Price Action Vs Indicator: Which Is The Better Technical Trading Approach?

There are two main approaches to technical analysis trading, and both approaches have generated a lot of discussion from traders on either side.

The two approaches are indicator-based trading and price action trading.

In this article, we’re going to close once and for all the age-old debate. So, for one last time, which is a better forex technical trading approach: price action trading or indicator-based trading?

But before we give an answer to that question, here’s what each trading approach means, with its pros and cons.

What is Price Action Trading?

Price action trading is trading without indicators. It is a technical trading style where traders analyze the charts and make judgments using price movements, as opposed to using indicators.

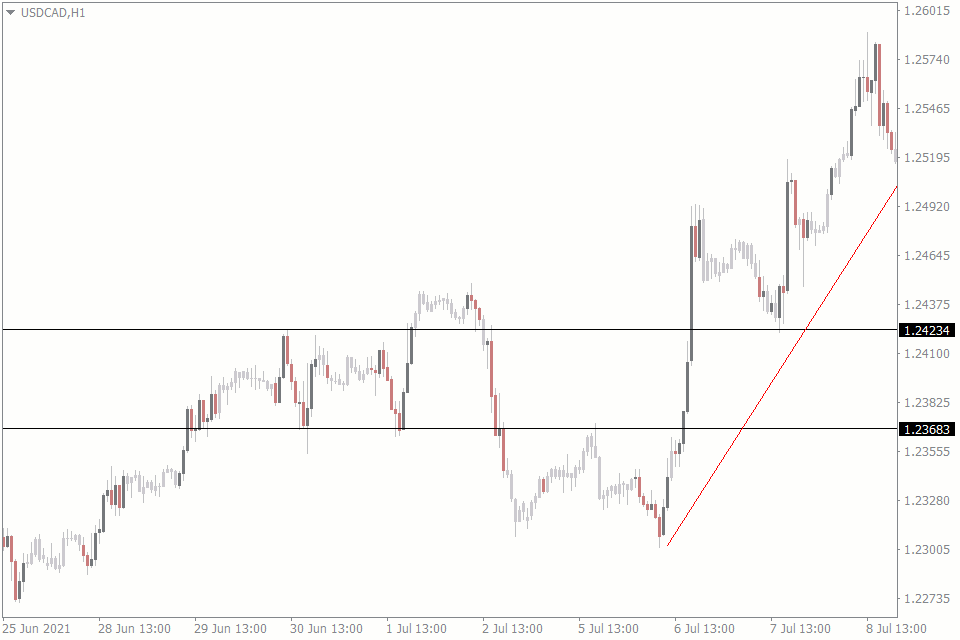

The tools that price action traders usually use are trendlines, support and resistance levels, candlestick patterns (Doji, engulfing, etc), and chart patterns (1-2-3, Heads and Shoulders, etc).

Advantages of Price Action Trading

- Price action trading allows every trader to draw their own unique conclusions from their analysis. It gives you more control over your trading decisions, as you get to make judgments based on your interpretation of the price action.

- Apart from its subjective interpretation, the trader’s way of using them in charts is also subjective. For instance, one trader could draw their support line across the tips of the lowest hanging wicks of the candlesticks. While the other one could draw theirs across the bodies instead. There is no right or wrong, which makes it possible for price action trading to fit into just about any kind of trading strategy.

Disadvantages of Price Action Trading

- Price action analysis can hardly be automated. The trader usually has to draw out everything they need on their chart, making price action analysis time-consuming. However, there are some useful indicators that can help you automate some price action tools, such as the FXSSI auto trendline and support and resistance indicators.

- Every trader could interpret signals differently. For instance, a candle breaking out of a support level could either be perceived as a breakout or a false breakout. This could be bad news for novice traders, who are yet to fully grasp what interpretations to hold on to when using price action trading.

What is Indicator-Based Trading?

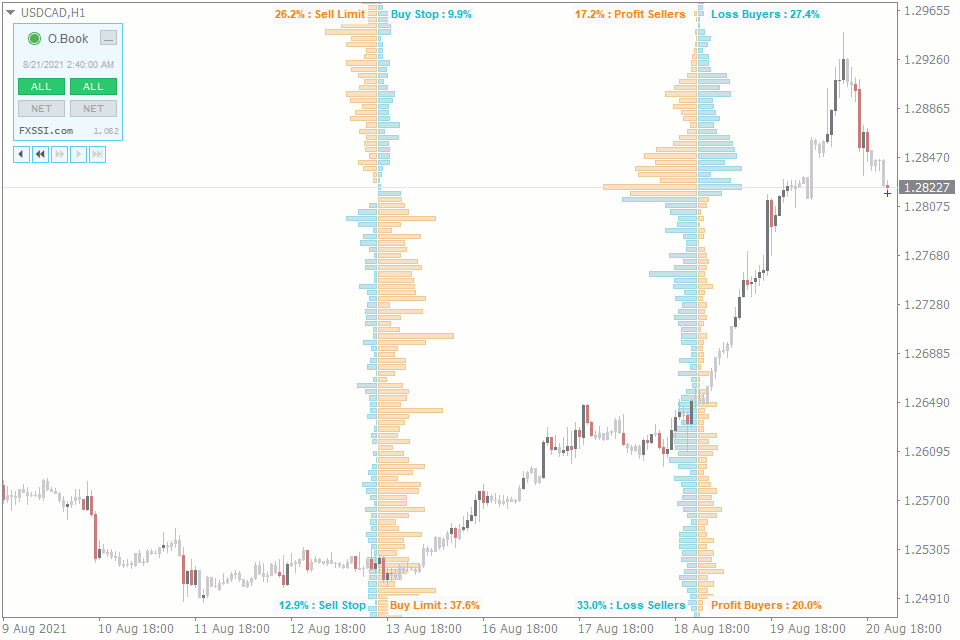

Indicator-based trading is a technical analysis trading style that relies on indicators to analyze a currency pair and generate trade signals.

Advantages of Indicator-Based Trading

- The signals of indicators are usually unambiguous. They mean the same thing to most traders. This is because indicators usually use pre-defined colors, line cross-overs, and all sorts of graphics to mean definite things.

- Let’s take a look at a scenario where a trader is using 20 and 50-period Moving Average indicators on a chart. The crossing of the 20 MA above the 50 MA is always a buy signal, irrespective of the trader’s trading style. But if the 20 MA crosses below the 50 MA, it is regarded as a clear sell signal.

- Indicators are less prone to human error because they are based on pure programming and calculation. Every trader gets the same output when they use the indicator settings.

- Trading with indicators is very easy to learn for novice traders. All they need to do is plug the indicator into their MT4 (for those using the trading platform) and the tools will automatically generate signals for them.

Disadvantages of Indicator-Based Trading

- No one knows what’s going on behind the attractive outward appearance of many indicators. As a result, there’s no way to tell if the indicators would give good or bad signals without rigorously testing them out.

- Many indicators repaint their signals, deceiving unknowing traders about their accuracy.

- Indicators can either lead or lag. Not knowing which one yours is doing could lead novice traders to making a lot of mistakes when trading.

Differences Between Price Action and Indicator-Based Trading

Indicator-based trading is easier and faster to learn for novice forex traders than price action trading. Note that “easier” and “faster” don’t necessarily translate to “more profitable.”

Indicators are automatically drawn on the chart. Price action patterns are drawn by the trader.

Because indicators are automatically drawn on the chart, their signals are often objective. They have their own meanings that are not subject to the interpretations of a trader.

And because price action patterns are drawn by the trader, the signals that develop depend on the trader’s interpretation of what they have drawn.

Indicators are often calculated based on specific prices, such as the opening and closing prices of certain periods. Moving averages, for instance, make use of the opening and closing prices of a set number period to plot its lines.

Although price action tools sometimes do this too, they often rely more on obvious visual patterns. For example, a pair is in an uptrend not because a calculation was done based on the previous candlesticks, but because the candlesticks simply look like they’re going up.

Which is Better? Indicators or Price Action?

The better technical trading approach between price action and indicator-based trading depends on your preferences as a trader. Each approach can only be as good as the trader using it.

An indicator-based trader might make consistently profitable trades based on just one indicator, while another one piles up to 5 indicators on their chart and still racks up consistent losses. Similarly, two price action traders may interpret the same price action differently and each could end up at the opposite end in terms of profit and loss.

So, Which Should You Use? Indicators Or Price Action?

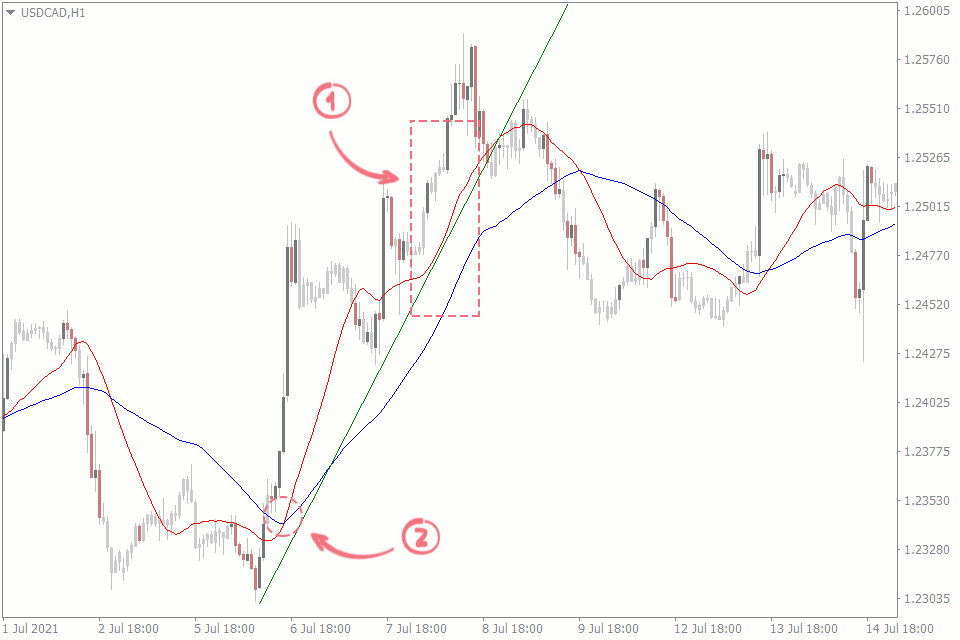

If you’re asking which of the two forex technical trading approaches to use, you might be focusing on the wrong thing here. Because we do recommend you to use both. Use the strengths of one to complement the weaknesses of the other.

You may rely on the objectiveness of indicators to form your judgment based on the price action analysis. For example, you wait till your indicator gives you a buy signal and use the price action to determine your trade entries based on the signal of the indicator. The chart below is an illustration.

Another way to use them both is to simply use one to confirm the other. When they both give out the “sell” signals, you sell. And when they are both signaling to buy, buy the pair. Otherwise, you steer clear of the trade.

The more familiar you get with both technical analysis approaches, the better you get at developing strategies to implement them into. However, if you find that you aren’t comfortable trading with either of them, stick with the one you’re more comfortable with.

Conclusion

In summary, the better technical trading approach between indicators and price action is the one that best suits your trading style. However, nothing stops you from using one to complement the other.