Timing the Market vs Buy and Hold

In the capital markets industry, a lot of emphases is put on timing, and this is especially true for the online Forex trading niche.

Visit the website of any Forex broker or platform provider, and one of the first points they’ll make is how fast your orders are executed on their low latency trading infrastructure.

If ensuring that traders can get in and out of the market in split-seconds is valuable, does that mean timing the market should be the primary concern for all traders? Will submillisecond order processing make or break the trade and the outcome of your trades?

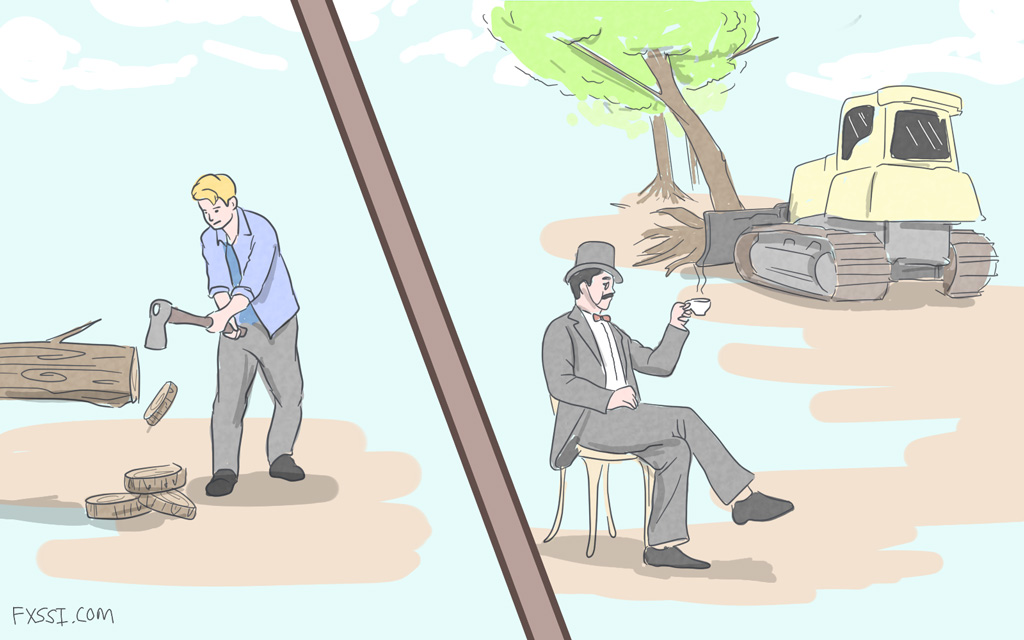

The need for speed depends on whether your trading strategy is based on timing the market vs buy and hold strategy.

What Wins: Buy and Hold vs Timing Strategies

There are dozens of methods and techniques that can be applied when trading financial markets. New traders on a quest to find the ultimate strategy end up chasing rainbows of which there is no pot of gold at the end. What traders realize is that a good strategy is not simply a key that opens the door to endless gains.

In fact, a trading strategy is somewhat like a glove; it needs to fit the occasion and fit the person wearing it. If you slip on a pair of Muhammad Ali’s boxing gloves, but you’re no good at boxing, they won’t make you any better, nor will they help you ride a motorbike. Your trading strategy should fit your level of experience, personality and objectives.

In this article, we’ll explore the differences as well as the benefits and drawbacks of buying and holding and timing the market.

Buy and Hold Strategy

A buy and hold strategy is quite literally the practice of purchasing an asset and holding it, generally for the long haul. The notion of holding onto an asset is considered investing rather than trading.

When you buy and hold an asset, you are expecting it to gain several percent each year for the next few years or even decades. Therefore, the entry price becomes less important.

A buy and hold approach is typically used on assets like stocks, precious metals and bonds, particularly if you are taking physical ownership of these assets as opposed to having a position in the form of a derivative, like a CFD or a Futures contract.

A physical transaction can take days to complete. Let’s say, for example, you’re buying five ounces of gold bullion from a local broker. You call them on a Monday afternoon with the order while the spot price is $1920.50 per ozt, they call you back on Tuesday to give a quote of $2016.10 per ozt, as there is a markup on the spot price, known as the premium.

On Wednesday, you transfer the money to the broker; meanwhile, the spot price has fallen to $1915.60. On Thursday, the broker now pays you a refund of $25 to cover the fall in price. On Friday, you eventually get the gold bullion.

As you can see from this example, it took a week to execute the order and timing was not really an issue for either party.

However, the story would be quite different if you were trading much larger leveraged positions. One gold contract is 100 ozt which makes small movements more painful or attractive, depending on which side of the market you’re on.

A buy and hold trading strategy is very hands-off, and the psychological toll is far lower than margin trading. Since you physically own the asset, a bit of drawdown or a pullback doesn’t stress many people out. This type of investing is also much more straightforward as traders aren’t obsessed with knowing how to set a stop-loss properly.

To put it into context, here is a chart of the S&P 500 from the past few years, there is a clear upward trend.

S&P 500 Weekly Chart:

Someone who is investing in stocks is less concerned about their entry price and more worried about the security of their custodian or nominee holding their shares for the next decade.

Market Timing Strategies

A market timing strategy is a system that puts emphasis on getting in a position just before a trend breaks out or reverses and to close the position once the momentum exhausts. You might know this technique as scalping. Traders want to capture profits on small price movements as the market moves naturally throughout the course of a trading session.

When you look at gold and the stock market, you’ll notice that these markets have a well defined upward trend. That’s what makes holding these assets for decades worthwhile.

Currencies do not behave in the same way. A currency pair is in a constant battle with its counterpart, which means prices are volatile and as opposed to having a defined long term trend, prices oscillate.

You can see this in the chart below; the EURGBP pair has just been trading in a defined range.

EUR/GBP Weekly Chart:

When you are timing the market, especially if Forex trading, the entry and exit price of a trade is critical. As a currency pair swings dozens of pips each day, scalpers and swing traders look to exploit those movements with high leverage and large positions.

Mistiming a trade can cause uncomfortable drawdown, and experiencing slippage can eat your profits. Pending orders are one of the reasons traders working with market timing strategies need to know the difference between stop-loss vs stop-limit-orders.

Conclusion of Timing the Market vs Buy and Hold

Due to the necessity of holding large positions in Forex to see meaningful returns, traders depend on high leverage. The margin in Forex trading is notorious for its high Swap rates for rolling positions over to the following day, but the high cost of carrying position means most traders prefer not to do it.

Therefore, Forex traders confine their trading activity to a window of just a few hours to get in and out of the market before the New York session closes. One thing that market timing traders rely on is knowing what’s a trailing-stop. This tool helps traders to get out of a position when it starts pulling back.

Pullbacks often signal the end of a trend and therefore helps them to get out of the position, in profit, before the end of the day. In many cases, the cost to put on a new trade can be lower than the overnight financing charges applied by brokers.

The fundamental concept of trading Forex and CFDs makes buy and hold strategies almost irrelevant. Timing is everything. That’s why Forex traders obsess over speed and timing and why brokers flaunt the superiority of their trading ecosystem.