prior.

- Time of the Day (TOTD) – A Market Order where you can specify a specific time for the order to be triggered.

What is a Limit Order?

A Limit Order isn’t just a pending order that is triggered when a certain price level is reached; it’s much more. Unlike a Market Order which is filled at the best available price, whatever that may be, a Limit Order is filled at the specified price or better. This feature allows traders to eliminate slippage from their orders.

You use a Limit Order if you think the market will go down to a certain level and then reverse so you can use a Limit Order to Buy below. Your order will not be filled any lower than your market price. Similarly, a Limit Order allows you to Sell above the market when you expect the price to reverse and turn into a bearish move.

Limit Orders have a higher probability of being rejected. In the event that your order is triggered, but the market moves abruptly before it can be filled, your order will be rejected and cancelled. Different trading platforms process Limit Orders differently. In the case of MetaTrader 4, Limit Orders follow a Fill or Kill policy where the entire order must be filled at the determined price or better; otherwise, the order will be cancelled.

Types of Limit Orders

Take Profit Order: A Take Profit Order is a Limit Order that is not used to open a new position but rather to close an existing one.

Market Range Order: A Market Range Order (sometimes referred to as a Limit Range or Limit Entry Order) is an enhancement to a Market Order in the sense that it’s used as a quick and straightforward way to submit an order with just a couple clicks. It’s essentially a Market Order that allows you to reduce slippage by taking the market price and adding a predefined limit range and submitting a Limit Order.

Stop-Limit Orders: A Stop Limit Order, as you might have guessed by the name, is a combination of a Stop Order and Limit Order. The way this type of order works is that when the Stop Price is reached the Limit Order is activated. You can find more on the difference between Stop Loss and Stop Limit orders, inside another FXSSI detailed article by clicking that link.

What’s the Difference Between Market and Limit Orders?

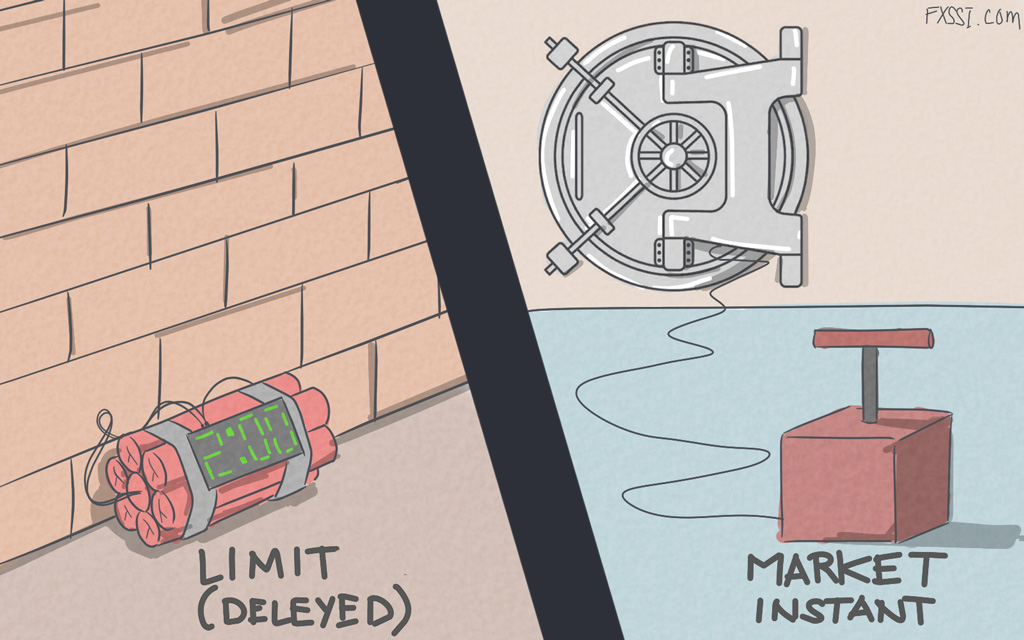

Determining the difference between Market Orders and Limit Orders is not particularly simple when you take into consideration the several variations of each one. For the sake of keeping it simple, let’s compare each order type in its classic format to explain the difference between a Market Order and Limit Order.

A Limit Order is a pending order that can only be submitted as a Buy order when placed under the Ask price or as a Sell order when placed under the Bid price. A Market Order is a request to buy or sell at the best available price on the market at the moment you submit the order. Market Orders usually get filled instantly.

Here is a tidy table to show the differences between Limit and Market Orders and any concerns you may have about either.

| Concern | Market Order | Limit Order |

|---|---|---|

| How is the order triggered? | Order is sent to your broker at the click of a button | Order rests on your broker’s trading platform server until a qualifying quote triggers the order |

| Will there be slippage? | Slippage is possible | Slippage is excluded |

| Will the order be filled? | High chance of the order being filled | Risk of order not being executed |

When to Use Limit Orders or Market Orders

Market Orders are not pending orders and submitted on demand. This makes Market Orders useful to Price Action traders who are following the behavior of candlestick formations and enter the market when they feel the time is right.

Traders with more structured trading strategies which incorporate an assortment of technical analysis indicators find value in using Pending Orders such as Limit Orders. By using Technical Analysis, you can find your entry and exit points ahead of time. With a Limit Order, you can place orders ahead of time and wait for the scenario to play out. Which type of limit order you use, will depend on your analysis and trading strategy.

The following charts show an example of when to use limit order or market orders:

You can see the first chart shows buy limits and sell limits in action when price would approach, while the second displays a market order that instantly executes in either direction.