The Most Volatile Currency Pairs in 2026

Here we will talk about the most volatile currency pairs in the Foreign Exchange (Forex) market in 2023.

You are probably familiar with the concept of "volatility". If not, we recommend you get more information on the subject by reading this article – Volatility Explained in Simple Words.

We should note that, by definition, volatility tends to change over time and is not a constant.

Volatility is Relative

If you have ever traded in the Forex market or at least watched price movements from the sidelines, you might have noticed that the prices move non-linearly on the chart.

There are times when the currency price stands still or moves within a very narrow range. In this case, we talk about the low volatility in the market.

On the other hand, when key economic data are published, or officials make a speech, the market price makes sharp and strong movements. So, we can see an increase or even a volatility spike.

To illustrate the non-constant nature of volatility, let’s look at the Forex Volatility Calculator.

All you need to do before you start using the tool is to enter the period in weeks over which you want to measure the volatility.

Let’s take NZD/USD (New Zealand vs. US dollar) as an example. We select the four weeks to calculate the volatility on the website mentioned above. The results are displayed in three diagrams:

These diagrams show the average daily volatility of the NZD/USD pair since July 1. They also display an average weekly, daily, and hourly fluctuations of the pair.

Based on all three diagrams, we can conclude that volatility tends to change during any period.

The hourly volatility diagram for NZD/USD, which peaks at 12 and 21 o’clock (GMT), is of particular interest. It entirely coincides with the time of economic data releases for the USA and New Zealand. It also confirms the thesis on volatility increase upon major financial data releases mentioned at the beginning.

Volatility changes can be observed for all currency pairs. You can select any pair and see the statistics over different periods.

What Does Volatility Depend On?

So, what does the volatility of any currency pair depend on?

The main reason for the volatility is liquidity. A classic rule states: the higher the liquidity, the lower the volatility, and vice versa.

Liquidity is the amount of supply and demand in the market. The larger the supply and demand, the harder it is to get the price moving.

According to that rule, we can conclude that exotic currency pairs are the most volatile in the Forex market because their liquidity is often lower than that of major pairs.

Volatility often occurs during major economic data releases as well, so it may be useful to download and install MT4 news indicator:

It can help to protect yourself against unexpected market activity.

Let's use statistics to verify the previous statements.

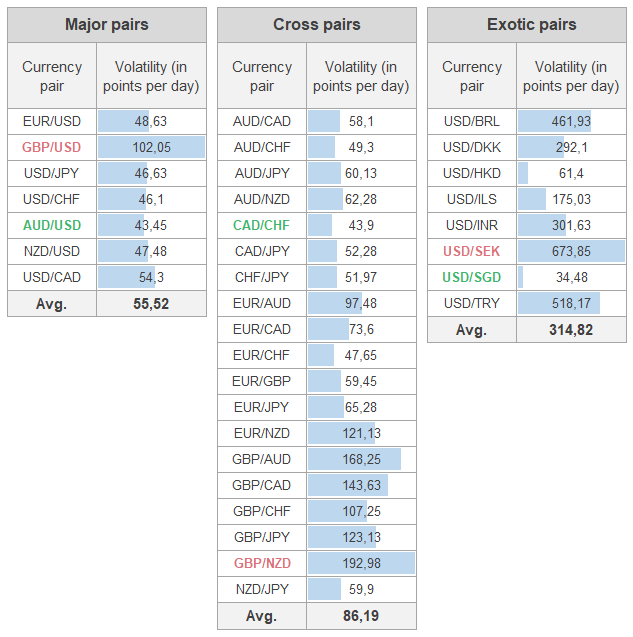

Table of the Most Volatile Forex Pairs

For our study, let's take seven major, cross, and exotic currency pairs and draw up a comparative table based on the obtained data:

The table shows that today the most volatile Forex pairs are exotic, namely, USD/SEK, USD/TRY, and USD/BRL. All of them move on average for more than 400 points per day.

The volatility of the major currency pairs is much lower. Only GBP/USD moves for more than 100 points per day. AUD/USD turned out to be the least volatile currency pair.

As for the cross rates, GBP/NZD, GBP/AUD, GBP/CAD, and GBP/JPY are the most fluctuating currency pairs. All of them move on average for more than 100 points per day.

CAD/CHF, EUR/CHF, AUD/CHF, and CHF/JPY are the less volatile Forex pairs among the cross rates. The amplitude of their movements doesn’t exceed 60 points per day.

Resume

Based on these statements, the reader may conclude that trading the exotic currency pairs or cross rates promises large profits. However, it isn’t quite that simple.

Indeed, the range of exotic pairs' movements is much broader than that of the major ones. However, such high volatility results from low liquidity, and trading the low liquidity currency pairs carries particular risks for a trader.

The fact is that various methods of technical analysis might not work in such situations. If you decide to trade, say, USD/SEK or GBP/NZD, your analysis may not work as effectively as, for example, when trading EUR/USD. Also, technical analysis patterns might generate false signals.

This is because the psychology of the market behavior in its most liquid form makes up the backbone of technical analysis. If the liquidity of a trading instrument is lower, the validity of technical analysis comes into question.

The second problem a trader can face when trading volatile financial instruments is a wide spread (additional trading expenses).

Of course, we won't discourage you from trading the low liquidity currency pairs. However, our task is to warn inexperienced traders and newbies that the risk of such trading is higher than that of trading the classic currency pairs. You can check out our article The Most Liquid Currency Pairs.