Answers to Tricky Questions Of the “Trading Against the Crowd” Strategy

People tend to treat something new with a grain of salt. Sometimes it comes to the point where new information is so incompatible with their firm beliefs that it results in a stream of ill-considered criticism.

Our version of the “Trading Against the Crowd” strategy is also something new for many people and very often causes the very same ill-considered criticism.

We don’t want to offend anyone by calling their statement ill-considered – all we are saying is that many people reject this theory even before trying to delve into it. This happens by reflex: a man finds the counterargument in own head that allegedly undermines the essence of the theory and declares with complete confidence that it has been exposed.

In this article, we will “accept a fight” and try to respond to the most frequent counterarguments and tricky questions of the “Trading Against the Crowd” strategy.

“This Strategy Doesn't Work!”

This is probably the most common counterargument, if you can call it as such.

The application of the “Trading Against the Crowd” theory in practice comes down to the analysis of mid- and small-size market participants’ behavior and making trading decisions based on this analysis.

None of you will argue that the price movement in the market occurs exactly due to the interaction of market participants but not because of various overbought conditions, divergences or crossovers. Yes, the latter might signal something, but as derivatives of the price, they will always be inferior to the primary market information in quality.

By the way, what is the primary information? This is the data that directly reflects both the past and the future (expected) activity of market participants.

More often, this primary information is called the stock market information. It includes volumes in the form of a stock tape, which is then converted into a variety of tools and indicators, option levels, as well as all sorts of the tools built based on the data from the order book.

It is the order book analysis that our version of the “Trading Against the Crowd” strategy focuses on, although other techniques, such as analysis of futures volumes, are built on the same principle. The only difference is that in the first case, we should seek for the crowd trading direction, and in the second, the trading direction of a conditional major player (market maker). Both these directions are always opposite to each other, so we just need to know one of them to guess what the second one will be like.

Even if we take the well-known “Head and Shoulders” pattern, its interpretation suggests that a major player adds to its positions at each of the tops of this pattern. The “Head and Shoulders” pattern usually occurs at the end of a trend, and each top of the pattern corresponds to the point where the crowd trying to jump into the last car is trading most actively.

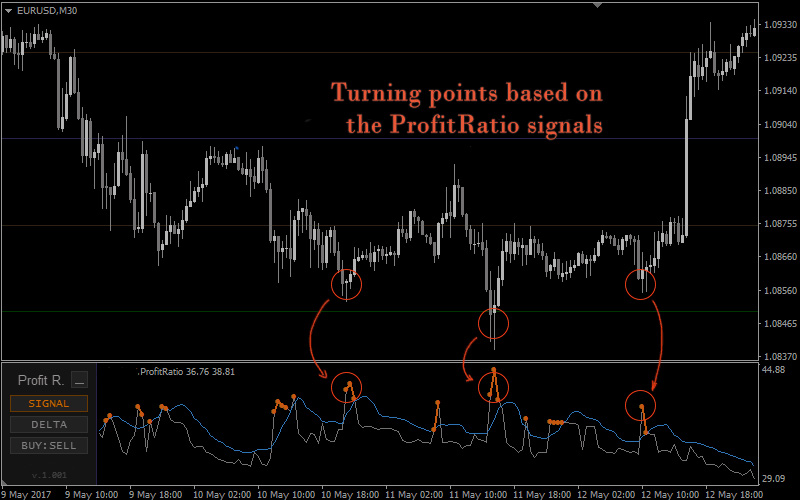

We can see all this activity in the order book or in the tools being derivatives of the order book. The following picture shows the formation which is essentially similar to the “Head and Shoulders” pattern. Note the three tops of this pattern and the readings of the Profit Ratio at these points.

Out of interest, we can go over other tools – there is an increase in the percentage of sellers as well as a large accumulation of Stop Losses, which has been eventually knocked out, at the very top of the pattern.

The result is that the crowd and its behavior are an integral part of pricing – it’s just a matter of the correct interpretation of the data.

As a backdrop to all this, the statement that the “Trading Against the Crowd” strategy doesn’t work sounds like fun, especially when someone who claims that is a fan of indicator-, arrow signals- or waves-based strategies that don’t allow for the trading data in any way.

The strategy is really sophisticated and it takes more than one year of practice to master it, but it will relieve you of the need to sort through many different trading systems. This once again confirms the groundless character of the claims that the strategy doesn’t work especially made by people who are not familiar with it pretty well and draw conclusions based only on their beliefs.

“The Crowd Doesn’t Affect the Market”

The essence of this argument implies that retail traders cannot affect the market through their actions and, thus, the analysis of their behavior won’t help in making trading decisions in any way.

It has long been known that various funds and banks come to the Forex market not only for currency exchange, but also for making an additional profit through speculation.

Even large corporations are not above involving in the speculation related to a usual exchange of revenue. In addition, these banks and funds may temporarily affect pricing thanks to their trading volume.

And now ask yourself the question: who has the best chances of winning – the crowd or a bank/fund?

The crowd is like chaotically moving plankton due to the lack of communication: someone moves up, and someone moves down. What do you think will happen to this chaotic mass if a whale (a big player) suddenly appears on the horizon? The whale will eat them all and even those who’re moving “up” and “down”.

What is remarkable here is that the crowd is a kind of “food” and hence the whale will swim to the place where there is this food. To put it in trading terms, a major player will drive the price to where there are clusters of the crowd’s orders. Therefore, the crowd affects pricing possibly not directly, but indirectly for sure.

In addition, the “Trading Against the Crowd” strategy is almost the same as following a major player. All successful day trading strategies are based on the following a major player.

After all, ask yourself the question: where does the money that the notorious 95% of traders* lose go? Do they go to the remaining 5% percent? Unlikely.

* – It’s about the customers of A-Book brokers. No need to write in the comments that all the money remains inside the kitchen.

“Data on One Broker are Not Sufficient, Because One Broker is Not the Whole Forex Market”

Probably, you have heard about such a thing as exit poll where anonymous surveys are taken among the voters and thus the preliminary voting results are received in elections before the official results are announced.

In most cases, the results of exit polls don’t differ much from the actual data and are often even guessed within an accuracy of one percent.

In our case, the effect is the same. Assuming that 10,000 traders trade with some broker. If 60% of them buy EURUSD, 60% of the remaining 990,000 traders in the entire Forex market will most likely buy as well. Anyone who is familiar with the concept of a representative sample will understand the above.

We actually take data on a particular broker as a representative sample and project these data onto the entire market. In addition, we have data on several brokers but not on the one that further adds value to our data.

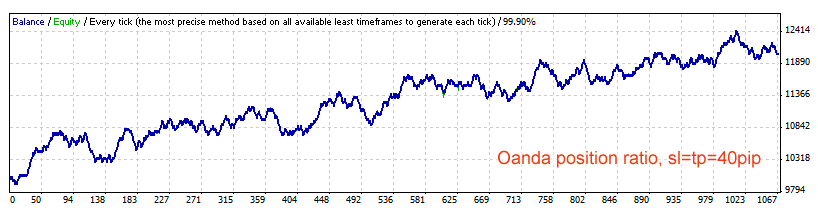

Just look at the results of this backtest using the ratio of the positions of the Oanda broker:

Do you mean there is not sufficient data on one broker?

We selected the value of 40 pips for the test to demonstrate the existence of regularity when there are a large number of trades, although the results of the study showed that the optimal values of TP and SL range from 60 to 120 points.

“Brokers Can Tamper With Data and Provide False Data”

Yes, they can, but so far nobody has done it in practice. What's the point? Are you saying that there is a global conspiracy against the poor retail traders?

On the other hand, if brokers do start to print data, we’ll be easily able to track the “liars”.

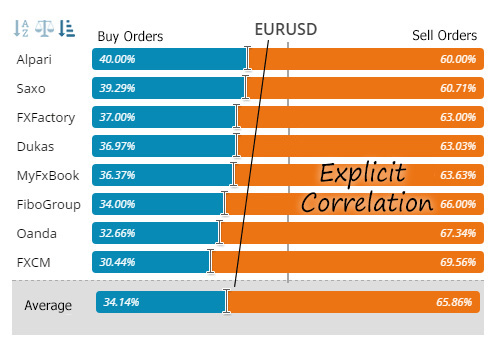

Look at the current ratio of positions:

All brokers are on the same side of the market. If some of them were tampering with data, we would have exposed it at once.

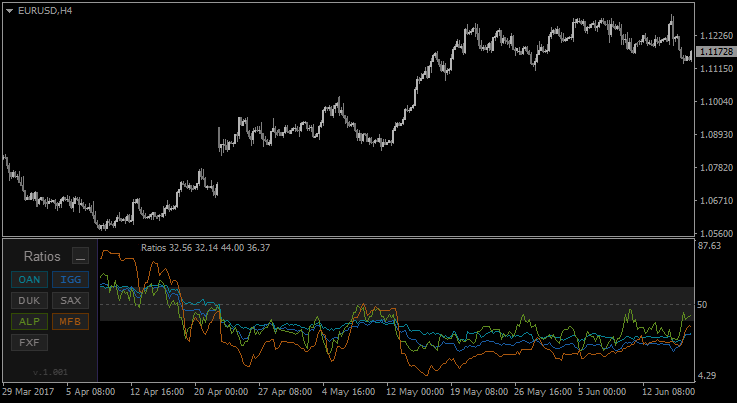

The same situation is true for the chart of the indicator of the ratio of traders' positions – it can be seen that brokers move in unison:

You won’t believe this, but even the data on a bucket shop which doesn’t send trades of its customers to the interbank market will suit us. In this case, connection with the rest of the crowd takes place due to the behavioral stereotypes inherent in all small traders both of an A-Book broker and a bucket shop. You can read about stereotypes in this article.

“What Matters is the Number of Traders , Not Their Trading Volume” or Vice Versa

Usually, opinions differ. Someone proves that it’s right to count the number of traders, while someone else, on the contrary, states that lot size is more important. We believe that the lot size is a little more important, because it’s the lot size that a major player is interested in.

In general, it doesn’t make much difference what the format of the data is – the number of traders or the lot size – because the output is very similar charts.

“What Will Happen if the Strategy Really Works and Everyone Starts Using It?”

They will not start. The propaganda machine advocating indicators, Fibonacci levels, Bollinger bands, etc. works much more effectively than our arguments. Moreover, brokers and some bloggers popularize these methods only because they (methods) are already popular and hence there is a chance to drive web traffic to their websites. None of the profit-oriented projects will promote new techniques of trading from scratch, since there is simply no profit in doing so.

The following history appropriate for this case. Our editor once got a call from a pseudo-brokerage company, was offered to open an account with them, and check out a unique strategy called “Fundamental Bollinger”. It was such nonsense to make it up: these two concepts seemed to be familiar, but it wasn’t clear how to compare them.

Now the “Trading Against the Crowd” strategy is consciously used by no more than 1-3% of traders.

It’s not so easy to make use of this strategy profitably so that all at once rush to study it. People are looking for easier ways out, but the strategy requires thinking, working and spending a lot of time. Most of the people, even of those who are reading it, will quit halfway through.

“If Brokers Remove Data From the Public Access, What Then?”

It doesn't make any sense. Publication of such data is a good PR stunt for a broker. There is reason to believe that almost every broker will provide such data on own website in the future, so we have nothing to worry about.

Once we have seen a statement that “when Oanda sees traders started to make money, it will remove its data from the public access”. Honestly speaking, it sounds like a conspiracy theory. It appears that a man who published it thought that people hadn’t made money more than 7 years before, and now they suddenly started doing it so it’s necessary to deny the access.

Even if we do happen to lose the data source, the previous experience of applying this technique will be a very valuable experience by then, because it helps to develop the correct perception of the market.

These questions and counterarguments to the “Trading Against the Crowd” strategy have been the most frequent ones.

Do you perhaps have your own “tricky” question to which you would like to get an answer? If you do, then write it in the comments.