Positional Trading in Forex and Strategies that Fit this Style

The beautiful thing about trading is that it accommodates different personality types, and as a result, different trading styles have been developed. And position trading is one of the common trading styles in Forex.

Like other trading styles, there are a lot of strategies that go well with it. This article contains everything you need to know about position trading and strategies suitable for it.

What is Position Trading?

Position trading is a trading style that involves holding trades for a long time. Position traders use anything from daily to monthly charts to determine major market trends and trade them. As a result, a trade could last for as long as weeks or even months, as long as the trend is still on.

Attributes that characterize positional trading are long-term charts, long-term trades, and trend trading. How to combine all three in a positional trading strategy?

Position Trading Strategies

Position trading is all about jumping on an established trend and exiting at the end of the trend. The following strategies are only ways to catch a trend and also know how to spot the end of a trend.

Support and Resistance

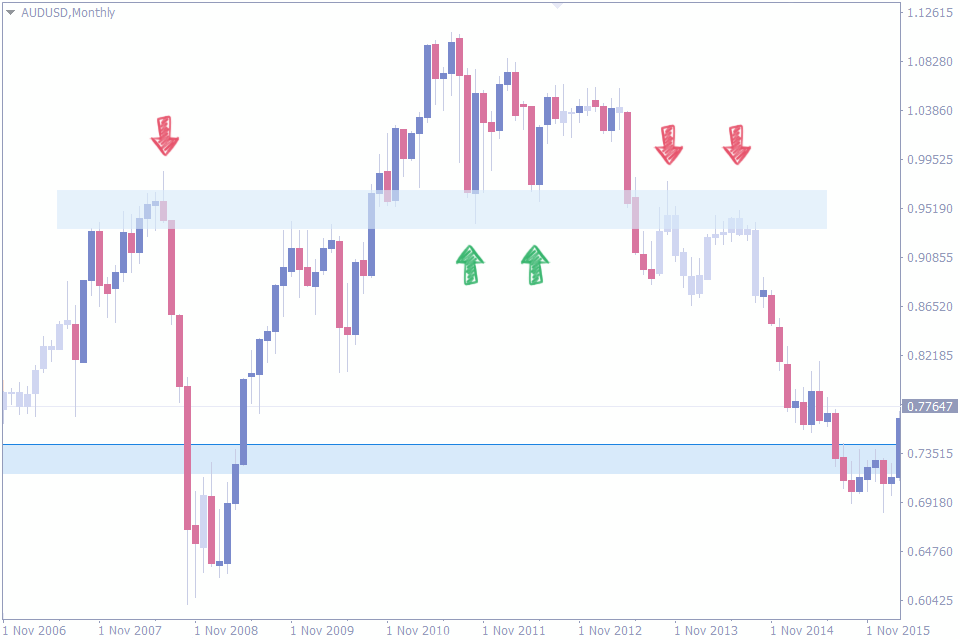

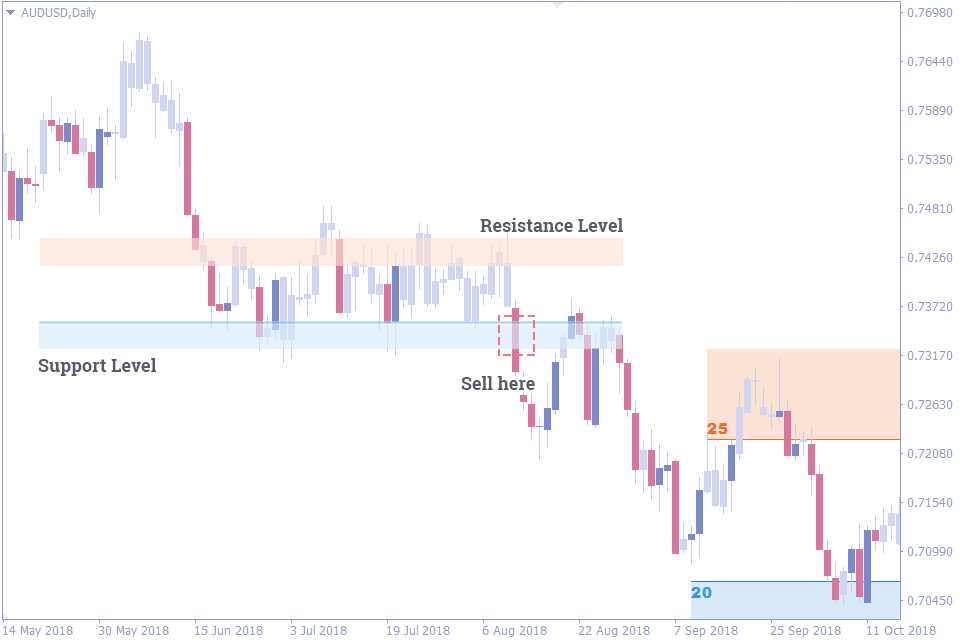

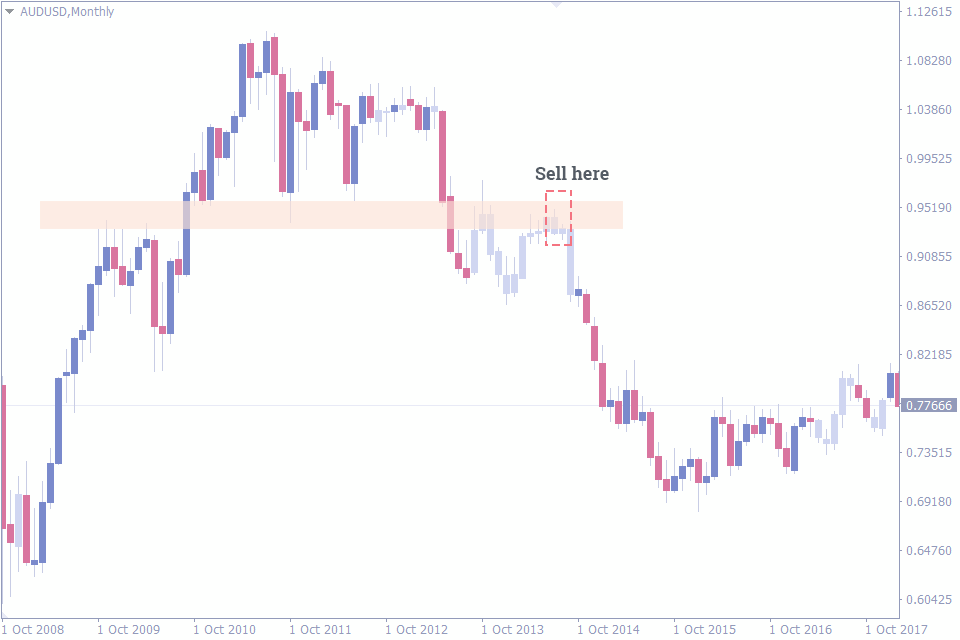

In forex, price does not only move in trends, but also within support and resistance levels. This knowledge is the basis of the support and resistance trading strategy.

A position trader sees a support level as a level where price is very unlikely to fall below. When the price falls to this level, it would likely bounce back up. And also from the perspective of a position trader, a resistance level is a level where the price is very unlikely to go beyond.

You can’t just make these support and resistance levels out of nothing, however. You have to use previous support and resistance levels to predict future support and resistance levels. These supports and resistances can last for months or years.

How to trade the support and resistance position trading strategy

Since price is likely to bounce off support and resistance levels, you may enter a buy trade at a support level and enter a sell trade at a resistance level.

You could use to identify support and resistance levels are technical indicators. An example is the FXSSI Support and Resistance indicator.

Breakout

When a forex currency pair ranges within a single pair of support and resistance, it is bound to break out at some point. This is the foundation for the position trading breakout strategy.

When a currency pair consolidates, you await a breakout. The good thing about this strategy is that it allows you to get in early on major trends. And usually, the longer the consolidation, the more forceful the breakout.

Breakouts also occur at the ends of trends. This is usually a sign of reversal to the opposite trend.

How to trade the breakout position trading strategy

When the price breaks out through the support level, traders go short. And when price breaks out through the resistance level, traders go long.

However, be wary of false breakouts when you’re trading the breakout strategy. You must know how to identify support and resistance levels and learn some trendline trading strategies. Otherwise, you would not be able to trade the position trading breakout strategy. Thankfully, tools like Auto Trendline indicator help you draw trendlines on your MT4 chart.

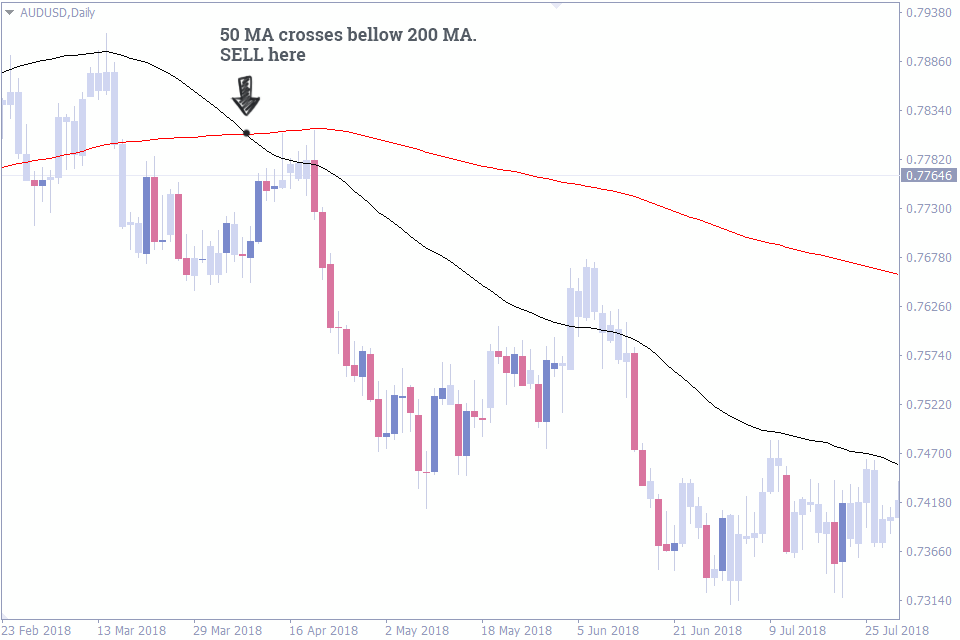

Moving Average

The moving average indicator is another tool you could use for your position trading. It does even not matter what kind of moving average you use, whether weighted, exponential, or simple. When you are trading long-term trades, the kind of moving average wouldn’t matter much.

The most common moving averages to use are the 50-period moving average and the 200-period moving average. The 50 MA serves as the fast MA that reacts more closely to the recent price movements, while the 200 MA is the steadier and the uneasily swayed moving average.

How to trade the moving average position trading strategy

When the 50 MA crosses over the 200 MA to the upside, you have what traders call the Golden Cross. Enter a buy trade. A Death Cross occurs when the 50 MA crosses the 200 MA to the downside. And this is a signal for a short order.

Another advantage of this position trading strategy is that you could also use the moving averages as your exit indicators. When the moving averages give you an opposing signal to what you are trading, exit the trade.

Pullback Trading Strategy

You may fail to catch all trends when the movements are just beginning. This is where the pullback trading strategy becomes useful. Pullbacks offer you opportunities to join an established trend at relatively better price levels.

How to trade the pullback position trading strategy

There are many pullback trading strategies in forex. But the basic idea is to go long when price temporarily falls in a major uptrend and to sell when price makes a temporary rise in a downtrend.

Things to Know About Position Trading

It would be a major advantage for you to understand the fundamentals of the forex market to help reduce guesswork. These fundamentals are often responsible for major trends on the charts.

The forex news indicator is one tool you could use to get a grip of their fundamental analysis among many others.

Also, position trading requires a lot of money in the account. And since you would be trading the higher timeframes, more pips are at stake. So, there should be a lot of room in the stop loss to allow the market to make its move.

Also, one thing that should be bigger than the account of a position trader is their patience. Some trades take weeks or months.

It may also help to know about market sentiments for a currency pair. This data is what the FXSSI Ratios Indicator provides.