Round Levels in Forex and Why You Should Consider Them

Starting as a Forex trader means understanding and applying support and resistance levels in trading strategies. What if you could predict possible support and resistance zones before they form? You can, by identifying round levels.

This article will explore how our recently launched round levels indicator for MT4 can assist you and how to apply this information in your trading strategy for the best results.

But first, let’s take a step back and look at the notion of support and resistance levels.

The concept of support and resistance is helpful on so many levels (no pun intended). Support and resistance levels help traders with risk management, timing, and targets.

When we think about support and resistance levels, we usually identify them based on chart formations and instinctively draw horizontal lines at those levels.

But there is a different approach to understanding support and resistance zones. Let’s get to the bottom of this.

What are Round Numbers?

The notion of rounding prices is not exclusive to Forex trading. Humans operate according to hundreds of cognitive biases. Traders and investors spend years conditioning themselves to suppress their biases and listen to data. One of such biases is the Round Number bias.

For example, if someone asked how much your laptop cost, you would answer them without hesitation and round the price to the nearest number that is exactly divisible by one-hundred.

If your laptop has a cost of $691.75, you would be an outlier if you actually said out loud “691 dollars and 75 cents”. Most people would round up and answer “I bought it for seven-hundred dollars”. We all do this in the interest of saving and simplifying our time.

If the value of a product you are describing is lower, you will round up or down with more precision. If a box of chocolates cost $4.89, you’d describe that as “five dollars”, and if a new microwave cost $91.90 and paid $4 shipping, most people would round that up to “one-hundred dollars”.

We like to round numbers in all situations. Whether you’re filling your fuel tank at the petrol station, baking a cake, planning how long it will take to complete a journey and many, many more examples; but you probably get the point by now!

Round Levels in Forex

Many psychological behaviors traders experience directly influenced profit and loss. Having a bias for round numbers in Forex isn’t detrimental, but it’s important to be aware of it at least to protect your stop-losses. Still, this bias can easily be exploited in a round number trading system.

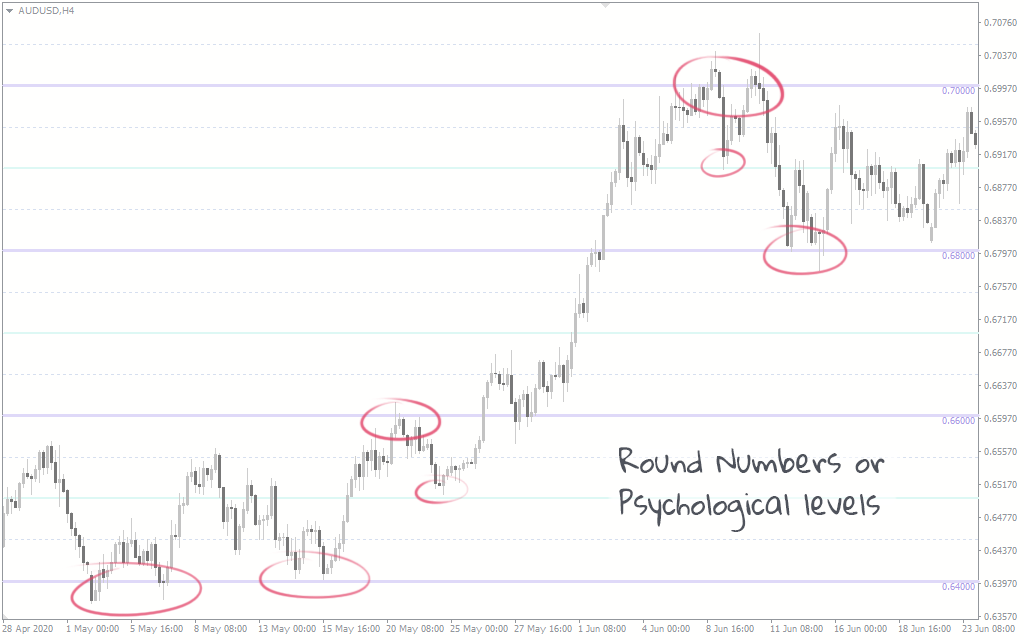

Perhaps you have noticed before that your support and resistance levels seems to be very close to round numbers. See the chart above. You would be forgiven for mistaking these horizontal lines as support and resistance levels. These lines are round numbers, also known as psychological levels.

Can you see how the price is supported at the 0.64000 level? This chart gives numerous examples of the way round levels are influencing how the price is moving.

Why Consider Round Numbers in Forex?

For all of this to make sense, you have to remember why prices in a market move. Markets respond to the orders that traders make and the actions of participants in a market influence how prices move.

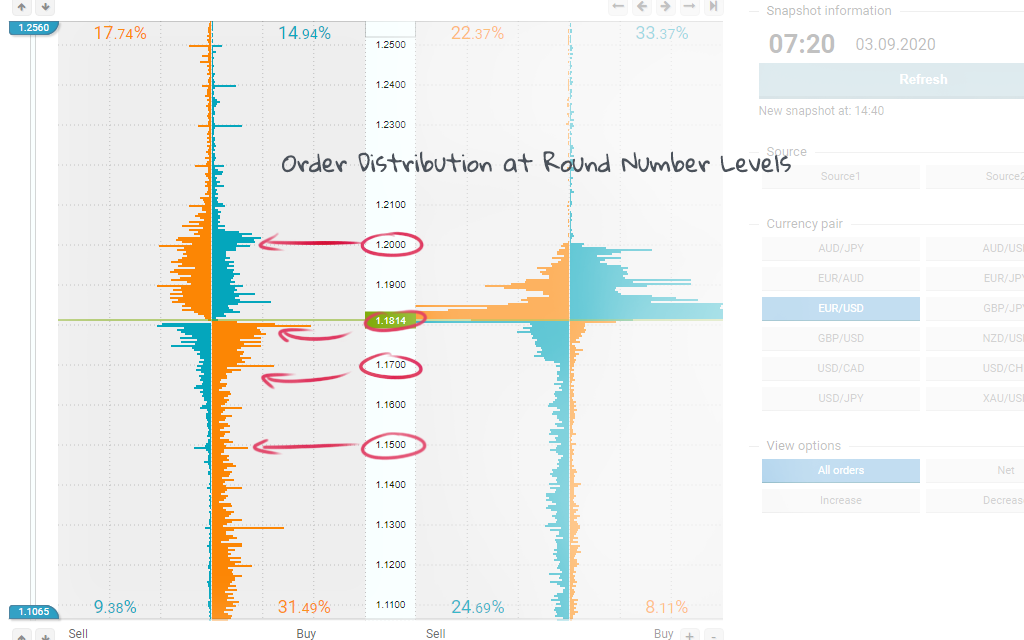

The majority of traders will place their stop and limit entry orders and take-profit orders on or close to big round levels. A lot of traders who are unfamiliar with the bias for rounded numbers will also (dangerously) place their stop-loss orders on round levels too. Traders may do this consciously, or even subconsciously. Check the image below, taken from our depth of market snapshot tool, you can see how orders are clustered at round levels.

The fact that round number levels have a significant influence on the market cannot be denied and should not be overlooked. These psychological levels are used by both retail Forex traders and major banks that deal in Forex.

This theory explains why prices seems to lose momentum, even in a strong trend. When you feel that pressure is stopping the price from continuing at these round levels, it’s because there is resistance from the buy and sell orders clustered at these round levels.

Psychological Levels in Forex vs Round Numbers

While big round number levels are frequently presented as support and resistance points, it’s interesting to observe the way price responds to them in other ways, even within an active trend. See the chart below, most price reversals shown are aligned with round-number price levels.

Price reversals at round numbers happen because traders create sufficient trading volumes that allow the price to bounce off these levels and move in the opposite direction. For this reason, we can’t regard them as potential levels of support and resistance.

When price approaches these levels, the number of trades and trading volume increases, and the price moves in a more dynamic way.

How to Trade with Round Numbers

Now you know why round numbers have such a significant impact on how the price of a currency pair moves. But how can you put that theory into practice and apply a round number trading system?

To recap, an overwhelming majority of participants in the Forex market, and other asset classes for that matter, have a tendency to place their entries and exits near round levels. The price naturally moves towards these clusters, because market orders must be matched against other orders in the book.

That’s why many new traders who put their stop-losses at round levels feel like they are getting stop-loss hunted. When in fact, that’s just a natural dynamic of the market they haven’t figured out yet.

Trading round numbers in Forex allows you to increase the efficacy of setting a take-profit, a stop-loss and identifying the right levels to open a trade. Consider using our Stop-Loss clusters MT4 indicator to corroborate the two principles.

Rebound and Breakout Indicator

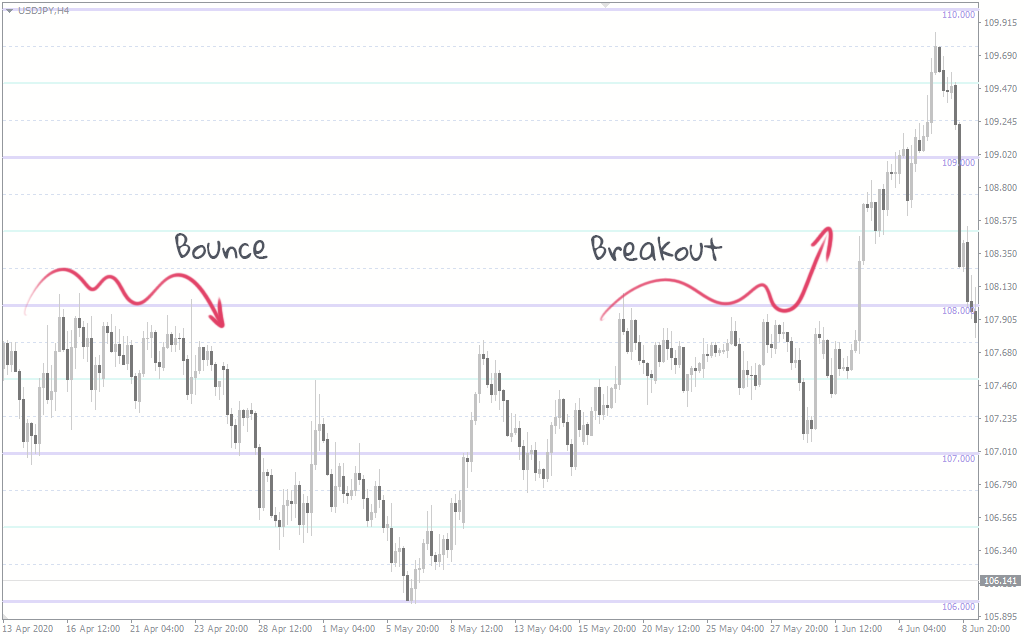

When using round numbers to determine psychological levels, you can follow the sentiment of the market and possess more clarity on how the price can develop in the future. A considerable accumulation of pending orders being triggered can easily change the flow and move the price in the opposite direction.

It’s worth noting that seeing how the price responds to these key levels isn’t always sufficient, especially if you’re trying to judge if it’s time to enter the market. Context is needed to truly understand the premise of why the price reacts the way it does.

Selling pressure that pushes the price down can be due to people positioning themselves for a downtrend, or it could be traders having their take-profit or stop-losses hit.

Stop-Loss & Take-Profit Tactics

As mentioned, pending orders tend to be grouped on round-levels. For a take-profit, it is a good idea to place it on a round level since there is a more substantial probability that the price will move towards it and ultimately be hit.

On the other hand, for a stop-loss, you will want to move it away from a round-price as the likelihood of it getting hit is much higher. The idea of using a stop-loss is to get out of a position when you know the trade is invalid.

We know that prices can bounce off round levels, which means there is a strong chance that the price can move in your favor after bouncing off the round-level. For more context, read our article, which outlines how to set a stop-loss correctly.

Conclusion about Round Levels in Forex

The role psychology plays and how it influences the decisions made by traders and investors is crucial. Ultimately, it’s how participants behave that dictates how an asset is priced. Each individual interprets and acts upon the same fundamental and technical analysis in a slightly different way, but when it comes to round levels, there is a lot of consistency.

Given how effective applying round numbers in Forex is proven to be, they are used by all professional participants of the Forex market. Everyone from private traders to large investment funds and global banking giants. Analysts whose commentary is relied on by major players in the market rely on these psychological levels in their market reviews as well.

This is why you should not overlook the importance of using the round levels indicator for MT4. If you take round-number levels into account while planning your trading strategy, it will initially increase your chances of making a successful trade.